Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with part (iii) only ! can you do this on excel?? This is Summer 2020, and you want to work out whether

i need help with part (iii) only !

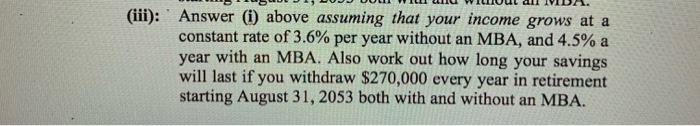

can you do this on excel?? This is Summer 2020, and you want to work out whether going to graduate school for your MBA, an otherwise desirable prospect, is a financially sound decision. You have been offered a job that pays $144,000 per year starting September 1, 2020, and you plan to take it up if you do not go for an MBA. If you do go for an MBA, you will: (a): have to pay $72,000 each on September 1, 2020 and September 1, 2021 toward the cost of education, and (b): start earning only upon graduation, with your post-MBA job starting on September 1, 2022. For computational simplicity, assume that you are paid your annual salary in a lump sum at the end of each working year. You plan to retire on August 31, 2052 whether or not you go for an MBA in 2020. For the purposes of this problem you find it reasonable to assume that the term structure is flat at 4.5%. (i): Assuming that your income remains constant over time with or without an MBA, that your starting salary after MBA is $189,000, and that you save a constant 15% of your income over your working life, work out the amount you would have saved on retirement (a) if you go for an MBA, and (b) if you do not go for an MBA. (ii): Answer (i) above assuming that your income grows at a constant rate of 2.25% per year without an MBA, and 3.6% a year with an MBA. Also work out how long your savings will last if you withdraw $225,000 every year in retirement starting August 31, 2053 both with and without an MBA. (iii): Answer (i) above assuming that vour income grows at a (iii): ' Answer (i) above assuming that your income grows at a constant rate of 3.6% per year without an MBA, and 4.5% a year with an MBA. Also work out how long your savings will last if you withdraw $270,000 every year in retirement starting August 31, 2053 both with and without an MBA

can you do this on excel?? This is Summer 2020, and you want to work out whether going to graduate school for your MBA, an otherwise desirable prospect, is a financially sound decision. You have been offered a job that pays $144,000 per year starting September 1, 2020, and you plan to take it up if you do not go for an MBA. If you do go for an MBA, you will: (a): have to pay $72,000 each on September 1, 2020 and September 1, 2021 toward the cost of education, and (b): start earning only upon graduation, with your post-MBA job starting on September 1, 2022. For computational simplicity, assume that you are paid your annual salary in a lump sum at the end of each working year. You plan to retire on August 31, 2052 whether or not you go for an MBA in 2020. For the purposes of this problem you find it reasonable to assume that the term structure is flat at 4.5%. (i): Assuming that your income remains constant over time with or without an MBA, that your starting salary after MBA is $189,000, and that you save a constant 15% of your income over your working life, work out the amount you would have saved on retirement (a) if you go for an MBA, and (b) if you do not go for an MBA. (ii): Answer (i) above assuming that your income grows at a constant rate of 2.25% per year without an MBA, and 3.6% a year with an MBA. Also work out how long your savings will last if you withdraw $225,000 every year in retirement starting August 31, 2053 both with and without an MBA. (iii): Answer (i) above assuming that vour income grows at a (iii): ' Answer (i) above assuming that your income grows at a constant rate of 3.6% per year without an MBA, and 4.5% a year with an MBA. Also work out how long your savings will last if you withdraw $270,000 every year in retirement starting August 31, 2053 both with and without an MBA

i need help with part (iii) only !

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started