I need help with this problems. Please

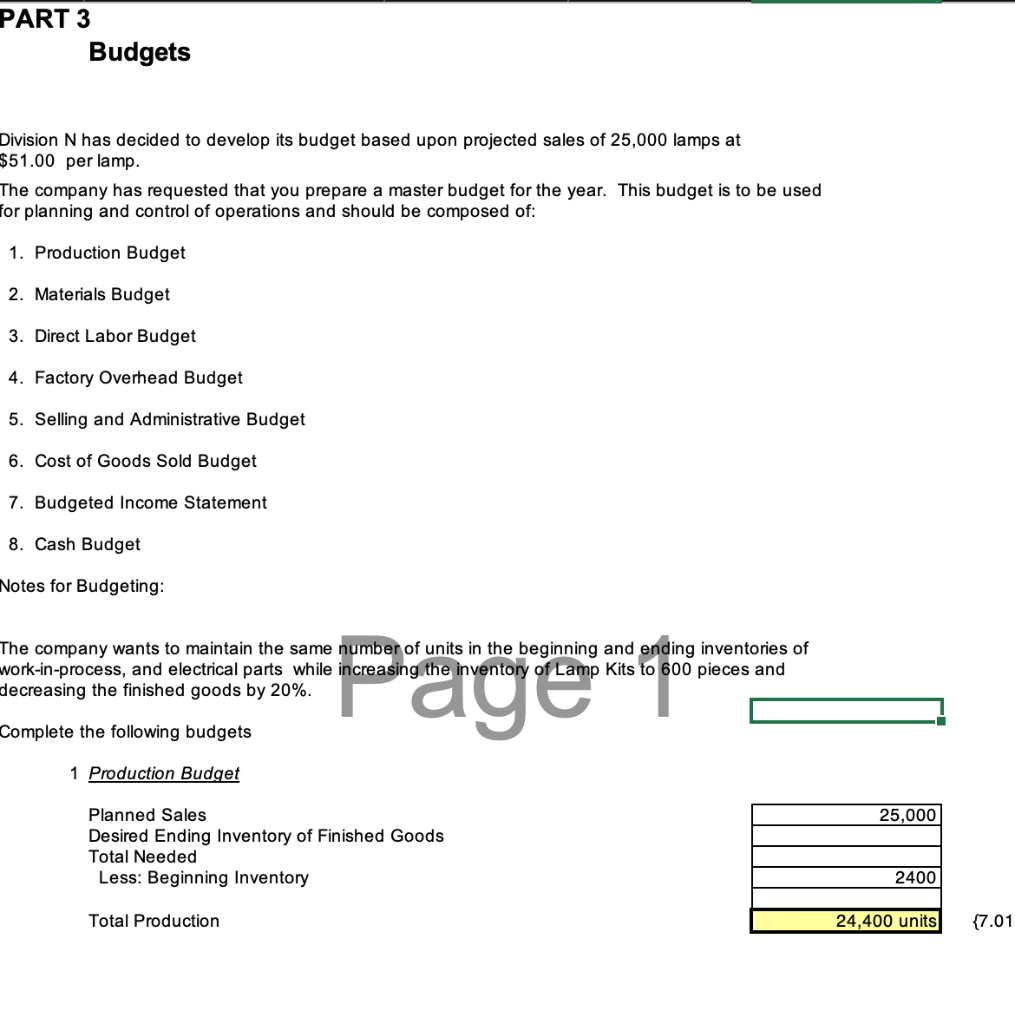

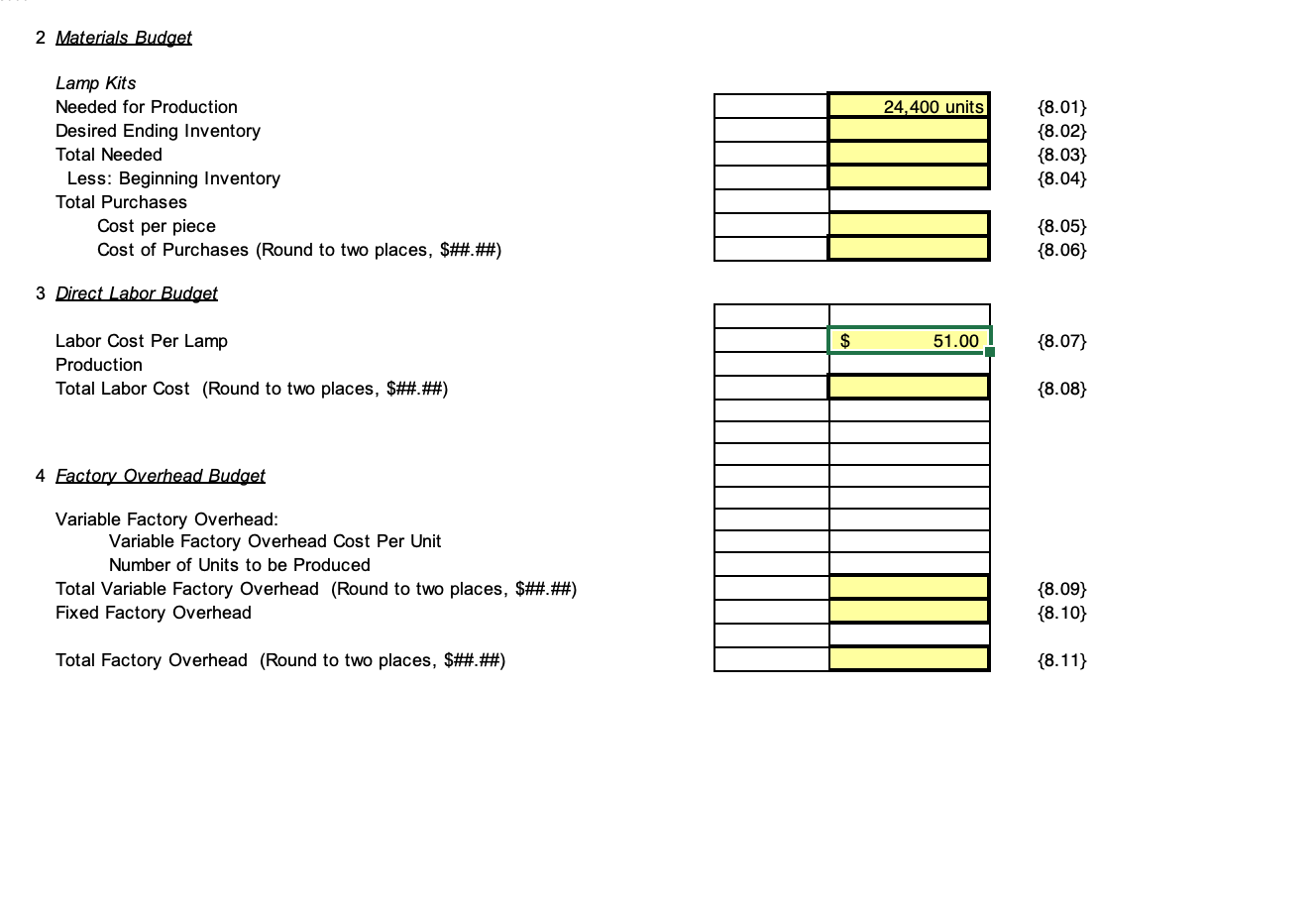

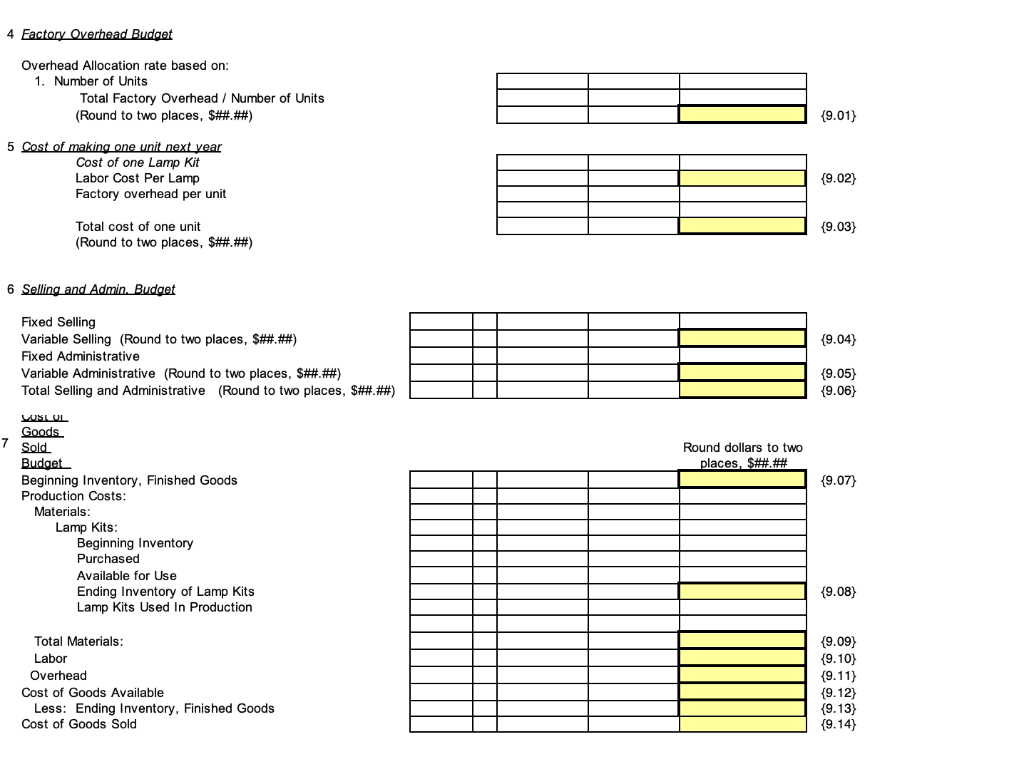

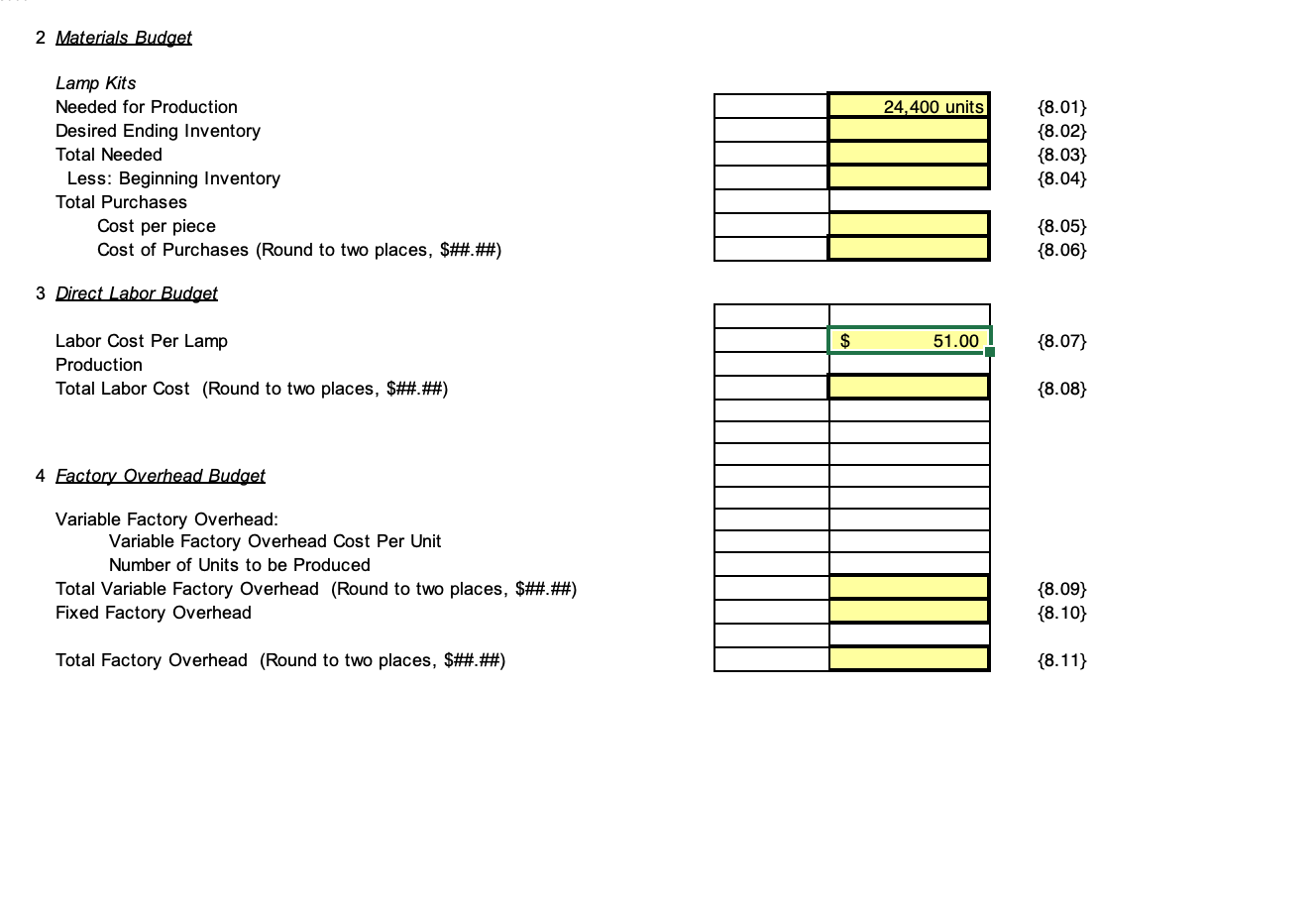

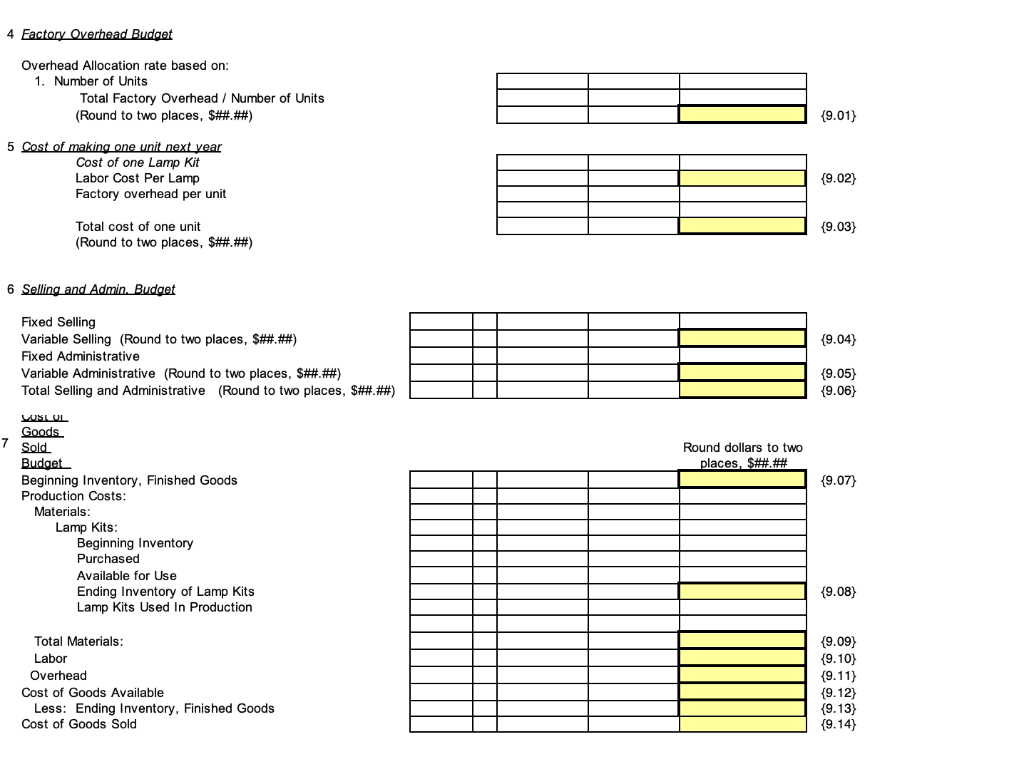

Division N has decided to develop its budget based upon projected sales of 25,000 lamps at $51.00 per lamp. The company has requested that you prepare a master budget for the year. This budget is to be used for planning and control of operations and should be composed of: 1. Production Budget 2. Materials Budget 3. Direct Labor Budget 4. Factory Overhead Budget 5. Selling and Administrative Budget 6. Cost of Goods Sold Budget 7. Budgeted Income Statement 8. Cash Budget Notes for Budgeting: 2 Materials Budget Lamp Kits {8.01} {8.02} {8.03} {8.04} {8.06} 3 Direct Labor Budget 4 Eactory Overhead Budget \begin{tabular}{|l|l|} \hline & $ \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} {8.07} {8.08} {8.09} {8.10} Total Factory Overhead (Round to two places, \$\#\#\#\#) {8.11} 4 Eactory Overhead Budget Overhead Allocation rate based on: 1. Number of Units Total Factory Overhead / Number of Units (Round to two places, \$\#\#.\#) \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} {9.01} 5 Cost of making one unit next year Cost of one Lamp Kit Labor Cost Per Lamp Factory overhead per unit Total cost of one unit \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} {9.02} (Round to two places, \$\#\#.\#\#) {9.03} 6 Selling and Admin. Budget Fixed Selling Variable Selling (Round to two places, \$\#\#.\#\#) Fixed Administrative Variable Administrative (Round to two places, \$\#\#.\#\#) Total Selling and Administrative (Round to two places, \$\#\#.\#\#) Goods Sold Budget Beginning Inventory, Finished Goods Production C Materials: Lamp Kits: Beginning Inventory Purchased Available for Use Ending Inventory of Lamp Kits Lamp Kits Used In Production Total Materials: Labor Overhead Cost of Goods Available Less: Ending Inventory, Finished Goods Cost of Goods Sold {9.07} {9.08} Division N has decided to develop its budget based upon projected sales of 25,000 lamps at $51.00 per lamp. The company has requested that you prepare a master budget for the year. This budget is to be used for planning and control of operations and should be composed of: 1. Production Budget 2. Materials Budget 3. Direct Labor Budget 4. Factory Overhead Budget 5. Selling and Administrative Budget 6. Cost of Goods Sold Budget 7. Budgeted Income Statement 8. Cash Budget Notes for Budgeting: 2 Materials Budget Lamp Kits {8.01} {8.02} {8.03} {8.04} {8.06} 3 Direct Labor Budget 4 Eactory Overhead Budget \begin{tabular}{|l|l|} \hline & $ \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} {8.07} {8.08} {8.09} {8.10} Total Factory Overhead (Round to two places, \$\#\#\#\#) {8.11} 4 Eactory Overhead Budget Overhead Allocation rate based on: 1. Number of Units Total Factory Overhead / Number of Units (Round to two places, \$\#\#.\#) \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} {9.01} 5 Cost of making one unit next year Cost of one Lamp Kit Labor Cost Per Lamp Factory overhead per unit Total cost of one unit \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} {9.02} (Round to two places, \$\#\#.\#\#) {9.03} 6 Selling and Admin. Budget Fixed Selling Variable Selling (Round to two places, \$\#\#.\#\#) Fixed Administrative Variable Administrative (Round to two places, \$\#\#.\#\#) Total Selling and Administrative (Round to two places, \$\#\#.\#\#) Goods Sold Budget Beginning Inventory, Finished Goods Production C Materials: Lamp Kits: Beginning Inventory Purchased Available for Use Ending Inventory of Lamp Kits Lamp Kits Used In Production Total Materials: Labor Overhead Cost of Goods Available Less: Ending Inventory, Finished Goods Cost of Goods Sold {9.07} {9.08}