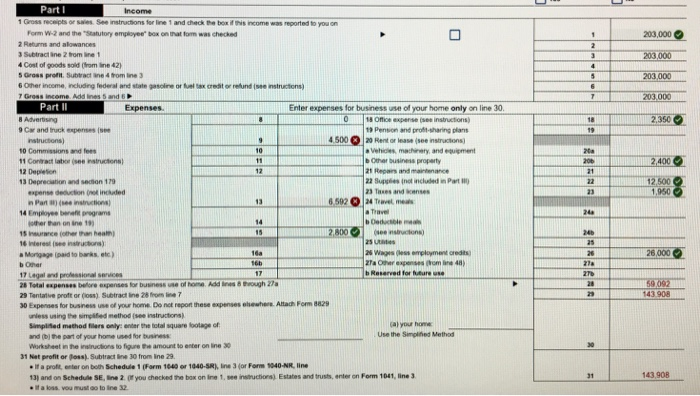

I need help with lines 9 Car and truck expenses

Also line 13 Depreciation and section 179 expense deduction please.

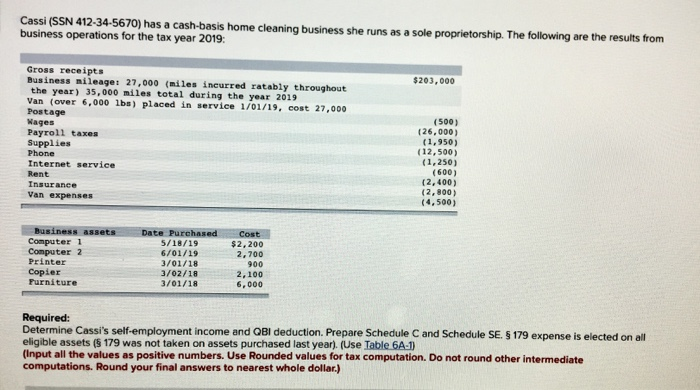

Cassi (SSN 412-34-5670) has a cash-basis home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2019: $203,000 Gross receipts Business mileage: 27,000 miles incurred ratably throughout the year) 35,000 miles total during the year 2019 Van (over 6,000 lbs) placed in service 1/01/19, cost 27,000 Postage Wages Payroll taxes Supplies Phone Internet service (500) (26,000) (1,950) (12,500) (1.250) (600) (2,400) (2,800) (4,500) Rent Insurance Van expenses Business assets Computer 1 Computer 2 Printer Copier Furniture Date Purehased 5/18/19 6/01/19 3/01/18 3/02/18 3/01/18 Cost $2,200 2.700 900 2,100 6,000 Required: Determine Cassi's self-employment income and QBI deduction. Prepare Schedule C and Schedule SE. S 179 expense is elected on all eligible assets (5 179 was not taken on assets purchased last year). (Use Table 6A-1 (Input all the values as positive numbers. Use Rounded values for tax computation. Do not round other intermediate computations. Round your final answers to nearest whole dollar.) 203.000 203.000 200 000 200 000 2.350 2,400 Part 1 income 1 Gro w See on edhe me ted to you on For w hen wachache 2 us and once 3 Subtractine 2 teminat 4 Cost of goods homine 62) 5 Gross prot Subwa na tom 6 Oher incomencluding federal and t e r r ori structions) Gross income. Addies and Part II Expenses Enter expenses for business use of your home only on line 30. 8 A ng 1 Office expe ctions 9 Cw and track expenses 1 Pension and proting plans structions) 20 Restoran as 10 Commissions and fees mary and met 11 Contract se c tions Other property 12 Depletion 21 Rendance 13 Depreciation and section 10 22 Spesinot included Part 10 expense deduction to inced 23 Tendances in Partner 6.502 C 24 Travel mes 14 Employee bent programs a Travel her than o ne 19 be 15 weethan het 12.800 16 Wrest o r a Mortgage and tobakset) 2 Wag o mployment credits One Tar om) 17 Legal and pro c es Reserved for 26 Total expensesore eyes for buss elhome Adres rough 27 23 Tentative protor ) Subtractie 2 Expenses for business use of your home. Do not report the expens e s. Attach Form 629 es using the lified methods tructions Sampled methods only the total are bote of your home and the part of your home used for business Use the Simplified Method 12 500 26.000 59709 31 Napro pro 13 and Sh tre che 16401440-GR or 1940-ARI i ne you checked the box on intention Estates and trusserter on Form 1041, in