I need help with only with question 3, I am done with question 1 and 2. Thank you very much.

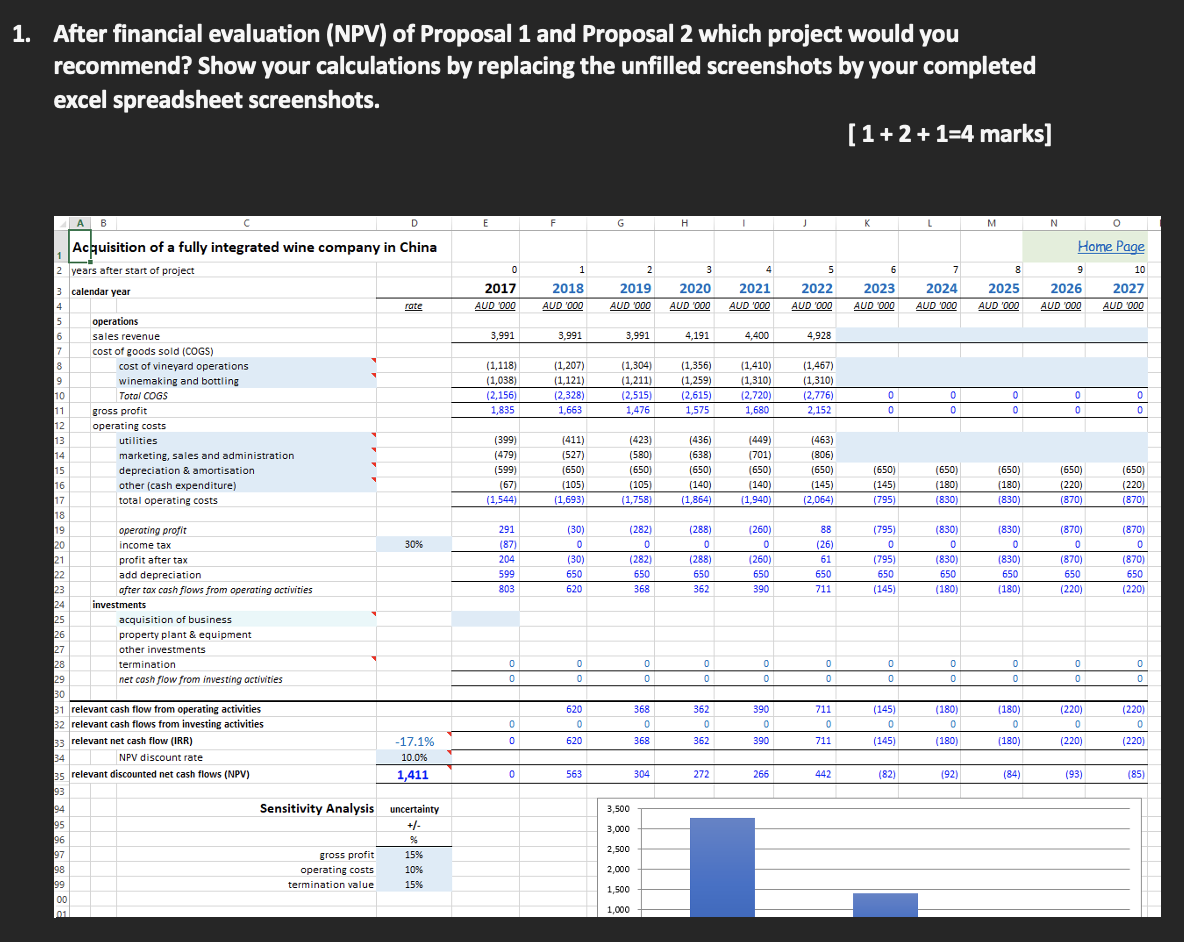

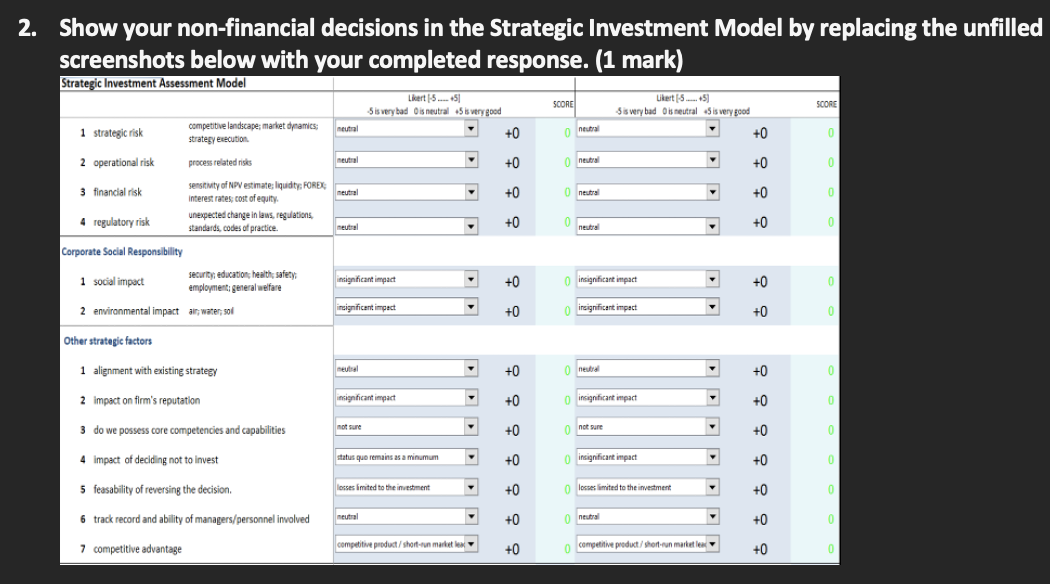

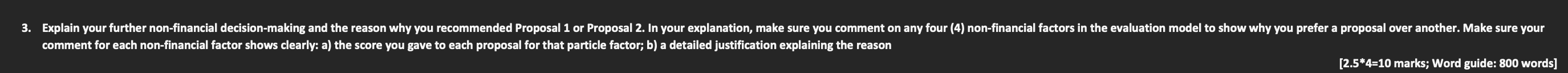

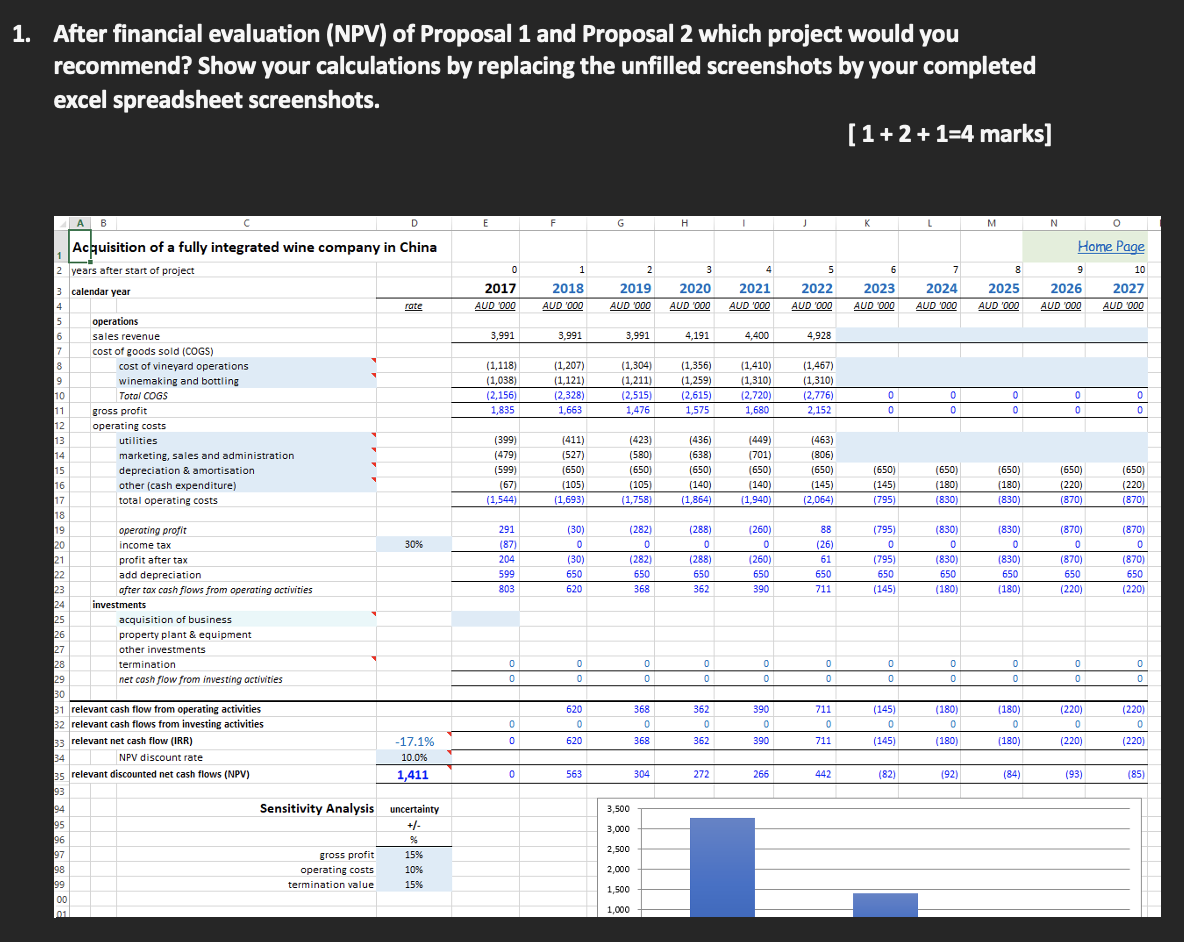

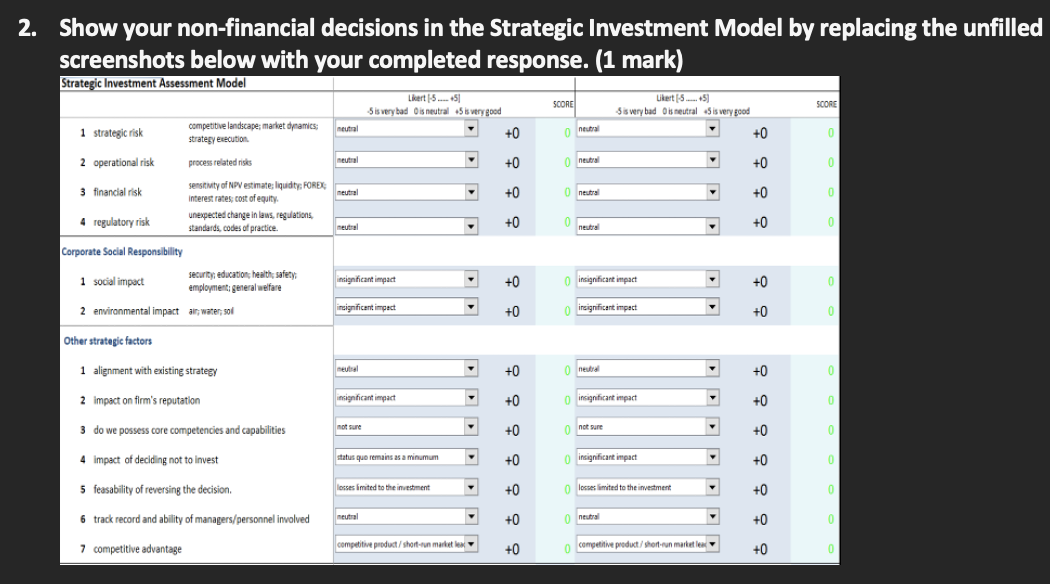

1. After financial evaluation (NPV) of Proposal 1 and Proposal 2 which project would you recommend? Show your calculations by replacing the unfilled screenshots by your completed excel spreadsheet screenshots. [1+ 2 + 1=4 marks] A B D E F G 1 K L M N O Home Page 1 2 3 4 5 6 10 0 2017 AUD OOO 2023 2018 AUD 1000 2019 AUD 1000 2020 AUD 000 2027 2021 AUD 000 7 2024 AUD 000 2022 AUD 1000 8 2025 AUD '000 9 2026 AUD 000 AUD 000 AUD 1000 3,991 3,991 3,991 4.191 4,400 4,928 (1,118) (1,038) (2,156) 1.835 (1,207) (1.121) (2,328) 1,663 (1,304) (1,211) (2,515) 1,476 (1,356) ) (1,259) (2,615) 1,575 (1,410) (1,310) (2,720) 1.680 (1,467) (1,310) (2,776) 2,152 0 0 0 0 0 0 0 gross profit 0 0 0 (399) (479) (599) (67) (1,544) (411) (527) (650) (105) (1,693) (423) (580) (650) (105) (1,758) (436) (638) (650) (140) (1,864) (449) (701) (650) (140) (1.940) (463) (806) (650) (145) (2,064) (650) (145) (795) (650) (180) ( (830) (650) (180) (830) (650) (220) (870) (650) (220) (870) Acquisition of a fully integrated wine company in China 1 2 years after start of project 3 calendar year 4 rate 5 operations 6 sales revenue 7 cost of goods sold (COGS) 8 cost of vineyard operations 9 winemaking and bottling 10 Total COGS 11 12 operating costs 13 utilities 14 marketing, sales and administration 15 depreciation & amortisation 16 other (cash expenditure) 17 total operating costs 18 19 operating profit 20 income tax 30% 21 profit after tax 22 add depreciation 23 after tax cash flows from operating activities 24 investments 25 acquisition of business 26 property plant & equipment 27 other investments 28 termination 29 net cash flow from investing activities 30 31 relevant cash flow from operating activities 32 relevant cash flows from investing activities 33 relevant net cash flow (IRR) -17.1% 34 NPV discount rate 10.0% 35 relevant discounted net cash flows (NPV) 1,411 93 94 Sensitivity Analysis uncertainty 95 +/- 96 % 97 gross profit 15% 98 20 operating costs 10% 99 termination value 15% 00 01 291 (87) 204 599 803 (30) 0 (30) 650 620 (282) 0 (282) 650 368 (288) 0 (288) 650 362 (260) 0 (260) 650 390 88 (26) 61 650 711 (795) 0 (795) 650 (145) (830) 0 (830) 650 (180) (830) 0 (830) 650 (180) (870) 0 (870) 650 (220) (870) 0 (870) 650 (220) ) 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 620 0 620 0 368 0 368 362 0 362 390 0 390 711 0 711 (145) 0 (145) (180) 0 (180) (180) 0 (180) (220) 0 (220) 0 (220) 0 (220) 0 563 304 272 266 442 (82) (92) (84) (93) (85) 3,500 3,000 2,500 2,000 1,500 1,000 2. Show your non-financial decisions in the Strategic Investment Model by replacing the unfilled screenshots below with your completed response. (1 mark) Strategic Investment Assessment Model SCORE SCORE Likert [...-+5] Sis very bad Ois neutral is very good +0 Likert 5.....5) 5 is very bad is neutral is very good +0 1 1 strategic risk competitive landscape: market dynamics: strategy execution neutral 0 2 operational risk process related risks +0 nel +0 0 3 financial risk neutral +0 neutral +0 0 sensitivity of NPV estimate liquidity FOREX interest rates, cost of equity. unexpected change in laws, regulations standards, codes of practice. 4 regulatory risk +0 0 +0 0 | neutra) Corporate Social Responsibility 1 social impact security, education, health, safety employment general welfare insignificant impact +0 insignificant impact +0 0 2 environmental impact air, water, so insignificant impact 7 +0 Oireignificant impact +0 0 Other strategic factors 1 1 alignment with existing strategy +0 net +0 0 2 impact on firm's reputation insignificant impact +0 insignificant impact +0 0 3 do we possess core competencies and capabilities not sure +0 0 not sure +0 4 Impact of deciding not to invest status quo remains as a minumum +0 insignificant impact +0 0 5 feasability of reversing the decision. losses imited to the investment +0 0 losses limited to the investment +0 0 6 track record and ability of managers/personnel involved neutral +0 Outral +0 0 7 competitive advantage competitive product/short-un marble +0 o competitive product/short-un market le +0 0 3. Explain your further non-financial decision-making and the reason why you recommended Proposal 1 or Proposal 2. In your explanation, make sure you comment on any four (4) non-financial factors in the evaluation model to show why you prefer a proposal over another. Make sure your comment for each non-financial factor shows clearly: a) the score you gave to each proposal for that particle factor; b) a detailed justification explaining the reason [2.5*4=10 marks; Word guide: 800 words]