I need help with this please!!!

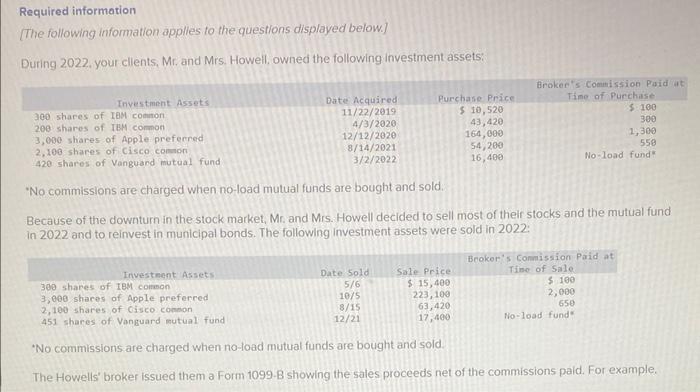

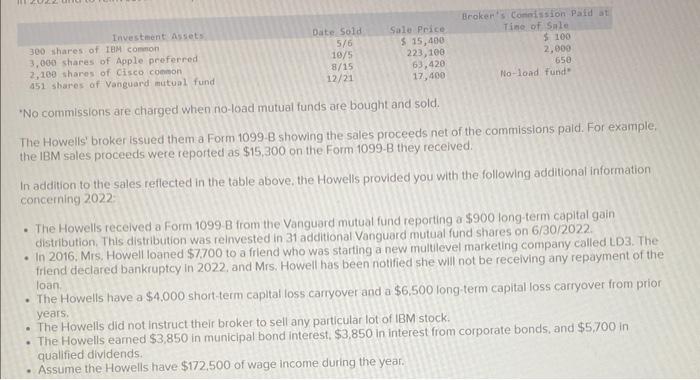

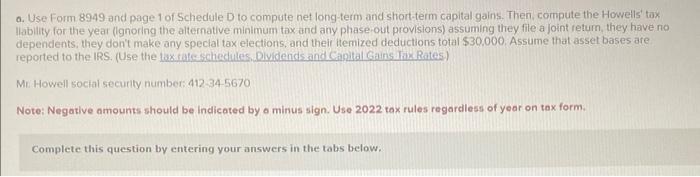

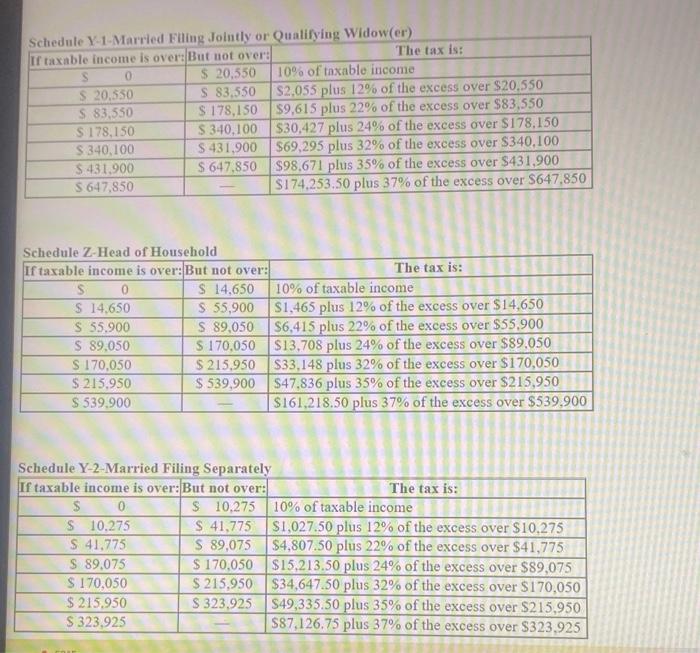

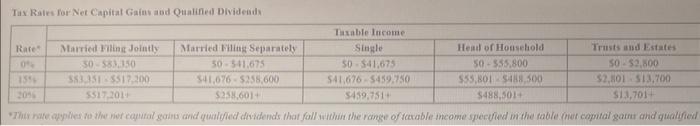

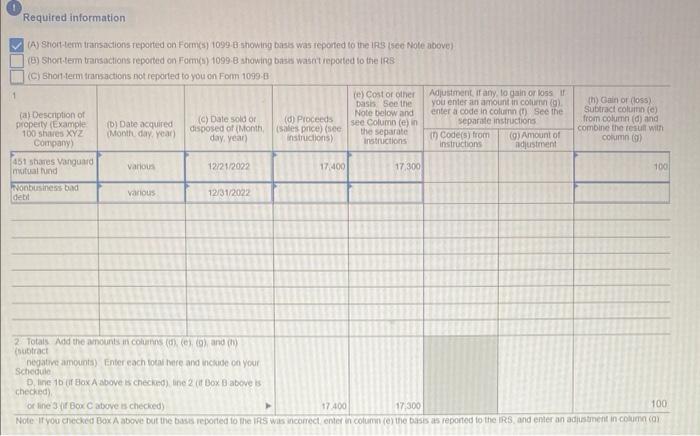

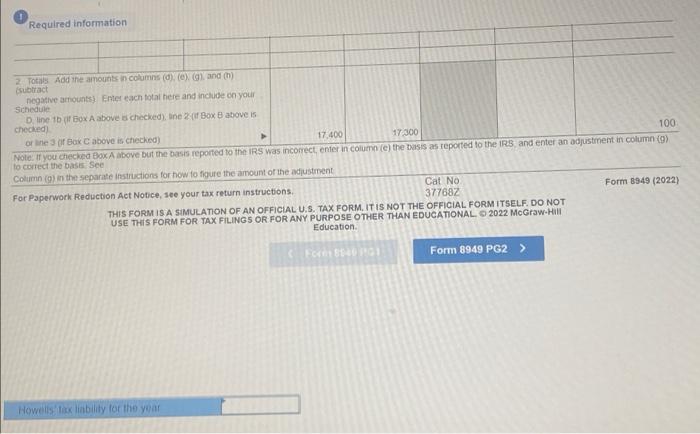

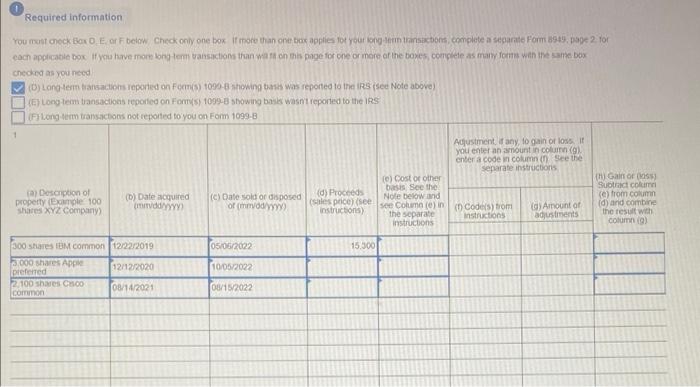

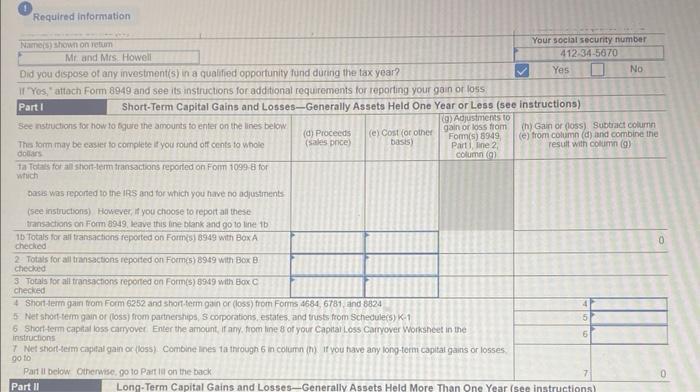

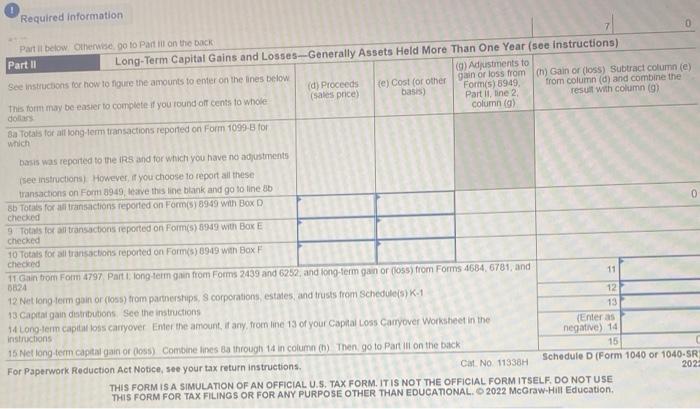

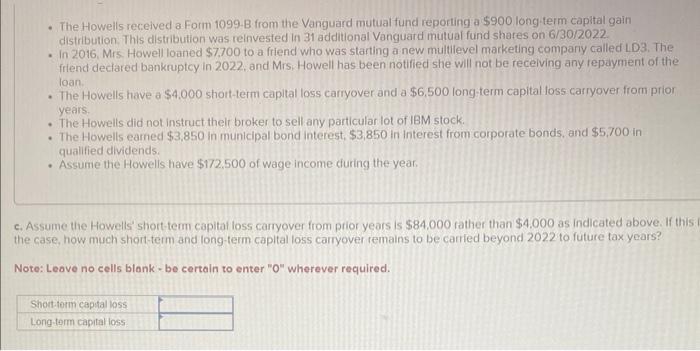

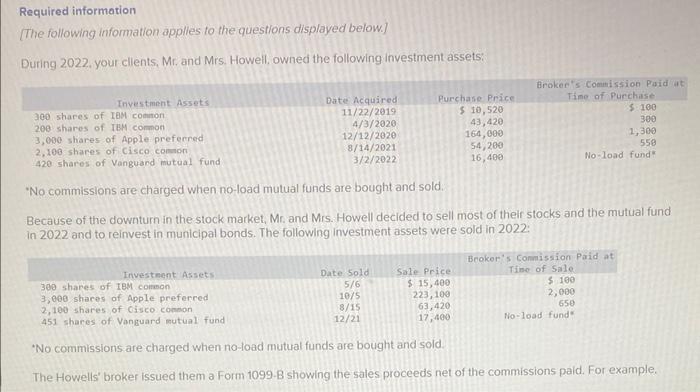

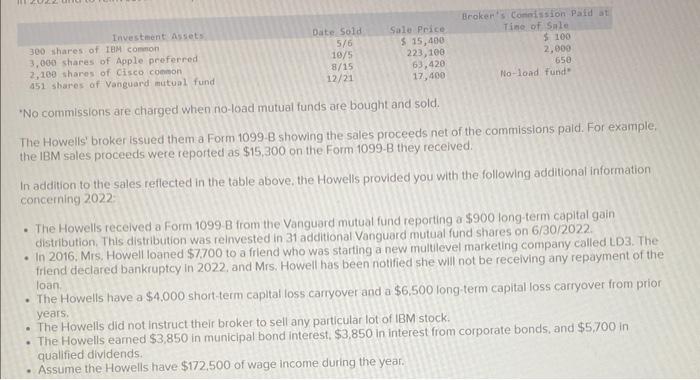

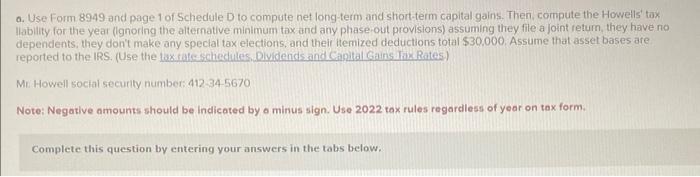

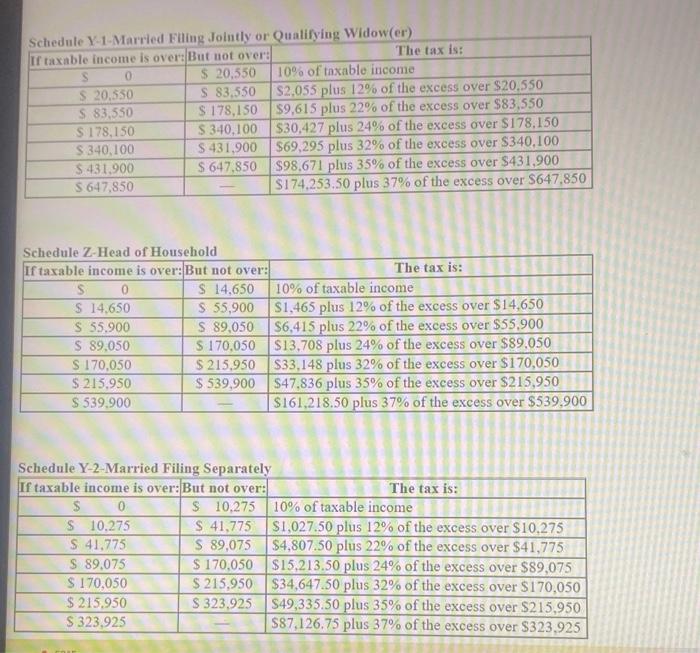

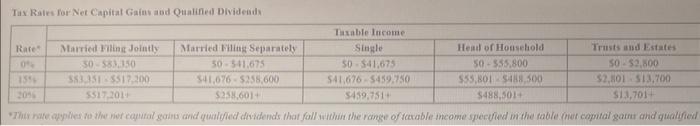

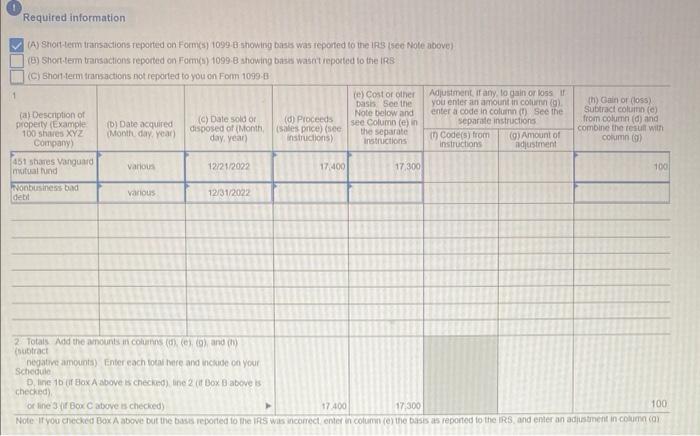

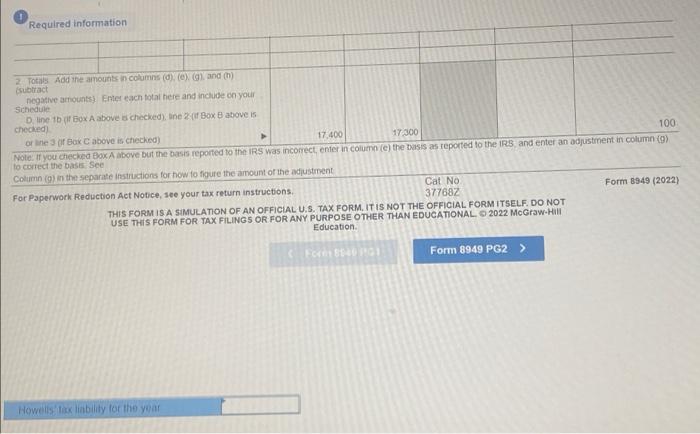

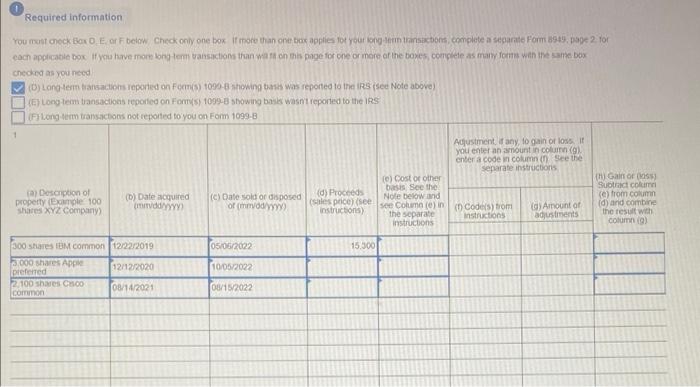

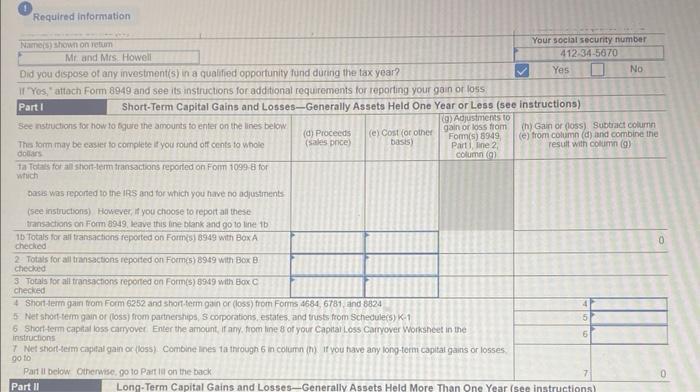

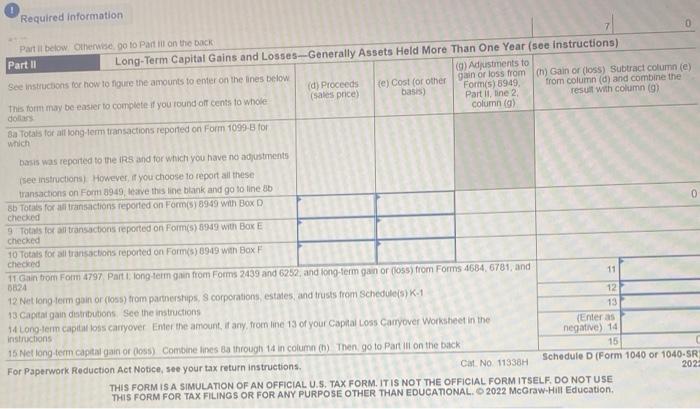

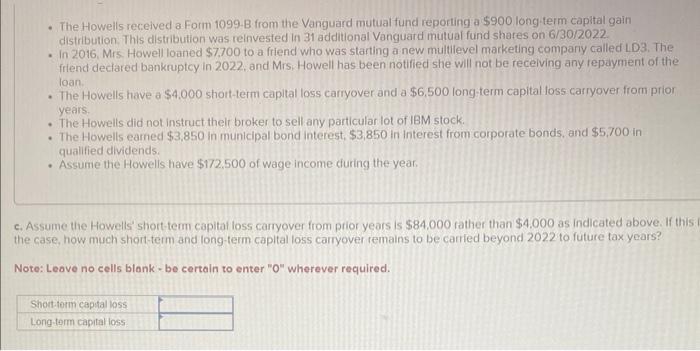

Required information [The following information applies to the questions displayed below] During 2022, your ellents, Mr, and Mrs. Howell, owned the following investment assets: "No commissions are charged when no-load mulual funds are bought and sold. Because of the downturn in the stock market, Mr. and Mrs. Howell decided to sell most of their stocks and the mutual fund in 2022 and to reinvest in municipal bonds. The following investment assets were sold in 2022: "No commissions are charged when no-load mutual funds are bought and sold. The Howells' broker issued them a Form 1099-B showing the sales proceeds net of the commissions paid. For example. 'No commissions are charged when no-load mutual funds are bought and sold. The Howells' broker issued them. Form 1099-B showing the sales proceeds net of the commissions pald. For example. the IBM sales proceeds were reported as $15,300 on the Form 1099-B they recelved. In addition to the sales reflected in the table above, the Howelis provided you with the following additional information concerning 2022 : - The Howells received a Form 1099. B from the Vanguard mutual fund reporting a $900 long-term capital gain distribution, This distribution was reinvested in 31 additional Vanguard mutual fund shares on 6/30/2022. - In 2016. Mrs. Howell loaned $7.700 to a frlend who was starting a new multlevel marketing company called LD3. The friend declared bankruptcy in 2022. and Mrs. Howell has been notified she will not be receiving any repayment of the loan. - The Howells have a $4.000 short-term capital loss carryover and a $6.500 long-term capital loss carryover from prior years. - The Howelis did not instruct their broker to sell any particular lot of IBM stock. - The Howells eamed $3,850 in municipal bond interest, $3,850 in interest from corporate bonds, and $5,700 in qualified dividends. - Assume the Howells have $172,500 of wage income during the year. a. Use Form 8949 and page 1 of Schedule D to compute net long-term and short-term capital gains. Then, compute the Howell' tax llability for the year (lgnoring the alternative minimum tax and any phase-out provisions) assuming they file a joint retum, they have no dependents, they don't make any spectal tax elections, and their ltemized deductions total $30,000. Assume that asset bases are reported to the IRS. (Use the tax fateschedules, Dividends and Canital Gains Ini Rates) Mr. Howell social security number: 412345670 Note: Negative amounts should be indicated by a minus sign. Use 2022 tax rules regardless of year on tax form. Complete this question by entering your answers in the tabs below. Schedule X-1-Married Filing Jointly or Qualifying Widow(er) \begin{tabular}{|} Schedule X-1-Married Fuing dointiy or Quatifying Widow(er) \\ \hline If taxable income is over: But uot over: & The tax is: \\ \hline \hline$ & $20,550 & 10% of taxable income \\ \hline$20,550 & $83,550 & $2,055 plus 12% of the excess over $20,550 \\ \hline$3,550 & $178,150 & $9,615 plus 22% of the excess over $83,550 \\ \hline$178,150 & $340,100 & $30,427 plus 24% of the excess over $178,150 \\ \hline$340,100 & $431,900 & $69,295 plus 32% of the excess over $340,100 \\ \hline$431,900 & $647,850 & $98,671 plus 35% of the excess over $431,900 \\ \hline$647,850 & & $174,253.50 plus 37% of the excess over $647,850 \\ \hline \end{tabular} Schedule Z-Head of Household \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$0 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c||l|l|} \hline If taxable income is over: But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$0 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$323,925 & & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular} Tas. Rales for Net Capital Gaine arod Qualified Dividesid (B) Short fem transactions reported on Foem(s) 1099:B showing basi wascitrepored fo the ir: (1) Required information Note. If you checkia Box. to correct the base: See Column (9) in the separate instructions for how to figure the amount of the adiustinent. For Papenwork Rediction Act Notice, see your tax return instructions. THIS FORM IS A SMMLATION OF AN OFFICIAL U.3. TAX FORM. IT IS NOT THE OEFICIAL THIS FORM IS A SIMULATION OF AN OFFICIALU.S. TAX FORM, IT IS NOT THE OFFICIAL FORM ITSELF, DO NOT USE THIS FORM FOR TAX FILING.5 OR FOR ANY PURPOSE OTHER THAN EDUEATONAL USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 92022 McCHOWHIII Education. Howeils bisk linbility fof the year checonas you necod (1) Required information (1) Required information Partil betow onhense go to Pantil on the back Part II Long-Term Capital Gains and Losses_-Generally Assets Held More Than One Year (see instructions) THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. O 2022 MCGraW-HII EdUCation. - The Howells received a Form 1099-B from the Vanguard mutual fund reporting a $900 long term capital gain distribution. This distribution was reinvested in 31 additional Vanguatd mutual fund shares on 6/30/2022. - in 2016, Mrs. Howell loaned $7,700 to a friend who was starting a new multilevel marketing company called LD3. The friend declared bankruptcy in 2022, and Mrs. Howell has been notified she will not be receiving any repayment of the loan. - The Howells have a $4,000 short-term capital loss carryover and a $6,500 long-term capital loss carryover from prior years. - The Howells did not instruct their broker to sell any particular lot of IBM stock. - The Howells earned $3,850 in municipal bond interest, $3,850 in interest from corporate bonds, and $5,700 in qualified dividends. - Assume the Howells have \$172,500 of wage income during the year. c. Assume the Howells' short-tem capitaf loss carryover from prior years is $84.000 father than $4.000 as indicated above. If this the case, how much short-term and long-term capital loss carryover remains to be carried beyond 2022 to future tax years? Note: Leave no cells blank - be certain to enter "O" wherever required. Required information [The following information applies to the questions displayed below] During 2022, your ellents, Mr, and Mrs. Howell, owned the following investment assets: "No commissions are charged when no-load mulual funds are bought and sold. Because of the downturn in the stock market, Mr. and Mrs. Howell decided to sell most of their stocks and the mutual fund in 2022 and to reinvest in municipal bonds. The following investment assets were sold in 2022: "No commissions are charged when no-load mutual funds are bought and sold. The Howells' broker issued them a Form 1099-B showing the sales proceeds net of the commissions paid. For example. 'No commissions are charged when no-load mutual funds are bought and sold. The Howells' broker issued them. Form 1099-B showing the sales proceeds net of the commissions pald. For example. the IBM sales proceeds were reported as $15,300 on the Form 1099-B they recelved. In addition to the sales reflected in the table above, the Howelis provided you with the following additional information concerning 2022 : - The Howells received a Form 1099. B from the Vanguard mutual fund reporting a $900 long-term capital gain distribution, This distribution was reinvested in 31 additional Vanguard mutual fund shares on 6/30/2022. - In 2016. Mrs. Howell loaned $7.700 to a frlend who was starting a new multlevel marketing company called LD3. The friend declared bankruptcy in 2022. and Mrs. Howell has been notified she will not be receiving any repayment of the loan. - The Howells have a $4.000 short-term capital loss carryover and a $6.500 long-term capital loss carryover from prior years. - The Howelis did not instruct their broker to sell any particular lot of IBM stock. - The Howells eamed $3,850 in municipal bond interest, $3,850 in interest from corporate bonds, and $5,700 in qualified dividends. - Assume the Howells have $172,500 of wage income during the year. a. Use Form 8949 and page 1 of Schedule D to compute net long-term and short-term capital gains. Then, compute the Howell' tax llability for the year (lgnoring the alternative minimum tax and any phase-out provisions) assuming they file a joint retum, they have no dependents, they don't make any spectal tax elections, and their ltemized deductions total $30,000. Assume that asset bases are reported to the IRS. (Use the tax fateschedules, Dividends and Canital Gains Ini Rates) Mr. Howell social security number: 412345670 Note: Negative amounts should be indicated by a minus sign. Use 2022 tax rules regardless of year on tax form. Complete this question by entering your answers in the tabs below. Schedule X-1-Married Filing Jointly or Qualifying Widow(er) \begin{tabular}{|} Schedule X-1-Married Fuing dointiy or Quatifying Widow(er) \\ \hline If taxable income is over: But uot over: & The tax is: \\ \hline \hline$ & $20,550 & 10% of taxable income \\ \hline$20,550 & $83,550 & $2,055 plus 12% of the excess over $20,550 \\ \hline$3,550 & $178,150 & $9,615 plus 22% of the excess over $83,550 \\ \hline$178,150 & $340,100 & $30,427 plus 24% of the excess over $178,150 \\ \hline$340,100 & $431,900 & $69,295 plus 32% of the excess over $340,100 \\ \hline$431,900 & $647,850 & $98,671 plus 35% of the excess over $431,900 \\ \hline$647,850 & & $174,253.50 plus 37% of the excess over $647,850 \\ \hline \end{tabular} Schedule Z-Head of Household \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$0 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c||l|l|} \hline If taxable income is over: But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$0 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$323,925 & & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular} Tas. Rales for Net Capital Gaine arod Qualified Dividesid (B) Short fem transactions reported on Foem(s) 1099:B showing basi wascitrepored fo the ir: (1) Required information Note. If you checkia Box. to correct the base: See Column (9) in the separate instructions for how to figure the amount of the adiustinent. For Papenwork Rediction Act Notice, see your tax return instructions. THIS FORM IS A SMMLATION OF AN OFFICIAL U.3. TAX FORM. IT IS NOT THE OEFICIAL THIS FORM IS A SIMULATION OF AN OFFICIALU.S. TAX FORM, IT IS NOT THE OFFICIAL FORM ITSELF, DO NOT USE THIS FORM FOR TAX FILING.5 OR FOR ANY PURPOSE OTHER THAN EDUEATONAL USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 92022 McCHOWHIII Education. Howeils bisk linbility fof the year checonas you necod (1) Required information (1) Required information Partil betow onhense go to Pantil on the back Part II Long-Term Capital Gains and Losses_-Generally Assets Held More Than One Year (see instructions) THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. O 2022 MCGraW-HII EdUCation. - The Howells received a Form 1099-B from the Vanguard mutual fund reporting a $900 long term capital gain distribution. This distribution was reinvested in 31 additional Vanguatd mutual fund shares on 6/30/2022. - in 2016, Mrs. Howell loaned $7,700 to a friend who was starting a new multilevel marketing company called LD3. The friend declared bankruptcy in 2022, and Mrs. Howell has been notified she will not be receiving any repayment of the loan. - The Howells have a $4,000 short-term capital loss carryover and a $6,500 long-term capital loss carryover from prior years. - The Howells did not instruct their broker to sell any particular lot of IBM stock. - The Howells earned $3,850 in municipal bond interest, $3,850 in interest from corporate bonds, and $5,700 in qualified dividends. - Assume the Howells have \$172,500 of wage income during the year. c. Assume the Howells' short-tem capitaf loss carryover from prior years is $84.000 father than $4.000 as indicated above. If this the case, how much short-term and long-term capital loss carryover remains to be carried beyond 2022 to future tax years? Note: Leave no cells blank - be certain to enter "O" wherever required