Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with this question Baird Brothers Construction is considering the purchase of a machine at a cost of $129.000. The machine is expected

I need help with this question

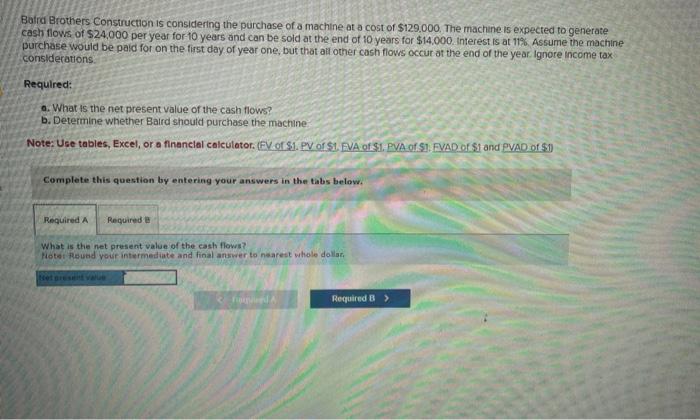

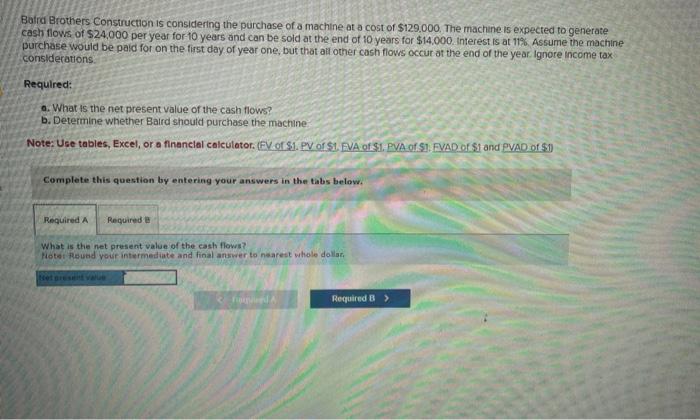

Baird Brothers Construction is considering the purchase of a machine at a cost of $129.000. The machine is expected to generate casin flows of $24,000 per year for-10 years and can be sold at the end of 10 years for $14,000. interest is at 11%. Assume the machine purchase would be paid for on the first day of year one, but that all other cash flows occur at the end of the year ignore income tax considerations: Required: a. What is the net present value of the cash flows? b. Determine whether Baird should purchase the machine Note: Use tables, Excel, or a financial colculator. (EV of \$1. PV of S1. EVA of S1. PVA of S1: EVAD of S1 and PVAD of S1) Complete this question by entering your answers in the tabs below. What is the net present value of the cash flows? Potet Resed yosf intermediate and final answer to nearest whole dollac Bata 3 o others construction is considering the purchase of a mactine at a cost or 5129.000. The machtie fis expecred ro generate purchase would be paic for on the first day of year one but that att other cash flows occur at the end of the year lgnole ingeme tisk: considerations: Required: b. What is the net present value of the cash flows? b. Determine whether Baird showld purchase the machine. Complete this question by entering your answers in the tabs below. betaritine whether Baird should purchase the machine: Betermine wheether Baird thoud purthase the ruabbine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started