Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with this question im stuck on 1d rn Comparative financial statement data of Hanfield, Ine follow: (Click the icon to view the

i need help with this question im stuck on 1d rn

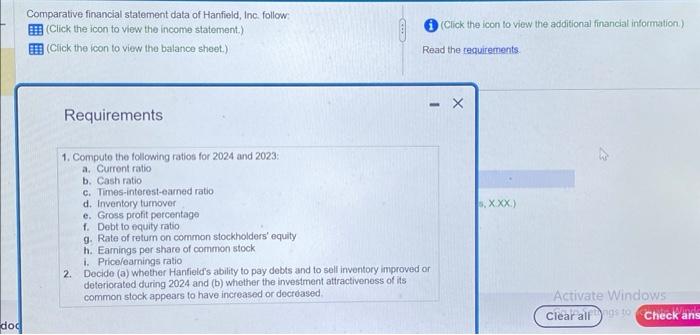

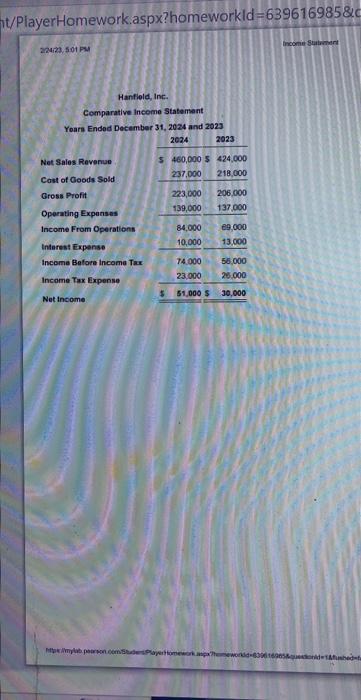

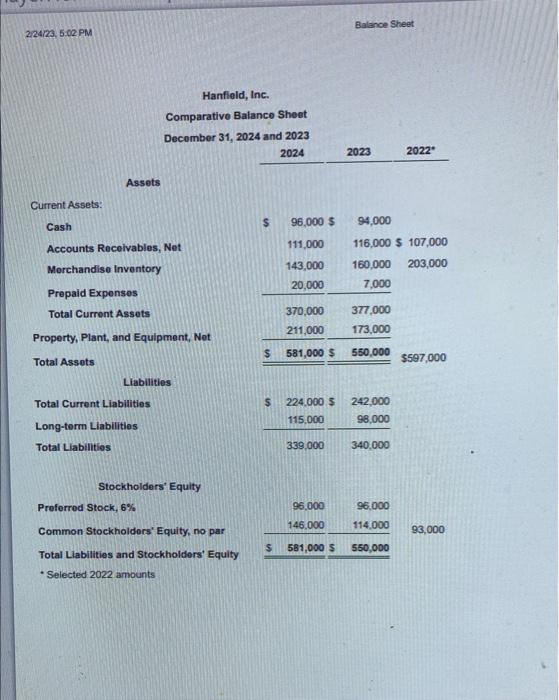

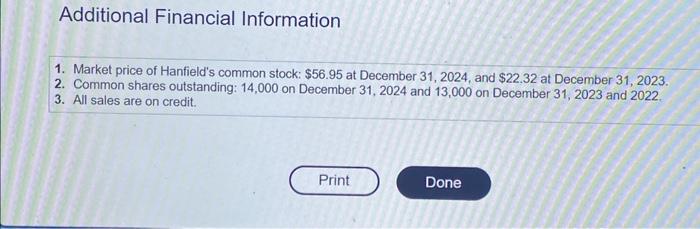

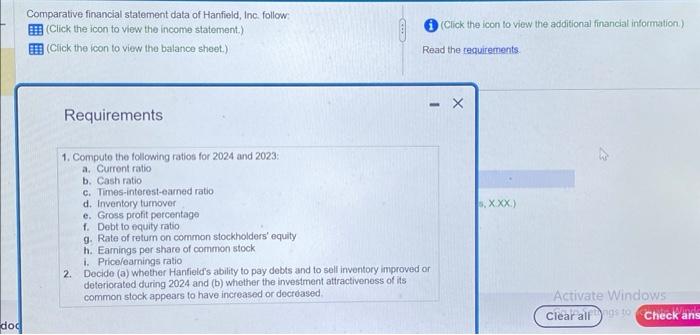

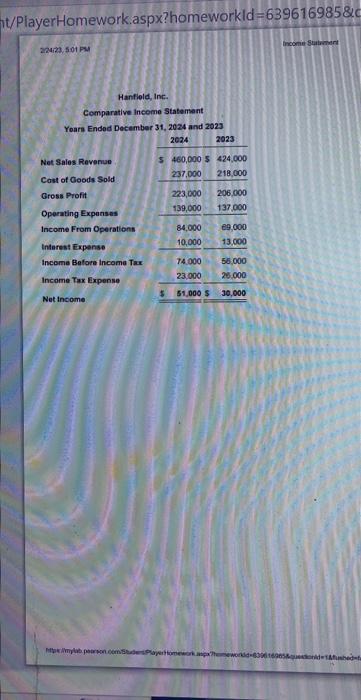

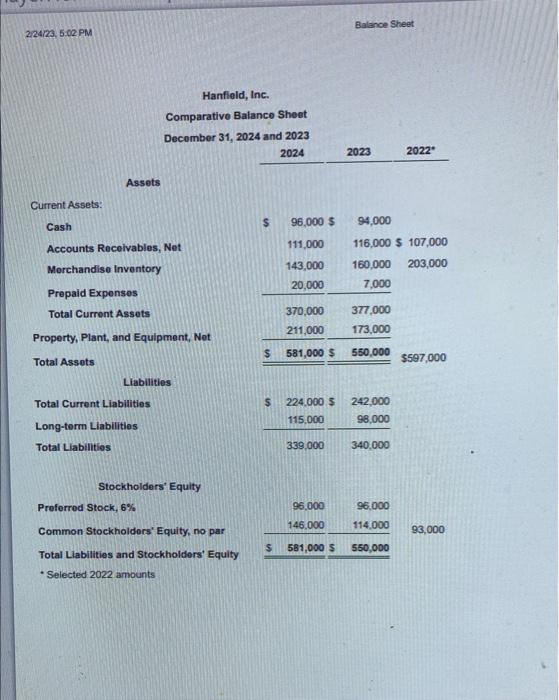

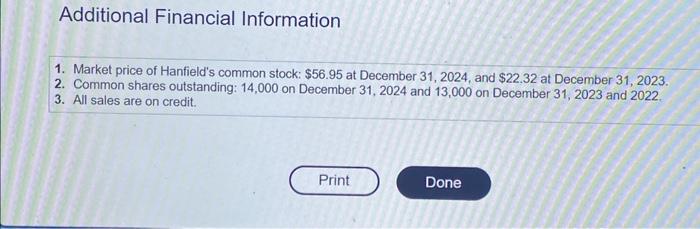

Comparative financial statement data of Hanfield, Ine follow: (Click the icon to view the income statement.) (i) (Click the icon to view the additional financial information.) (Cick the icon to view the balance sheet.) Read the requirements: Requirements 1. Compute the following ratios for 2024 and 2023: a. Current ratio b. Cash ratio c. Times-interest-earned ratio d. Inventory tumover e. Gross profit percentage f. Debt to equity ratio 9. Rate of retum on common stockholders' equity h. Earnings per share of common stock i. Price/eamings ratio 2. Decide (a) whether Hanfield's ability to pay debts and to sell inventory improved or deteriorated during 2024 and (b) whether the investment attractiveness of iss common stock appears to have increased or decruased. t/PlayerHomework.aspx? homeworkld =6396169858C 2anipe siot FM Balance Sheet 2/24i23, 5.02 PM Hanfleld, Inc. Comparative Balance Sheet Decomber 31,2024 and 2023 202420232022 Assets Current Assets: Cash $96,000$94,000 Accounts Recolvables, Net Morchandise Inventory Prepaid Expenses Total Current Assets Property, Plant, and Equipment, Not Total Assots \begin{tabular}{rrr} 111,000 & 116,000$107,000 \\ 143,000 & 160,000 & 203,000 \\ 20,000 & 7,000 \\ \hline 370,000 & 377,000 \\ \hline 211,000 & 173,000 \\ \hline 581,000 & 550,000 \\ \hline \hline \end{tabular} Liabilities Total Current Liabilities Long-term Liabilitios Total Liabilities Stockholders' Equity Preferrod Stock, 6% Common Stockholders' Equity, no par Total Liabilities and Stockholders' Equity $581,000$550,000 - Selected 2022 amounts Additional Financial Information 1. Market price of Hanfield's common stock: $56.95 at December 31,2024 , and $22.32 at December 31,2023. 2. Common shares outstanding: 14,000 on December 31, 2024 and 13,000 on December 31,2023 and 2022. 3. All sales are on credit. Comparative financial statement data of Hanfield, Ine follow: (Click the icon to view the income statement.) (i) (Click the icon to view the additional financial information.) (Cick the icon to view the balance sheet.) Read the requirements: Requirements 1. Compute the following ratios for 2024 and 2023: a. Current ratio b. Cash ratio c. Times-interest-earned ratio d. Inventory tumover e. Gross profit percentage f. Debt to equity ratio 9. Rate of retum on common stockholders' equity h. Earnings per share of common stock i. Price/eamings ratio 2. Decide (a) whether Hanfield's ability to pay debts and to sell inventory improved or deteriorated during 2024 and (b) whether the investment attractiveness of iss common stock appears to have increased or decruased. t/PlayerHomework.aspx? homeworkld =6396169858C 2anipe siot FM Balance Sheet 2/24i23, 5.02 PM Hanfleld, Inc. Comparative Balance Sheet Decomber 31,2024 and 2023 202420232022 Assets Current Assets: Cash $96,000$94,000 Accounts Recolvables, Net Morchandise Inventory Prepaid Expenses Total Current Assets Property, Plant, and Equipment, Not Total Assots \begin{tabular}{rrr} 111,000 & 116,000$107,000 \\ 143,000 & 160,000 & 203,000 \\ 20,000 & 7,000 \\ \hline 370,000 & 377,000 \\ \hline 211,000 & 173,000 \\ \hline 581,000 & 550,000 \\ \hline \hline \end{tabular} Liabilities Total Current Liabilities Long-term Liabilitios Total Liabilities Stockholders' Equity Preferrod Stock, 6% Common Stockholders' Equity, no par Total Liabilities and Stockholders' Equity $581,000$550,000 - Selected 2022 amounts Additional Financial Information 1. Market price of Hanfield's common stock: $56.95 at December 31,2024 , and $22.32 at December 31,2023. 2. Common shares outstanding: 14,000 on December 31, 2024 and 13,000 on December 31,2023 and 2022. 3. All sales are on credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started