Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with this question here is the data 9-1. If Reed sells his interest in Slicenhook to Indie Ruff, what are the amount

I need help with this question here is the data

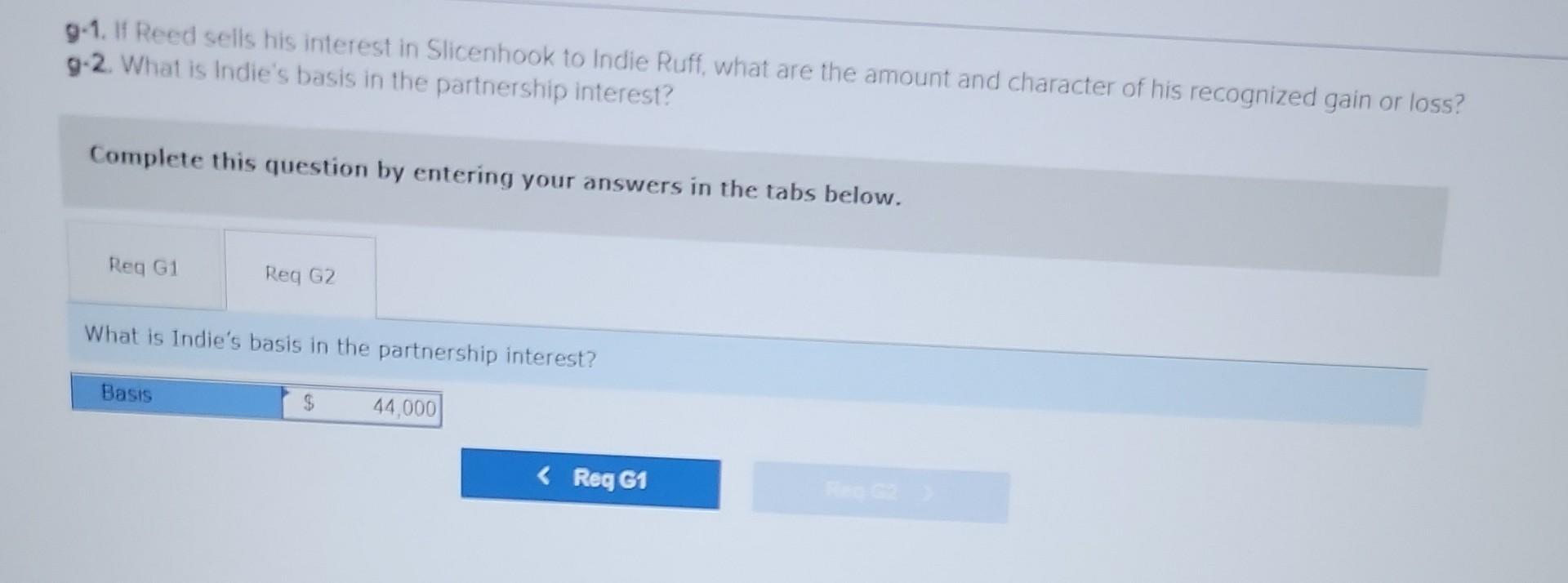

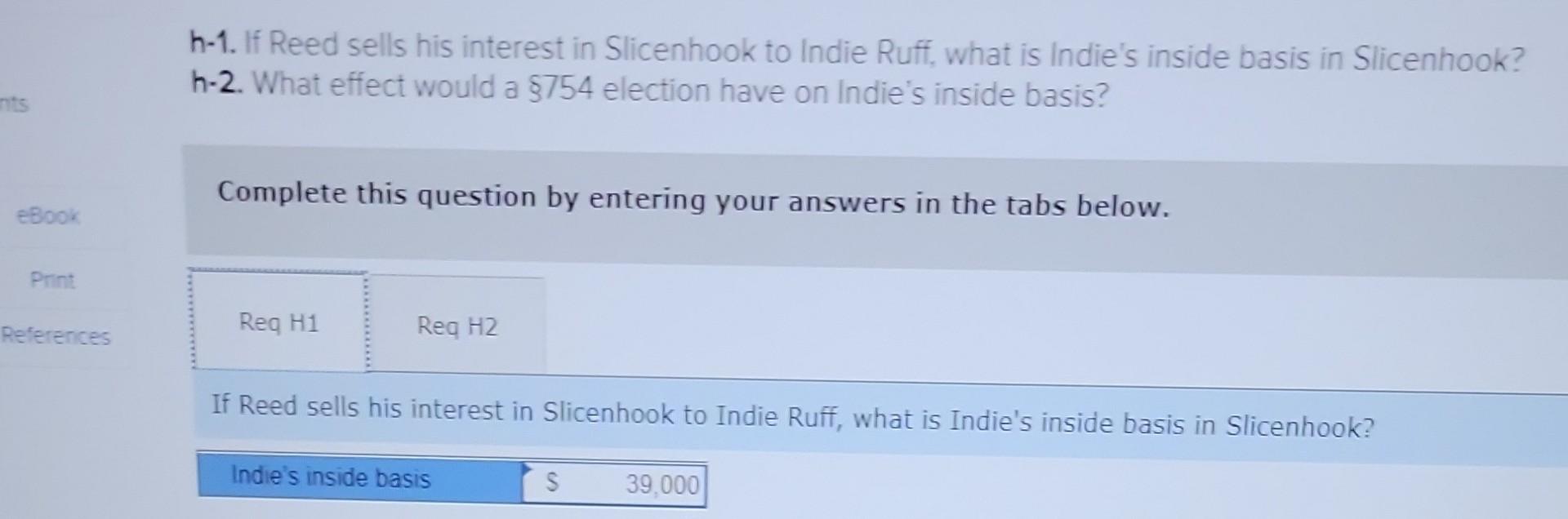

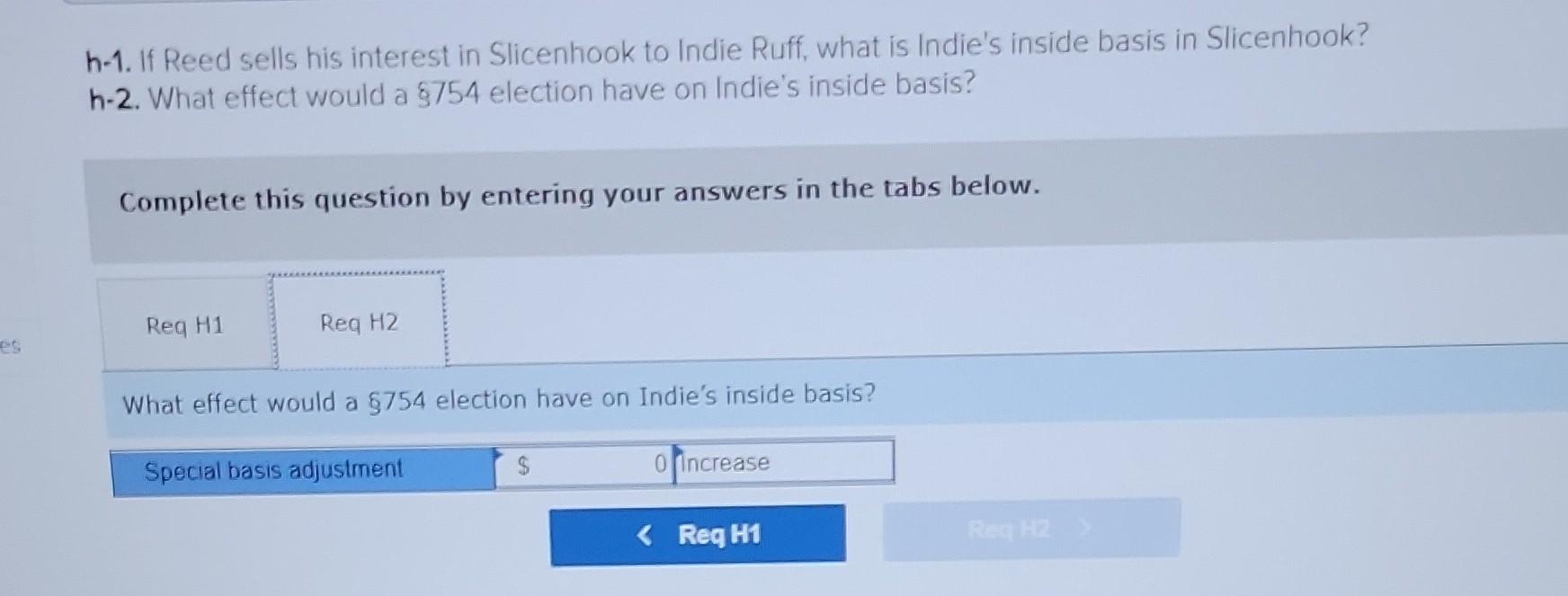

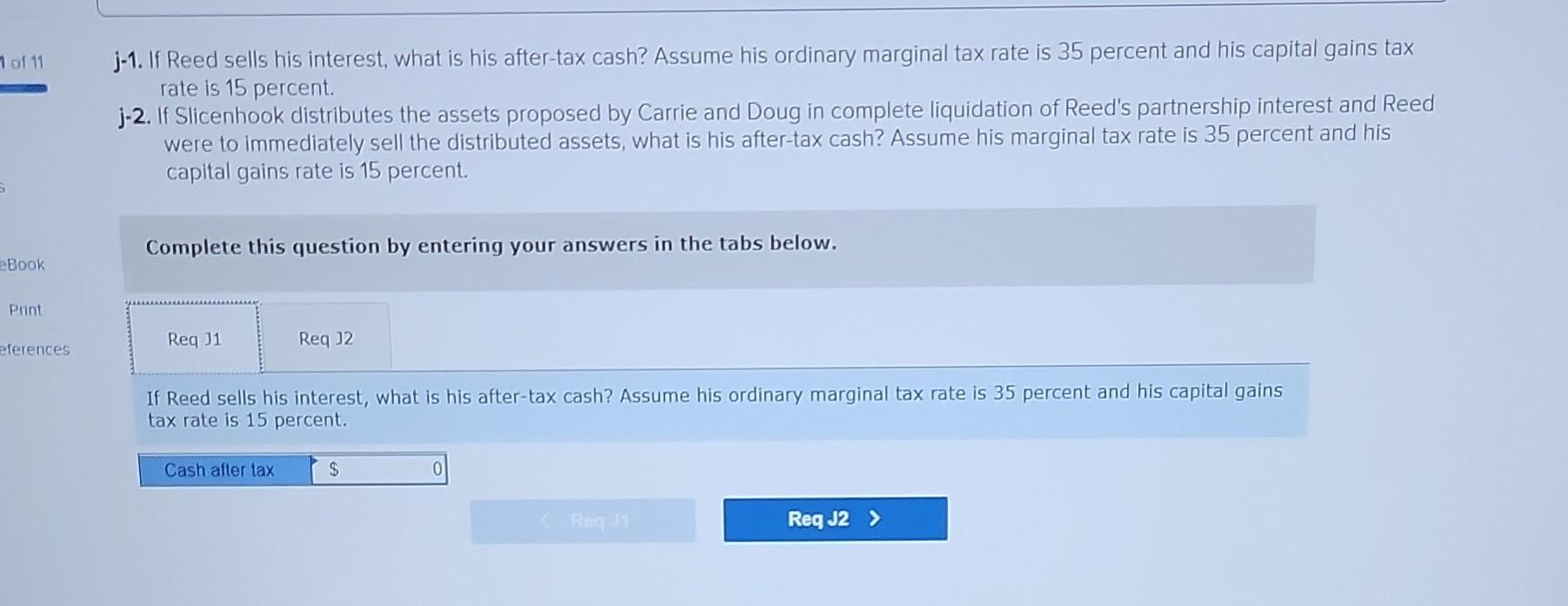

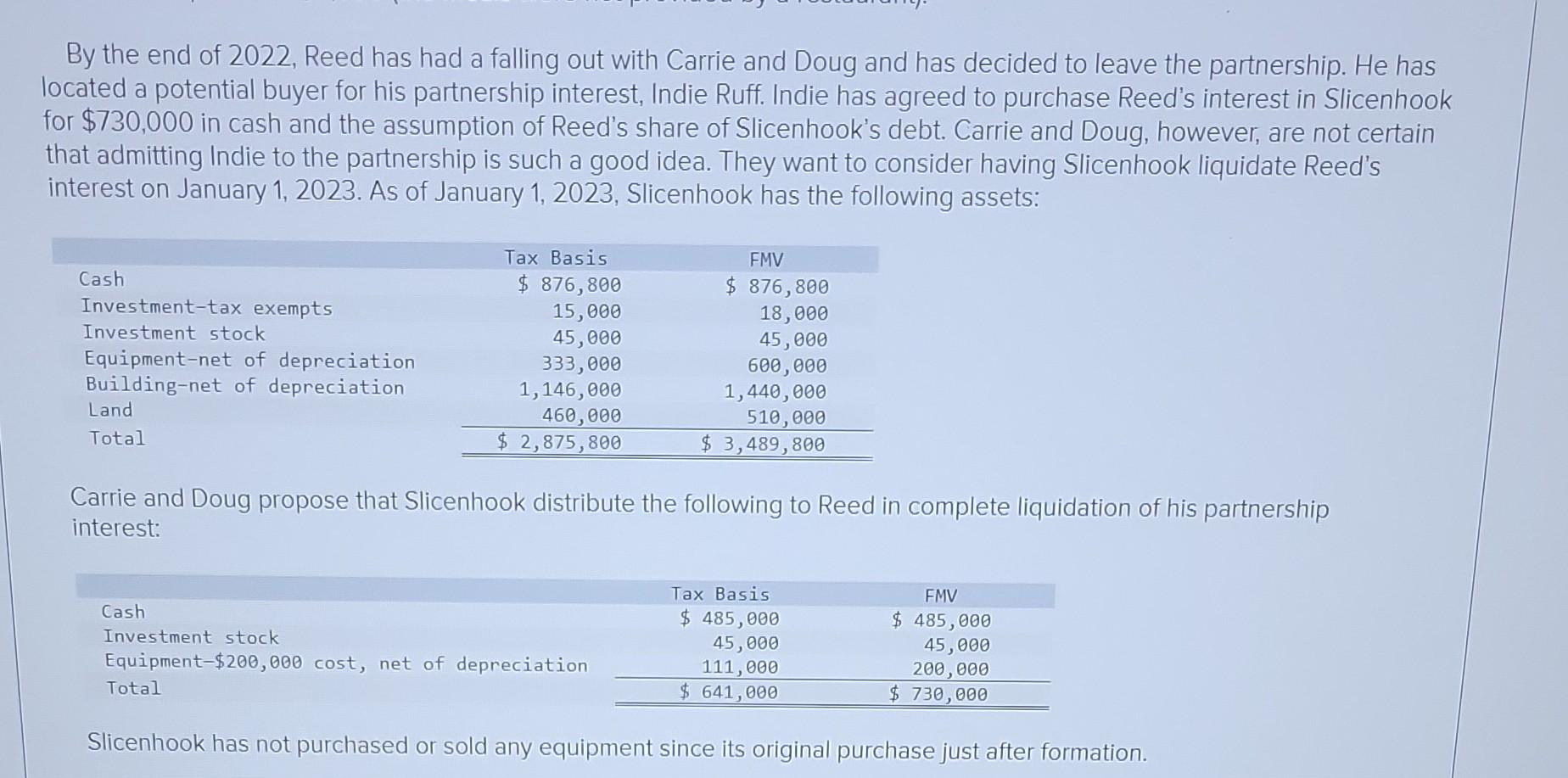

9-1. If Reed sells his interest in Slicenhook to Indie Ruff, what are the amount and character of his recognized gain or loss? 9.2. What is Indie's basis in the partnership interest? Complete this question by entering your answers in the tabs below. What is Indie's basis in the partnership interest? h-1. If Reed sells his interest in Slicenhook to Indie Ruff, what is Indie's inside basis in Slicenhook? h.2. What effect would a $754 election have on Indie's inside basis? Complete this question by entering your answers in the tabs below. If Reed sells his interest in Slicenhook to Indie Ruff, what is Indie's inside basis in Slicenhook? h-1. If Reed sells his interest in Slicenhook to Indie Ruff, what is Indie's inside basis in Slicenhook? h-2. What effect would a $754 election have on Indie's inside basis? Complete this question by entering your answers in the tabs below. What effect would a 754 election have on Indie's inside basis? j-1. If Reed sells his interest, what is his after-tax cash? Assume his ordinary marginal tax rate is 35 percent and his capital gains tax rate is 15 percent. j-2. If Slicenhook distributes the assets proposed by Carrie and Doug in complete liquidation of Reed's partnership interest and Reed were to immediately sell the distributed assets, what is his after-tax cash? Assume his marginal tax rate is 35 percent and his capital gains rate is 15 percent. Complete this question by entering your answers in the tabs below. If Reed sells his interest, what is his after-tax cash? Assume his ordinary marginal tax rate is 35 percent and his capital gains tax rate is 15 percent. By the end of 2022 , Reed has had a falling out with Carrie and Doug and has decided to leave the partnership. He has located a potential buyer for his partnership interest, Indie Ruff. Indie has agreed to purchase Reed's interest in Slicenhook for $730,000 in cash and the assumption of Reed's share of Slicenhook's debt. Carrie and Doug, however, are not certain that admitting Indie to the partnership is such a good idea. They want to consider having Slicenhook liquidate Reed's interest on January 1, 2023. As of January 1, 2023, Slicenhook has the following assets: Carrie and Doug propose that Slicenhook distribute the following to Reed in complete liquidation of his partnership interest: Slicenhook has not purchased or sold any equipment since its original purchase just after formation. 9-1. If Reed sells his interest in Slicenhook to Indie Ruff, what are the amount and character of his recognized gain or loss? 9.2. What is Indie's basis in the partnership interest? Complete this question by entering your answers in the tabs below. What is Indie's basis in the partnership interest? h-1. If Reed sells his interest in Slicenhook to Indie Ruff, what is Indie's inside basis in Slicenhook? h.2. What effect would a $754 election have on Indie's inside basis? Complete this question by entering your answers in the tabs below. If Reed sells his interest in Slicenhook to Indie Ruff, what is Indie's inside basis in Slicenhook? h-1. If Reed sells his interest in Slicenhook to Indie Ruff, what is Indie's inside basis in Slicenhook? h-2. What effect would a $754 election have on Indie's inside basis? Complete this question by entering your answers in the tabs below. What effect would a 754 election have on Indie's inside basis? j-1. If Reed sells his interest, what is his after-tax cash? Assume his ordinary marginal tax rate is 35 percent and his capital gains tax rate is 15 percent. j-2. If Slicenhook distributes the assets proposed by Carrie and Doug in complete liquidation of Reed's partnership interest and Reed were to immediately sell the distributed assets, what is his after-tax cash? Assume his marginal tax rate is 35 percent and his capital gains rate is 15 percent. Complete this question by entering your answers in the tabs below. If Reed sells his interest, what is his after-tax cash? Assume his ordinary marginal tax rate is 35 percent and his capital gains tax rate is 15 percent. By the end of 2022 , Reed has had a falling out with Carrie and Doug and has decided to leave the partnership. He has located a potential buyer for his partnership interest, Indie Ruff. Indie has agreed to purchase Reed's interest in Slicenhook for $730,000 in cash and the assumption of Reed's share of Slicenhook's debt. Carrie and Doug, however, are not certain that admitting Indie to the partnership is such a good idea. They want to consider having Slicenhook liquidate Reed's interest on January 1, 2023. As of January 1, 2023, Slicenhook has the following assets: Carrie and Doug propose that Slicenhook distribute the following to Reed in complete liquidation of his partnership interest: Slicenhook has not purchased or sold any equipment since its original purchase just after formation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started