I need help with the formulas

Create three Excel worksheets of annual balance sheet data for Stitch Fix stock for the past three years. Use formulas to calculate the following financial indicators for each year of data:

o Current ratio o Debt/equity ratio o Free cash flow o Earnings per share o Price/earnings ratio o Return on equity o Net profit margin

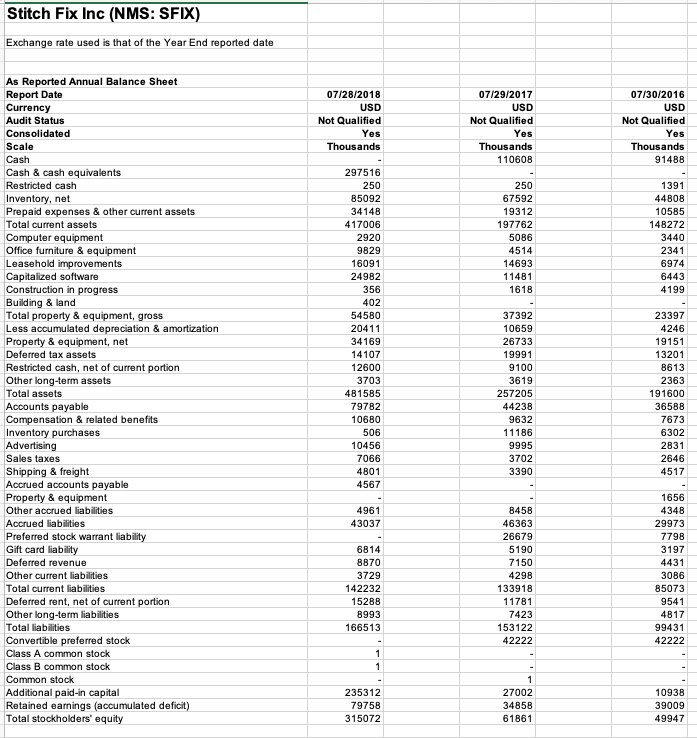

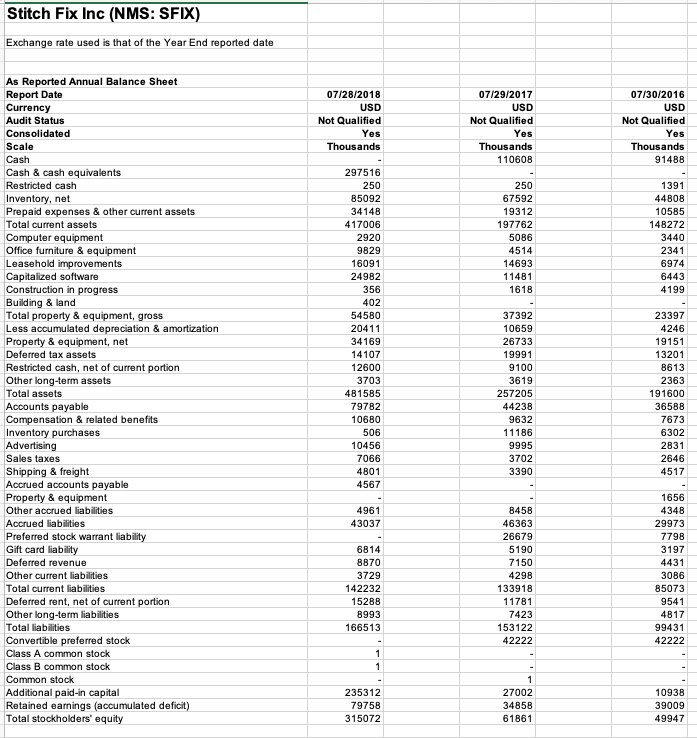

Stitch Fix Inc (NMS: SFIX) Exchange rate used is that of the Year End reported date As Reported Annual Balance Sheet Report Date 07/28/2018 07/29/2017 07/30/2016 Audit Status Consolidated Not Qualified Not Qualified Not Qualified 110608 91488 Cash & cash equivalents Restricted cash 297516 85092 417006 9829 24982 67592 44808 10585 148272 Prepaid expenses &other current assets Total current assets Computer equipment Office furniture&equipment Leasehold improvements Capitalized software Construction in progress Building & land Total property& equipment, gross Less accumulated depreciation& amortization Property & equipment, net Deferred tax assets Restricted cash, net of current portion Other long-term assets Total assets Accounts payable Compensation& related benefits Inventory purchases Advertising Sales taxes Shipping & freight Accrued accounts payable Property & equipment Other accrued liabilities Accrued liabilities Preferred stock warrant liability Gift card liability Deferred revenue Other current liabilities Total current liabilities Deferred rent, net of current portion Other long-term liabilities Total liabilities Convertible preferred stock Class A common stock Class B common stock Common stock Additional paid-in capital Retained earnings (accumulated deficit) Total stockholders' equity 197762 2341 6974 14693 402 54580 20411 34169 23397 4246 37392 10659 26733 19991 13201 3703 481585 79782 10680 506 10456 7066 4801 257205 44238 9632 36588 3702 2646 4348 29973 46363 26679 43037 8870 3729 142232 15288 8993 166513 4298 133918 3086 85073 99431 42222 42222 235312 79758 315072 27002 10938 39009 49947 Stitch Fix Inc (NMS: SFIX) Exchange rate used is that of the Year End reported date As Reported Annual Balance Sheet Report Date 07/28/2018 07/29/2017 07/30/2016 Audit Status Consolidated Not Qualified Not Qualified Not Qualified 110608 91488 Cash & cash equivalents Restricted cash 297516 85092 417006 9829 24982 67592 44808 10585 148272 Prepaid expenses &other current assets Total current assets Computer equipment Office furniture&equipment Leasehold improvements Capitalized software Construction in progress Building & land Total property& equipment, gross Less accumulated depreciation& amortization Property & equipment, net Deferred tax assets Restricted cash, net of current portion Other long-term assets Total assets Accounts payable Compensation& related benefits Inventory purchases Advertising Sales taxes Shipping & freight Accrued accounts payable Property & equipment Other accrued liabilities Accrued liabilities Preferred stock warrant liability Gift card liability Deferred revenue Other current liabilities Total current liabilities Deferred rent, net of current portion Other long-term liabilities Total liabilities Convertible preferred stock Class A common stock Class B common stock Common stock Additional paid-in capital Retained earnings (accumulated deficit) Total stockholders' equity 197762 2341 6974 14693 402 54580 20411 34169 23397 4246 37392 10659 26733 19991 13201 3703 481585 79782 10680 506 10456 7066 4801 257205 44238 9632 36588 3702 2646 4348 29973 46363 26679 43037 8870 3729 142232 15288 8993 166513 4298 133918 3086 85073 99431 42222 42222 235312 79758 315072 27002 10938 39009 49947