Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with these questions i will rate you Lithium, Inc. is considering two mutually exclusive projects, A and B. Project A costs $95.000

I need help with these questions

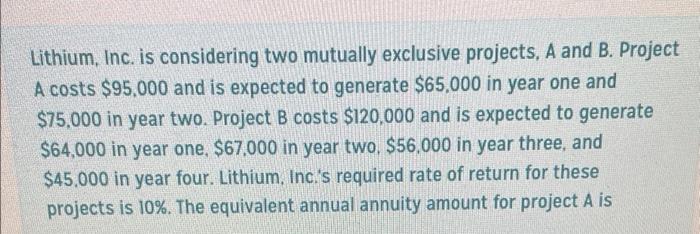

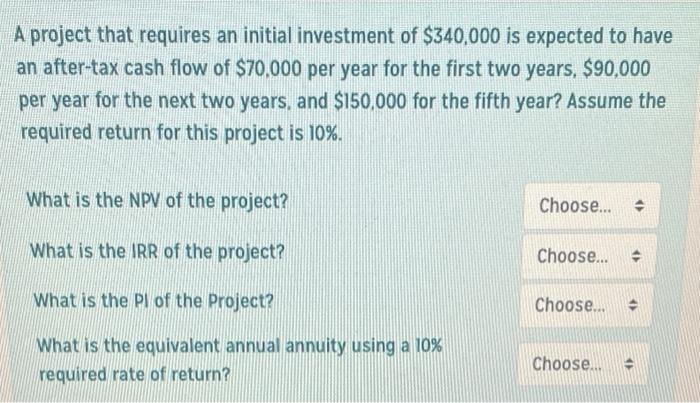

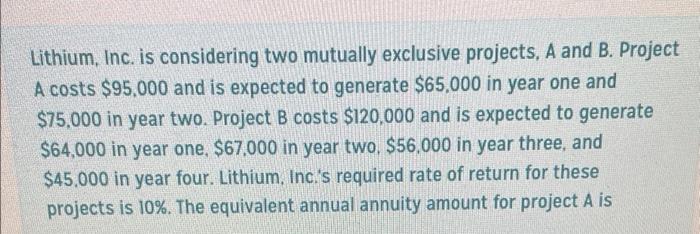

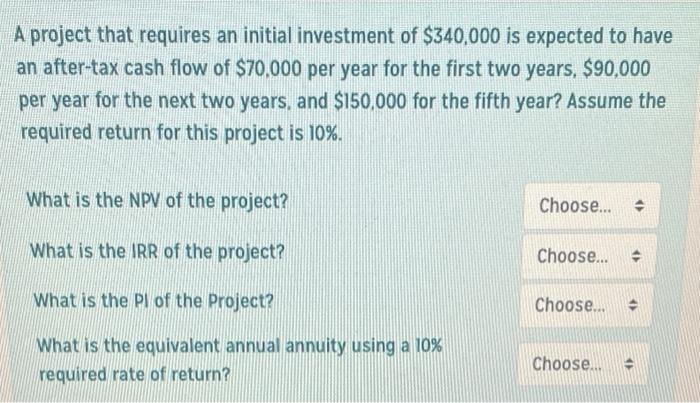

Lithium, Inc. is considering two mutually exclusive projects, A and B. Project A costs $95.000 and is expected to generate $65,000 in year one and $75,000 in year two. Project B costs $120,000 and is expected to generate $64,000 in year one, $67,000 in year two. $56,000 in year three, and $45,000 in year four. Lithium, Inc.'s required rate of return for these projects is 10%. The equivalent annual annuity amount for project A is A project that requires an initial investment of $340,000 is expected to have an after-tax cash flow of $70,000 per year for the first two years, $90,000 per year for the next two years, and $150,000 for the fifth year? Assume the required return for this project is 10%. What is the NPV of the project? Choose... . What is the IRR of the project? Choose... What is the pl of the Project? Choose... What is the equivalent annual annuity using a 10% required rate of return? Choose i will rate you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started