Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The disclosure note below is from the 2 0 2 0 1 0 - K report of Casey's General Stores, Inc., an operator of convenience

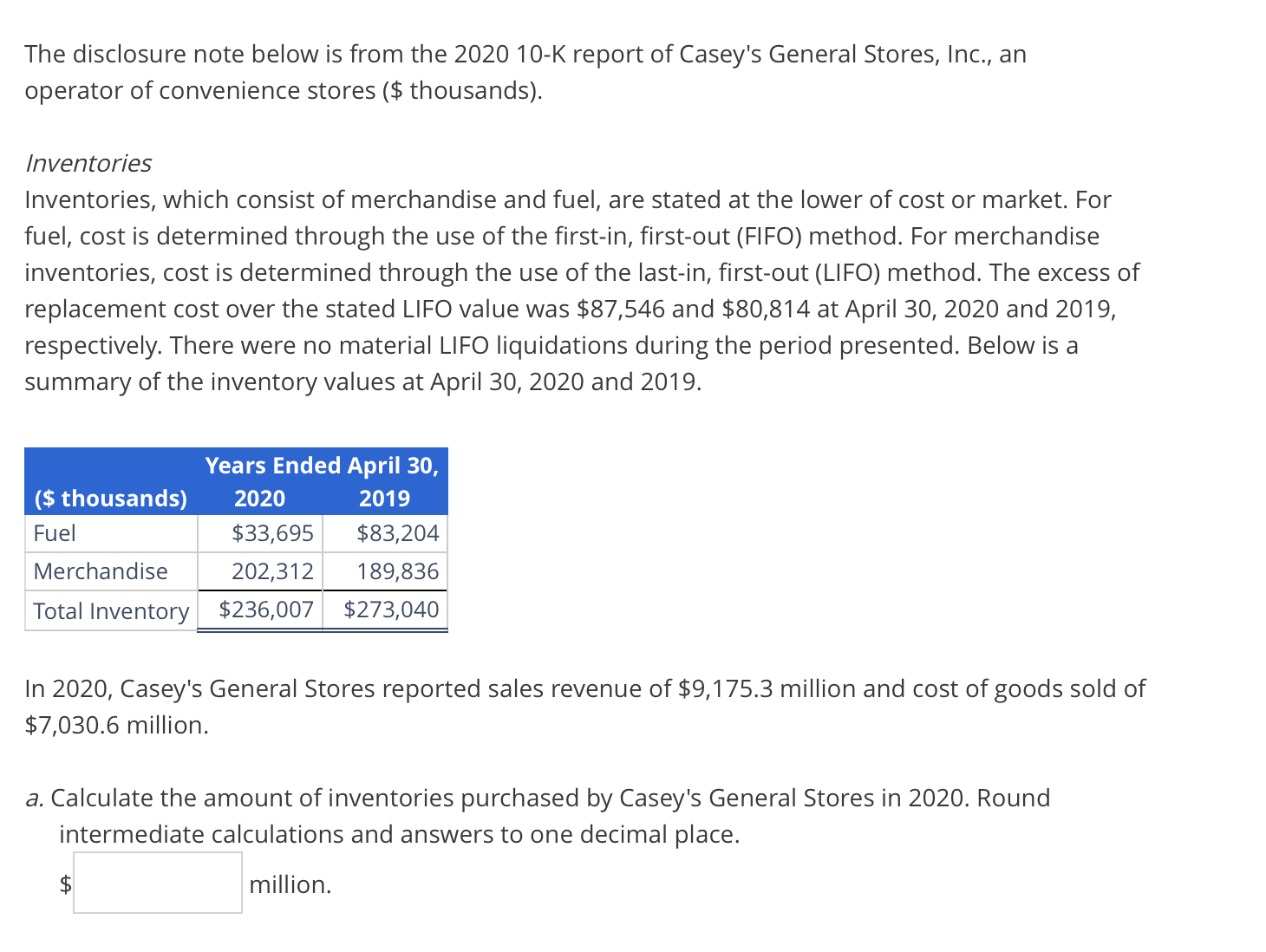

The disclosure note below is from the K report of Casey's General Stores, Inc., an

operator of convenience stores $ thousands

Inventories

Inventories, which consist of merchandise and fuel, are stated at the lower of cost or market. For

fuel, cost is determined through the use of the firstin firstout FIFO method. For merchandise

inventories, cost is determined through the use of the lastin firstout LIFO method. The excess of

replacement cost over the stated LIFO value was $ and $ at April and

respectively. There were no material LIFO liquidations during the period presented. Below is a

summary of the inventory values at April and

In Casey's General Stores reported sales revenue of $ million and cost of goods sold of

$ million.

a Calculate the amount of inventories purchased by Casey's General Stores in Round

intermediate calculations and answers to one decimal place.

$

million.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started