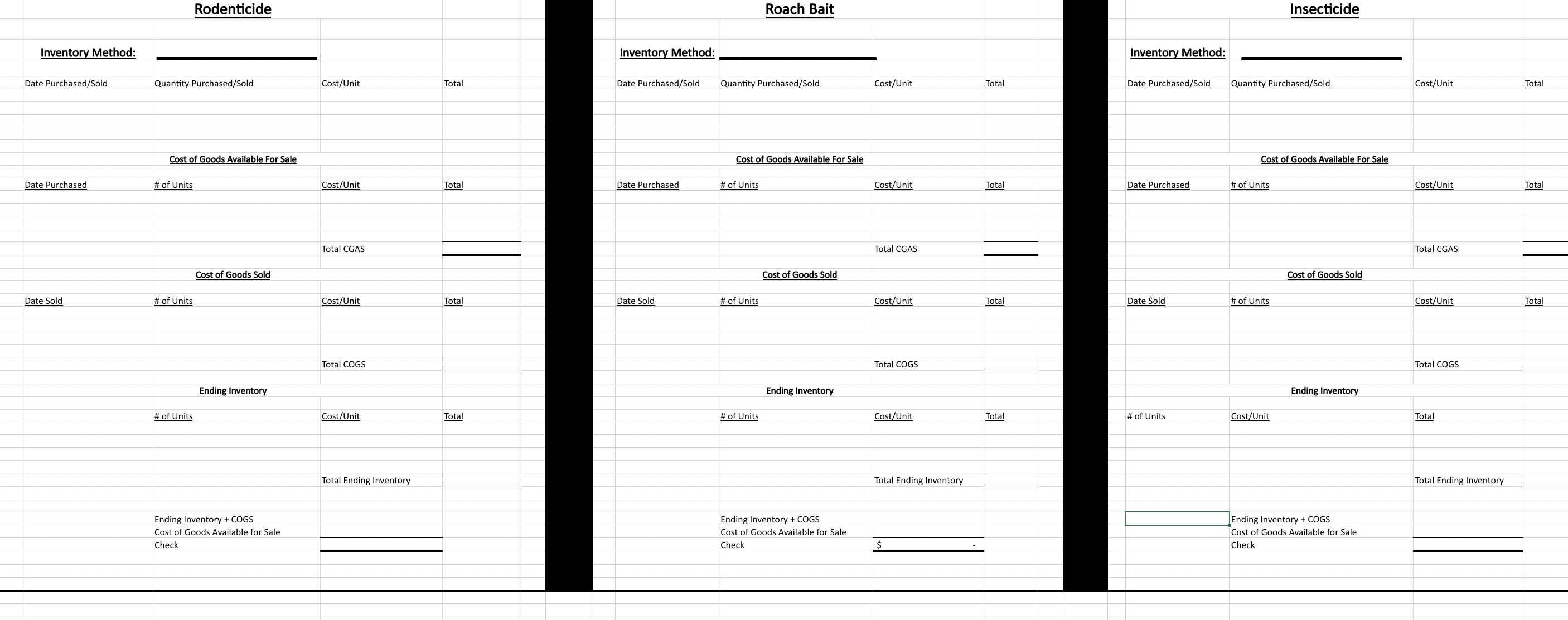

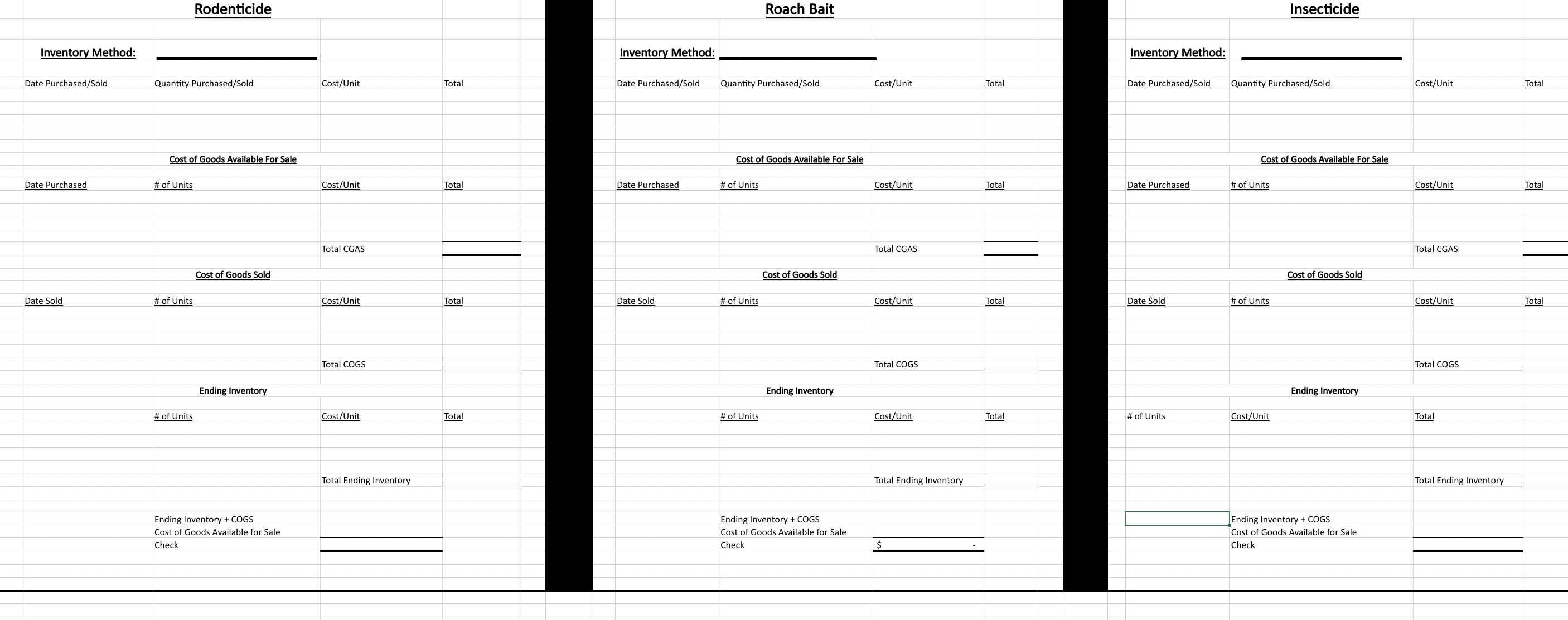

I NEED HELP WITH FILLING OUT THE LIFO AND FIFO FOR EACH PRODUCT

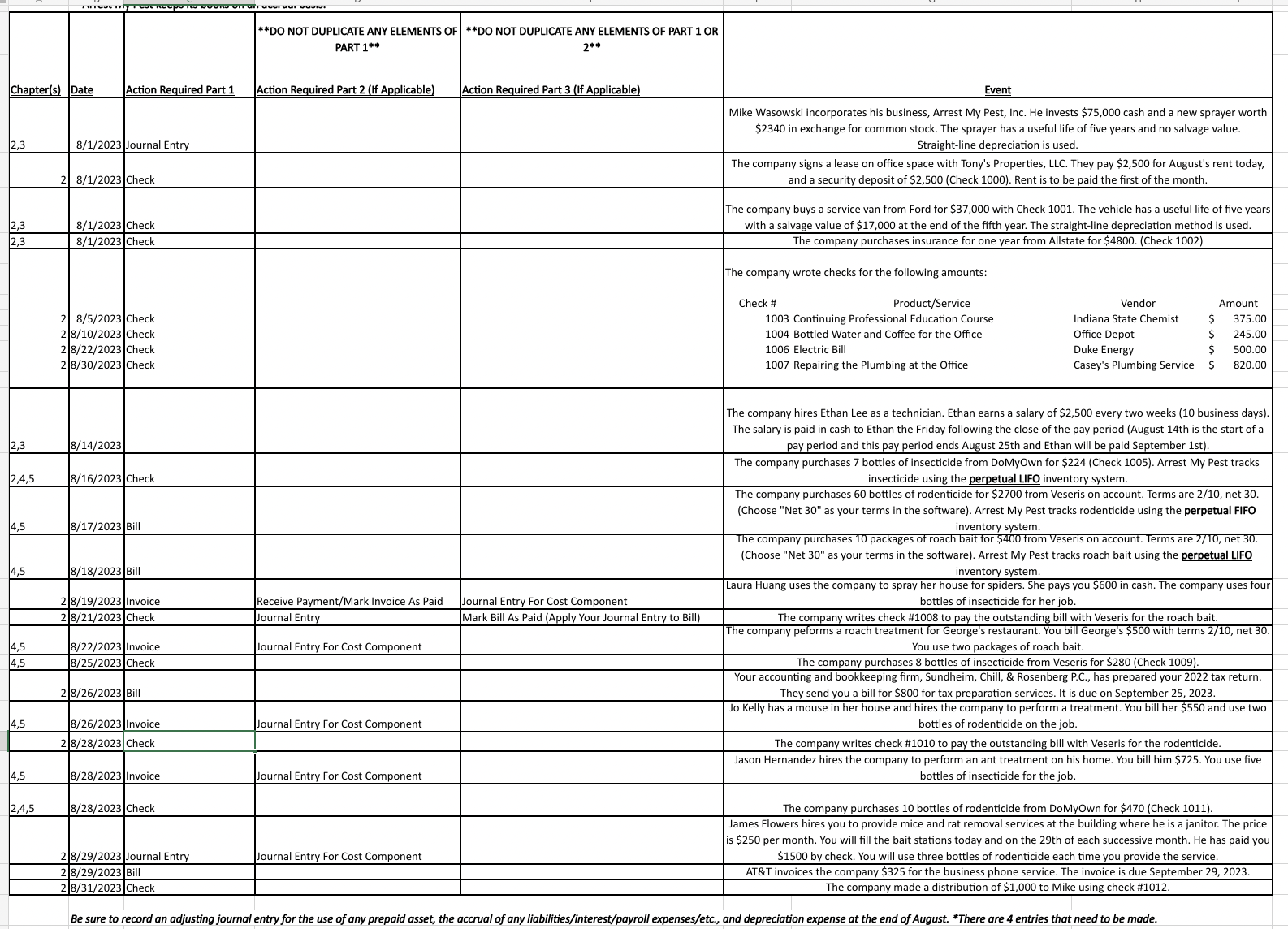

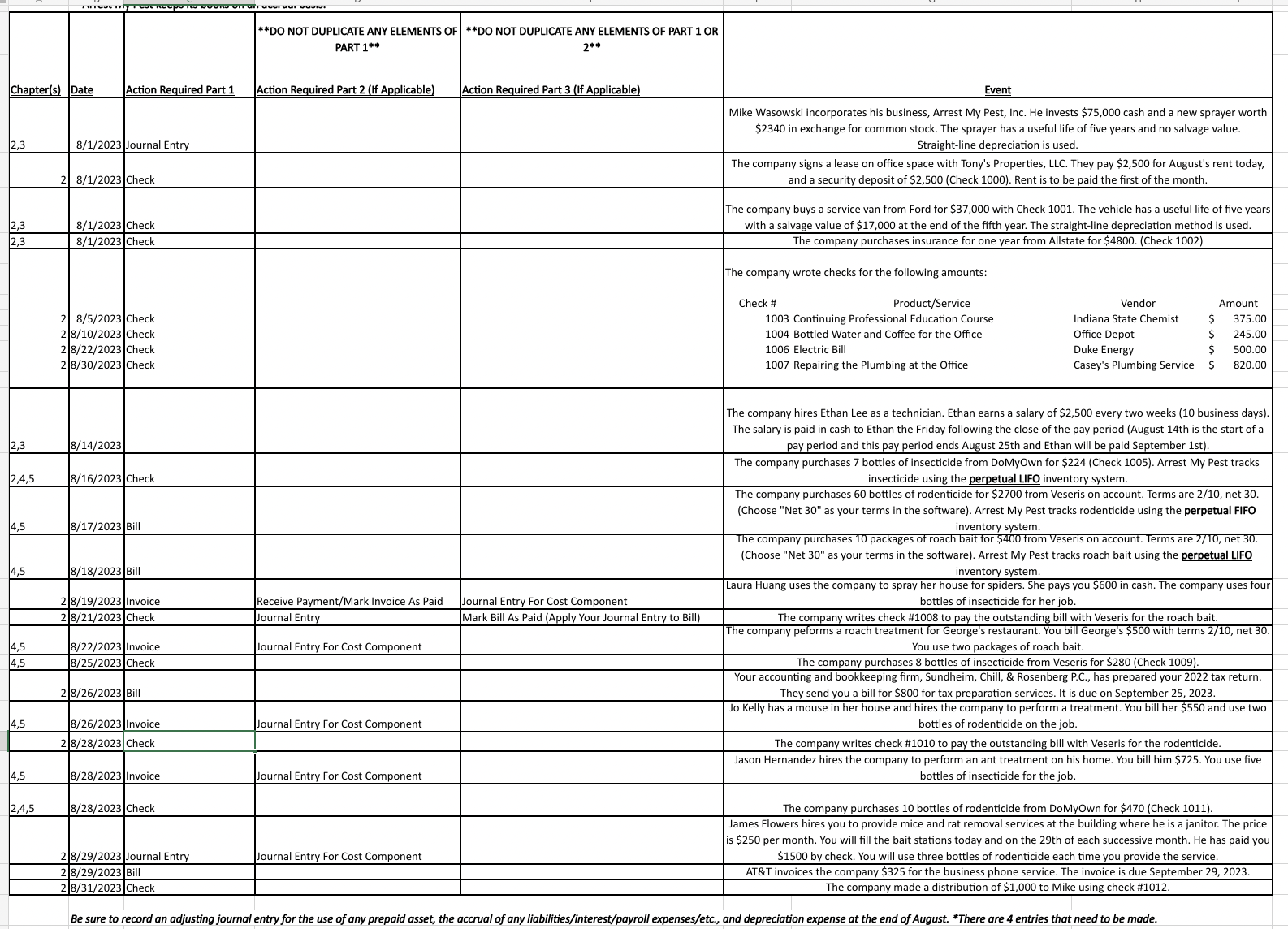

\begin{tabular}{|c|c|c|c|c|c|} \hline Chapter(s) & Date & Action Required Part 1 & **DONOTDUPLICATEANYELEMENTSOFPART1**ActionRequiredPart2(IfApplicable) & ***DONOTDUPLICATEANYELEMENTSOFPART1OR2ActionRequiredPart3(IfApplicable) & Event \\ \hline 2,3 & 8/1/2023 & Journal Entry & & & \begin{tabular}{|l} Mike Wasowski incorporates his business, Arrest My Pest, Inc. He invests $75,000 cash and a new sprayer worth \\ $2340 in exchange for common stock. The sprayer has a useful life of five years and no salvage value. \\ Straight-line depreciation is used. \end{tabular} \\ \hline & \begin{tabular}{|c|c|} 2 & 8/1/2023 \\ \end{tabular} & Check & & & \begin{tabular}{|c|} ThecompanysignsaleaseonofficespacewithTonysProperties,LLC.Theypay$2,500forAugustsrenttoday,andasecuritydepositof$2,500(Check1000).Rentistobepaidthefirstofthemonth. \\ \end{tabular} \\ \hline 2,3 & 8/1/2023 & Check & & & ThecompanybuysaservicevanfromFordfor$37,000withCheck1001.Thevehiclehasausefullifeoffiveyearswithasalvagevalueof$17,000attheendofthefifthyear.Thestraight-linedepreciationmethodisused. \\ \hline 2,3 & 8/1/2023 & Check & & & The company purchases insurance for one year from Allstate for $4800. (Check 1002) \\ \hline & \begin{tabular}{l|r|} 2 & 8/5/2023 \\ 2 & 8/10/2023 \\ 2 & 8/22/2023 \\ 2 & 8/30/2023 \end{tabular} & CheckCheckCheckCheck & & & \\ \hline 2,3 & 8/14/2023 & & & & ThecompanyhiresEthanLeeasatechnician.Ethanearnsasalaryof$2,500everytwoweeks(10businessdays).ThesalaryispaidincashtoEthantheFridayfollowingthecloseofthepayperiod(August14thisthestartofapayperiodandthispayperiodendsAugust25thandEthanwillbepaidSeptember1st). \\ \hline 2,4,5 & 8/16/2023 & Check & & & Thecompanypurchases7bottlesofinsecticidefromDoMyOwnfor$224(Check1005).ArrestMyPesttracksinsecticideusingtheperpetualLIFOinventorysystem. \\ \hline 4,5 & 8/17/2023 & Bill & & & Thecompanypurchases60bottlesofrodenticidefor$2700fromVeserisonaccount.Termsare2/10,net30.(Choose"Net30"asyourtermsinthesoftware).ArrestMyPesttracksrodenticideusingtheperpetualFIFOinventorysystem. \\ \hline 4,5 & 8/18/2023 & Bill & & & Thecompanypurchases10packagesofroachbaitfor$400fromVeserisonaccount.Termsare2/10,net30.(Choose"Net30"asyourtermsinthesoftware).ArrestMyPesttracksroachbaitusingtheperpetualLIFOinventorysystem. \\ \hline & 28/19/2023 & Invoice & Receive Payment/Mark Invoice As Paid & Journal Entry For Cost Component & LauraHuangusesthecompanytosprayherhouseforspiders.Shepaysyou$600incash.Thecompanyusesfourbottlesofinsecticideforherjob. \\ \hline & \begin{tabular}{|l|l|} 2 & 8/21/2023 \\ \end{tabular} & Check & Journal Entry & Mark Bill As Paid (Apply Your Journal Entry to Bill) & \begin{tabular}{|l|} The company writes check \#1008 to pay the outstanding bill with Veseris for the roach bait. \\ The company peforms a roach treatment for George's restaurant. You bill George's $500 with terms 2/10, net 30 . \end{tabular} \\ \hline 4,5 & 8/22/2023 & Invoice & Journal Entry For Cost Component & & You use two packages of roach bait. \\ \hline 4,5 & 8/25/2023 & Check & & & The company purchases 8 bottles of insecticide from Veseris for $280 (Check 1009). \\ \hline & 28/26/2023 & Bill & & & Youraccountingandbookkeepingfirm,Sundheim,Chill,&RosenbergP.C.,haspreparedyour2022taxreturn.Theysendyouabillfor$800fortaxpreparationservices.ItisdueonSeptember25,2023. \\ \hline 4,5 & 8/26/2023 & Invoice & Journal Entry For Cost Component & & JoKellyhasamouseinherhouseandhiresthecompanytoperformatreatment.Youbillher$550andusetwobottlesofrodenticideonthejob. \\ \hline & 28/28/2023 & Check & & & The company writes check #1010 to pay the outstanding bill with Veseris for the rodenticide. \\ \hline 4,5 & 8/28/2023 & Invoice & Journal Entry For Cost Component & & \\ \hline 2,4,5 & 8/28/2023 & Check & & & The company purchases 10 bottles of rodenticide from DoMyOwn for $470 (Check 1011). \\ \hline & 28/29/2023 & Journal Entry & Journal Entry For Cost Component & & \\ \hline & 2/8/29/2023 & Bill & & & AT\&T invoices the company $325 for the business phone service. The invoice is due September 29, 2023. \\ \hline & 2/8/31/2023 & Check & & & The company made a distribution of $1,000 to Mike using check \#1012. \\ \hline \end{tabular}