I need help with these questions.

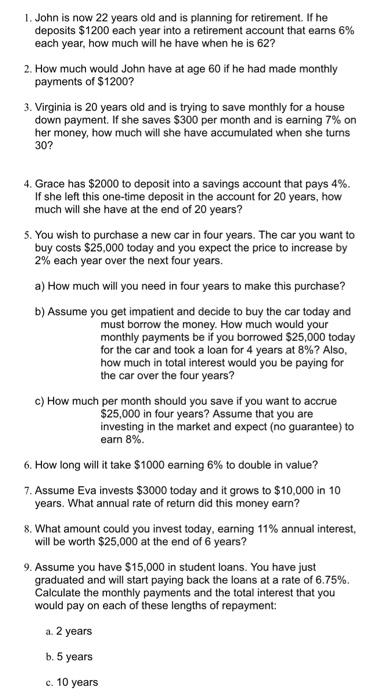

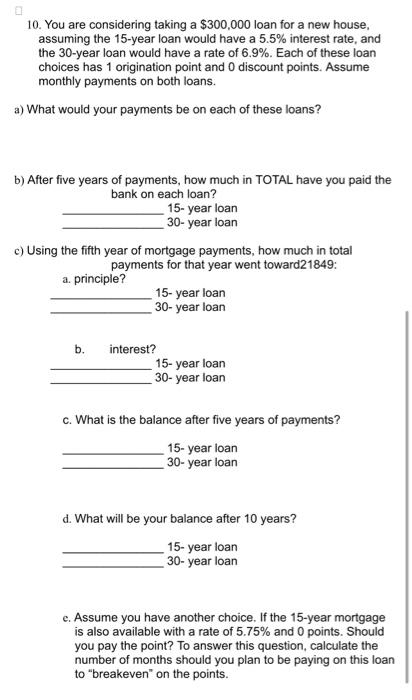

1. John is now 22 years old and is planning for retirement. If he deposits $1200 each year into a retirement account that earns 6% each year, how much will he have when he is 62 ? 2. How much would John have at age 60 if he had made monthly payments of $1200 ? 3. Virginia is 20 years old and is trying to save monthly for a house down payment. If she saves $300 per month and is earning 7% on her money, how much will she have accumulated when she turns 30 ? 4. Grace has $2000 to deposit into a savings account that pays 4%. If she left this one-time deposit in the account for 20 years, how much will she have at the end of 20 years? 5. You wish to purchase a new car in four years. The car you want to buy costs $25,000 today and you expect the price to increase by 2% each year over the next four years. a) How much will you need in four years to make this purchase? b) Assume you get impatient and decide to buy the car today and must borrow the money. How much would your monthly payments be if you borrowed $25,000 today for the car and took a loan for 4 years at 8% ? Also, how much in total interest would you be paying for the car over the four years? c) How much per month should you save if you want to accrue $25,000 in four years? Assume that you are investing in the market and expect (no guarantee) to earn 8%. 6. How long will it take $1000 earning 6% to double in value? 7. Assume Eva invests $3000 today and it grows to $10,000 in 10 years. What annual rate of return did this money earn? 8. What amount could you invest today, earning 11% annual interest, will be worth $25,000 at the end of 6 years? 9. Assume you have $15,000 in student loans. You have just graduated and will start paying back the loans at a rate of 6.75%. Calculate the monthly payments and the total interest that you would pay on each of these lengths of repayment: a. 2 years b. 5 years c. 10 years 10. You are considering taking a $300,000 loan for a new house, assuming the 15-year loan would have a 5.5% interest rate, and the 30 -year loan would have a rate of 6.9%. Each of these loan choices has 1 origination point and 0 discount points. Assume monthly payments on both loans. a) What would your payments be on each of these loans? b) After five years of payments, how much in TOTAL have you paid the bank on each loan? 15- year loan 30- year loan c) Using the fifth year of mortgage payments, how much in total payments for that year went toward21849: a. principle? 15- year loan 30-year loan b. interest? 15- year loan 30 - year loan c. What is the balance after five years of payments? 15- year loan 30 - year loan d. What will be your balance after 10 years? 15-year loan 30-year loan e. Assume you have another choice. If the 15-year mortgage is also available with a rate of 5.75% and 0 points. Should you pay the point? To answer this question, calculate the number of months should you plan to be paying on this loan to "breakeven" on the points