I need help with parts C and D where you see the red X's please.

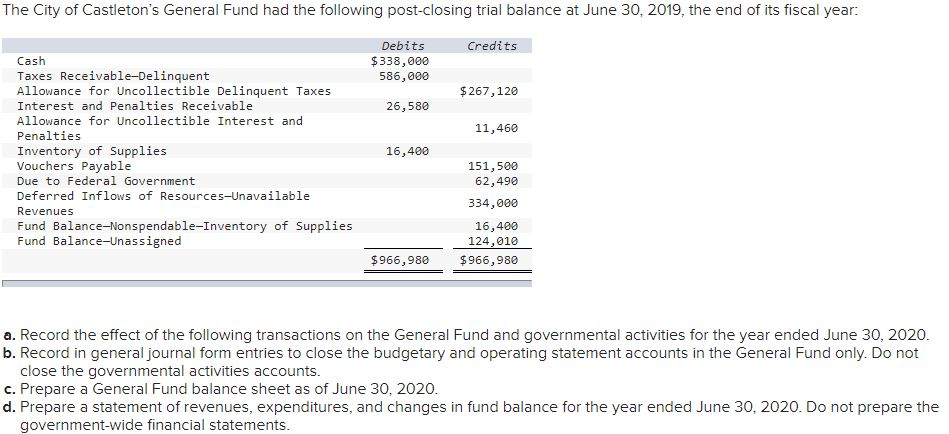

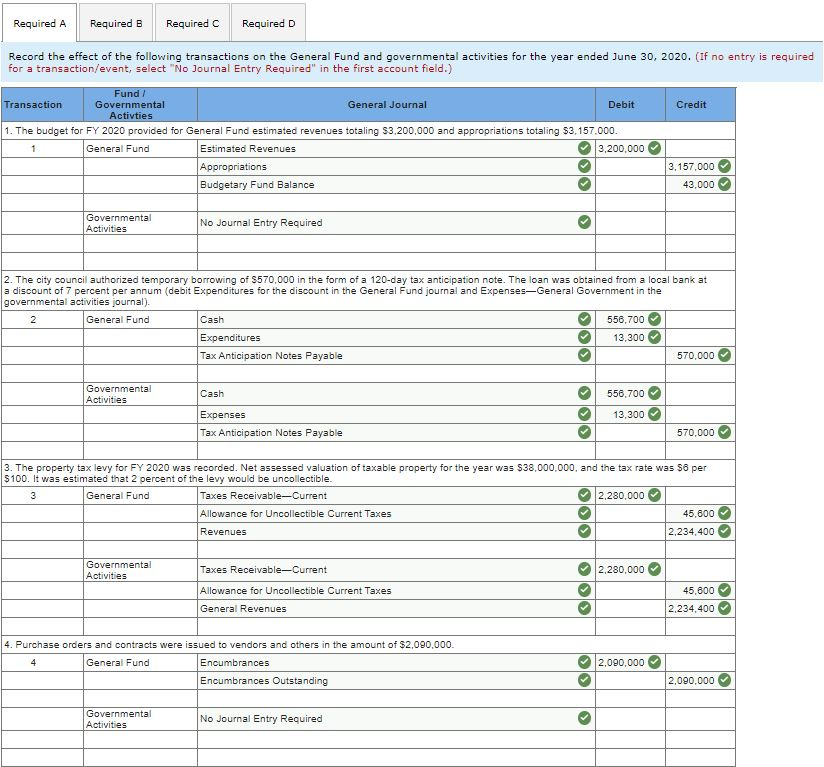

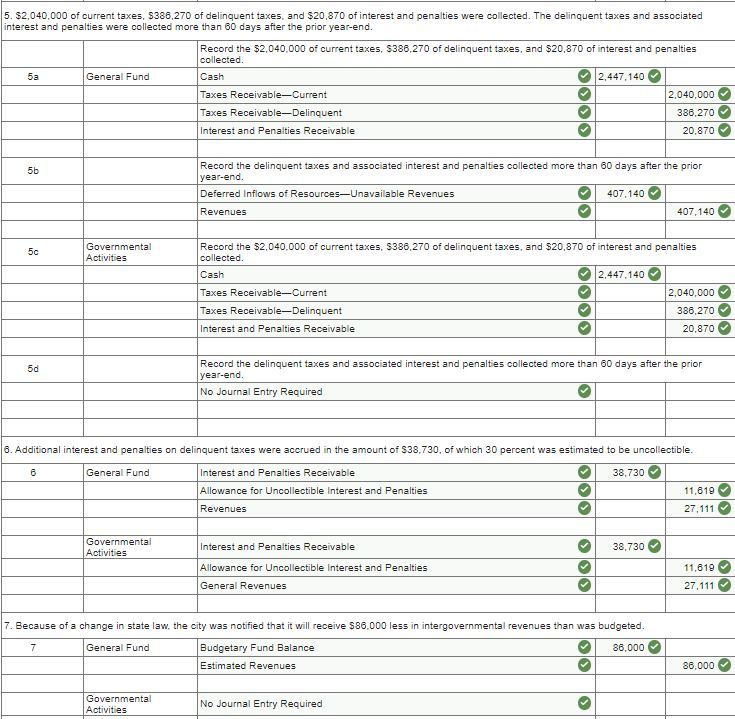

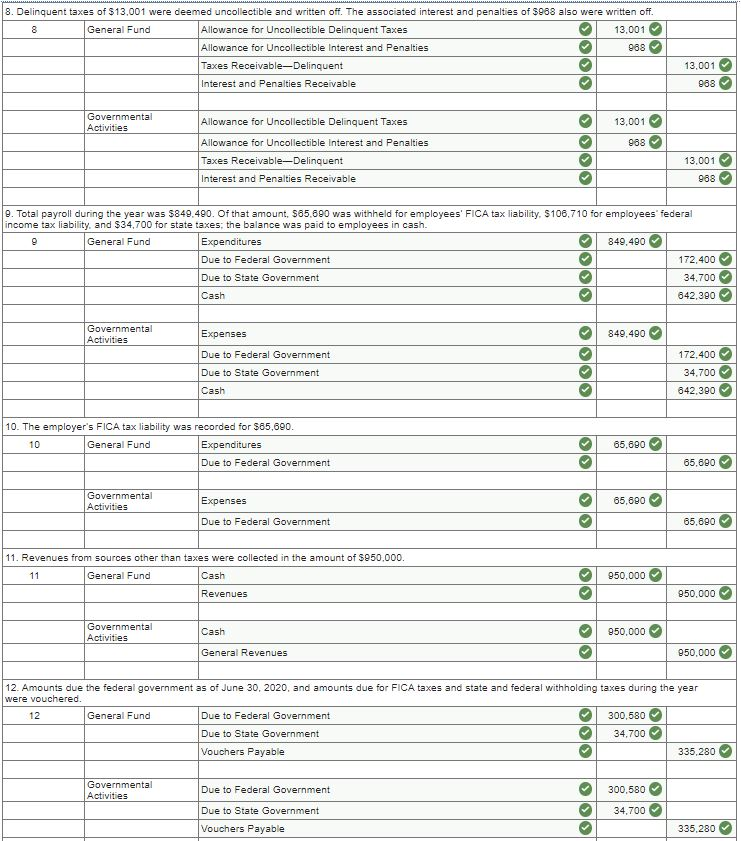

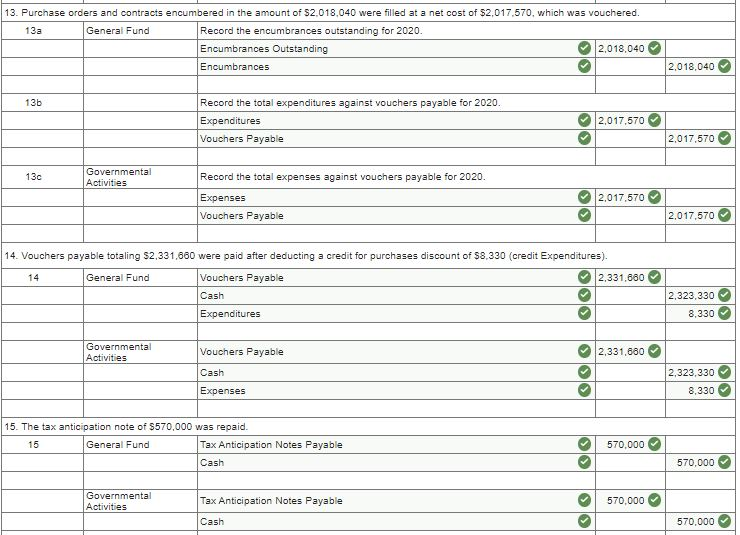

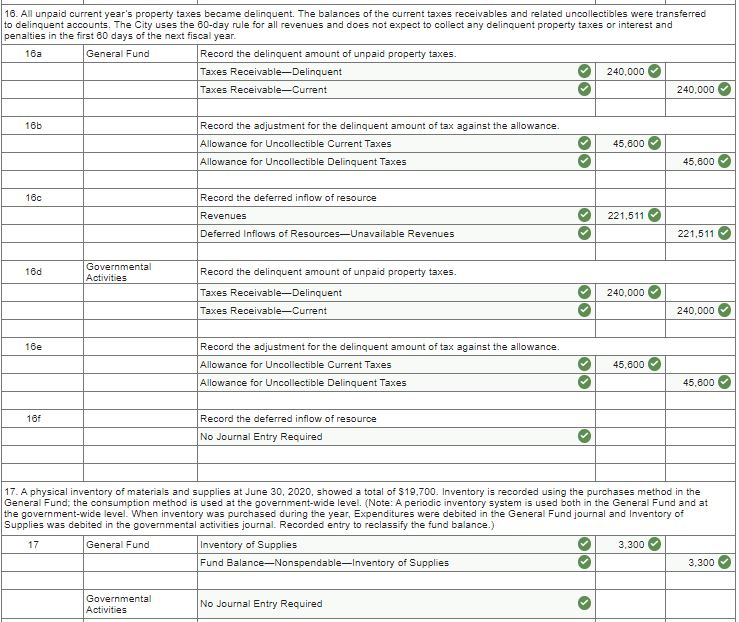

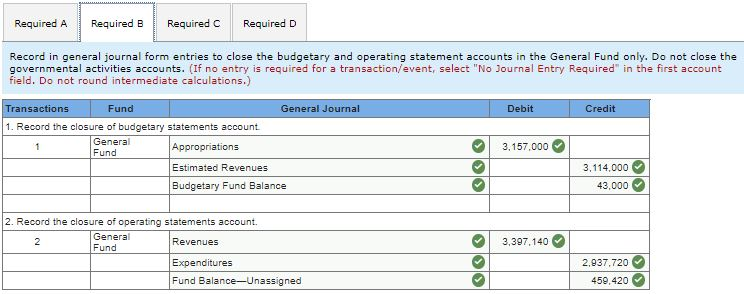

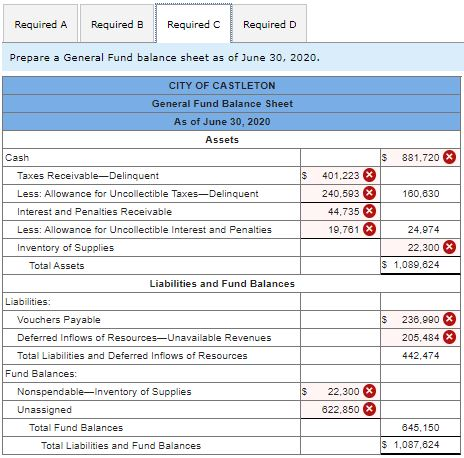

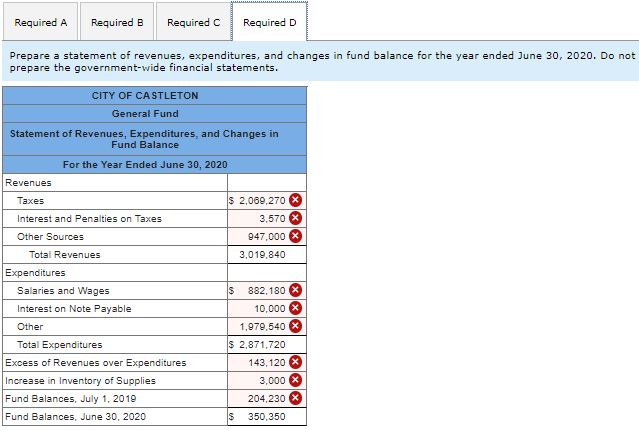

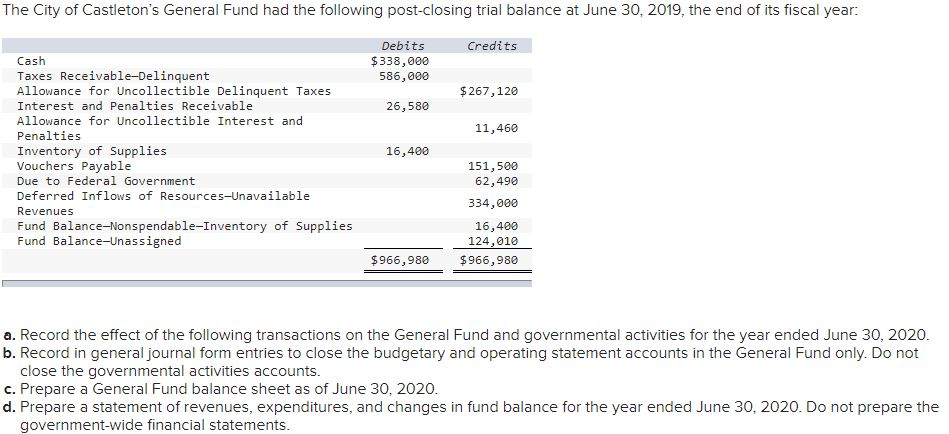

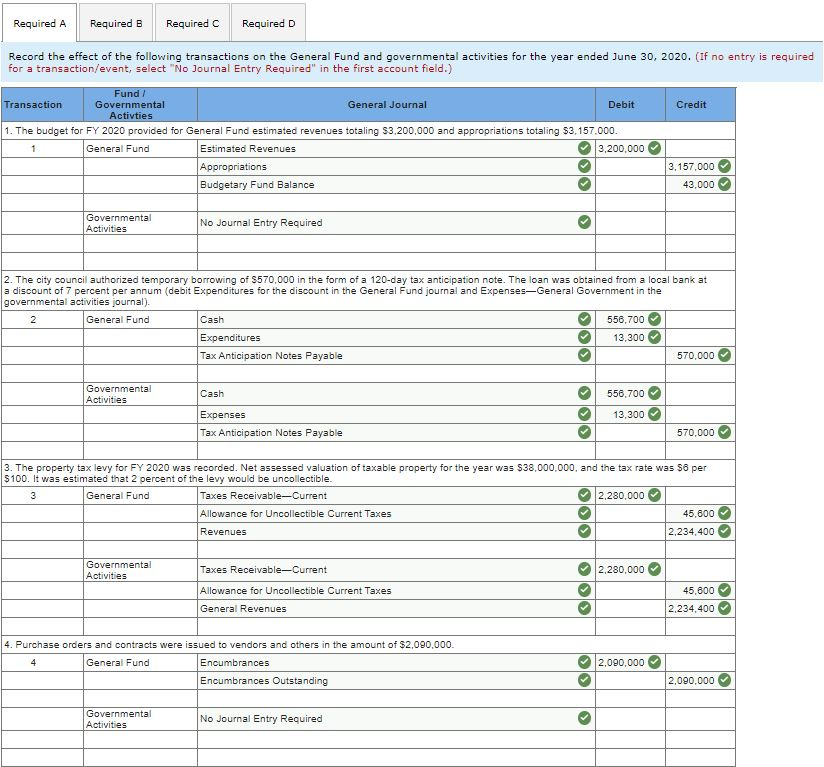

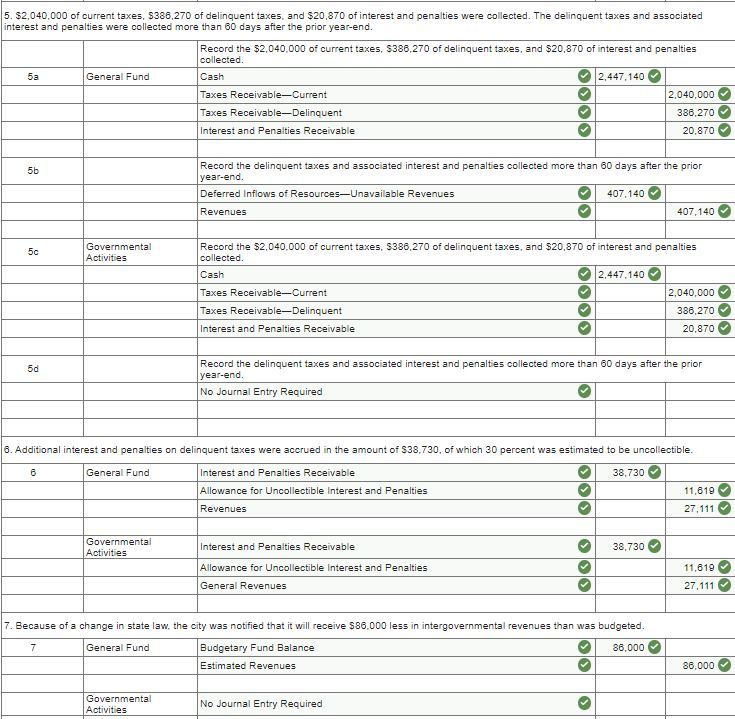

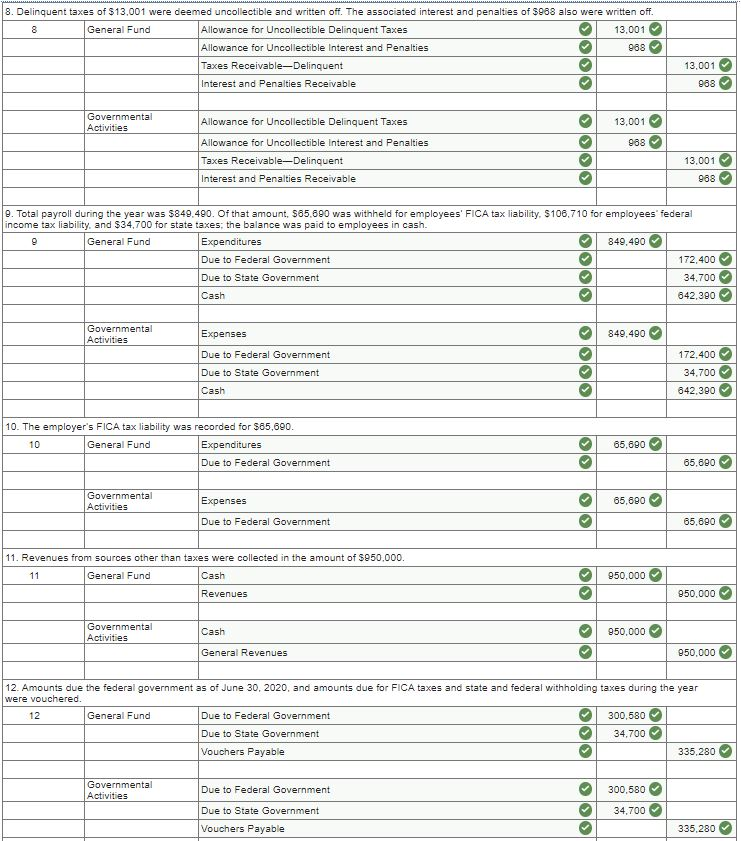

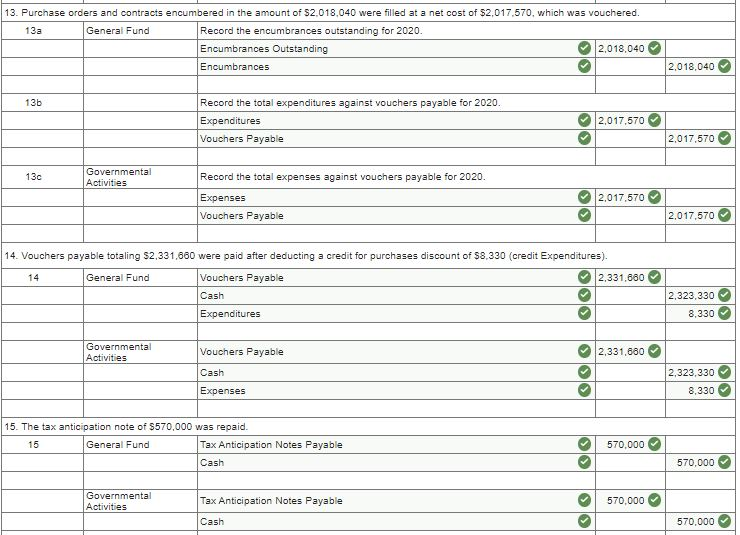

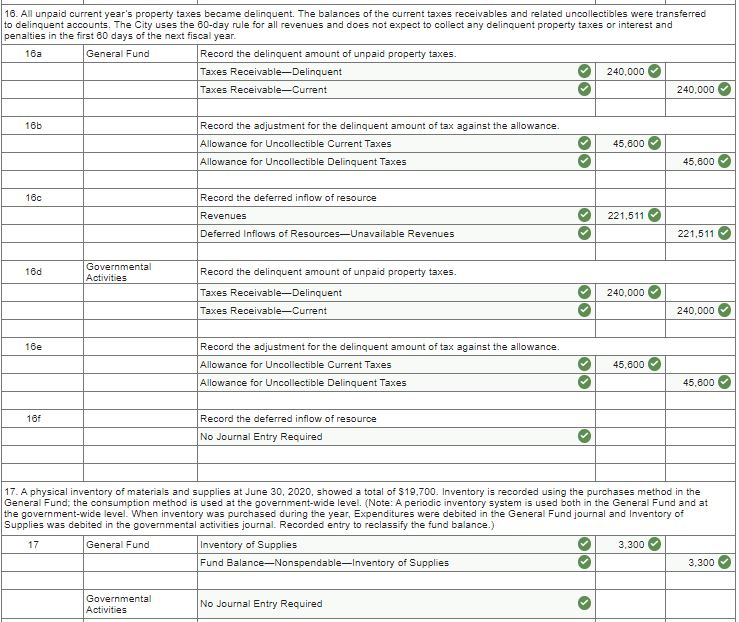

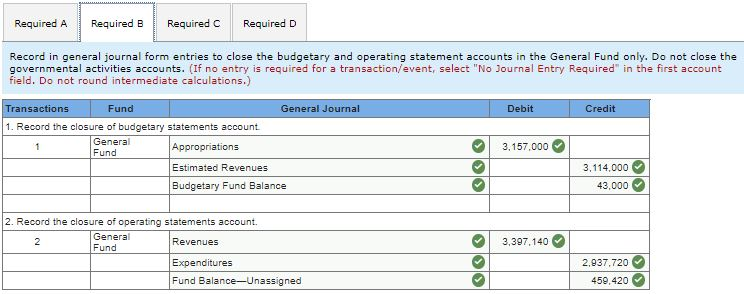

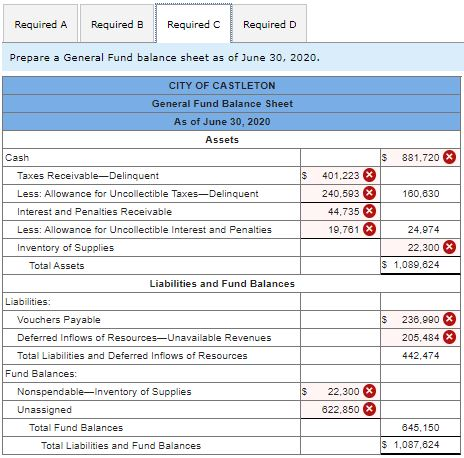

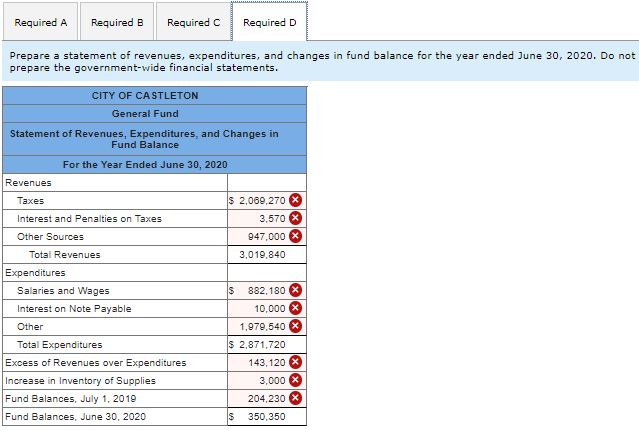

The City of Castleton's General Fund had the following post-closing trial balance at June 30, 2019, the end of its fiscal year: Credits Debits $338,000 586,000 $ 267, 120 26,580 11,460 Cash Taxes Receivable-Delinquent Allowance for Uncollectible Delinquent Taxes Interest and Penalties Receivable Allowance for Uncollectible Interest and Penalties Inventory of Supplies Vouchers Payable Due to Federal Government Deferred Inflows of Resources-Unavailable Revenues Fund Balance-Nonspendable-Inventory of Supplies Fund Balance-Unassigned 16,400 151,500 62,490 334,000 16,400 124,010 $966,980 $966,980 a. Record the effect of the following transactions on the General Fund and governmental activities for the year ended June 30, 2020. b. Record in general journal form entries to close the budgetary and operating statement accounts in the General Fund only. Do not close the governmental activities accounts. c. Prepare a General Fund balance sheet as of June 30, 2020. d. Prepare a statement of revenues, expenditures, and changes in fund balance for the year ended June 30, 2020. Do not prepare the government-wide financial statements. Required A Required B Required c Required D Record the effect of the following transactions on the General Fund and governmental activities for the year ended June 30, 2020. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Credit Fund/ Transaction Governmental General Journal Debit Activties 1. The budget for FY 2020 provided for General Fund estimated revenues totaling $3.200,000 and appropriations totaling $3,157.000. General Fund Estimated Revenues 3,200.000 Appropriations Budgetary Fund Balance 1 3,157,000 43.000 Governmental Activities No Journal Entry Required 2. The city council authorized temporary borrowing of S570,000 in the form of a 120-day tax anticipation note. The loan was obtained from a local bank at a discount of 7 percent per annum (debit Expenditures for the discount in the General Fund journal and ExpensesGeneral Government in the governmental activities journal). 2 General Fund Cash 556.700 Expenditures 13,300 Tax Anticipation Notes Payable 570,000 Governmental Activities Cash 556.700 13,300 Expenses Tax Anticipation Notes Payable 570,000 3. The property tax levy for FY 2020 was recorded. Net assessed valuation of taxable property for the year was $38,000,000, and the tax rate was $6 per $ 100. It was estimated that 2 percent of the levy would be uncollectible. 3 General Fund Taxes Receivable-Current 2,280,000 Allowance for Uncollectible Current Taxes 45.600 Revenues 2.234,400 Governmental Activities Taxes Receivable-Current 2,280,000 Allowance for Uncollectible Current Taxes 45,800 General Revenues 2.234,400 4. Purchase orders and contracts were issued to vendors and others in the amount of $2.090.000 4 General Fund Encumbrances 2.000.000 Encumbrances Outstanding 2.090.000 Governmental Activities No Journal Entry Required 8. Delinquent taxes of $13.001 were deemed uncollectible and written off. The associated interest and penalties of $988 also were written off. 8 General Fund Allowance for Uncollectible Delinquent Taxes 13,001 Allowance for Uncollectible Interest and Penalties 988 Taxes Receivable-Delinquent Interest and Penalties Receivable DOO 13,001 988 Governmental Activities 13,001 988 Allowance for Uncollectible Delinquent Taxes Allowance for Uncollectible Interest and Penalties Taxes Receivable-Delinquent Interest and Penalties Receivable OOO 13,001 988 2. Total payroll during the year was $849.490. Of that amount, $65.690 was withheld for employees' FICA tax liability, $106.710 for employees' federal income tax liability, and $34,700 for state taxes; the balance was paid to employees in cash. 9 General Fund Expenditures 849,490 Due to Federal Government 172,400 Due to State Government 34,700 Cash 842,390 Governmental Activities Expenses 849,400 Due to Federal Government Due to State Government Cash 172,400 34,700 642,390 10. The employer's FICA tax liability was recorded for $65,690. 10 General Fund Expenditures Due to Federal Government 65,600 65.890 Governmental Activities Expenses 65,000 Due to Federal Government 65,890 11. Revenues from sources other than taxes were collected in the amount of $950.000. 11 General Fund 950,000 Cash Revenues 950,000 Governmental Activities Cash 950,000 General Revenues 950.000 12. Amounts due the federal government as of June 30, 2020, and amounts due for FICA taxes and state and federal withholding taxes during the year were vouchered. 12 General Fund Due to Federal Government 300,580 Due to State Government 34,700 Vouchers Payable 335,280 Governmental Activities Due to Federal Government 300,580 Due to State Government 34,700 Vouchers Payable 335.280 13. Purchase orders and contracts encumbered in the amount of $2.018,040 were filled at a net cost of $2,017,570, which was vouchered. 13a General Fund Record the encumbrances outstanding for 2020. Encumbrances Outstanding 2,018,040 Encumbrances 2,018,040 13b Record the total expenditures against vouchers payable for 2020. Expenditures Vouchers Payable 2,017,570 2,017,570 13c Governmental Activities Record the total expenses against vouchers payable for 2020. 2,017,570 Expenses Vouchers Payable 2,017,570 14. Vouchers payable totaling $2,331,660 were paid after deducting a credit for purchases discount of $8.330 (credit Expenditures). 14 General Fund Vouchers Payable 2,331,660 Cash Expenditures 2,323,330 8,330 Governmental Activities Vouchers Payable 2,331,680 Cash Expenses 2,323,330 8.330 15. The tax anticipation note of $570,000 was repaid. 15 General Fund Tax Anticipation Notes Payable Cash 570,000 570,000 Governmental Activities Tax Anticipation Notes Payable 570.000 Cash > 570.000 16. All unpaid current year's property taxes became delinquent. The balances of the current taxes receivables and related uncollectibles were transferred to delinquent accounts. The City uses the 60-day rule for all revenues and does not expect to collect any delinquent property taxes or interest and penalties in the first 60 days of the next fiscal year. 16a General Fund Record the delinquent amount of unpaid property taxes. Taxes Receivable-Delinquent 240,000 Taxes Receivable-Current 240,000 16b Record the adjustment for the delinquent amount of tax against the allowance. Allowance for Uncollectible Current Taxes Allowance for Uncollectible Delinquent Taxes 45,800 45.600 16c Record the deferred inflow of resource Revenues Deferred Inflows of ResourcesUnavailable Revenues 221.511 221,511 16d Governmental Activities Record the delinquent amount of unpaid property taxes. Taxes Receivable-Delinquent Taxes Receivable-Current 240,000 240,000 16e Record the adjustment for the delinquent amount of tax against the allowance. Allowance for Uncollectible Current Taxes Allowance for Uncollectible Delinquent Taxes 45.800 45,600 10+ Record the deferred inflow of resource No Journal Entry Required 17. A physical inventory of materials and supplies at June 30, 2020, showed a total of $19,700. Inventory is recorded using the purchases method in the General Fund, the consumption method is used at the government-wide level. (Note: A periodic inventory system is used both in the General Fund and at the government-wide level. When inventory was purchased during the year, Expenditures were debited in the General Fund journal and Inventory of Supplies was debited in the governmental activities journal. Recorded entry to reclassify the fund balance.) 17 General Fund 3.300 Inventory of Supplies Fund Balance-Nonspendable-Inventory of Supplies 3,300 Governmental Activities No Journal Entry Required Required A Required B Required Required D Record in general journal form entries to close the budgetary and operating statement accounts in the General Fund only. Do not close the governmental activities accounts. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) Debit Credit Transactions Fund General Journal 1. Record the closure of budgetary statements account General 1 Fund Appropriations Estimated Revenues Budgetary Fund Balance 3,157.000 3, 114,000 43,000 3,397,140 2. Record the closure of operating statements account. General 2 Revenues Fund Expenditures Fund Balance-Unassigned SON 2.937.720 459,420 Required A Required B Required c Required D Prepare a General Fund balance sheet as of June 30, 2020. CITY OF CASTLETON General Fund Balance Sheet As of June 30, 2020 Assets S881.720 X TA 401,223 X 160,830 240,593 X 44,735 X 19,761 24.974 22,300 X $ 1.089,824 Cash Taxes Receivable-Delinquent Less: Allowance for Uncollectible Taxes-Delinquent Interest and Penalties Receivable Less: Allowance for Uncollectible Interest and Penalties Inventory of Supplies Total Assets Liabilities and Fund Balances Liabilities: Vouchers Payable Deferred Inflows of Resources-Unavailable Revenues Total Liabilities and Deferred Inflows of Resources Fund Balances: Nonspendable-Inventory of Supplies Unassigned Total Fund Balances Total Liabilities and Fund Balances $ 236.990 X 205.484 X 442,474 GA 22.300 X 622,850 X 645,150 $ 1,087,824 Required A Required B Required c Required D Prepare a statement of revenues, expenditures, and changes in fund balance for the year ended June 30, 2020. Do not prepare the government-wide financial statements. CITY OF CASTLETON General Fund Statement of Revenues, Expenditures, and Changes in Fund Balance For the Year Ended June 30, 2020 Revenues $ 2,069,270 Taxes Interest and Penalties on Taxes Other Sources Total Revenues 3,570 947.000 3,019,840 Expenditures Salaries and Wages Interest on Note Payable Other Total Expenditures Excess of Revenues over Expenditures Increase in Inventory of Supplies Fund Balances, July 1, 2019 Fund Balances, June 30, 2020 $ 882, 180 10,000 1.970.540 $ 2.871,720 143, 120 3,000 X 204,230 350.350 IS The City of Castleton's General Fund had the following post-closing trial balance at June 30, 2019, the end of its fiscal year: Credits Debits $338,000 586,000 $ 267, 120 26,580 11,460 Cash Taxes Receivable-Delinquent Allowance for Uncollectible Delinquent Taxes Interest and Penalties Receivable Allowance for Uncollectible Interest and Penalties Inventory of Supplies Vouchers Payable Due to Federal Government Deferred Inflows of Resources-Unavailable Revenues Fund Balance-Nonspendable-Inventory of Supplies Fund Balance-Unassigned 16,400 151,500 62,490 334,000 16,400 124,010 $966,980 $966,980 a. Record the effect of the following transactions on the General Fund and governmental activities for the year ended June 30, 2020. b. Record in general journal form entries to close the budgetary and operating statement accounts in the General Fund only. Do not close the governmental activities accounts. c. Prepare a General Fund balance sheet as of June 30, 2020. d. Prepare a statement of revenues, expenditures, and changes in fund balance for the year ended June 30, 2020. Do not prepare the government-wide financial statements. Required A Required B Required c Required D Record the effect of the following transactions on the General Fund and governmental activities for the year ended June 30, 2020. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Credit Fund/ Transaction Governmental General Journal Debit Activties 1. The budget for FY 2020 provided for General Fund estimated revenues totaling $3.200,000 and appropriations totaling $3,157.000. General Fund Estimated Revenues 3,200.000 Appropriations Budgetary Fund Balance 1 3,157,000 43.000 Governmental Activities No Journal Entry Required 2. The city council authorized temporary borrowing of S570,000 in the form of a 120-day tax anticipation note. The loan was obtained from a local bank at a discount of 7 percent per annum (debit Expenditures for the discount in the General Fund journal and ExpensesGeneral Government in the governmental activities journal). 2 General Fund Cash 556.700 Expenditures 13,300 Tax Anticipation Notes Payable 570,000 Governmental Activities Cash 556.700 13,300 Expenses Tax Anticipation Notes Payable 570,000 3. The property tax levy for FY 2020 was recorded. Net assessed valuation of taxable property for the year was $38,000,000, and the tax rate was $6 per $ 100. It was estimated that 2 percent of the levy would be uncollectible. 3 General Fund Taxes Receivable-Current 2,280,000 Allowance for Uncollectible Current Taxes 45.600 Revenues 2.234,400 Governmental Activities Taxes Receivable-Current 2,280,000 Allowance for Uncollectible Current Taxes 45,800 General Revenues 2.234,400 4. Purchase orders and contracts were issued to vendors and others in the amount of $2.090.000 4 General Fund Encumbrances 2.000.000 Encumbrances Outstanding 2.090.000 Governmental Activities No Journal Entry Required 8. Delinquent taxes of $13.001 were deemed uncollectible and written off. The associated interest and penalties of $988 also were written off. 8 General Fund Allowance for Uncollectible Delinquent Taxes 13,001 Allowance for Uncollectible Interest and Penalties 988 Taxes Receivable-Delinquent Interest and Penalties Receivable DOO 13,001 988 Governmental Activities 13,001 988 Allowance for Uncollectible Delinquent Taxes Allowance for Uncollectible Interest and Penalties Taxes Receivable-Delinquent Interest and Penalties Receivable OOO 13,001 988 2. Total payroll during the year was $849.490. Of that amount, $65.690 was withheld for employees' FICA tax liability, $106.710 for employees' federal income tax liability, and $34,700 for state taxes; the balance was paid to employees in cash. 9 General Fund Expenditures 849,490 Due to Federal Government 172,400 Due to State Government 34,700 Cash 842,390 Governmental Activities Expenses 849,400 Due to Federal Government Due to State Government Cash 172,400 34,700 642,390 10. The employer's FICA tax liability was recorded for $65,690. 10 General Fund Expenditures Due to Federal Government 65,600 65.890 Governmental Activities Expenses 65,000 Due to Federal Government 65,890 11. Revenues from sources other than taxes were collected in the amount of $950.000. 11 General Fund 950,000 Cash Revenues 950,000 Governmental Activities Cash 950,000 General Revenues 950.000 12. Amounts due the federal government as of June 30, 2020, and amounts due for FICA taxes and state and federal withholding taxes during the year were vouchered. 12 General Fund Due to Federal Government 300,580 Due to State Government 34,700 Vouchers Payable 335,280 Governmental Activities Due to Federal Government 300,580 Due to State Government 34,700 Vouchers Payable 335.280 13. Purchase orders and contracts encumbered in the amount of $2.018,040 were filled at a net cost of $2,017,570, which was vouchered. 13a General Fund Record the encumbrances outstanding for 2020. Encumbrances Outstanding 2,018,040 Encumbrances 2,018,040 13b Record the total expenditures against vouchers payable for 2020. Expenditures Vouchers Payable 2,017,570 2,017,570 13c Governmental Activities Record the total expenses against vouchers payable for 2020. 2,017,570 Expenses Vouchers Payable 2,017,570 14. Vouchers payable totaling $2,331,660 were paid after deducting a credit for purchases discount of $8.330 (credit Expenditures). 14 General Fund Vouchers Payable 2,331,660 Cash Expenditures 2,323,330 8,330 Governmental Activities Vouchers Payable 2,331,680 Cash Expenses 2,323,330 8.330 15. The tax anticipation note of $570,000 was repaid. 15 General Fund Tax Anticipation Notes Payable Cash 570,000 570,000 Governmental Activities Tax Anticipation Notes Payable 570.000 Cash > 570.000 16. All unpaid current year's property taxes became delinquent. The balances of the current taxes receivables and related uncollectibles were transferred to delinquent accounts. The City uses the 60-day rule for all revenues and does not expect to collect any delinquent property taxes or interest and penalties in the first 60 days of the next fiscal year. 16a General Fund Record the delinquent amount of unpaid property taxes. Taxes Receivable-Delinquent 240,000 Taxes Receivable-Current 240,000 16b Record the adjustment for the delinquent amount of tax against the allowance. Allowance for Uncollectible Current Taxes Allowance for Uncollectible Delinquent Taxes 45,800 45.600 16c Record the deferred inflow of resource Revenues Deferred Inflows of ResourcesUnavailable Revenues 221.511 221,511 16d Governmental Activities Record the delinquent amount of unpaid property taxes. Taxes Receivable-Delinquent Taxes Receivable-Current 240,000 240,000 16e Record the adjustment for the delinquent amount of tax against the allowance. Allowance for Uncollectible Current Taxes Allowance for Uncollectible Delinquent Taxes 45.800 45,600 10+ Record the deferred inflow of resource No Journal Entry Required 17. A physical inventory of materials and supplies at June 30, 2020, showed a total of $19,700. Inventory is recorded using the purchases method in the General Fund, the consumption method is used at the government-wide level. (Note: A periodic inventory system is used both in the General Fund and at the government-wide level. When inventory was purchased during the year, Expenditures were debited in the General Fund journal and Inventory of Supplies was debited in the governmental activities journal. Recorded entry to reclassify the fund balance.) 17 General Fund 3.300 Inventory of Supplies Fund Balance-Nonspendable-Inventory of Supplies 3,300 Governmental Activities No Journal Entry Required Required A Required B Required Required D Record in general journal form entries to close the budgetary and operating statement accounts in the General Fund only. Do not close the governmental activities accounts. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) Debit Credit Transactions Fund General Journal 1. Record the closure of budgetary statements account General 1 Fund Appropriations Estimated Revenues Budgetary Fund Balance 3,157.000 3, 114,000 43,000 3,397,140 2. Record the closure of operating statements account. General 2 Revenues Fund Expenditures Fund Balance-Unassigned SON 2.937.720 459,420 Required A Required B Required c Required D Prepare a General Fund balance sheet as of June 30, 2020. CITY OF CASTLETON General Fund Balance Sheet As of June 30, 2020 Assets S881.720 X TA 401,223 X 160,830 240,593 X 44,735 X 19,761 24.974 22,300 X $ 1.089,824 Cash Taxes Receivable-Delinquent Less: Allowance for Uncollectible Taxes-Delinquent Interest and Penalties Receivable Less: Allowance for Uncollectible Interest and Penalties Inventory of Supplies Total Assets Liabilities and Fund Balances Liabilities: Vouchers Payable Deferred Inflows of Resources-Unavailable Revenues Total Liabilities and Deferred Inflows of Resources Fund Balances: Nonspendable-Inventory of Supplies Unassigned Total Fund Balances Total Liabilities and Fund Balances $ 236.990 X 205.484 X 442,474 GA 22.300 X 622,850 X 645,150 $ 1,087,824 Required A Required B Required c Required D Prepare a statement of revenues, expenditures, and changes in fund balance for the year ended June 30, 2020. Do not prepare the government-wide financial statements. CITY OF CASTLETON General Fund Statement of Revenues, Expenditures, and Changes in Fund Balance For the Year Ended June 30, 2020 Revenues $ 2,069,270 Taxes Interest and Penalties on Taxes Other Sources Total Revenues 3,570 947.000 3,019,840 Expenditures Salaries and Wages Interest on Note Payable Other Total Expenditures Excess of Revenues over Expenditures Increase in Inventory of Supplies Fund Balances, July 1, 2019 Fund Balances, June 30, 2020 $ 882, 180 10,000 1.970.540 $ 2.871,720 143, 120 3,000 X 204,230 350.350 IS