Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with part (ii) of this question. The answers to part (i) are given above. Thank you Sugar plc and Tea plc are

I need help with part (ii) of this question. The answers to part (i) are given above. Thank you

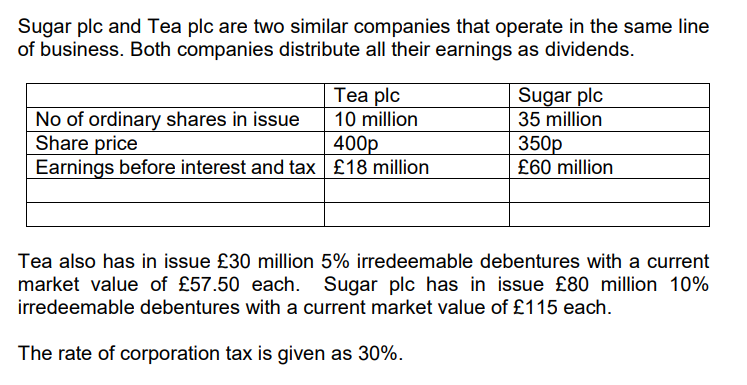

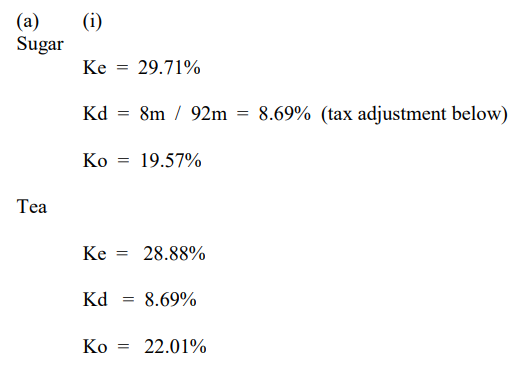

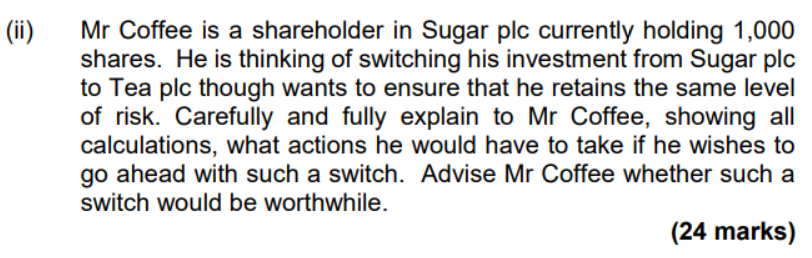

Sugar plc and Tea plc are two similar companies that operate in the same line of business. Both companies distribute all their earnings as dividends. Tea plc No of ordinary shares in issue 10 million Share price 400p Earnings before interest and tax 18 million Sugar plc 35 million 350p 60 million Tea also has in issue 30 million 5% irredeemable debentures with a current market value of 57.50 each. Sugar plc has in issue 80 million 10% irredeemable debentures with a current market value of 115 each. The rate of corporation tax is given as 30%. (a) Sugar ) (i) 29.71% Kd = 8m / 92m = 8.69% (tax adjustment below) = Ko = 19.57% Tea = 28.88% Kd = 8.69% Ko 22.01% (ii) ) Mr Coffee is a shareholder in Sugar plc currently holding 1,000 shares. He is thinking of switching his investment from Sugar plc to Tea plc though wants to ensure that he retains the same level of risk. Carefully and fully explain to Mr Coffee, showing all calculations, what actions he would have to take if he wishes to go ahead with such a switch. Advise Mr Coffee whether such a switch would be worthwhile. (24 marks) Sugar plc and Tea plc are two similar companies that operate in the same line of business. Both companies distribute all their earnings as dividends. Tea plc No of ordinary shares in issue 10 million Share price 400p Earnings before interest and tax 18 million Sugar plc 35 million 350p 60 million Tea also has in issue 30 million 5% irredeemable debentures with a current market value of 57.50 each. Sugar plc has in issue 80 million 10% irredeemable debentures with a current market value of 115 each. The rate of corporation tax is given as 30%. (a) Sugar ) (i) 29.71% Kd = 8m / 92m = 8.69% (tax adjustment below) = Ko = 19.57% Tea = 28.88% Kd = 8.69% Ko 22.01% (ii) ) Mr Coffee is a shareholder in Sugar plc currently holding 1,000 shares. He is thinking of switching his investment from Sugar plc to Tea plc though wants to ensure that he retains the same level of risk. Carefully and fully explain to Mr Coffee, showing all calculations, what actions he would have to take if he wishes to go ahead with such a switch. Advise Mr Coffee whether such a switch would be worthwhile. (24 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started