Answered step by step

Verified Expert Solution

Question

1 Approved Answer

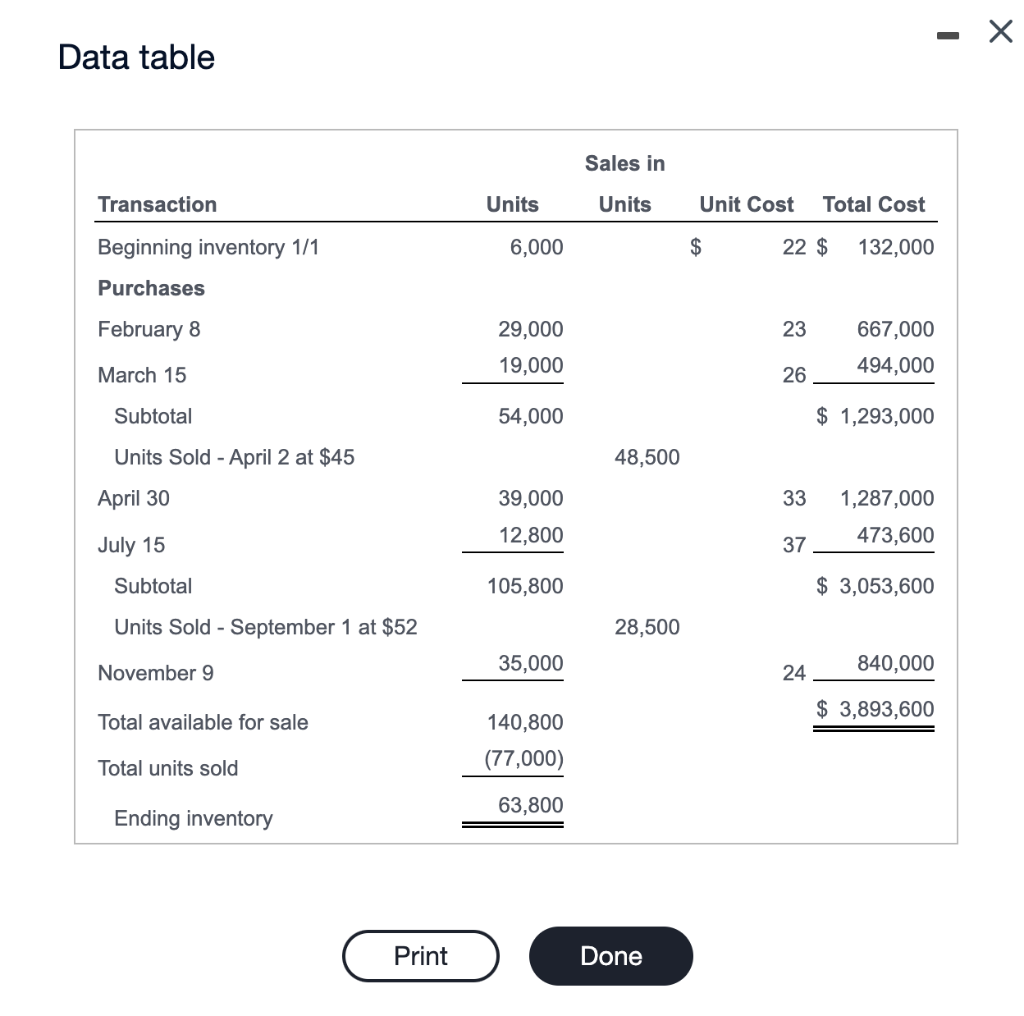

I need help with requirements b and c. - Data table Sales in Transaction Units Units Unit Cost Total Cost 6,000 $ 22 $ 132,000

I need help with requirements b and c.

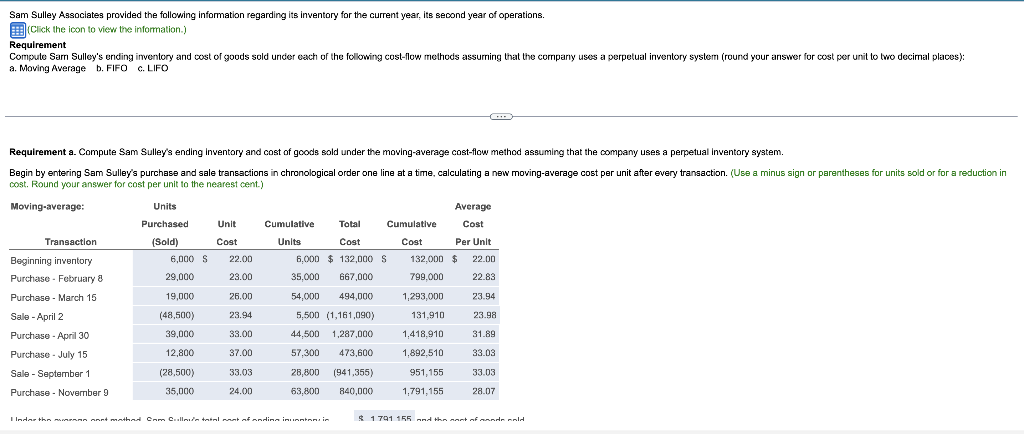

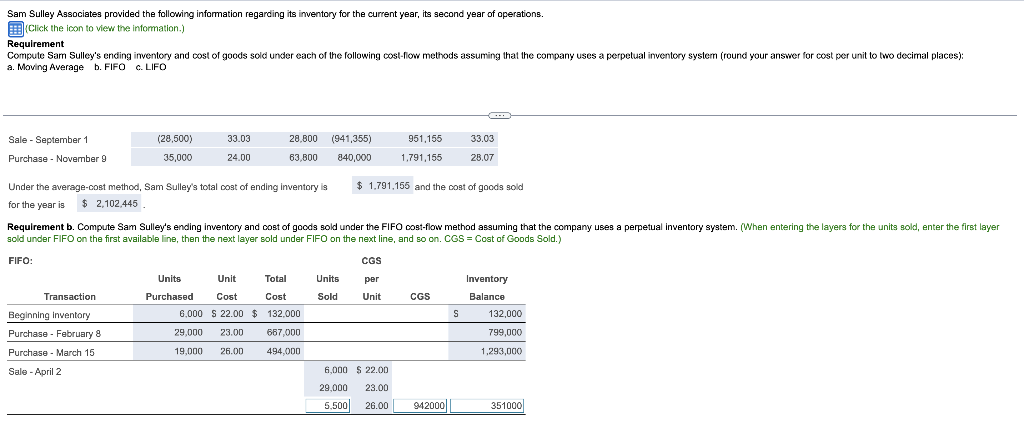

- Data table Sales in Transaction Units Units Unit Cost Total Cost 6,000 $ 22 $ 132,000 Beginning inventory 1/1 Purchases February 8 23 29,000 19,000 667,000 494,000 March 15 26 Subtotal 54,000 $ 1,293,000 Units Sold - April 2 at $45 48,500 April 30 33 39,000 12,800 1,287,000 473,600 July 15 37 Subtotal 105,800 $ 3,053,600 Units Sold - September 1 at $52 28,500 November 9 35,000 24 840,000 $ 3,893,600 Total available for sale 140,800 (77,000) Total units sold 63,800 Ending inventory Print Done Sam Sulley Associates provided the following information regarding its inventory for the current year, its second year of operations. Click the icon to view the information.) Requirement Compute Sarri Sulley's ending inventory and cost of goods sold under cach of the following cost-flow methods assurring that the company uses a perpetual inventory system (round your answer for cost per unit to two decimal places): a. Moving Average b. FIFO C. LIFO Requirement a. Compute Sam Sulley's ending Inventory and cost of goods sold under the moving average cost-flow method assuming that the company uses a perpetual Inventory system. Begin by entering Sam Sulley's purchase and sale transactions in chronological order one line at a time, calculating a new moving-average cost per unit after every transaction. (Use a minus sign or parentheses for units sold or for a reduction in cost. Round your answer for cost per unit to the nearest cent.) Moving-average: Unit Transaction Units Purchased (Sold) 6,000 S 29,000 Cost 22.00 Average Cumulative Total Cumulative Cost Units Cost Cost Per Unit 6.000 $ 132,000 S 132.000 $ 22.00 35,000 667,000 799.000 22.83 54,000 494,000 1,293,000 23.94 Beginning inventory Purchase. February 8 Purchase - March 15 23.00 19,000 26.00 23.94 131,910 23.98 Sale - April 2 Purchase - April 30 (48,500) 39,000 5,500 (1,161,090) 44.500 1,287,000 33.00 31.89 1,418,910 1.892,510 12,800 37.00 57,300 473,600 33.03 Purchase - July 15 Sale - September 1 28,800 (941,355) 951,155 33.03 (28,500) 35,000 33.03 24.00 Purchase - November 9 63,800 840,000 1,791,155 28.07 I Indarth LAN Ant mathal Com Claula totalment af andina intensin $ 1791 455 med fandeld Sam Sulley Associates provided the following information regarding its inventory for the current year, its second year of operations. Click the icon to view the information.) Requirement Compute Sar Sulley's ending inventory and cost of goods sold under each of the following cost-flow methods assuming that the company uses a perpetual inventory system (round your answer for cost per unit to two decimal places): a. Moving Average b. FIFO C. LIFO (28,500) 33.03 28.800 (941,355) 951,156 33.03 Sale - September 1 Purchase - November 9 35,000 24.00 63.800 840,000 1,791,155 28.07 $ 1.791.155 and the cost of goods sold Under the average-cost method, Sam Sulley's total cost of ending inventory is for the year is $ 2,102.445 Requirement b. Compute Sam Sulley's ending inventory and cost of goods sold under the FIFO Cost-flow method assuming that the company uses a perpetual inventory system. (When entering the layers for the units sold, enter the first layer sold under FIFO on the first available line, then the next layer sold under FIFO on the next line, and so on. CGS = Cost of Goods Sold.) FIFO: CGS Units per Transaction Sold Unit CGS Units Unit Total Purchased Cost Cost 6.000 S 22.00 $ 132.000 29,000 23.00 667,000 19,000 26.00 494 ODO Inventory Balance 132,000 799,000 Beginning Inventory Purchase - February 8 - Purchase - March 15 S 1.293,000 Sale - April 2 6,000 $ 22.00 29,000 23.00 5.500 26.00 942000 L 351000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started