Answered step by step

Verified Expert Solution

Question

1 Approved Answer

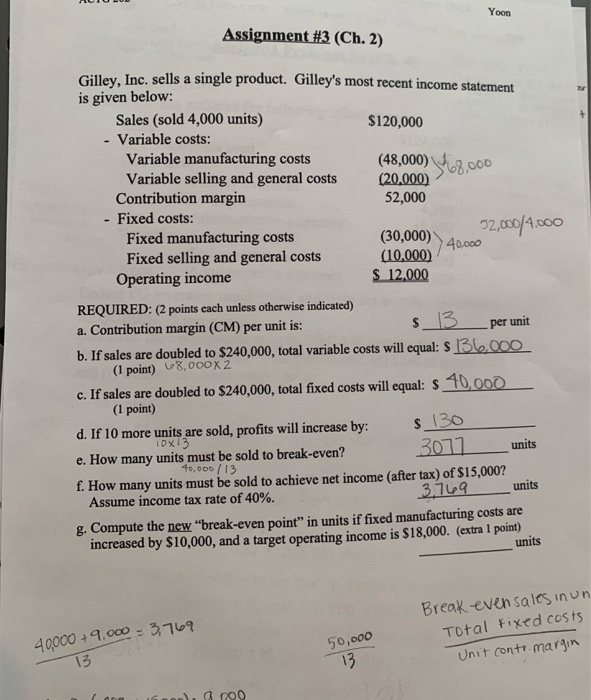

i need help with letter g Yoon Assignment #3 (Ch. 2) Gilley, Inc. sells a single product. Gilley's most recent income statement is given below:

i need help with letter "g"

Yoon Assignment #3 (Ch. 2) Gilley, Inc. sells a single product. Gilley's most recent income statement is given below: Sales (sold 4,000 units) $120,000 - Variable costs: Variable manufacturing costs (48,000) Variable selling and general costs 168,000 (20,000) Contribution margin 52,000 - Fixed costs: Fixed manufacturing costs (30,000) 02,000/4.000 40.000 Fixed selling and general costs (10,000) Operating income $ 12.000 REQUIRED: (2 points each unless otherwise indicated) a. Contribution margin (CM) per unit is: b. If sales are doubled to $240,000, total variable costs will equal: $ 136.000 (1 point) 68,000X2 c. If sales are doubled to $240,000, total fixed costs will equal: $ 40.000 (1 point) d. If 10 more units are sold, profits will increase by: 1DX13 3077 units e. How many units must be sold to break-even? 40,000/13 f. How many units must be sold to achieve net income (after tax) of $15,000? 3769 units Assume income tax rate of 40%. g. Compute the new break-even point" in units if fixed manufacturing costs are increased by $10,000, and a target operating income is $18,000. (extra 1 point) units $_13 per unit $_130 Break even sales in un Total Fixed costs Unit contr.margin 40000 +9,000 - 3769 50,000 13 13 a poo Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started