Answered step by step

Verified Expert Solution

Question

1 Approved Answer

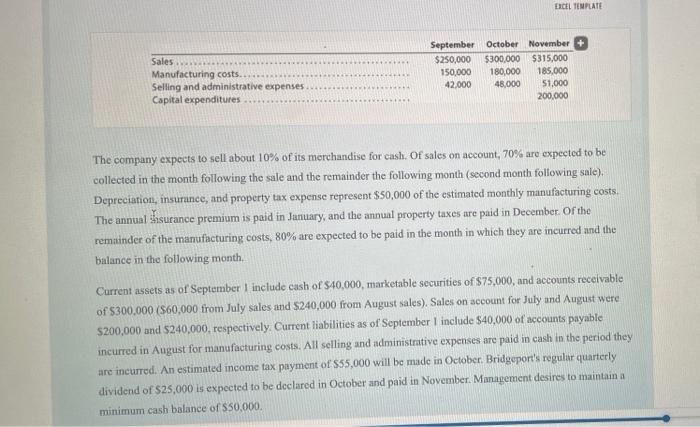

i need help with the missing blanks and with the formula please EXCEL TEMPLATE Sales Manufacturing costs. Selling and administrative expenses Capital expenditures September October

i need help with the missing blanks and with the formula please

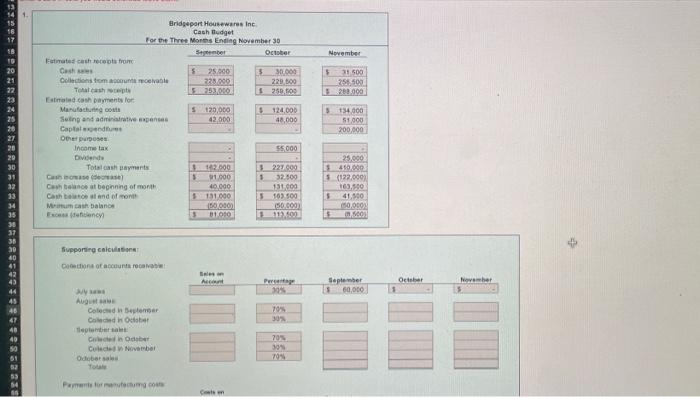

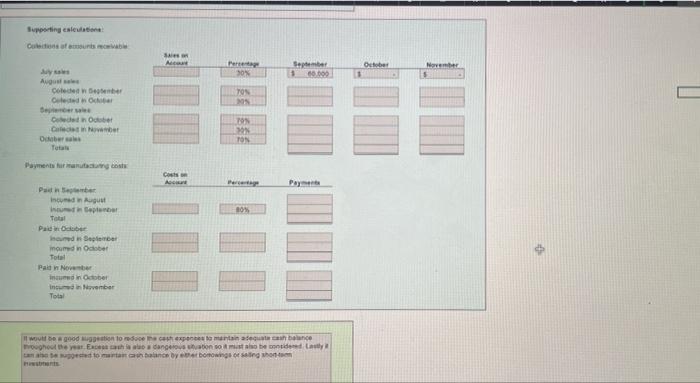

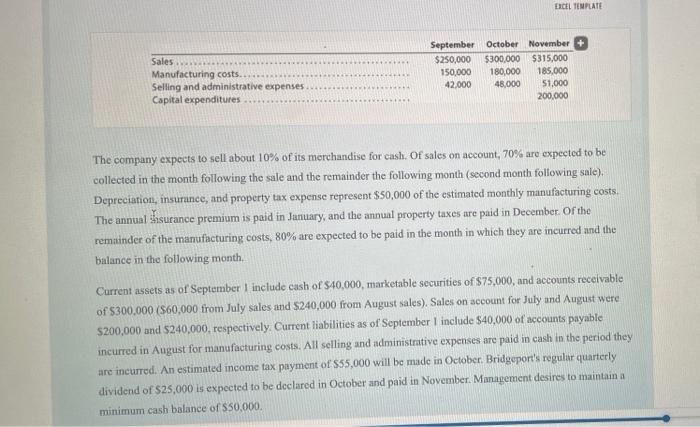

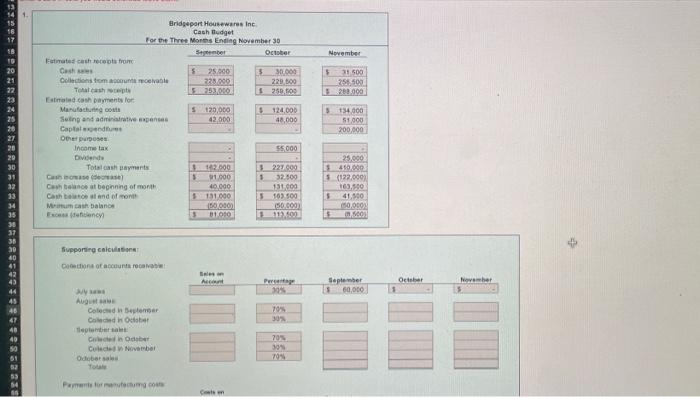

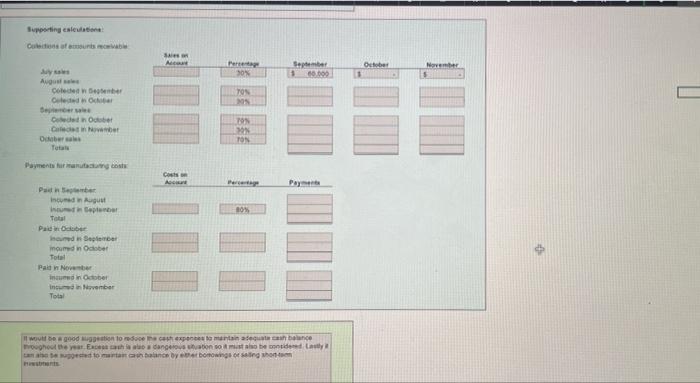

EXCEL TEMPLATE Sales Manufacturing costs. Selling and administrative expenses Capital expenditures September October November $250,000 $300,000 $315,000 150,000 180,000 185,000 42.000 48,000 $1,000 200.000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $50,000 of the estimated monthly manufacturing costs. The annual shsurance premium is paid in January, and the annual property taxes are paid in December of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of September 1 include cash of $40,000, marketable securities of $75,000, and accounts receivable of $300,000 (560,000 from July sales and $240,000 from August sales), Sales on account for July and August were $200,000 and $240,000, respectively. Current liabilities as of September I include $40,000 of accounts payable incurred in August for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of $55,000 will be made in October. Bridgeport's regular quarterly dividend of $25,000 is expected to be declared in October and paid in November. Management desires to maintain a minimum cash balance of $50,000 13 November 5 31.500 255,500 500.000 Bridgeport Housewares Inc Cash tudget For the Three Montes Ending November 30 October Ette cachorro Cash 5 25.000 3 30.000 Collections from the 325.000 220.000 Total cash 5253,000 250,00 En cash payments for Manufach S 120,000 $ 124,000 Suting and administrative me 42.000 48,000 Captalande Oberproses Income tax 55.000 Dividende Totalcahaya 142.000 3222.000 Goose . 91000 1 32.500 Chance at beginning of month 40.000 131.000 Cam tot end of 5131000 5 103 500 Men balans 150.000 150.000 French 0100 13.00 TD 20 21 22 23 24 25 20 27 28 20 30 31 32 13 34 35 3134.800 51.000 200.000 25.000 $10.000 5 (122.000 16.00 5 41.500 0.000 ES . 36 30 40 41 Supporting calon Doction of accounts receive A September 15 60,000 October 1 November 44 45 46 70% 30% August Coted Beter Cecedor Team Check in der Cold November Odebars 40 703 304 70% Pastoram co Calen Supporting calen Cara Sales AL Peter 30 September 60.000 October November 5 August Cote Order TON DO Caber Obers Total ON TON Payment to Co Pay 10 Paber In August in September Total Paid Odobe Inne Sep moured in October Total Pald in Nov ind in October invember Total it would be good to reduce companies hace houghout the year. Exces dangervation to must be da to mananalice by tomongso sing whom EXCEL TEMPLATE Sales Manufacturing costs. Selling and administrative expenses Capital expenditures September October November $250,000 $300,000 $315,000 150,000 180,000 185,000 42.000 48,000 $1,000 200.000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $50,000 of the estimated monthly manufacturing costs. The annual shsurance premium is paid in January, and the annual property taxes are paid in December of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of September 1 include cash of $40,000, marketable securities of $75,000, and accounts receivable of $300,000 (560,000 from July sales and $240,000 from August sales), Sales on account for July and August were $200,000 and $240,000, respectively. Current liabilities as of September I include $40,000 of accounts payable incurred in August for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of $55,000 will be made in October. Bridgeport's regular quarterly dividend of $25,000 is expected to be declared in October and paid in November. Management desires to maintain a minimum cash balance of $50,000 13 November 5 31.500 255,500 500.000 Bridgeport Housewares Inc Cash tudget For the Three Montes Ending November 30 October Ette cachorro Cash 5 25.000 3 30.000 Collections from the 325.000 220.000 Total cash 5253,000 250,00 En cash payments for Manufach S 120,000 $ 124,000 Suting and administrative me 42.000 48,000 Captalande Oberproses Income tax 55.000 Dividende Totalcahaya 142.000 3222.000 Goose . 91000 1 32.500 Chance at beginning of month 40.000 131.000 Cam tot end of 5131000 5 103 500 Men balans 150.000 150.000 French 0100 13.00 TD 20 21 22 23 24 25 20 27 28 20 30 31 32 13 34 35 3134.800 51.000 200.000 25.000 $10.000 5 (122.000 16.00 5 41.500 0.000 ES . 36 30 40 41 Supporting calon Doction of accounts receive A September 15 60,000 October 1 November 44 45 46 70% 30% August Coted Beter Cecedor Team Check in der Cold November Odebars 40 703 304 70% Pastoram co Calen Supporting calen Cara Sales AL Peter 30 September 60.000 October November 5 August Cote Order TON DO Caber Obers Total ON TON Payment to Co Pay 10 Paber In August in September Total Paid Odobe Inne Sep moured in October Total Pald in Nov ind in October invember Total it would be good to reduce companies hace houghout the year. Exces dangervation to must be da to mananalice by tomongso sing whom

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started