I need help with these following questions

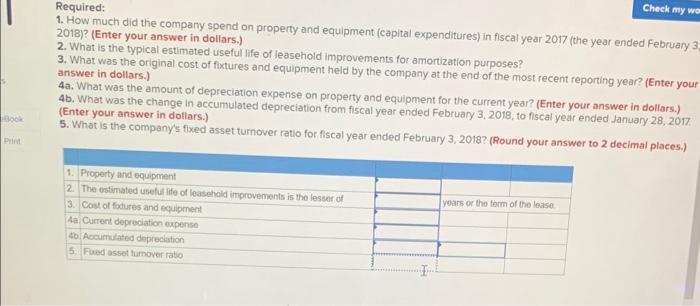

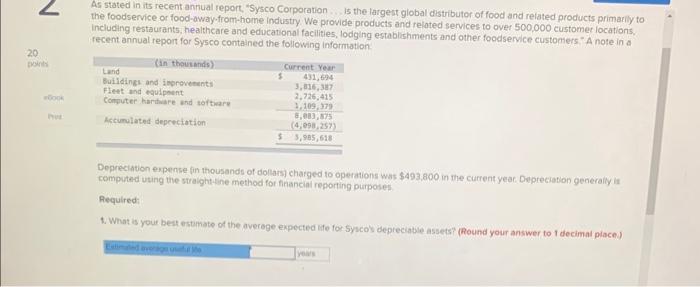

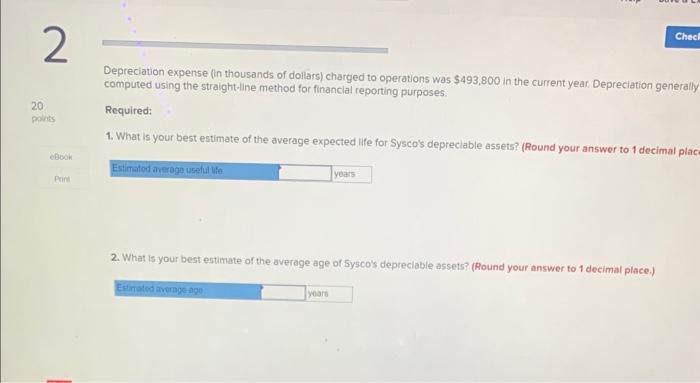

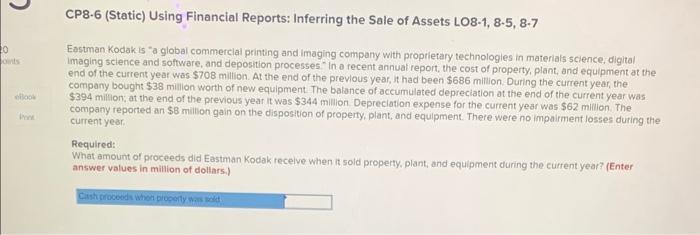

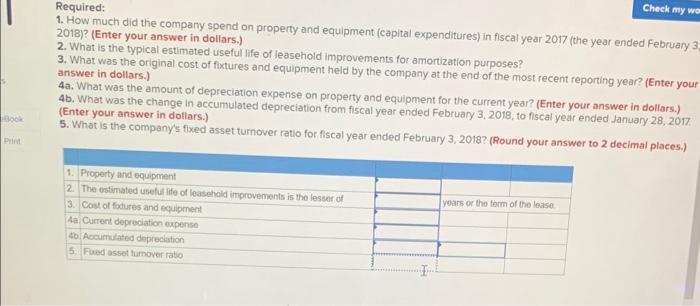

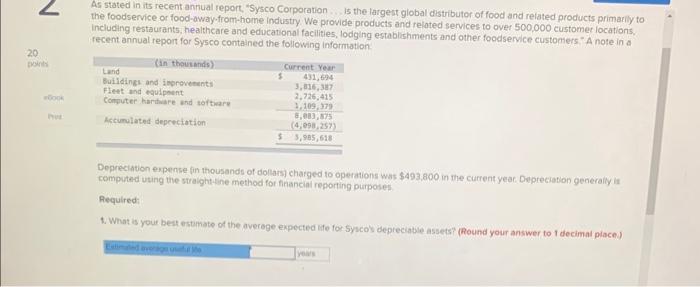

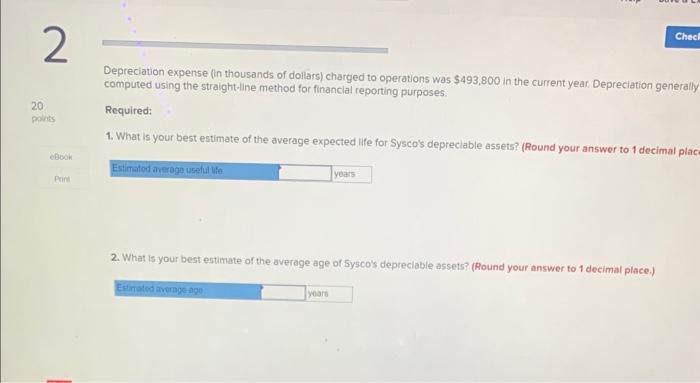

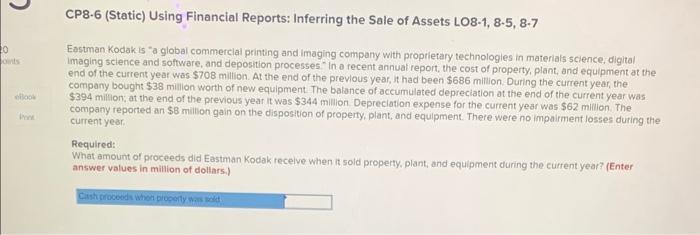

Required: 1. How much did the company spend on property and equipment (capital expenditures) in flscal year 2017 (the year ended February 3 ) 2018)? (Enter your answer in dollars.) 2. What is the typical estimated useful life of leasehold imptovements for amortization purposes? 3. What was the original cost of fixtures and equipment held by the company at the end of the most recent reporting year? (Enter your answer in dollars.) 4a. What was the amount of depreciation expense on property and equipment for the current year? (Enter your answer in dollars.) 4b. What was the change in accumulated depreciation from fiscal year ended February 3, 2018, to fiscal year ended January 28 , 2017. (Enter your answer in dollars.) 5. What is the company's fixed asset turnover ratio for fiscal year ended February 3, 2018? (Round your answer to 2 decimal places.) As stated in its recent annual report, "Sysco Corporation... is the largest global distributor of food and related products primarily to the foodsenvice or food-away.from-home industry. We provide products and related services to over 500,000 customet locations. Including restaurants, healthcare and educational facilities, lodging establishments and other foodservice customers, "A note in a fecent annual report for Sysco contained the following informtation. Depreciation expense fin thousands of dollars) charged to operations was $493.800 in the current yeat. Depreciation generaily it computed uting the straight tine method for financial reporting purposes. Pequired: 1. What is your best estamate of the averoge expected ife for Syscov depreciable asseets" (Round your answer to 1 decimat piace) Depreciation expense (in thousands of dollars) charged to operations was $493,800 in the current year. Depreciation generally computed using the straight-line method for financlal reporting purposes. Required: 1. What is your best estimate of the average expected life for Sysco's depreclable assets? (Round your answer to 1 decimal plac 2. What is your best estimate of the average age of Sysco's depreclable assets? (Round your answer to 1 decimal place.) CP8.6 (Static) Using Financial Reports: Inferring the Sale of Assets LO8-1, 8.5, 8.7 Eastman Kodak is "a global commerclal printing and imaging company with propiletary technologles in materials science, digital imaging science and software, and deposition processes" In o recent annual report, the cost of property, plant, and equipment at the end of the current year was $708 million. At the end of the previous year, it had been $686 million. During the current year, the company bought $38 million worth of new equipment. The balance of accumulated depreciation at the end of the current year was $394 million; at the end of the previous year it was $344 million. Depreclation expense for the current year was $62 million. The company reported an $8 milifion gain on the disposition of property, plant, and equipment. There were no impairment losses during the currentyear. Required: What amount of proceeds did Eastman Kodak recelve when it sold property, plant, and equipment during the current year? (Enter answer values in million of dollars.)