I need help with the first question problem 15-1

I need help with the first problem 15-1 it is for excel app.

15-1 15-3 15-4

15-1 15-3 15-4

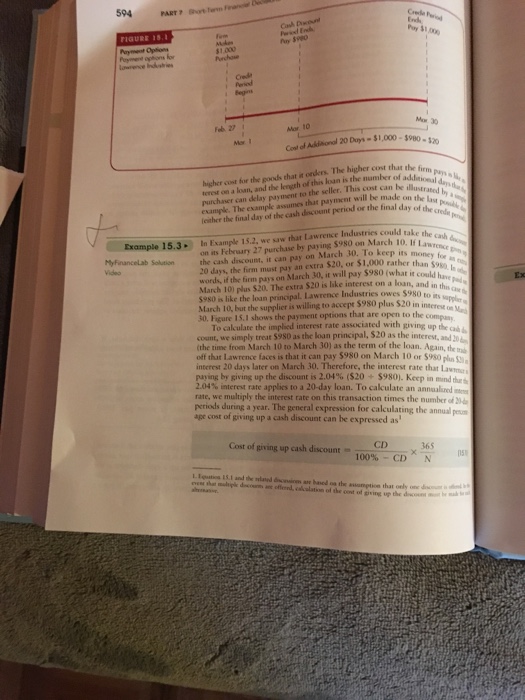

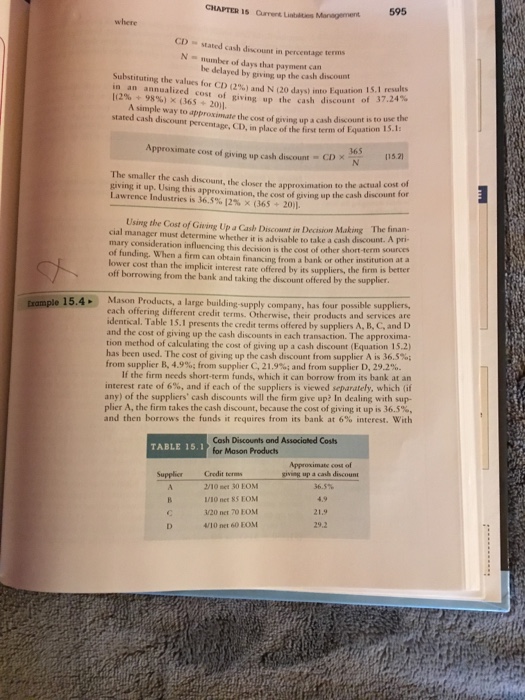

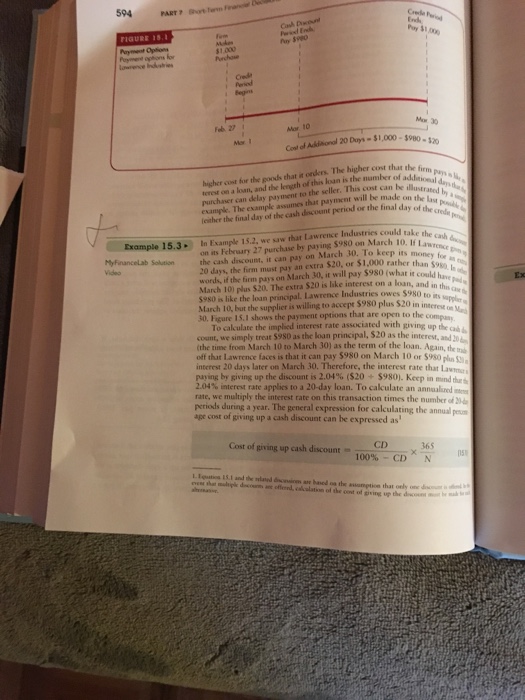

15.1 593 CHAPTER 15 current Liabilities Management In 2013, Brown-Forman Corporation (BF), manufacturer of alco brands such as Jack D holic beverage of $1.8 had annual revenue cost of revenue billion, and accounts payable of on BF had an average age of an (AAI) 168 days, collection period (ACP) of 55 days, a average payment period (APP) of 136 days (BF's si.3 billion hus, the cash conversion cycle purchases were The resources BF had for BF was ss 136 a 365 nvested in this cash conversion cycle (assuming day year) were 1.8 billion x (168 365) $0.83 billion Accounts receivable 3.8 billion x (55 365) 0.57 billion Accounts payable 0.48 billion 1.3 billion x (136 365 0.92 billion Resources invested Based on BF's APP and average accounts payable, the daily accounts payable generated by BF is about $3.5 million ($0.48 billion 136). If BF were to in- crease its average payment period by 5 days, its accounts payable would increase by about $17.5 million (5 x $3.5 million). As a result, BF's cash conversion cycle would decrease by 5 days, and the firm would reduce its investment in operations by $17.5 million. Clearly, if this action did not damage BF's credit rating, it would be in the company's best interest. Analyzing Credit Terms The credit terms that a firm is offered by its suppliers enable it to delay payments for its purchases. Because the supplier's cost of having its money tied up in mer- chandise after it is sold is probably reflected in the purchase price, the purchaser is already indirectly paying for this benefit. Sometimes a supplier will offer a cash discount for early payment. In that case, the purchaser should carefully analyze credit terms to determine the best time to repay the supplier. The purchaser must weigh the benefits of paying the supplier as late as possible against the costs of passing up the discount for early payment. Taking the Cash Discount If a firm intends to take a cash discou should pay on the last day of the discount period. There is no added benefit from paying earlier than that date. ores, purchased $1,000 xtending terms of 2/10 t, it must pay $980 ive up the cash discount s an implicit cost associ p a cash discount i the

15-1 15-3 15-4

15-1 15-3 15-4