Answered step by step

Verified Expert Solution

Question

1 Approved Answer

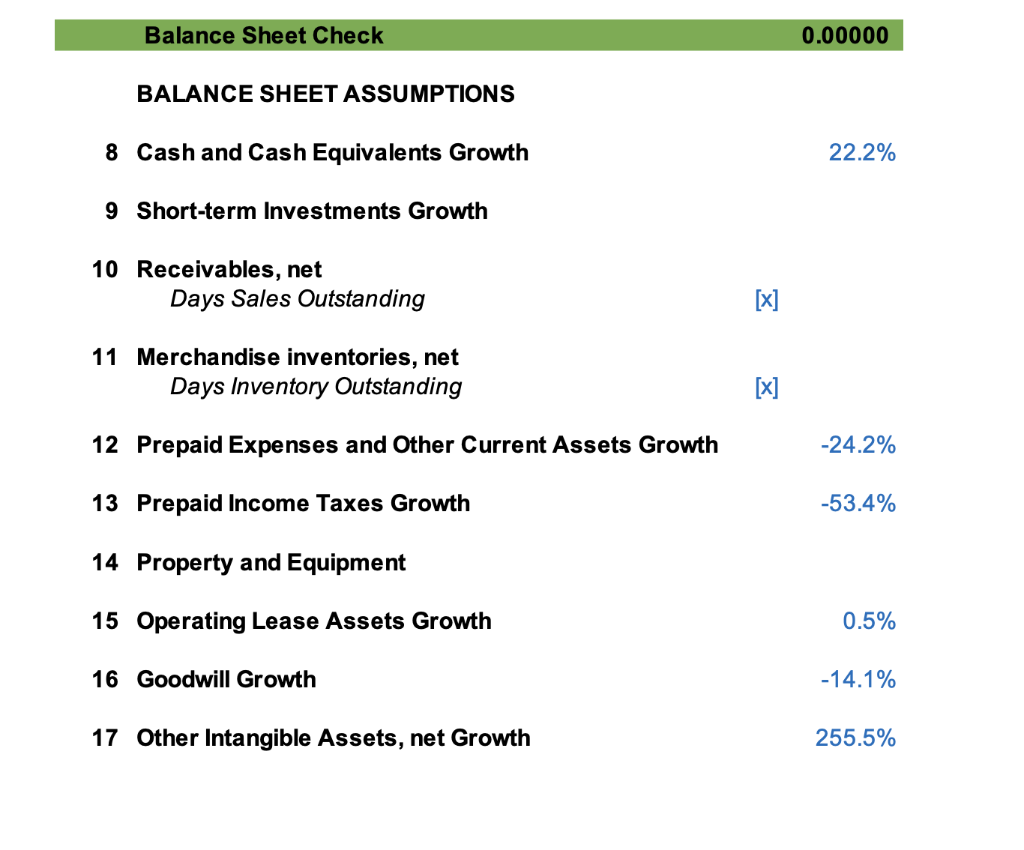

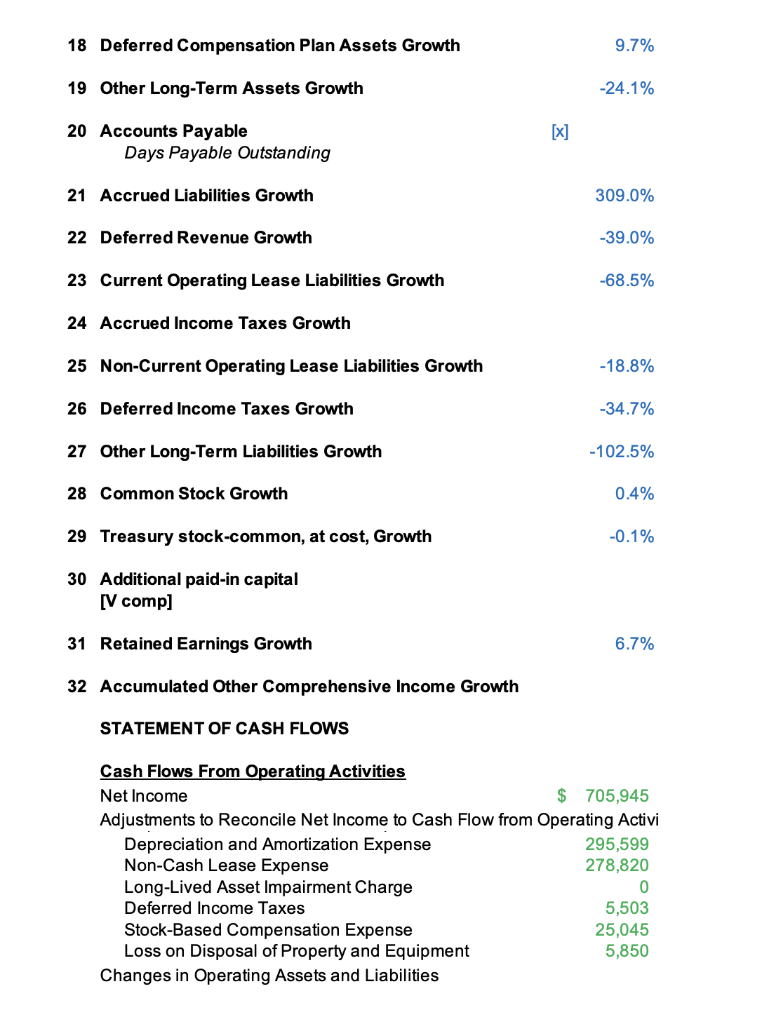

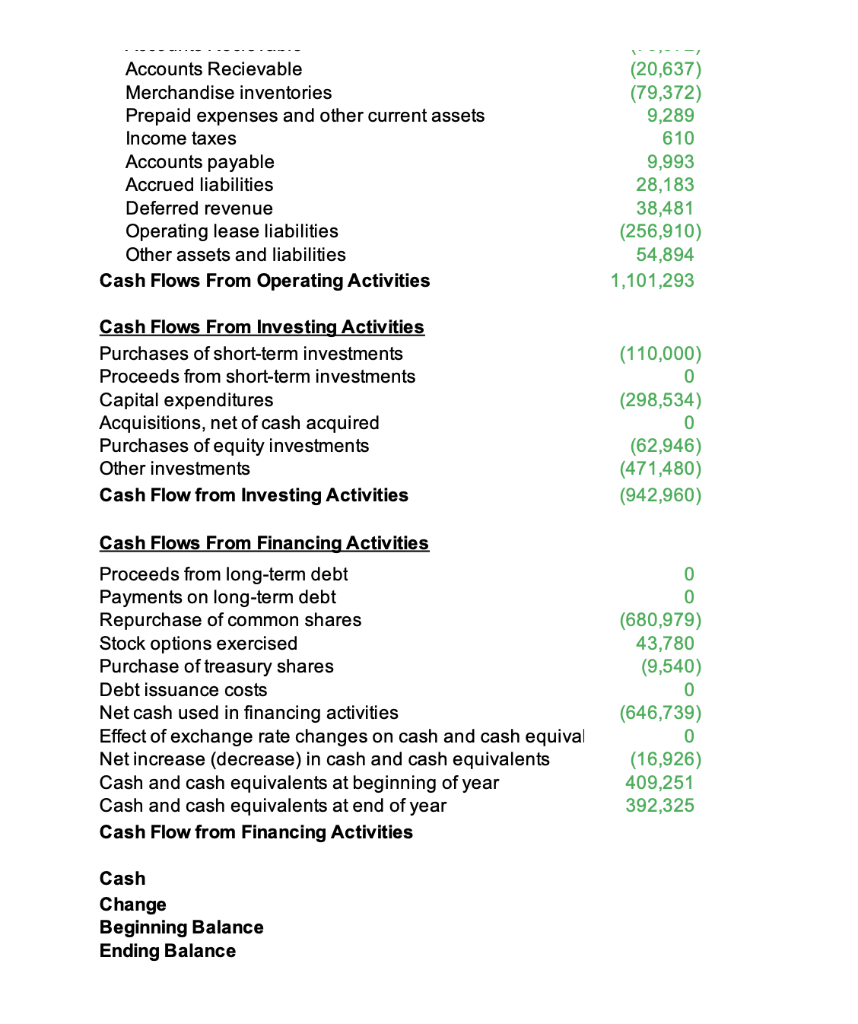

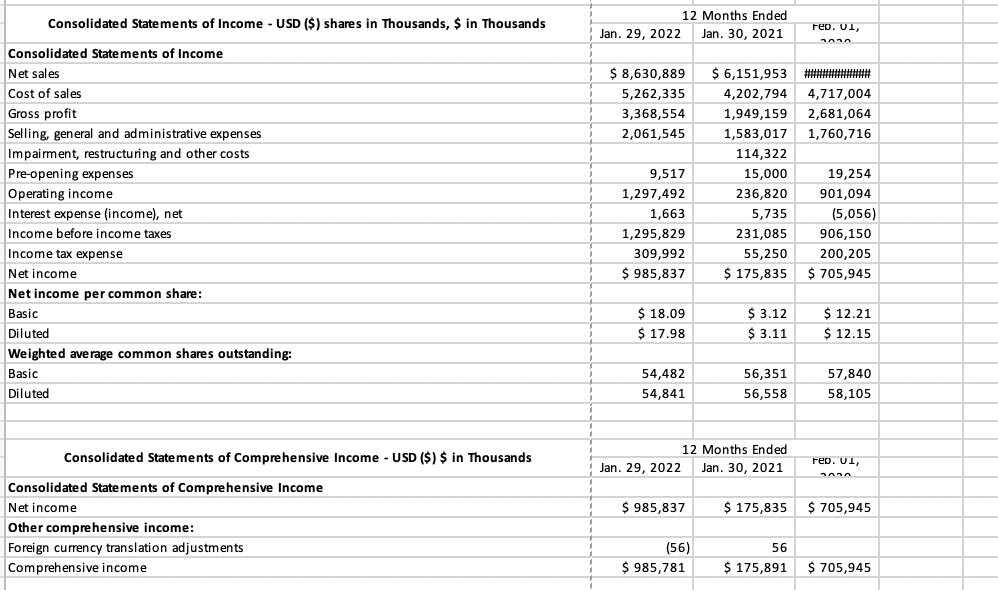

I need help with this balence sheet I've been struggling for hours, and I can't get it to balance. here's the sheet that needs help

I need help with this balence sheet I've been struggling for hours, and I can't get it to balance.

here's the sheet that needs help with the follow values. the follow values from 8 to ending cash balance need to be updated, based off of the following information below.

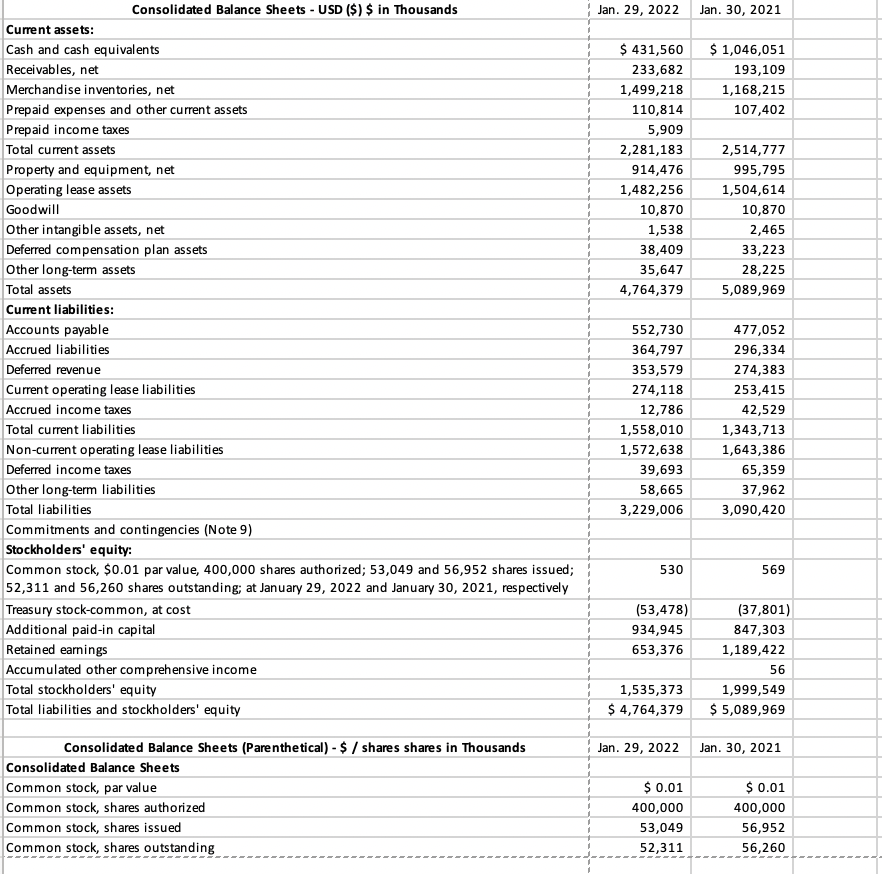

balence sheet numbers:

please help, I know it's a lot but I've been up for hours and can't figure it out.

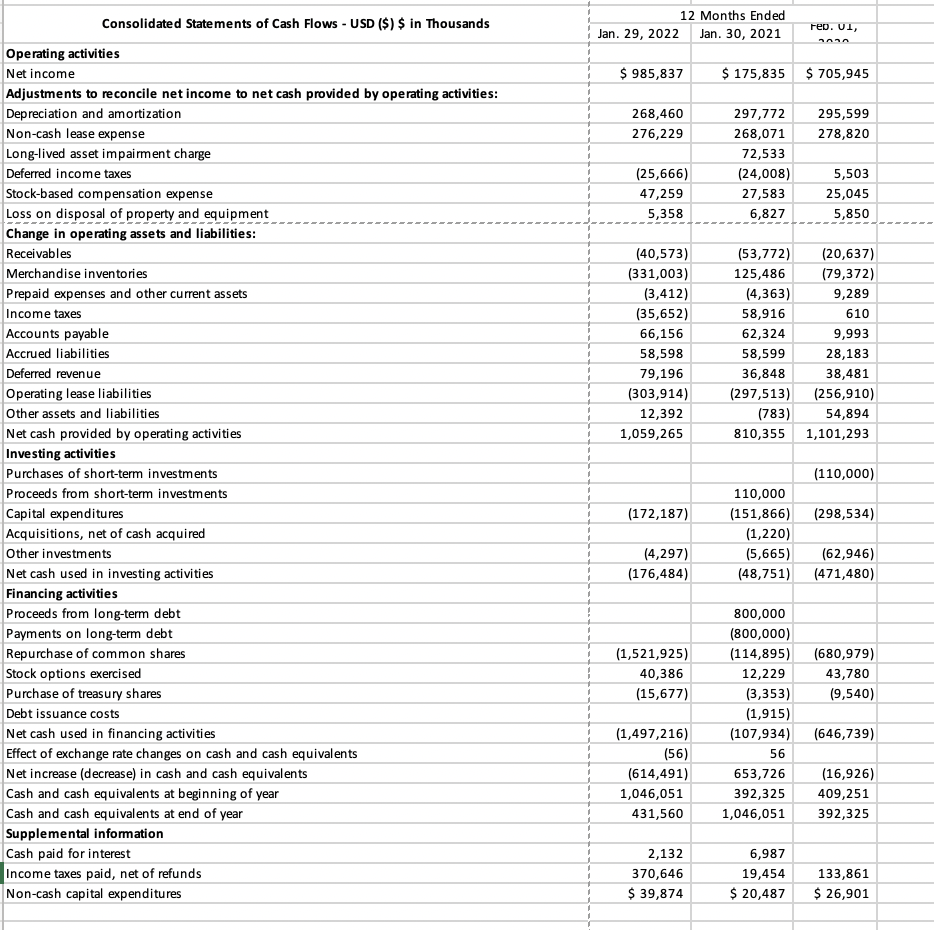

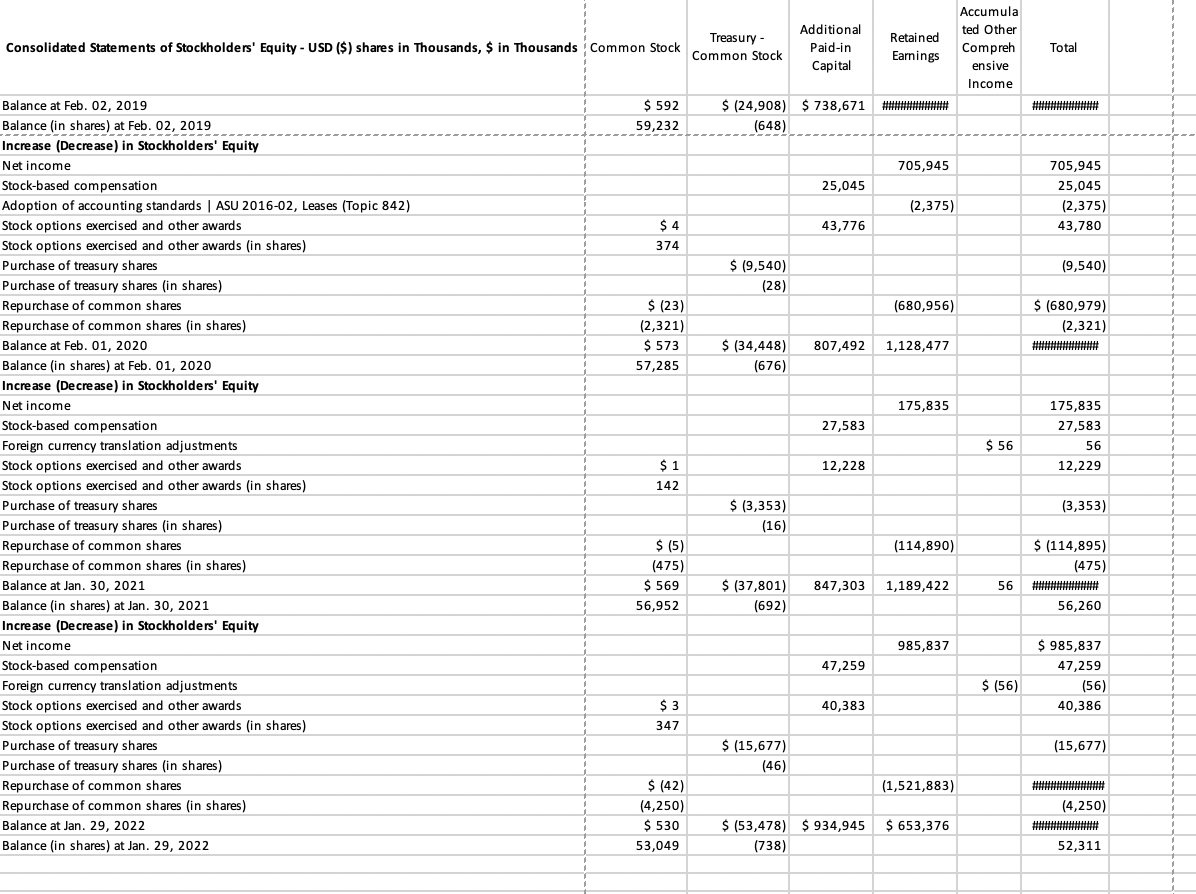

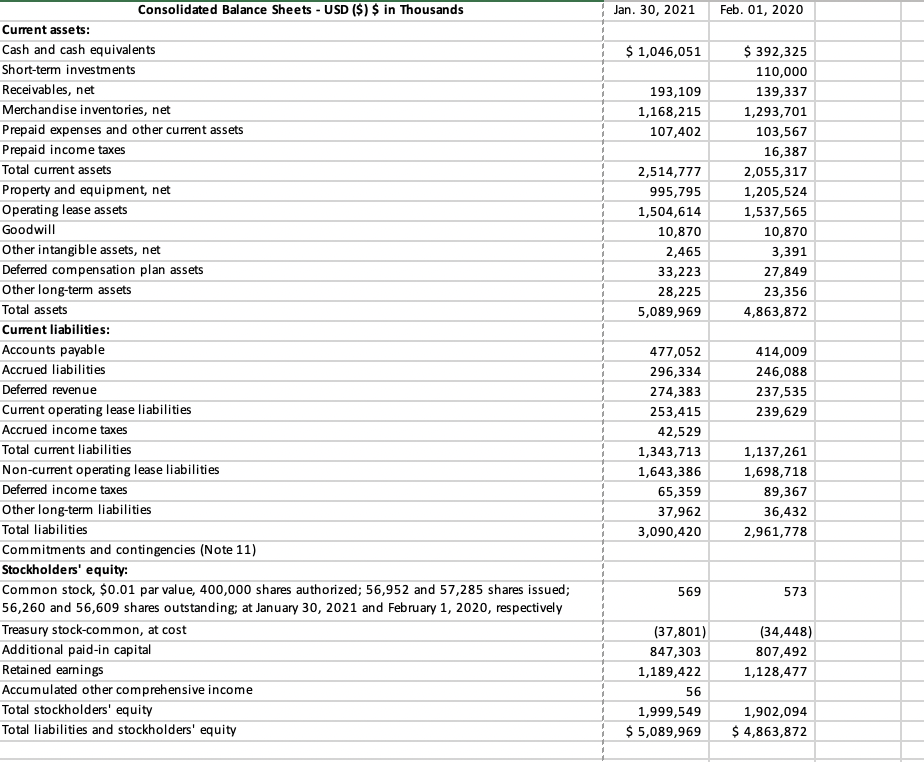

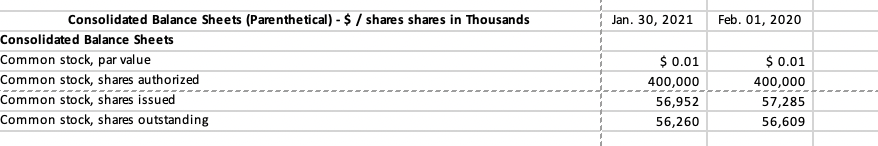

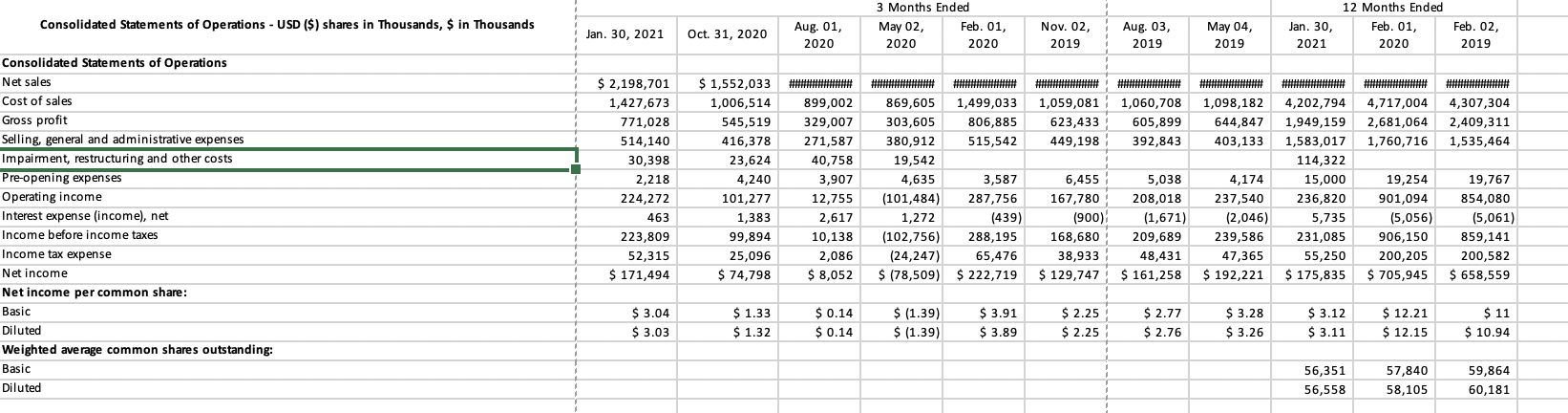

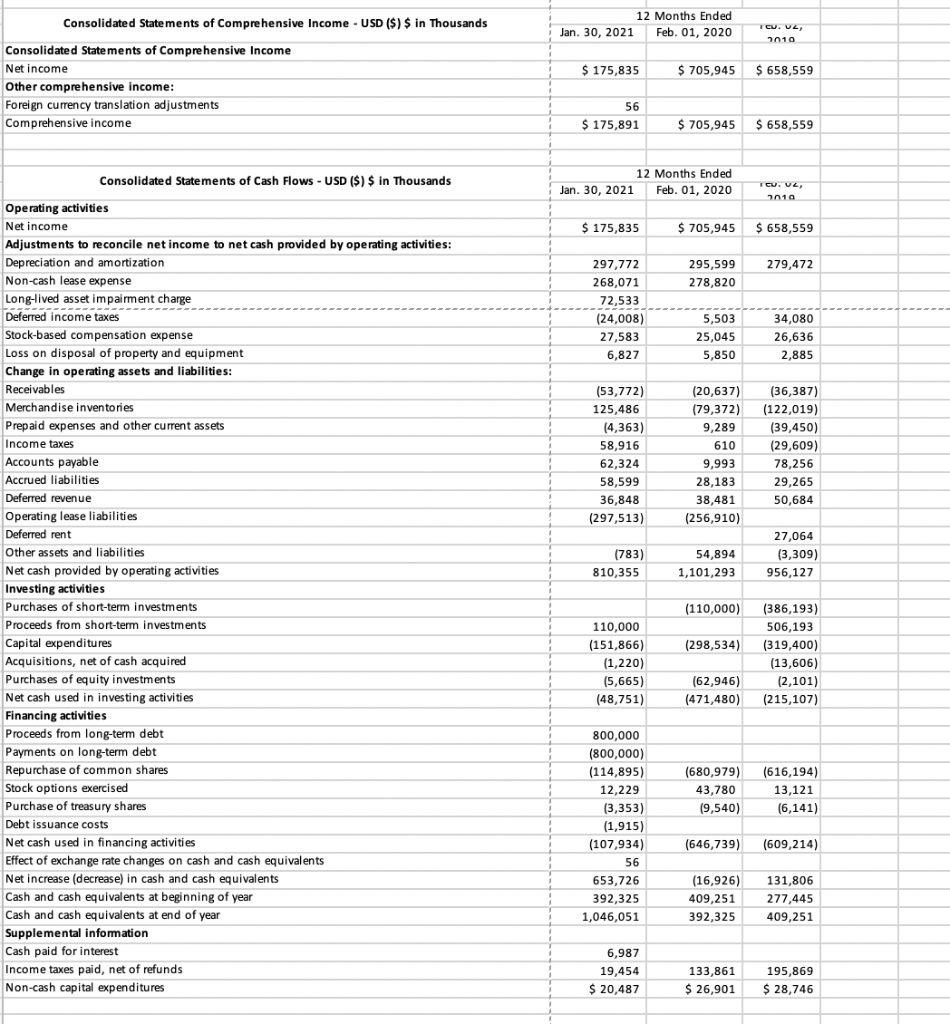

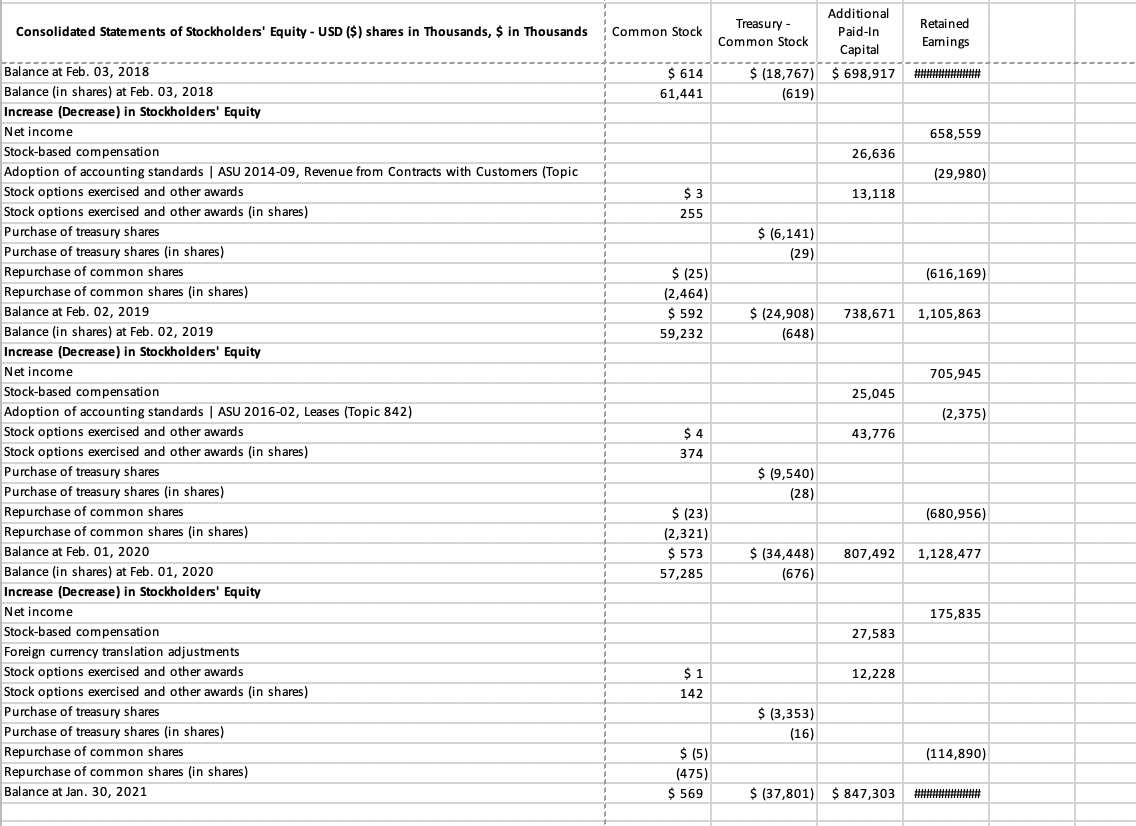

Balance Sheet Check 0.00000 BALANCE SHEET ASSUMPTIONS 8 Cash and Cash Equivalents Growth 22.2% 9 Short-term Investments Growth 10 Receivables, net Days Sales Outstanding [x] 11 Merchandise inventories, net Days Inventory Outstanding [x] 12 Prepaid Expenses and Other Current Assets Growth 24.2% 13 Prepaid Income Taxes Growth 53.4% 14 Property and Equipment 15 Operating Lease Assets Growth 0.5% 16 Goodwill Growth 14.1% 17 Other Intangible Assets, net Growth 255.5% 18 Deferred Compensation Plan Assets Growth 9.7% 19 Other Long-Term Assets Growth 24.1% 20 Accounts Payable [x] Days Payable Outstanding 21 Accrued Liabilities Growth 309.0% 22 Deferred Revenue Growth 39.0% 23 Current Operating Lease Liabilities Growth 68.5% 24 Accrued Income Taxes Growth 25 Non-Current Operating Lease Liabilities Growth 26 Deferred Income Taxes Growth 34.7% 27 Other Long-Term Liabilities Growth 102.5% 28 Common Stock Growth 0.4% 29 Treasury stock-common, at cost, Growth 0.1% 30 Additional paid-in capital [V comp] 31 Retained Earnings Growth 6.7% 32 Accumulated Other Comprehensive Income Growth STATEMENT OF CASH FLOWS Cash Flows From Operating Activities Net Income $705,945 Adjustments to Reconcile Net Income to Cash Flow from Operating Activi Depreciation and Amortization Expense 295,599 Non-Cash Lease Expense 278,820 Long-Lived Asset Impairment Charge 0 Deferred Income Taxes Stock-Based Compensation Expense 25,045 Loss on Disposal of Property and Equipment 5,850 Changes in Operating Assets and Liabilities Accounts Recievable (20,637) Merchandise inventories Prepaid expenses and other current assets Income taxes Accounts payable Accrued liabilities (79,372) 28,183 Operating lease liabilities (256,910) Other assets and liabilities 54,894 Cash Flows From Operating Activities 1,101,293 Cash Flows From Investing Activities Purchases of short-term investments Proceeds from short-term investments (110,000) Capital expenditures Acquisitions, net of cash acquired (298,534) Purchases of equity investments (62,946) Other investments (471,480) Cash Flow from Investing Activities (942,960) Cash Flows From Financing Activities Proceeds from long-term debt Payments on long-term debt Repurchase of common shares Stock options exercised Purchase of treasury shares Debt issuance costs Net cash used in financing activities Effect of exchange rate changes on cash and cash equival Net increase (decrease) in cash and cash equivalents (16,926) Cash and cash equivalents at beginning of year 409,251 Cash and cash equivalents at end of year 392,325 Cash Flow from Financing Activities Cash Change Beginning Balance Ending Balance Current assets: Consolidated Balance Sheets - USD (\$) \$ in Thousands Cash and cash equivalents Short-term investments Receivables, net Merchandise inventories, net Prepaid expenses and other current assets Prepaid income taxes Total current assets Property and equipment, net Operating lease assets Goodwill Other intangible assets, net Deferred compensation plan assets Other long-term assets Total assets Current liabilities: Accounts payable Accrued liabilities Deferred revenue Current operating lease liabilities Accrued income taxes Total current liabilities Non-current operating lease liabilities Deferred income taxes Other long-term liabilities Total liabilities Commitments and contingencies (Note 11) Stockholders' equity: Common stock, \$0.01 par value, 400,000 shares authorized; 56,952 and 57,285 shares issued; 56,260 and 56,609 shares outstanding; at January 30, 2021 and February 1, 2020, respectively Treasury stock-common, at cost Additional paid-in capital Retained earnings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity \begin{tabular}{l|l} Jan. 30,2021 & Feb. 01,2020 \end{tabular} \begin{tabular}{l|r|r|r|} \hline \multicolumn{1}{|c|}{ Consolidated Balance Sheets (Parenthetical) - $ / shares shares in Thousands } & Jan. 30,2021 & Feb. 01,2020 \\ \hline Consolidated Balance Sheets & $0.01 & \\ \hline Common stock, par value & 400,000 & 400,000 \\ \hline Common stock, shares authorized & 56,952 & 56,285 \\ \hline Common stock, shares issued & 56,260 & 56,609 \\ \hline Common stock, shares outstanding & \end{tabular} Balance Sheet Check 0.00000 BALANCE SHEET ASSUMPTIONS 8 Cash and Cash Equivalents Growth 22.2% 9 Short-term Investments Growth 10 Receivables, net Days Sales Outstanding [x] 11 Merchandise inventories, net Days Inventory Outstanding [x] 12 Prepaid Expenses and Other Current Assets Growth 24.2% 13 Prepaid Income Taxes Growth 53.4% 14 Property and Equipment 15 Operating Lease Assets Growth 0.5% 16 Goodwill Growth 14.1% 17 Other Intangible Assets, net Growth 255.5% 18 Deferred Compensation Plan Assets Growth 9.7% 19 Other Long-Term Assets Growth 24.1% 20 Accounts Payable [x] Days Payable Outstanding 21 Accrued Liabilities Growth 309.0% 22 Deferred Revenue Growth 39.0% 23 Current Operating Lease Liabilities Growth 68.5% 24 Accrued Income Taxes Growth 25 Non-Current Operating Lease Liabilities Growth 26 Deferred Income Taxes Growth 34.7% 27 Other Long-Term Liabilities Growth 102.5% 28 Common Stock Growth 0.4% 29 Treasury stock-common, at cost, Growth 0.1% 30 Additional paid-in capital [V comp] 31 Retained Earnings Growth 6.7% 32 Accumulated Other Comprehensive Income Growth STATEMENT OF CASH FLOWS Cash Flows From Operating Activities Net Income $705,945 Adjustments to Reconcile Net Income to Cash Flow from Operating Activi Depreciation and Amortization Expense 295,599 Non-Cash Lease Expense 278,820 Long-Lived Asset Impairment Charge 0 Deferred Income Taxes Stock-Based Compensation Expense 25,045 Loss on Disposal of Property and Equipment 5,850 Changes in Operating Assets and Liabilities Accounts Recievable (20,637) Merchandise inventories Prepaid expenses and other current assets Income taxes Accounts payable Accrued liabilities (79,372) 28,183 Operating lease liabilities (256,910) Other assets and liabilities 54,894 Cash Flows From Operating Activities 1,101,293 Cash Flows From Investing Activities Purchases of short-term investments Proceeds from short-term investments (110,000) Capital expenditures Acquisitions, net of cash acquired (298,534) Purchases of equity investments (62,946) Other investments (471,480) Cash Flow from Investing Activities (942,960) Cash Flows From Financing Activities Proceeds from long-term debt Payments on long-term debt Repurchase of common shares Stock options exercised Purchase of treasury shares Debt issuance costs Net cash used in financing activities Effect of exchange rate changes on cash and cash equival Net increase (decrease) in cash and cash equivalents (16,926) Cash and cash equivalents at beginning of year 409,251 Cash and cash equivalents at end of year 392,325 Cash Flow from Financing Activities Cash Change Beginning Balance Ending Balance Current assets: Consolidated Balance Sheets - USD (\$) \$ in Thousands Cash and cash equivalents Short-term investments Receivables, net Merchandise inventories, net Prepaid expenses and other current assets Prepaid income taxes Total current assets Property and equipment, net Operating lease assets Goodwill Other intangible assets, net Deferred compensation plan assets Other long-term assets Total assets Current liabilities: Accounts payable Accrued liabilities Deferred revenue Current operating lease liabilities Accrued income taxes Total current liabilities Non-current operating lease liabilities Deferred income taxes Other long-term liabilities Total liabilities Commitments and contingencies (Note 11) Stockholders' equity: Common stock, \$0.01 par value, 400,000 shares authorized; 56,952 and 57,285 shares issued; 56,260 and 56,609 shares outstanding; at January 30, 2021 and February 1, 2020, respectively Treasury stock-common, at cost Additional paid-in capital Retained earnings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity \begin{tabular}{l|l} Jan. 30,2021 & Feb. 01,2020 \end{tabular} \begin{tabular}{l|r|r|r|} \hline \multicolumn{1}{|c|}{ Consolidated Balance Sheets (Parenthetical) - $ / shares shares in Thousands } & Jan. 30,2021 & Feb. 01,2020 \\ \hline Consolidated Balance Sheets & $0.01 & \\ \hline Common stock, par value & 400,000 & 400,000 \\ \hline Common stock, shares authorized & 56,952 & 56,285 \\ \hline Common stock, shares issued & 56,260 & 56,609 \\ \hline Common stock, shares outstanding & \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started