i need help with these problems please! 13,14,15,17&18

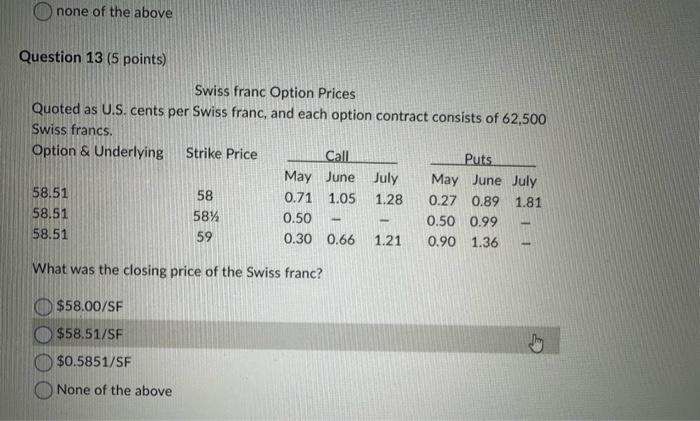

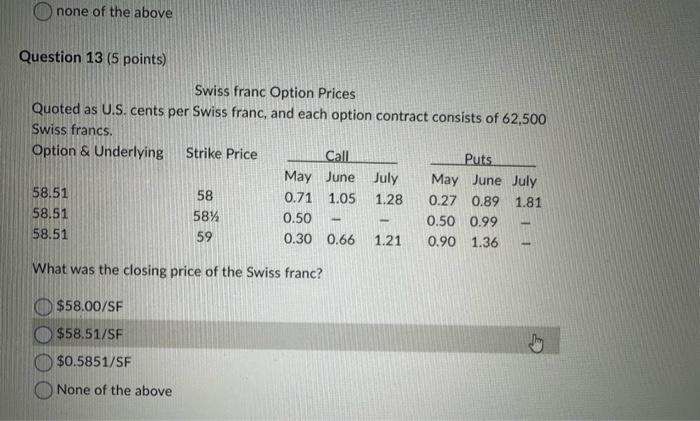

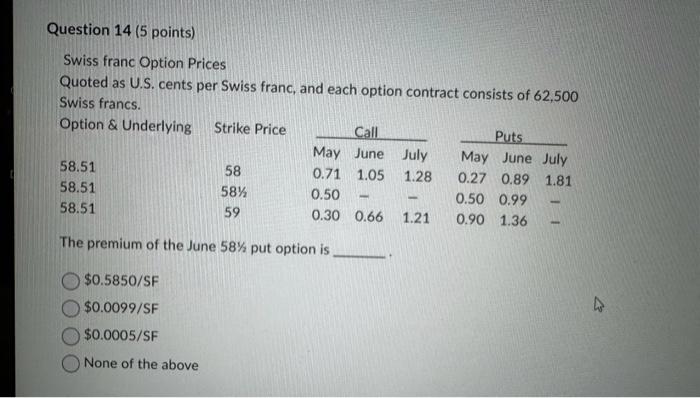

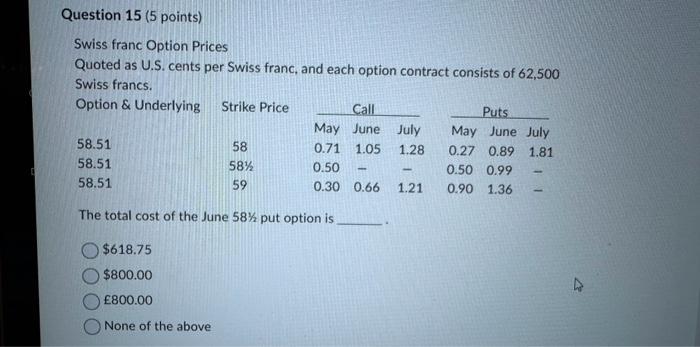

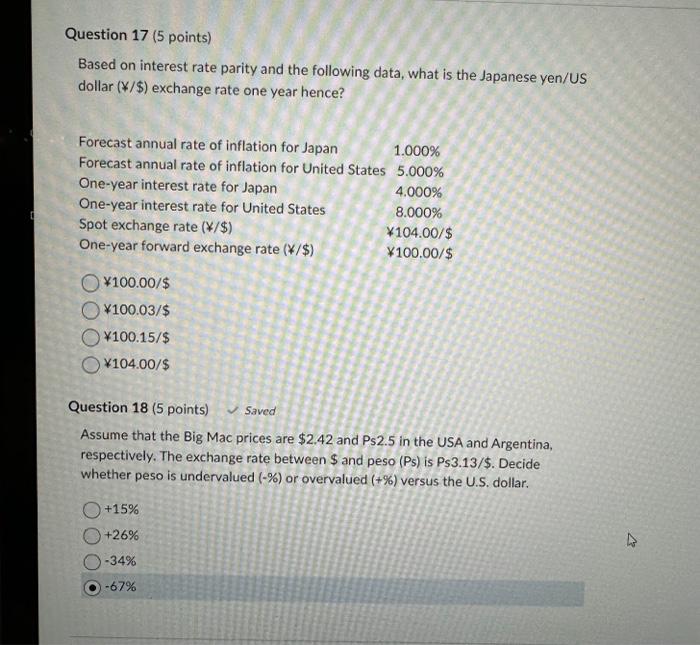

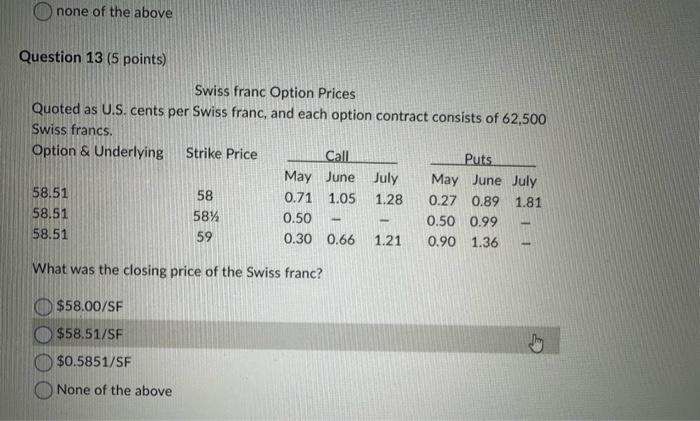

none of the above Question 13 (5 points) Swiss franc Option Prices Quoted as U.S. cents per Swiss franc, and each option contract consists of 62,500 Swiss francs. What was the closing price of the Swiss franc? \begin{tabular}{|} \hline$58.00/SF \\ $58.51/SF \\ & $0.5851/SF \end{tabular} None of the above Swiss franc Option Prices Quoted as U.S. cents per Swiss franc, and each option contract consists of 62,500 Swiss francs. The premium of the June 58% put option is $0.5850/SF $0.0099/SF $0.0005/SF None of the above Swiss franc Option Prices Quoted as U.S. cents per Swiss franc, and each option contract consists of 62,500 Swiss francs. The total cost of the June 5821 put option is $618.75$800.00800.00 None of the above Question 17 (5 points) Based on interest rate parity and the following data, what is the Japanese yen/US dollar ($/$) exchange rate one year hence? 100.00/$100.03/$100.15/$$104.00/$ Question 18 (5 points) Saved Assume that the Big Mac prices are $2.42 and Ps2.5 in the USA and Argentina, respectively. The exchange rate between $ and peso (P5) is PS3.13/$. Decide whether peso is undervalued (%) or overvalued (+%) versus the U.S. dollar. +15%+26%34%67% none of the above Question 13 (5 points) Swiss franc Option Prices Quoted as U.S. cents per Swiss franc, and each option contract consists of 62,500 Swiss francs. What was the closing price of the Swiss franc? \begin{tabular}{|} \hline$58.00/SF \\ $58.51/SF \\ & $0.5851/SF \end{tabular} None of the above Swiss franc Option Prices Quoted as U.S. cents per Swiss franc, and each option contract consists of 62,500 Swiss francs. The premium of the June 58% put option is $0.5850/SF $0.0099/SF $0.0005/SF None of the above Swiss franc Option Prices Quoted as U.S. cents per Swiss franc, and each option contract consists of 62,500 Swiss francs. The total cost of the June 5821 put option is $618.75$800.00800.00 None of the above Question 17 (5 points) Based on interest rate parity and the following data, what is the Japanese yen/US dollar ($/$) exchange rate one year hence? 100.00/$100.03/$100.15/$$104.00/$ Question 18 (5 points) Saved Assume that the Big Mac prices are $2.42 and Ps2.5 in the USA and Argentina, respectively. The exchange rate between $ and peso (P5) is PS3.13/$. Decide whether peso is undervalued (%) or overvalued (+%) versus the U.S. dollar. +15%+26%34%67%