i need help with theses two questions

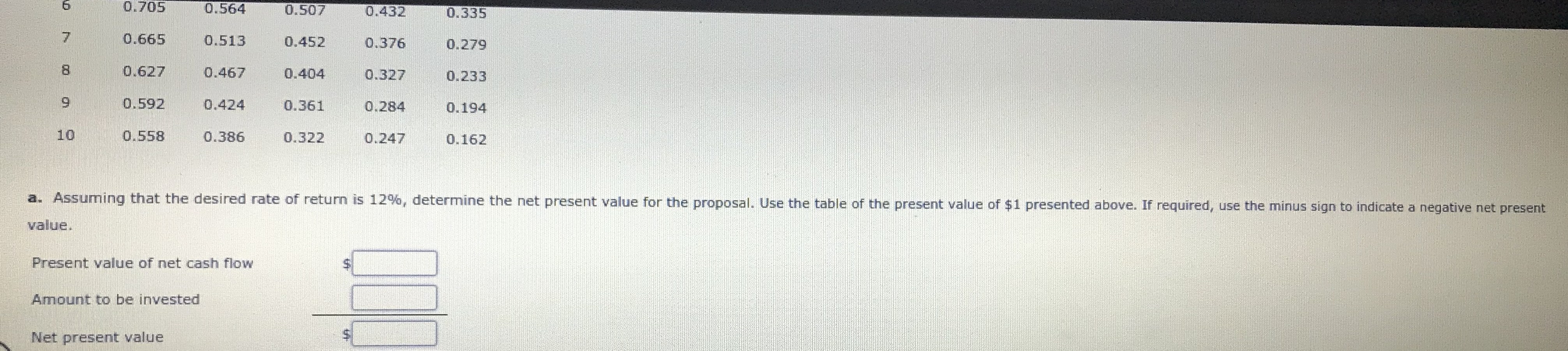

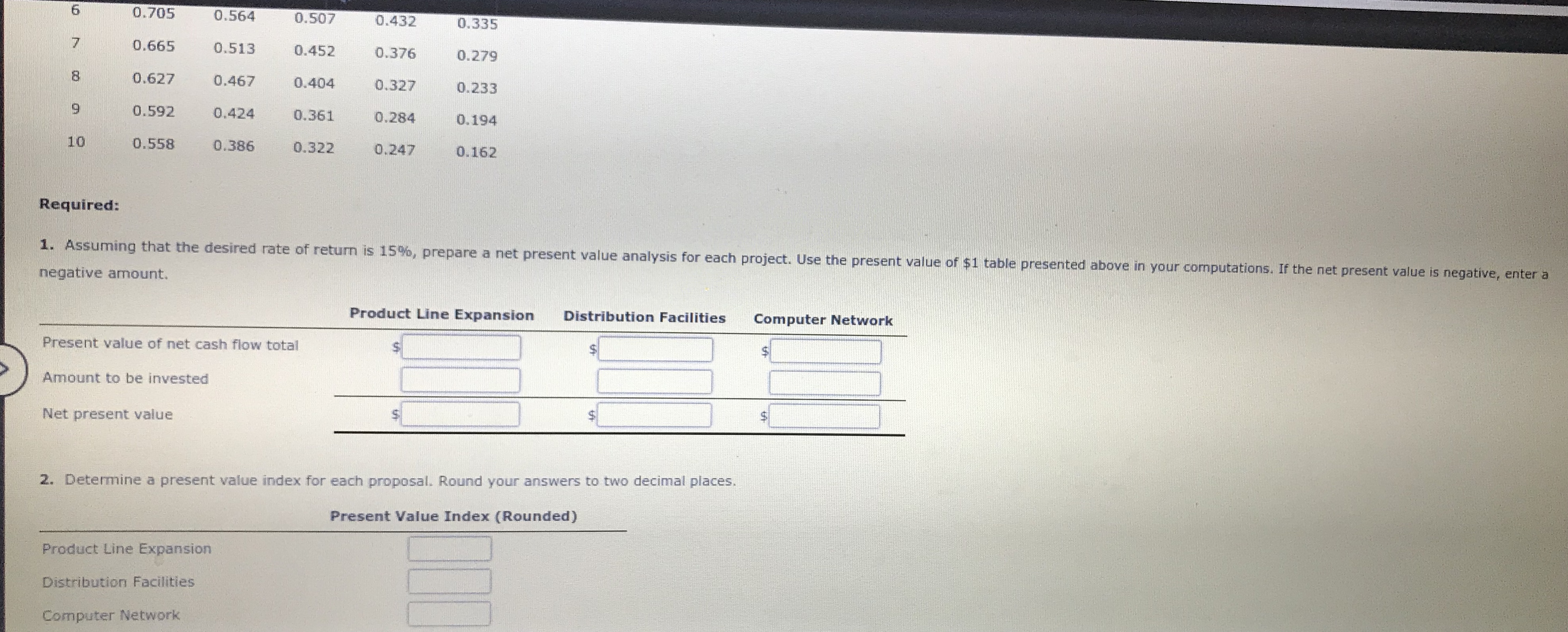

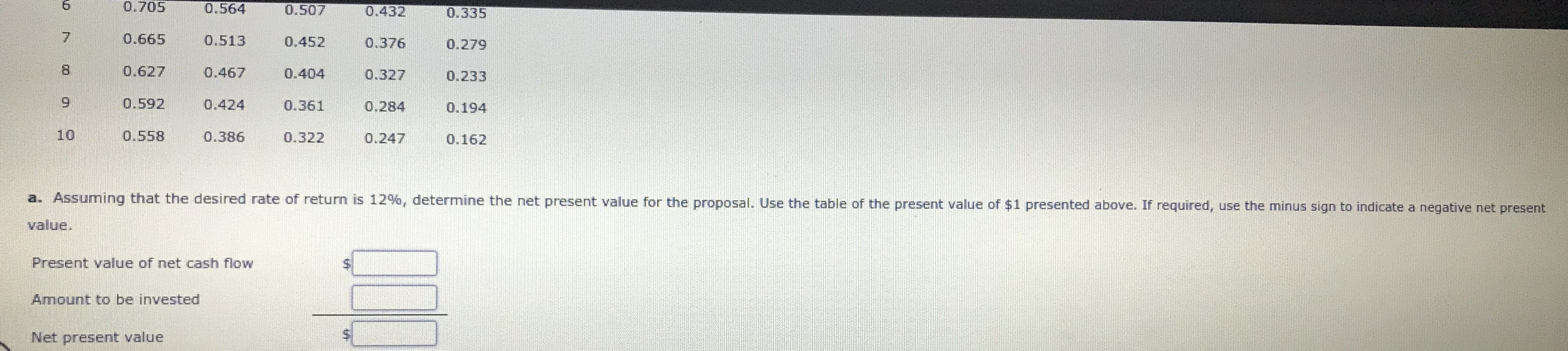

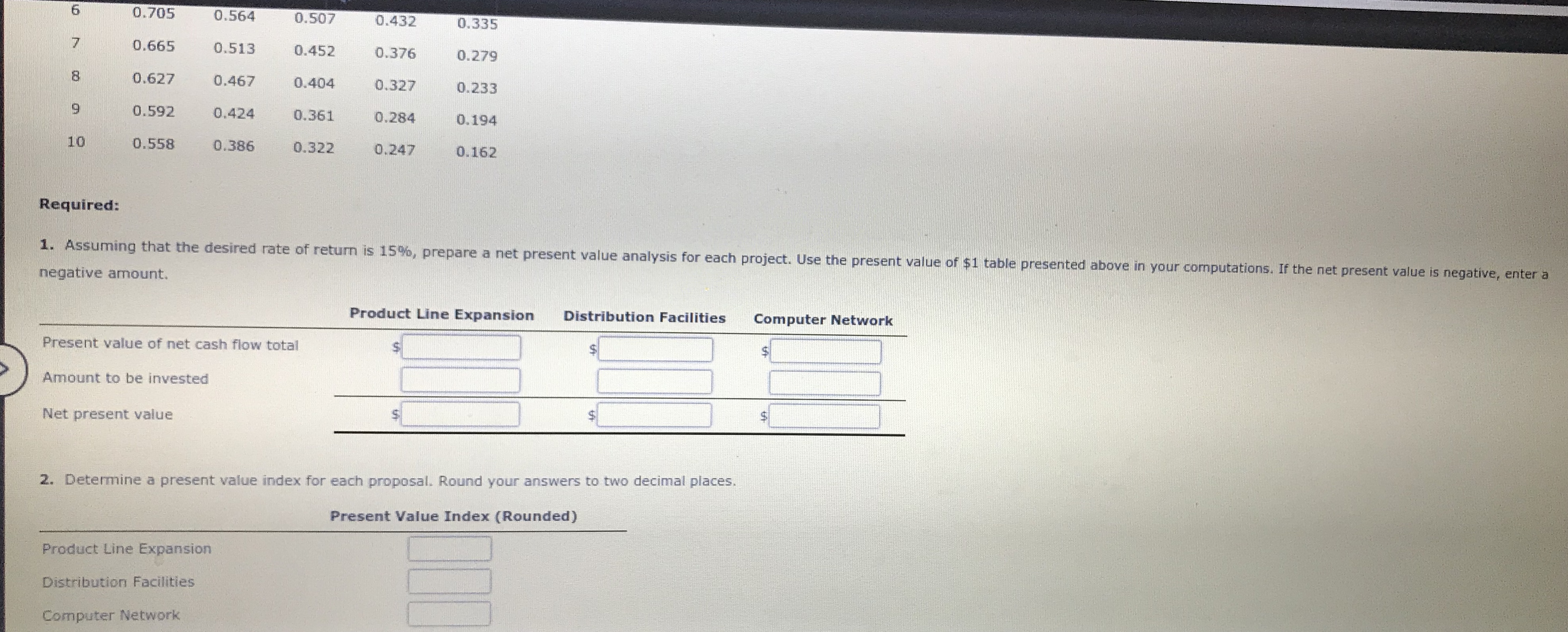

Net Present Value Method The following data are accumulated by Wocester Hat Company in evaluating the purchase of $105,700 of equipment, having a four-year useful life: Net Income (Loss) Net Cash Flows Year 1 $31,000 $52,000 Year 2 19,000 40,000 Year 3 9,000 30,000 Year 4 (1,000) 20,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.279 0.627 0.467 0.404 0.327 0.23B 0.592 0.424 0.361 0.284 0.194Net Present Value Method, Present Value Index, and Analysis Donahue Industries Inc. wishes to evaluate three capital investment projects by using the net present value method. Relevant data related to the projects are summarized as follows: Product Line Distribution Computer Expansion Facilities Network Amount to be invested $616,689 $400,117 $210,845 Annual net cash flows: Year 1 292,000 210,000 120,000 Year 2 272,000 189,000 83,000 Year 3 248,000 168,000 60,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 0.943 0.909 0.893 0.870 0.833 0.890 0.826 0.797 0.756 0.694 0.840 0. 751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 15 0.747 0.621 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.2790.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.279 CO 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 a. Assuming that the desired rate of return is 12%, determine the net present value for the proposal. Use the table of the present value of $1 presented above. If required, use the minus sign to indicate a negative net present value. Present value of net cash flow Amount to be invested Net present value6 0.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 0.592 0.424 0.361 0.284 0. 194 10 0.558 0.386 0.322 0.247 0.162 Required: 1. Assuming that the desired rate of return is 15%, prepare a net present value analysis for each project. Use the present value of $1 table presented above in your computations. If the net present value is negative, enter a negative amount. Product Line Expansion Distribution Facilities Computer Network Present value of net cash flow total Amount to be invested Net present value 2. Determine a present value index for each proposal. Round your answers to two decimal places. Present Value Index (Rounded) Product Line Expansion Distribution Facilities Computer Network