Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with the second question Anakin forms an aggressive growth portfolio by investing 21% of his savings in Ford stock, 21% in Nissan

i need help with the second question

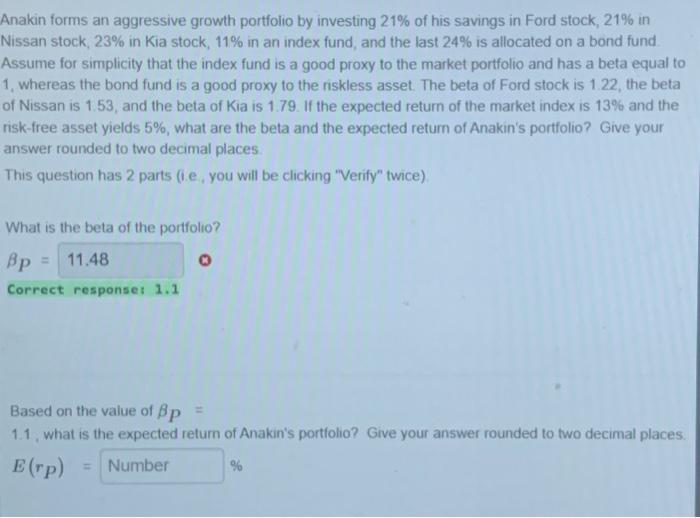

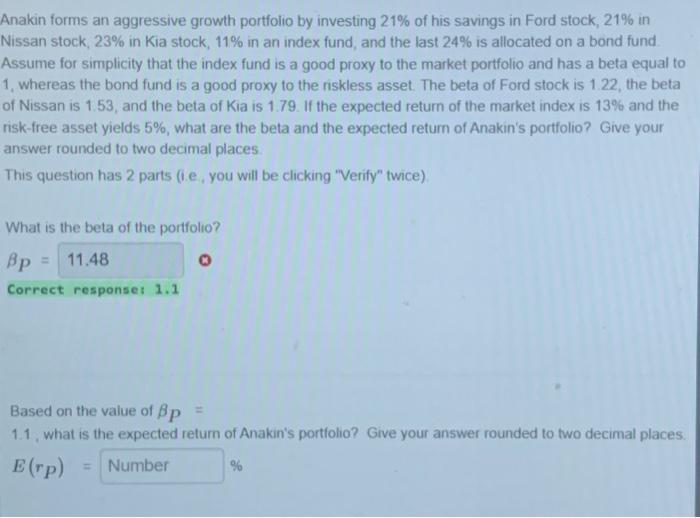

Anakin forms an aggressive growth portfolio by investing 21% of his savings in Ford stock, 21% in Nissan stock, 23% in Kia stock, 11% in an index fund, and the last 24% is allocated on a bond fund Assume for simplicity that the index fund is a good proxy to the market portfolio and has a beta equal to 1, whereas the bond fund is a good proxy to the riskless asset. The beta of Ford stock is 1.22 , the beta of Nissan is 1.53, and the beta of Kia is 1.79 . If the expected return of the market index is 13% and the risk-free asset yields 5%, what are the beta and the expected return of Anakin's portfolio? Give your answer rounded to two decimal places. This question has 2 parts (i.e, you will be clicking "Verify" twice) What is the beta of the portfolio? p= Correct responset 1.1 Based on the value of P= 1.1, what is the expected retum of Anakin's portfolio? Give your answer rounded to two decimal places. E(rP)= %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started