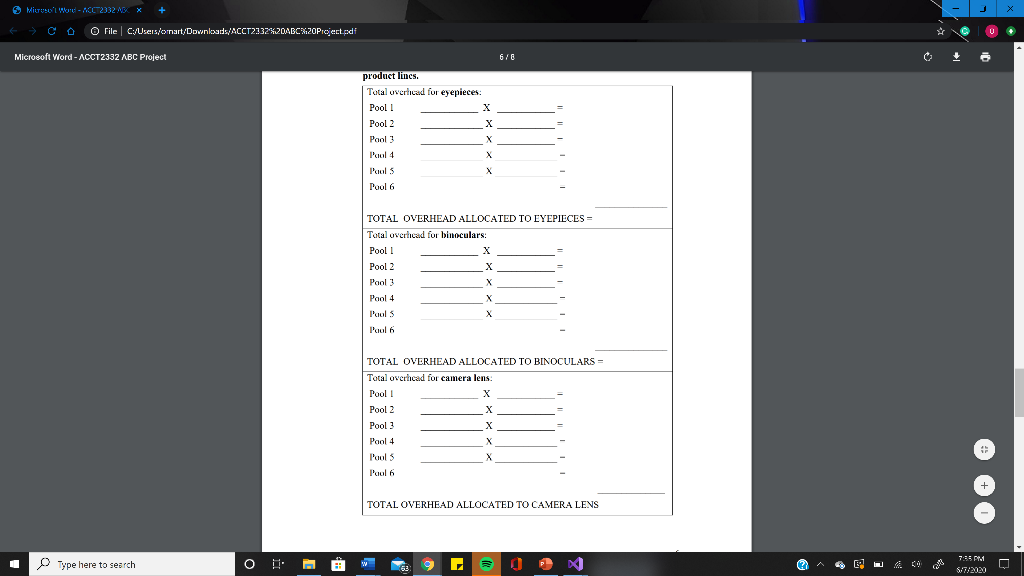

I need help with part C of the project. Part C is the last screenshot that is empty with pools 1-6 Thank you

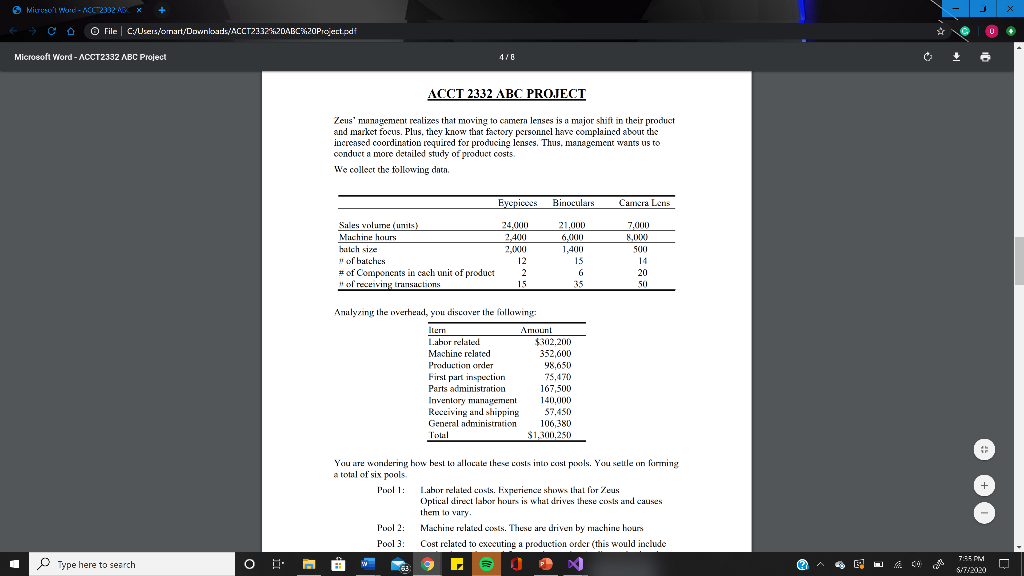

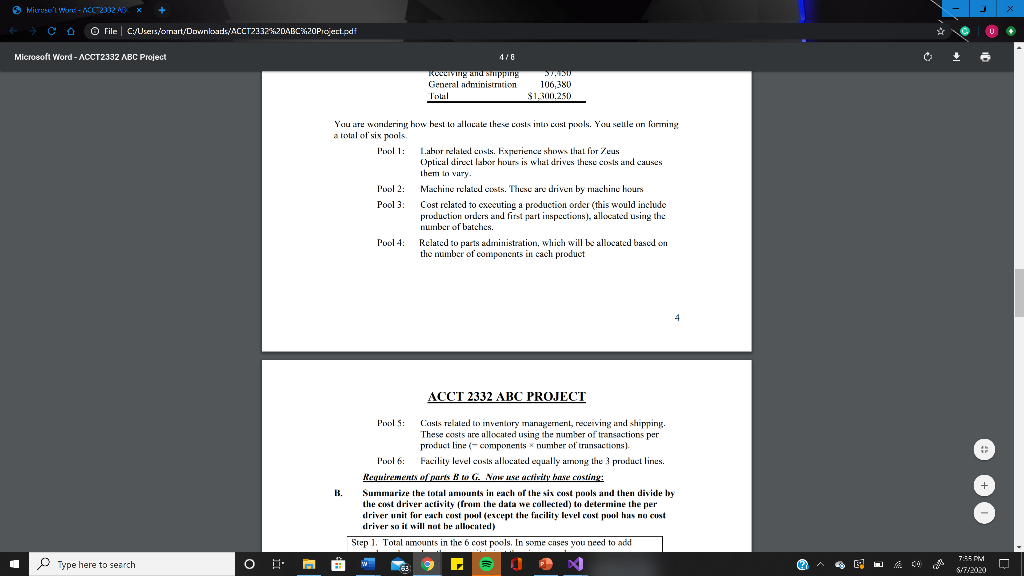

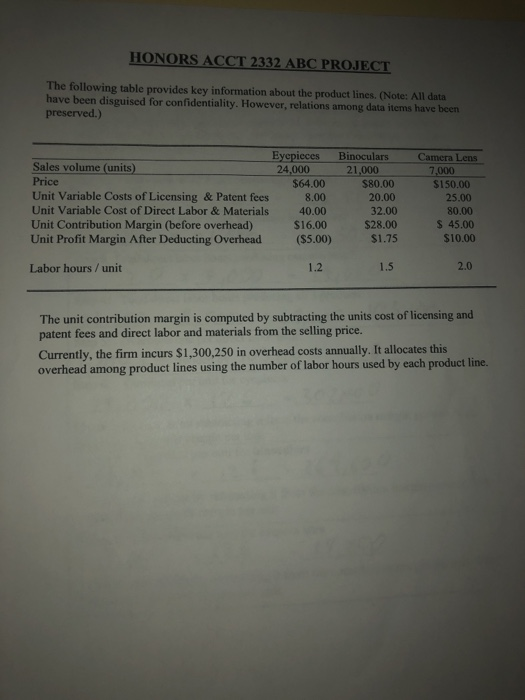

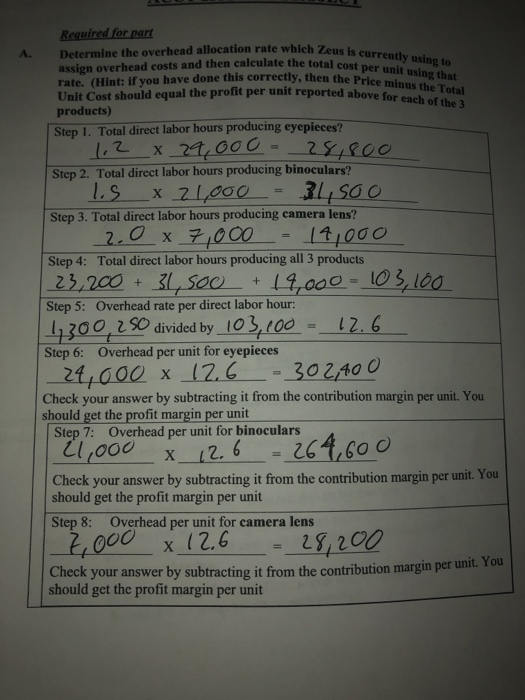

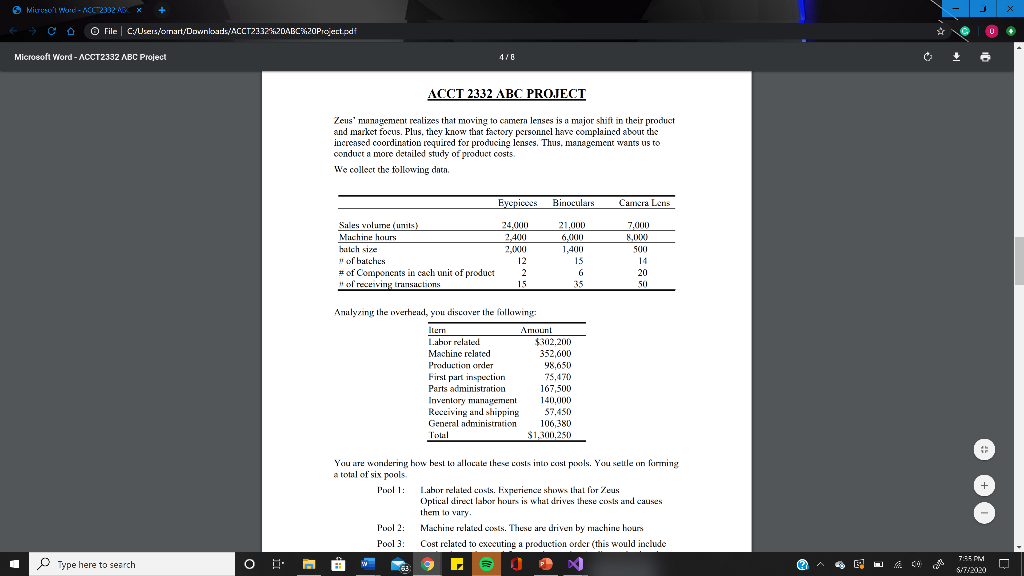

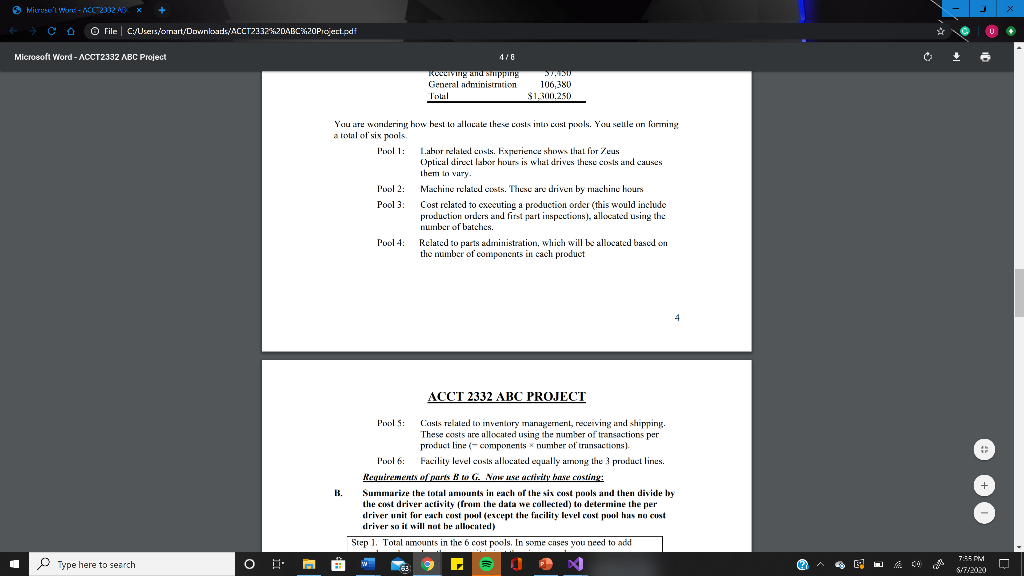

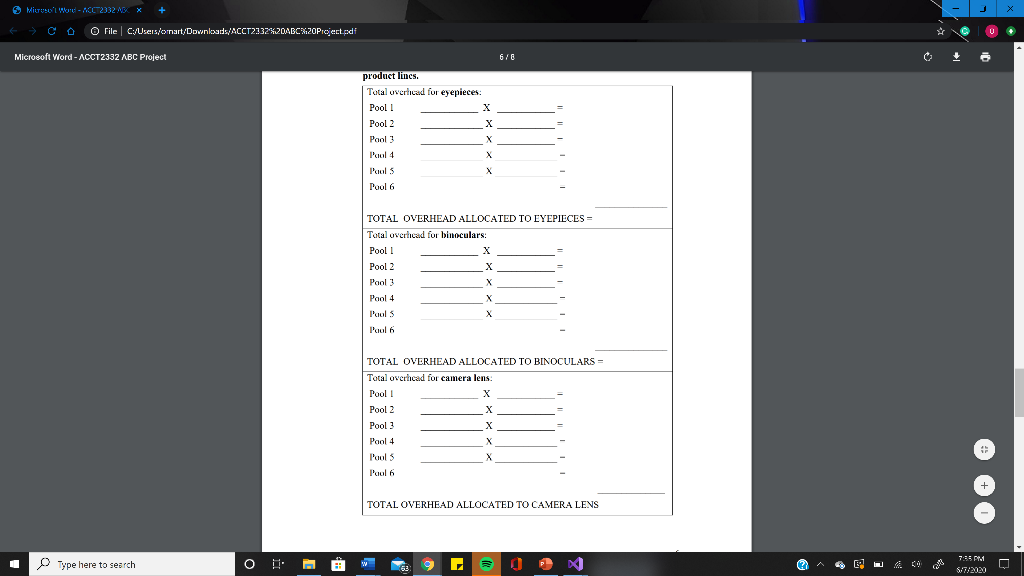

Miruso't Worr-C2332 O File C/Users/omart/Downloads/ACCT2132420ABC%20Project.pdf C Microsoft Word - ACCT2332 ABC Project 4/6 + ACCT 2332 ABC PROJECT Zeus' management realizes that moving to camera lenses is a major shift in their product and market focus. Plus, they know that factory personnel have complained about the increased coordination required for producing lenses. Thus, managemcat wants us to conduct a more detailed study of product costs We collect the following data. Eyepics Binoculars Camera Lens 21,000 Sales volume(ms) Machine hours halch size of batches # of Components in each unit of product # of receiving inclus 24.000 2,400 2,0XX 12 2 15 1,400 15 6 35 7.(100 NDIX) 500 14 20 50 Analyzing the overheid, you discover the following: Item Anicunt Labor relatex $302.200 Machine related 352,600 Production concler 98,650 First part inspection 75,470 Parts administration 167,500 Inventory management Receiving and shipping 57.450 General administration 106,380 Total $1.300.250 140,000 + You are wandering how best to allocate these costs into cost pools. You selile en forming a total of six pools Poll: Labor related costs. Experience shows that for Zeus Optical direct labor hours is what drives these costs and causes them to vary Pool 2 Machine related costs. These are driven by machine hours Pool 3: Cost related to cxocuting a production order (this would include Type here to search 0 w 7:35 PM S7/2020 Miruso't Worr-C2332 O File C/Users/omart/Downloads/ACCT2132420ABC%20Project.pdf C Microsoft Word - ACCT2332 ABC Project 4/6 + General devinistration Total NW 106,380 $1.500.250 You are wondering how best to allocate these costs into cost pexels. You selle on looming a total of six pools Labor related costs. Experience shows that for Zeus Optical direct labor hours is what drives these costs and causes them to Vitty Pool24 Maschine related costs. These are driven by machine hours Pool 3: Cost related to executing a production order (this would include production orders and first part inspection), allocated using the number of batches. Pool 4 Related to parts administration, which will be allocated based on the number of components in cach product 4 ACCT 2332 ABC PROJECT Pools: Cases related to inventory management, receiving and shipping. These costs are allocated using the number of transactions per product line (-components x number of transactions) Pool 6: Facility level costs allocated equally among the product lines. Requirements of paris 8 w G. Now lese activity base costing: Summarize the total amounts in each of the six cost pools and then divide by the cost driver activity (from the data we collected to determine the per driver unit for each cost pool (except the facility level cost pool has no cust driver so it will not be allocated) Step 1. Total numints in the cost pools. In some cases you need to add + B. Type here to search 0 X 7:35 PM S7/2020 Miruso't Worr-C2332 O File C/Users/omart/Downloads/ACCT2132420ABC%20Project.pdf C Microsoft Word - ACCT2332 ABC Project 6/6 + product lincs. Tatal Overhead for eyepieces. Pool! Pool 2 Pool 3 Paul 4 Pals Pool 6 X X TOTAL OVERHEAD ALLOCATED TO EYEPIECES = Total overhead for binoculars: Pool! Pool 2 Paol 3 Pool 4 X Parol X Pool 6 TOTAL OVERHEAD ALLOCATED TO BINOCULARS = Total overhead for camera lens. Pool X Pool 2 Pool 3 X Pool 4 Parol Paul + TOTAL OVERHEAD ALLOCATED TO CAMERA LENS Type here to search 0 X 7:35 PM S7/2020 HONORS ACCT 2332 ABC PROJECT The following table provides key information about the product lines. (Note: All data have been disguised for confidentiality. However, relations among data items have been preserved.) Eyepieces Sales volume (units) 24,000 Price $64.00 Unit Variable Costs of Licensing & Patent fees 8.00 Unit Variable Cost of Direct Labor & Materials 40.00 Unit Contribution Margin (before overhead) $16.00 Unit Profit Margin After Deducting Overhead ($5.00) Binoculars 21,000 $80.00 20.00 32.00 $28.00 $1.75 Camera Lens 7,000 $150.00 25.00 80.00 $ 45.00 $10.00 Labor hours / unit 1.2 1.5 2.0 The unit contribution margin is computed by subtracting the units cost of licensing and patent fees and direct labor and materials from the selling price. Currently, the firm incurs $1,300,250 in overhead costs annually. It allocates this overhead among product lines using the number of labor hours used by each product line. rate. (Hint: if you have done this correctly, then the Price minus the Total Determine the overhead allocation rate which Zeus is currently using to assign overhead costs and then calculate the total cost per unit using that Required for part A. x 29,000 Unit Cost should equal the profit per unit reported above for each of Thea products) Step 1. Total direct labor hours producing eyepieces? 1.2 28,800 Step 2. Total direct labor hours producing binoculars? 1.S X 21,000 31,500 Step 3. Total direct labor hours producing camera lens? 2.0 x 7,000 14,000 Step 4: Total direct labor hours producing all 3 products 23,200 + 31,500 + 19,000 - 103, 100 Step 5: Overhead rate per direct labor hour: 47300,250 divided by 103,000 = = 12.6 Step 6: Overhead per unit for eyepieces 24,000 x 12.6 302,400 Check your answer by subtracting it from the contribution margin per unit. You should get the profit margin per unit Step 7: Overhead per unit for binoculars 21,000 : 264,600 Check your answer by subtracting it from the contribution margin per unit. You should get the profit margin per unit Step 8: Overhead per unit for camera lens 7,000 x 12,6 28,200 Check your answer by subtracting it from the contribution margin per unit. You should get the profit margin per unit X 12.6 Miruso't Worr-C2332 O File C/Users/omart/Downloads/ACCT2132420ABC%20Project.pdf C Microsoft Word - ACCT2332 ABC Project 4/6 + ACCT 2332 ABC PROJECT Zeus' management realizes that moving to camera lenses is a major shift in their product and market focus. Plus, they know that factory personnel have complained about the increased coordination required for producing lenses. Thus, managemcat wants us to conduct a more detailed study of product costs We collect the following data. Eyepics Binoculars Camera Lens 21,000 Sales volume(ms) Machine hours halch size of batches # of Components in each unit of product # of receiving inclus 24.000 2,400 2,0XX 12 2 15 1,400 15 6 35 7.(100 NDIX) 500 14 20 50 Analyzing the overheid, you discover the following: Item Anicunt Labor relatex $302.200 Machine related 352,600 Production concler 98,650 First part inspection 75,470 Parts administration 167,500 Inventory management Receiving and shipping 57.450 General administration 106,380 Total $1.300.250 140,000 + You are wandering how best to allocate these costs into cost pools. You selile en forming a total of six pools Poll: Labor related costs. Experience shows that for Zeus Optical direct labor hours is what drives these costs and causes them to vary Pool 2 Machine related costs. These are driven by machine hours Pool 3: Cost related to cxocuting a production order (this would include Type here to search 0 w 7:35 PM S7/2020 Miruso't Worr-C2332 O File C/Users/omart/Downloads/ACCT2132420ABC%20Project.pdf C Microsoft Word - ACCT2332 ABC Project 4/6 + General devinistration Total NW 106,380 $1.500.250 You are wondering how best to allocate these costs into cost pexels. You selle on looming a total of six pools Labor related costs. Experience shows that for Zeus Optical direct labor hours is what drives these costs and causes them to Vitty Pool24 Maschine related costs. These are driven by machine hours Pool 3: Cost related to executing a production order (this would include production orders and first part inspection), allocated using the number of batches. Pool 4 Related to parts administration, which will be allocated based on the number of components in cach product 4 ACCT 2332 ABC PROJECT Pools: Cases related to inventory management, receiving and shipping. These costs are allocated using the number of transactions per product line (-components x number of transactions) Pool 6: Facility level costs allocated equally among the product lines. Requirements of paris 8 w G. Now lese activity base costing: Summarize the total amounts in each of the six cost pools and then divide by the cost driver activity (from the data we collected to determine the per driver unit for each cost pool (except the facility level cost pool has no cust driver so it will not be allocated) Step 1. Total numints in the cost pools. In some cases you need to add + B. Type here to search 0 X 7:35 PM S7/2020 Miruso't Worr-C2332 O File C/Users/omart/Downloads/ACCT2132420ABC%20Project.pdf C Microsoft Word - ACCT2332 ABC Project 6/6 + product lincs. Tatal Overhead for eyepieces. Pool! Pool 2 Pool 3 Paul 4 Pals Pool 6 X X TOTAL OVERHEAD ALLOCATED TO EYEPIECES = Total overhead for binoculars: Pool! Pool 2 Paol 3 Pool 4 X Parol X Pool 6 TOTAL OVERHEAD ALLOCATED TO BINOCULARS = Total overhead for camera lens. Pool X Pool 2 Pool 3 X Pool 4 Parol Paul + TOTAL OVERHEAD ALLOCATED TO CAMERA LENS Type here to search 0 X 7:35 PM S7/2020 HONORS ACCT 2332 ABC PROJECT The following table provides key information about the product lines. (Note: All data have been disguised for confidentiality. However, relations among data items have been preserved.) Eyepieces Sales volume (units) 24,000 Price $64.00 Unit Variable Costs of Licensing & Patent fees 8.00 Unit Variable Cost of Direct Labor & Materials 40.00 Unit Contribution Margin (before overhead) $16.00 Unit Profit Margin After Deducting Overhead ($5.00) Binoculars 21,000 $80.00 20.00 32.00 $28.00 $1.75 Camera Lens 7,000 $150.00 25.00 80.00 $ 45.00 $10.00 Labor hours / unit 1.2 1.5 2.0 The unit contribution margin is computed by subtracting the units cost of licensing and patent fees and direct labor and materials from the selling price. Currently, the firm incurs $1,300,250 in overhead costs annually. It allocates this overhead among product lines using the number of labor hours used by each product line. rate. (Hint: if you have done this correctly, then the Price minus the Total Determine the overhead allocation rate which Zeus is currently using to assign overhead costs and then calculate the total cost per unit using that Required for part A. x 29,000 Unit Cost should equal the profit per unit reported above for each of Thea products) Step 1. Total direct labor hours producing eyepieces? 1.2 28,800 Step 2. Total direct labor hours producing binoculars? 1.S X 21,000 31,500 Step 3. Total direct labor hours producing camera lens? 2.0 x 7,000 14,000 Step 4: Total direct labor hours producing all 3 products 23,200 + 31,500 + 19,000 - 103, 100 Step 5: Overhead rate per direct labor hour: 47300,250 divided by 103,000 = = 12.6 Step 6: Overhead per unit for eyepieces 24,000 x 12.6 302,400 Check your answer by subtracting it from the contribution margin per unit. You should get the profit margin per unit Step 7: Overhead per unit for binoculars 21,000 : 264,600 Check your answer by subtracting it from the contribution margin per unit. You should get the profit margin per unit Step 8: Overhead per unit for camera lens 7,000 x 12,6 28,200 Check your answer by subtracting it from the contribution margin per unit. You should get the profit margin per unit X 12.6