Answered step by step

Verified Expert Solution

Question

1 Approved Answer

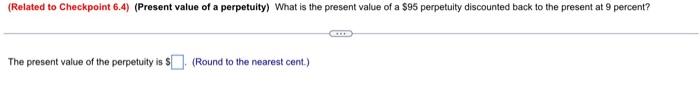

I need help with these questions (Related to Checkpoint 6.4) (Present value of a perpetuity) What is the present value of a $95 perpetuity discounted

I need help with these questions

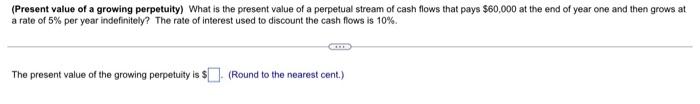

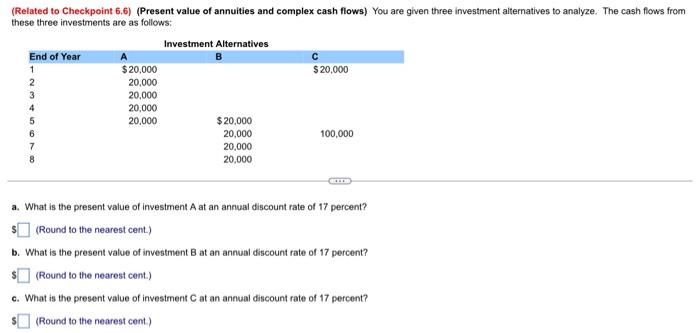

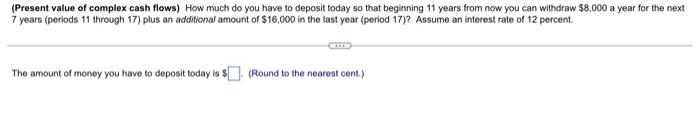

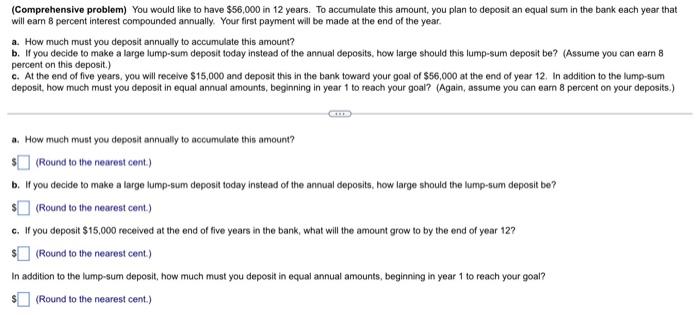

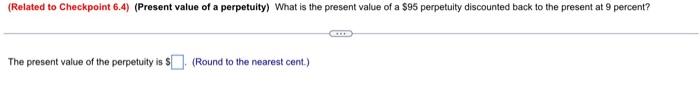

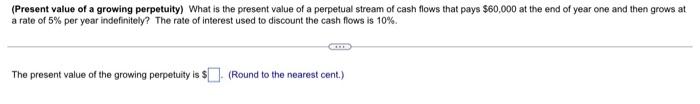

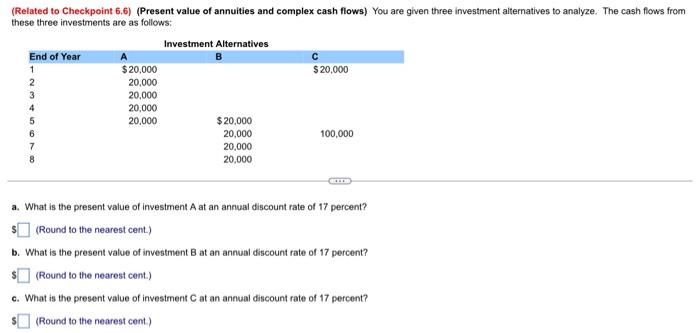

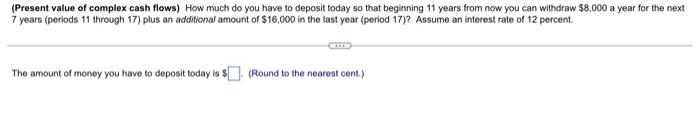

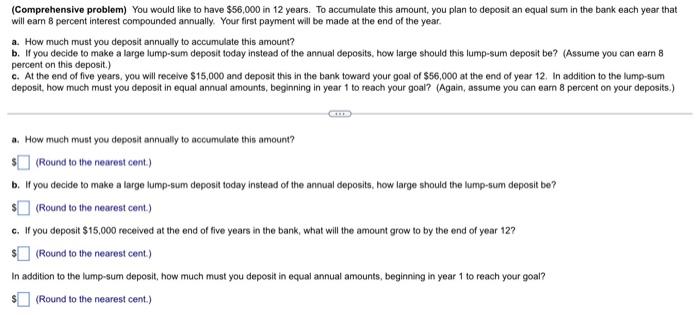

(Related to Checkpoint 6.4) (Present value of a perpetuity) What is the present value of a $95 perpetuity discounted back to the present at 9 percent? EGOOD The present value of the perpetuity is $(Round to the nearest cent.) (Present value of a growing perpetuity) What is the present value of a perpetual stream of cash flows that pays $60,000 at the end of year one and then grows at a rate of 5% per year indefinitely? The rate of interest used to discount the cash flows is 10% The present value of the growing perpetuity is $. (Round to the nearest cent.) (Related to Checkpoint 6.6) (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment Alternatives End of Year 1 $ 20,000 $20,000 2 20,000 3 20,000 20,000 5 20,000 $20,000 6 20,000 100,000 7 20,000 8 20,000 4 a. What is the present value of investment at an annual discount rate of 17 percent? (Round to the nearest cent.) b. What is the present value of investment B at an annual discount rate of 17 percent? (Round to the nearest cent.) c. What is the present value of investment at an annual discount rate of 17 percent? (Round to the nearest cent) (Present value of complex cash flows) How much do you have to deposit today so that beginning 11 years from now you can withdraw $8,000 a year for the next 7 years (periods 11 through 17) plus an acclitional amount of $16,000 in the last year (period 1777 Assume an interest rate of 12 percent. The amount of money you have to deposit today is $. (Round to the nearest cont.) (Comprehensive problem) You would like to have $56,000 in 12 years. To accumulate this amount, you plan to deposit an equal sum in the bank each year that will earn 8 percent interest compounded annually. Your first payment will be made at the end of the year a. How much must you deposit annually to accumulate this amount? b. If you decide to make a large lump-sum deposit today instead of the annual deposits, how large should this lump-sum deposit be? (Assume you can eam 8 percent on this deposit.) c. At the end of five years, you will receive $15,000 and deposit this in the bank toward your goal of $56,000 at the end of year 12. In addition to the lump-sum deposit, how much must you deposit in equal annual amounts, beginning in year 1 to reach your goal? (Again, assume you can earn 8 percent on your deposits.) a. How much must you deposit annually to accumulate this amount? (Round to the nearest cont.) b. If you decide to make a large lump-sum deposit today instead of the annual deposits, how large should the lump-sum deposit be? (Round to the nearest cent.) c. If you deposit $15,000 received at the end of five years in the bank, what will the amount grow to by the end of year 12? (Round to the nearest cent.) In addition to the lump-sum deposit, how much must you deposit in equal annual amounts, beginning in year 1 to reach your goal? (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started