I need help with these questions asap

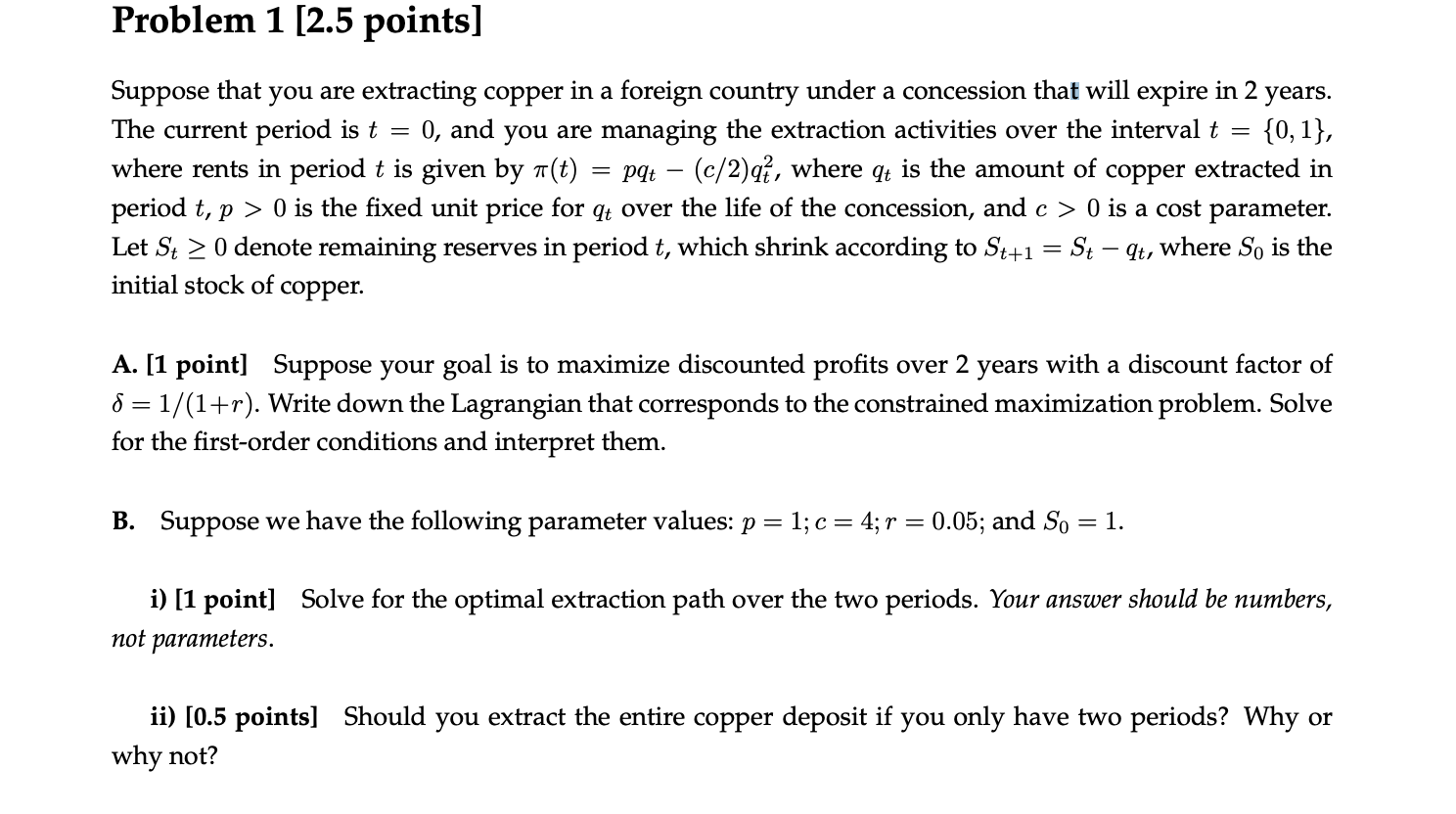

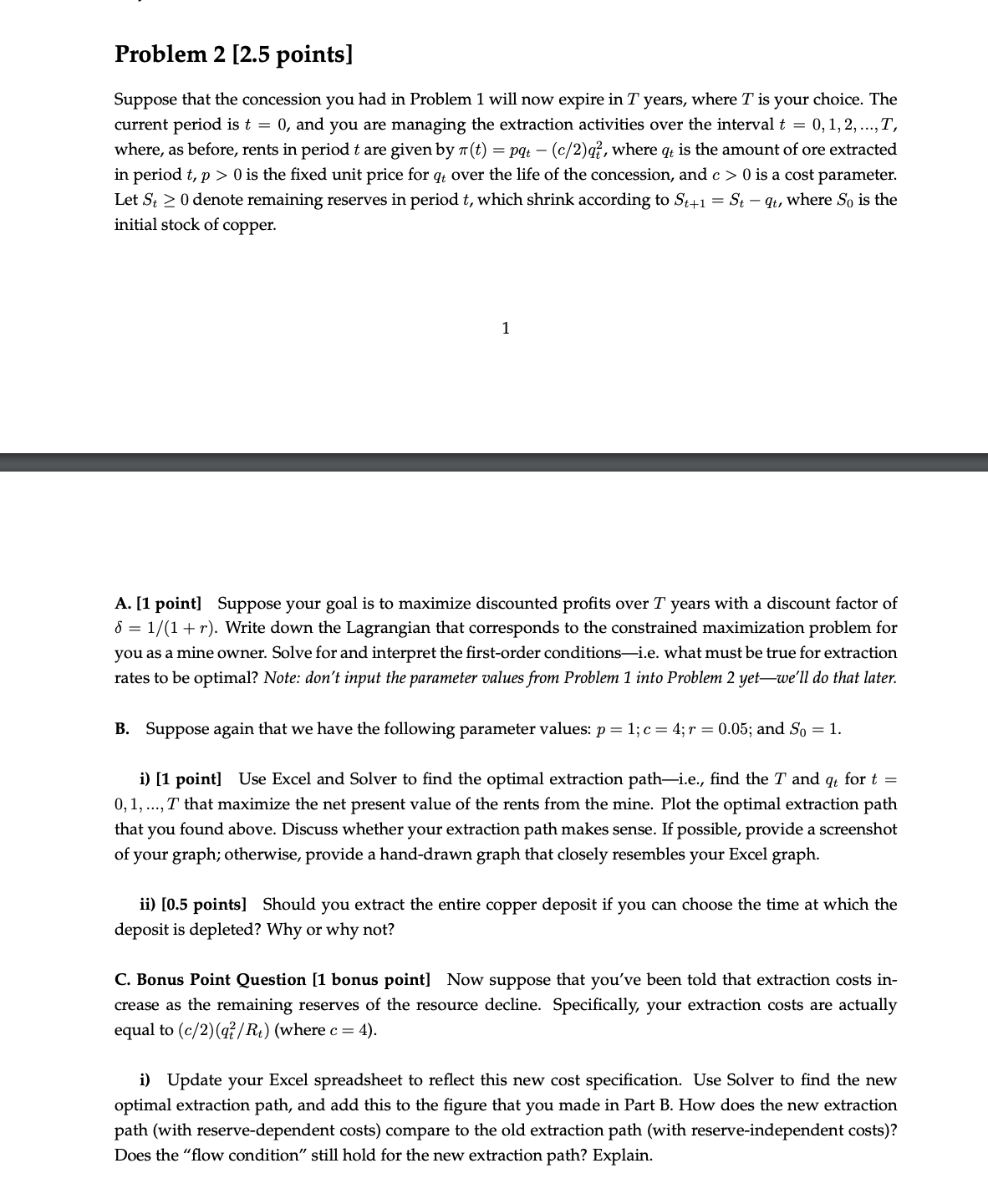

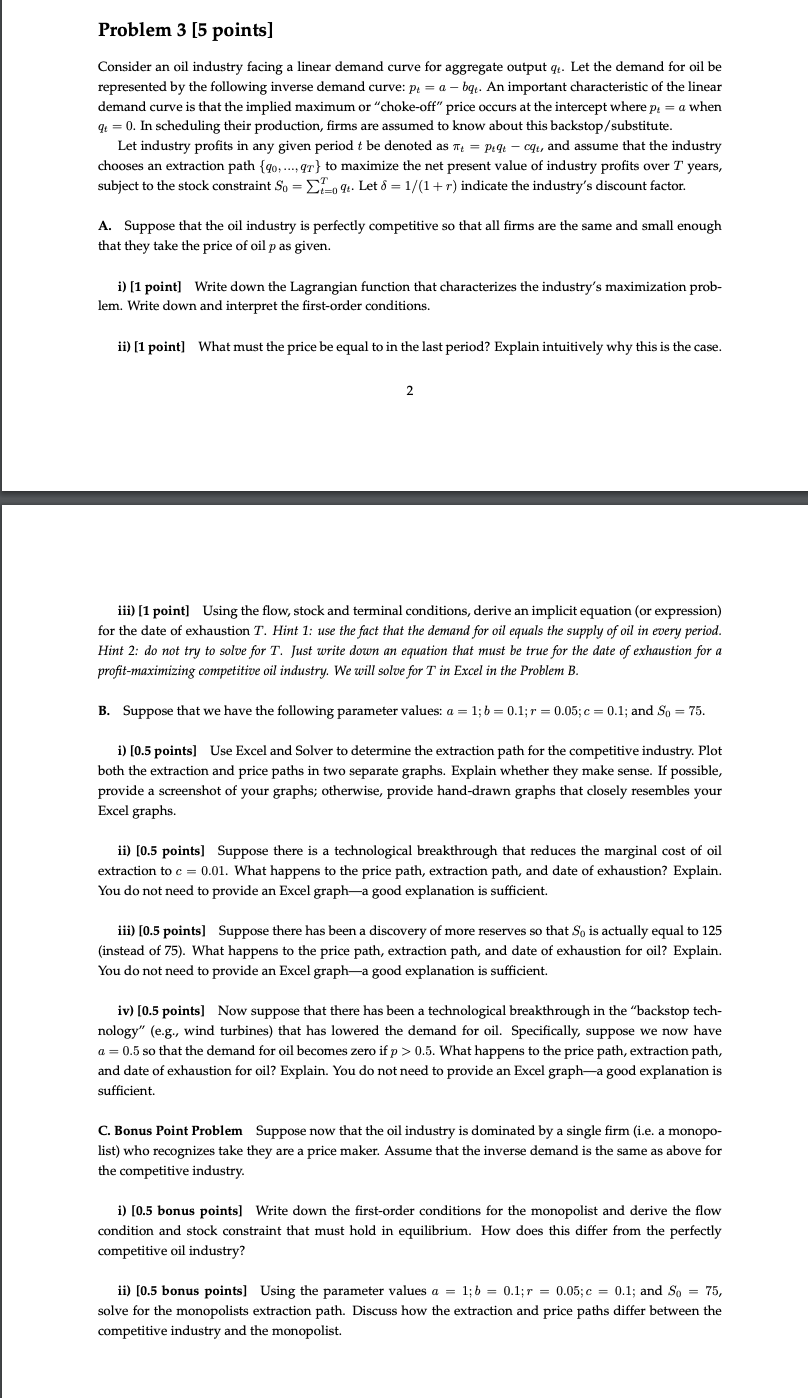

Problem 1 [2.5 points] Suppose that you are extracting copper in a foreign country under a concession thal will expire in 2 years. The current period is t = 0, and you are managing the extraction activities over the interval t = {0, 1}, where rents in period t is given by ar(t) = pg; (rs/2&2, where qt is the amount of copper extracted in period t, p > 0 is the xed unit price for qt over the life of the concession, and c > 0 is a cost parameter. Let 3.: Z 0 denote remaining reserves in period t, which shrink according to St+1 = S: qt, where 80 is the initial stock of copper. A. [1 point] Suppose your goal is to maximize discounted profits over 2 years with a discount factor of 6 = 1 / (1 + 7'). Write down the Lagrangian that corresponds to the constrained maximization problem. Solve for the first-order conditions and interpret them. B. Suppose we have the following parameter values: p = 1; c = 4; r = 0.05; and So = 1. i) [1 point] Solve for the optimal extraction path over the two periods. Your answer should be numbers, not parameters. ii) [0.5 points] Should you extract the entire copper deposit if you only have two periods? Why or why not? Problem 2 [2.5 points] Suppose that the concession you had in Problem 1 will now expire in T years, where T is your choice. The current period is t = 0, and you are managing the extraction activities over the interval t = D, 1, 2, ...,T, where, as before, rents in period t are given by 1r(t) = pg; (c/2)qf, where qt is the amount of ore extracted in period t, p > 0 is the xed unit price for qt over the life of the concession, and c > 0 is a cost parameter. Let S; 2 1] denote remaining reserves in period t, which shrink according to SH] = S; (1;, where So is the initial stock of copper. A. [1 point] Suppose your goal is to maximize discounted prots over T years with a discount factor of .5 = 1 f (1 + 1"). Write down the Lagrangian that corresponds to the constrained maximization problem for you as a mine owner. Solve for and interpret the rst-order conditionsi.e. what must be true for extraction rates to be optimal? Note: don't input the parameter values from Problem 1 into Problem 2 yetwe'll do that later. B. Suppose again that we have the following parameter values: p = 1; c = 4; r = 0.05; and 80 = 1. i) [1 point] Use Excel and Solver to nd the optimal extraction pathi.e., nd the T and q. for t = , 1, ..., T that maximize the net present value of the rents from the mine. Plot the optimal extraction path that you found above. Discuss whether your extraction path makes sense. If possible, provide a screenshot of your graph; otherwise, provide a handdrawn graph that closely resembles your Excel graph. ii} [0.5 points] Should you extract the entire copper deposit if you can choose the time at which the deposit is depleted? Why or why not? C. Bonus Point Question [1 bonus point] Now suppose that you've been told that extraction costs in- crease as the remaining reserves of the resource decline. Specically, your extraction costs are actually equal to (c/ZM/Rg) (where c = 4). i) Update your Excel spreadsheet to reect this new cost specication. Use Solver to nd the new optimal extraction path, and add this to the gure that you made in Part B. How does the new extraction path (with reserve-dependent costs) compare to the old extraction path (with reserve-independent costs)? Does the \"ow condition\" still hold for the new extraction path? Explain. Problem 3 [5 points] Consider an oil industry facing a linear demand curve for aggregate output q. Let the demand for oil be represented by the following inverse demand curve: p = a - bqt. An important characteristic of the linear demand curve is that the implied maximum or "choke-off" price occurs at the intercept where p: = a when gt = 0. In scheduling their production, firms are assumed to know about this backstop/ substitute. Let industry profits in any given period t be denoted as it = Pigt - cqt, and assume that the industry chooses an extraction path {qo,...,qr} to maximize the net present value of industry profits over T years, subject to the stock constraint So = >to qt. Let . = 1/(1 + r) indicate the industry's discount factor. A. Suppose that the oil industry is perfectly competitive so that all firms are the same and small enough that they take the price of oil p as given. i) [1 point] Write down the Lagrangian function that characterizes the industry's maximization prob- lem. Write down and interpret the first-order conditions. ii) [1 point] What must the price be equal to in the last period? Explain intuitively why this is the case. 2 iii) [1 point] Using the flow, stock and terminal conditions, derive an implicit equation (or expression) for the date of exhaustion T. Hint 1: use the fact that the demand for oil equals the supply of oil in every period. Hint 2: do not try to solve for T. Just write down an equation that must be true for the date of exhaustion for a profit-maximizing competitive oil industry. We will solve for T in Excel in the Problem B. B. Suppose that we have the following parameter values: a = 1; b = 0.1;r = 0.05; c = 0.1; and So = 75. i) [0.5 points] Use Excel and Solver to determine the extraction path for the competitive industry. Plot both the extraction and price paths in two separate graphs. Explain whether they make sense. If possible, provide a screenshot of your graphs; otherwise, provide hand-drawn graphs that closely resembles your Excel graphs. ii) [0.5 points] Suppose there is a technological breakthrough that reduces the marginal cost of oil extraction to c = 0.01. What happens to the price path, extraction path, and date of exhaustion? Explain. You do not need to provide an Excel graph-a good explanation is sufficient. iii) [0.5 points] Suppose there has been a discovery of more reserves so that So is actually equal to 125 instead of 75). What happens to the price path, extraction path, and date of exhaustion for oil? Explain. You do not need to provide an Excel graph-a good explanation is sufficient. iv) [0.5 points] Now suppose that there has been a technological breakthrough in the "backstop tech- nology" (e.g., wind turbines) that has lowered the demand for oil. Specifically, suppose we now have a = 0.5 so that the demand for oil becomes zero if p > 0.5. What happens to the price path, extraction path, and date of exhaustion for oil? Explain. You do not need to provide an Excel graph-a good explanation is sufficient. C. Bonus Point Problem Suppose now that the oil industry is dominated by a single firm (i.e. a monopo- list) who recognizes take they are a price maker. Assume that the inverse demand is the same as above for the competitive industry. i) [0.5 bonus points] Write down the first-order conditions for the monopolist and derive the flow condition and stock constraint that must hold in equilibrium. How does this differ from the perfectly competitive oil industry? ii) [0.5 bonus points] Using the parameter values a = 1;b = 0.1;r = 0.05; c = 0.1; and So = 75, solve for the monopolists extraction path. Discuss how the extraction and price paths differ between the competitive industry and the monopolist