Question

I need help with this homework assignment. I dont really understand programming. When you help me, could you please answer step by step? I dont

I need help with this homework assignment. I dont really understand programming. When you help me, could you please answer step by step? I dont want to get confused on what part was answered. This is what my profressor posted:

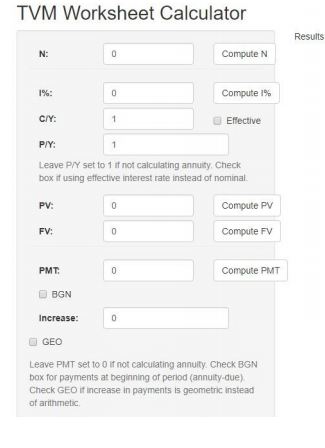

Submit your Program and program code (in a word file) separately. I will run your program in my computer. Therefore, I need actual program. I also need the code in a word file. Question 1: Using R, Mathematica or Matlab write a computer program which can calculate PV, FV, N, PMT, I/Y for annuity due and annuity immediate given other four quantities. In short, I want your program to imitate what BA II-Plus calculator annuity functions do. In BAII-Plus, when you enter four of FV, PV, PMT, N, I/Y it will give you the remaining quantity.

A. -Your program should work for annuity due as well as annuity immediate.

B. -In BAII plus calculator, I/Y is nominal rate and inside that function you can input C/Y and P/Y, your program should imitate this too.

C. Extend the program to arithmetic progression annuity by requesting P and Q (for annuity due and immediate). - This program should calculate present value/ future value

D. Extend the program to geometric progression annuity by requesting g (for annuity due and immediate) - This program should calculate present value/ future value

E. In BAII-Plus, you have to enter nominal rate in I/Y. Modify your program, so you can enter effective rate and still use C/Y and P/Y functions (In BAII-Plus, if we enter effective rate for I/Y then we have to set C/Y=1 , which limit the ability of calculator function)

For all these questions, you should have user-friendly interface. For example, for question 01, here is a sample interface using R-Shiny package. User should not bothered with what happening behind the interface. That mean all user see is this type interfaces for all three questions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started