Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with this question please! View Policies Current Attempt in Progress Cullumber Company purchased equipment on March 31, 2021, at a cost of

I need help with this question please!

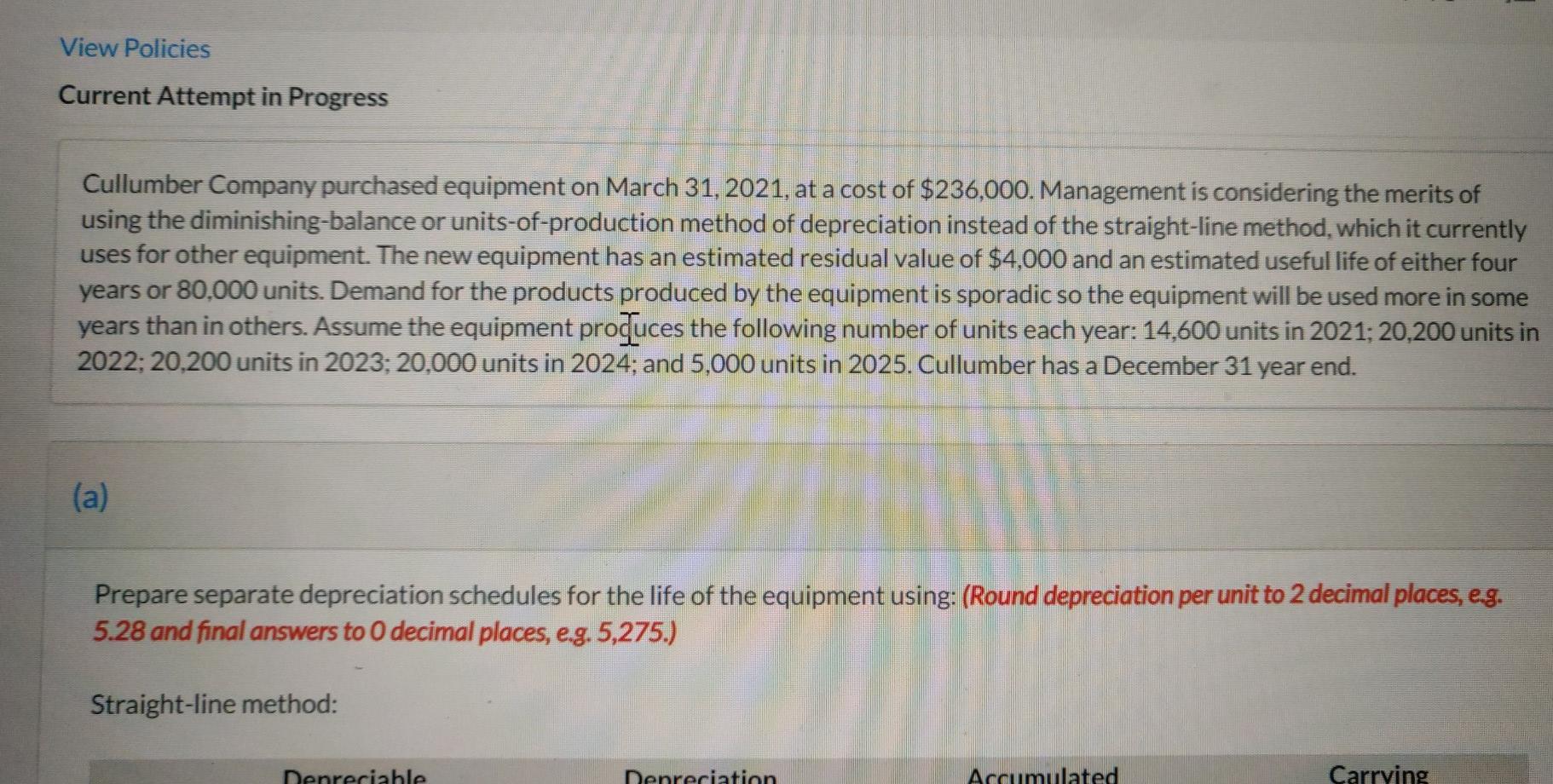

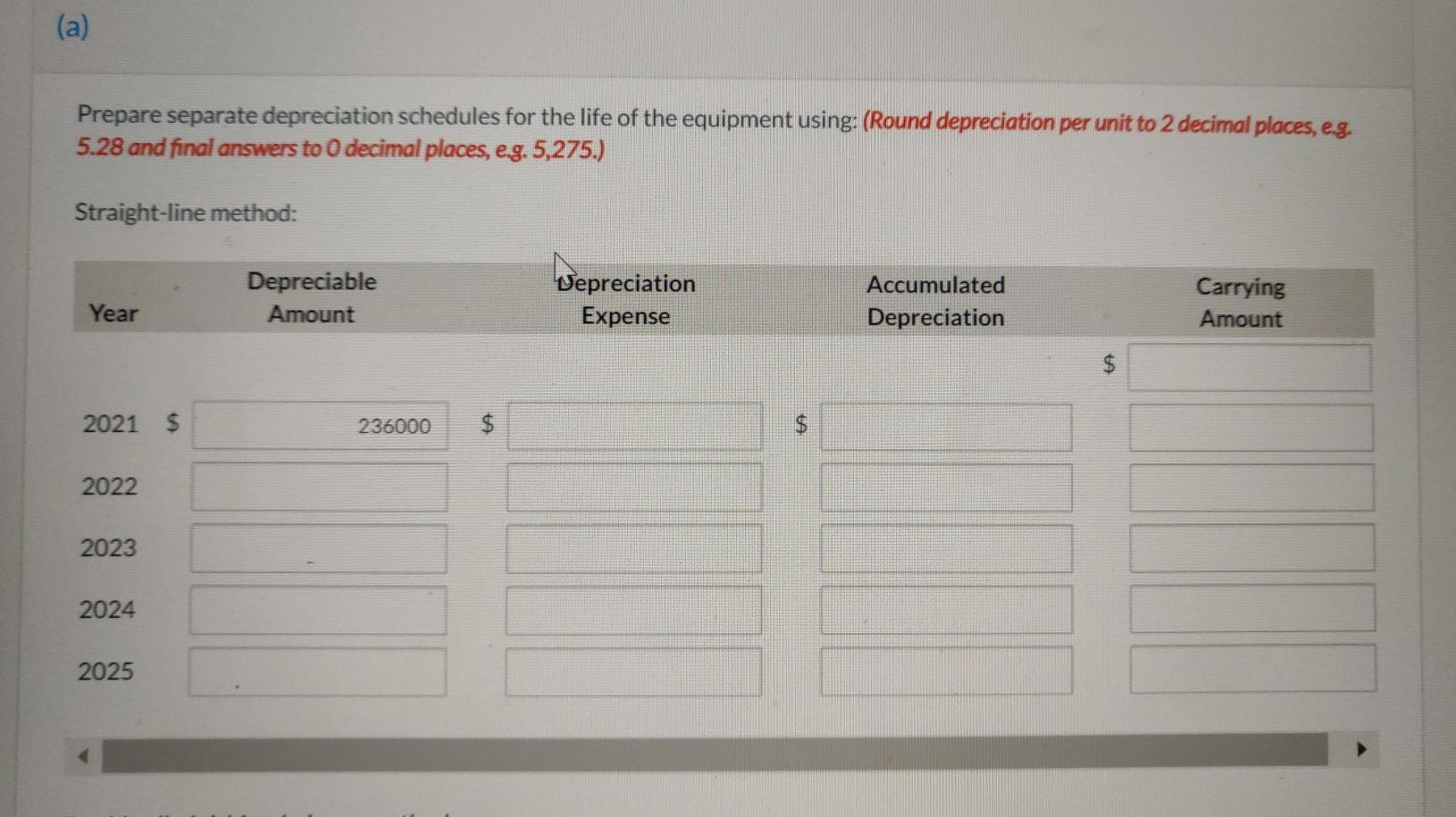

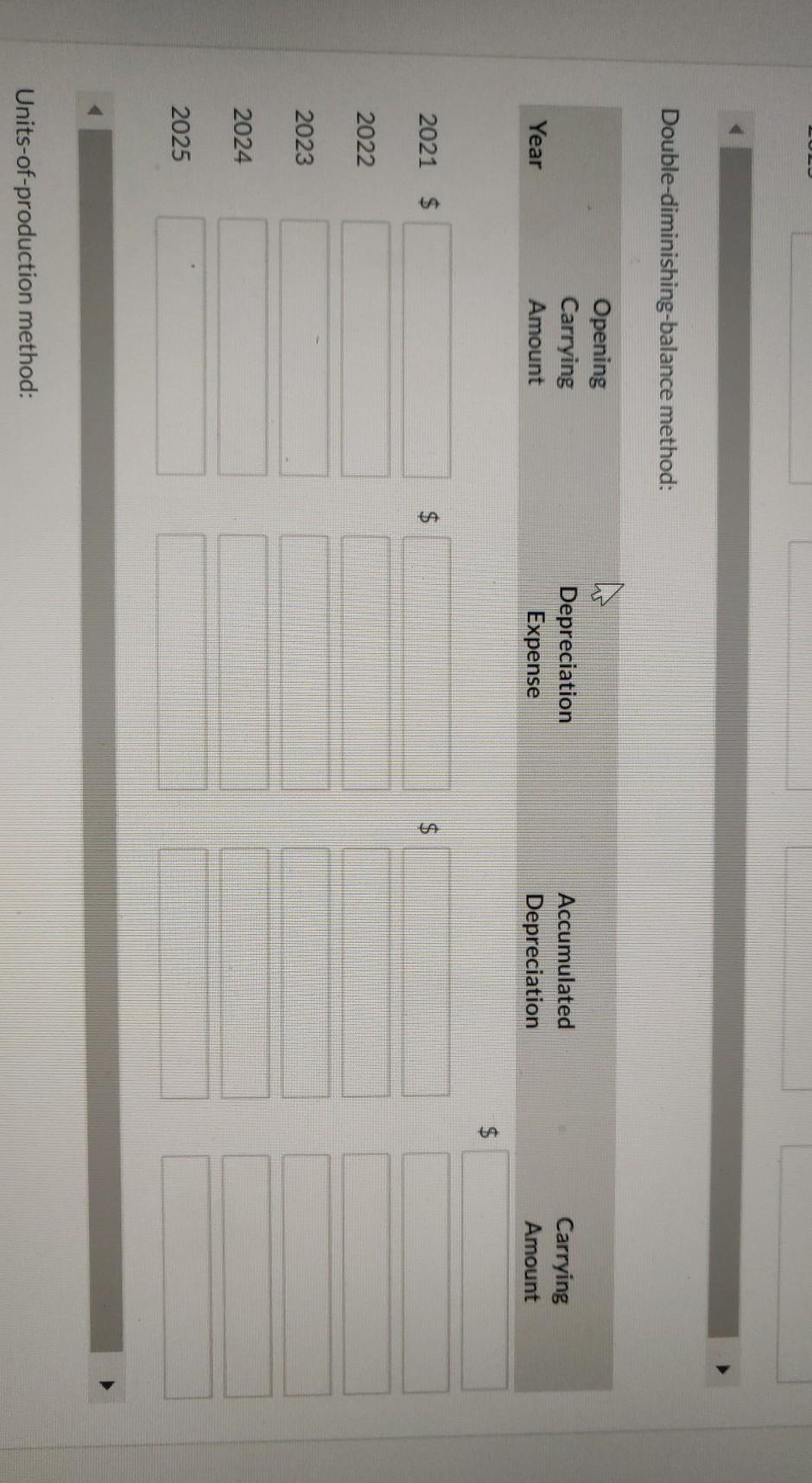

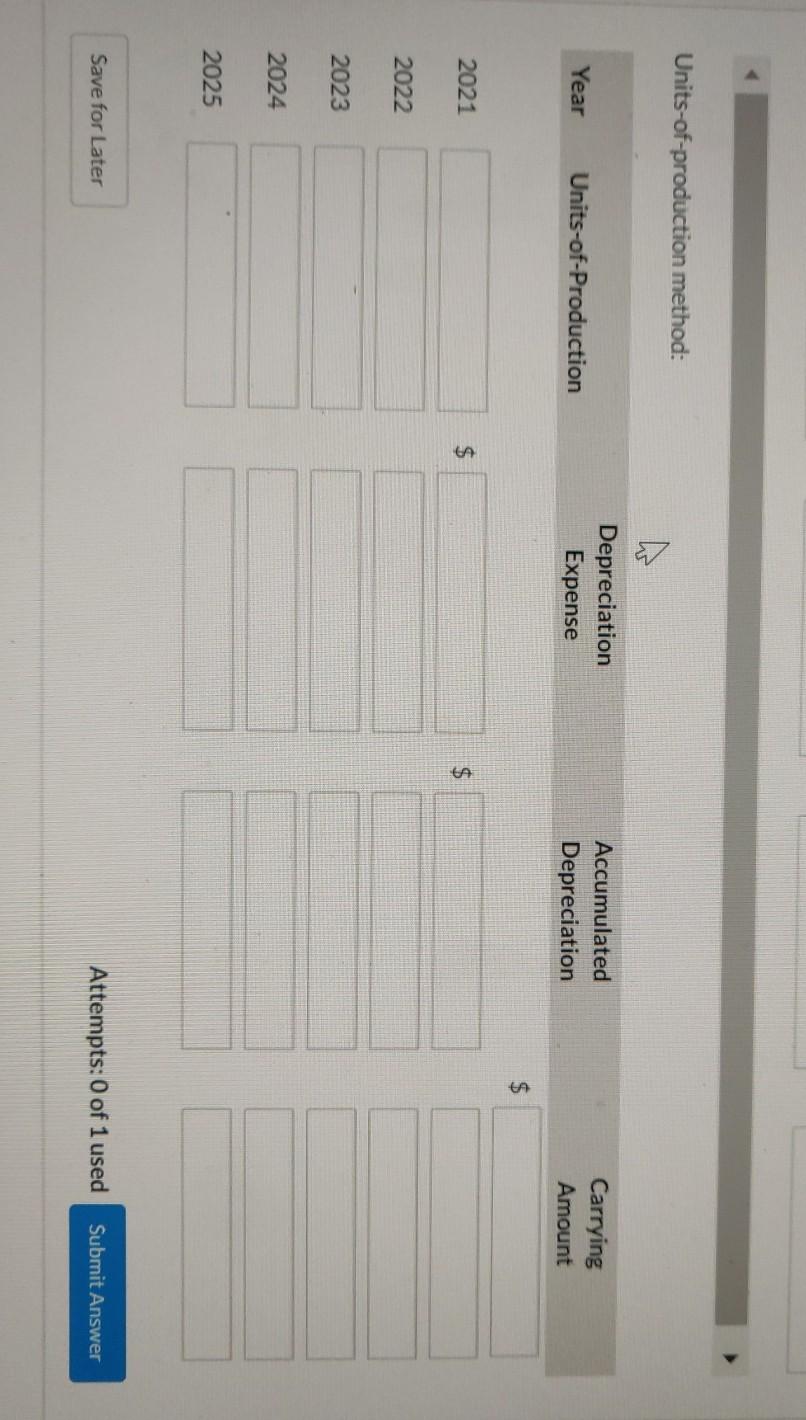

View Policies Current Attempt in Progress Cullumber Company purchased equipment on March 31, 2021, at a cost of $236,000. Management is considering the merits of using the diminishing-balance or units-of-production method of depreciation instead of the straight-line method, which it currently uses for other equipment. The new equipment has an estimated residual value of $4,000 and an estimated useful life of either four years or 80,000 units. Demand for the products produced by the equipment is sporadic so the equipment will be used more in some years than in others. Assume the equipment proquces the following number of units each year: 14,600 units in 2021; 20,200 units in 2022; 20,200 units in 2023; 20,000 units in 2024; and 5,000 units in 2025. Cullumber has a December 31 year end. (a) Prepare separate depreciation schedules for the life of the equipment using: (Round depreciation per unit to 2 decimal places, eg. 5.28 and final answers to O decimal places, eg. 5,275.) Straight-line method: Denreciable Depreciation Accumulated Carrying (a) Prepare separate depreciation schedules for the life of the equipment using: (Round depreciation per unit to 2 decimal places, e.g. 5.28 and final answers to O decimal places, eg. 5,275.) Straight-line method: Depreciable Amount Depreciation Expense Accumulated Depreciation Carrying Amount Year $ 2021 $ 236000 $ $ 2022 2023 2024 2025 Double-diminishing-balance method: Opening Carrying Amount Year Depreciation Expense Accumulated Depreciation Carrying Amount A 2021 $ $ 2022 2023 2024 2025 Units-of-production method: Units-of-production method: Year Units-of-Production Depreciation Expense Accumulated Depreciation Carrying Amount A 2021 $ 2022 2023 2024 2025 Save for Later Attempts: 0 of 1 used SubmitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started