I need help with this question soon. Thank you.

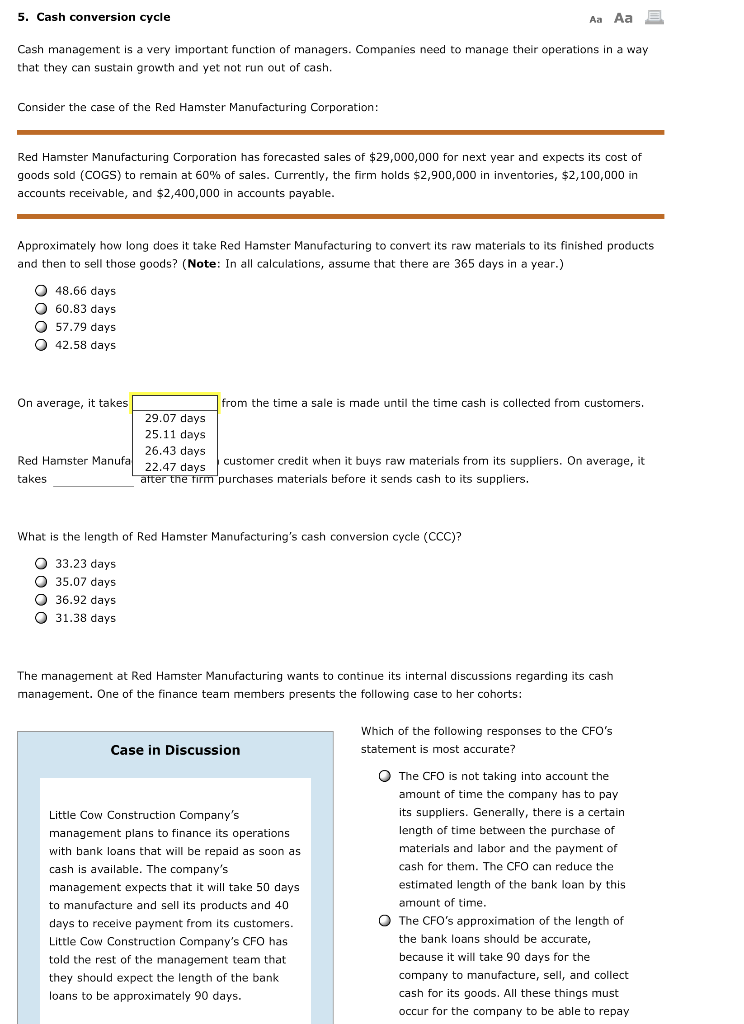

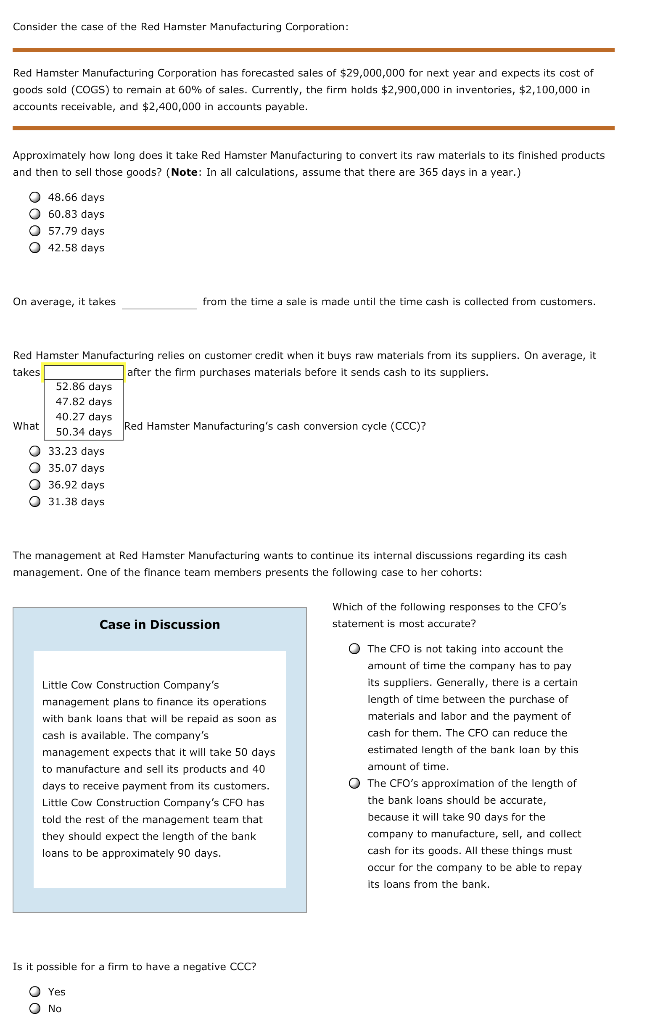

5. Cash conversion cycle Aa Aa E Cash management is a very important function of managers. Companies need to manage their operations in a way that they can sustain growth and yet not run out of cash. Consider the case of the Red Hamster Manufacturing Corporation: Red Hamster Manufacturing Corporation has forecasted sales of $29,000,000 for next year and expects its cost of goods sold (COGS) to remain at 60% of sales. Currently, the firm holds $2,900,000 in inventories, $2,100,000 in accounts receivable, and $2,400,000 in accounts payable. Approximately how long does it take Red Hamster Manufacturing to convert its raw materials to its finished products and then to sell those goods? (Note: In all calculations, assume that there are 365 days in a year.) 48.66 days 60.83 days 57.79 days 42.58 days On average, it takes from the time a sale is made until the time cash is collected from customers. 29.07 days 25.11 days 26.43 days 22.47 days customer credit when it buys raw materials from its suppliers. On average, it after the firm purchases materials before it sends cash to its suppliers. Red Hamster Manufa takes What is the length of Red Hamster Manufacturing's cash conversion cycle (CCC)? O 33.23 days O 35.07 days O 36.92 days O 31.38 days The management at Red Hamster Manufacturing wants to continue its internal discussions regarding its cash management. One of the finance team members presents the following case to her cohorts: Which of the following responses to the CFO's statement is most accurate? Case in Discussion Little Cow Construction Company's management plans to finance its operations with bank loans that will be repaid as soon as cash is available. The company's management expects that it will take 50 days to manufacture and sell its products and 40 days to receive payment from its customers. Little Cow Construction Company's CFO has told the rest of the management team that they should expect the length of the bank loans to be approximately 90 days. The CFO is not taking into account the amount of time the company has to pay its suppliers. Generally, there is a certain length of time between the purchase of materials and labor and the payment of cash for them. The CFO can reduce the estimated length of the bank loan by this amount of time. The CFO's approximation of the length of the bank loans should be accurate, because it will take 90 days for the company to manufacture, sell, and collect cash for its goods. All these things must occur for the company to be able to repay Consider the case of the Red Hamster Manufacturing Corporation: Red Hamster Manufacturing Corporation has forecasted sales of $29,000,000 for next year and expects its cost of goods sold (COGS) to remain at 60% of sales. Currently, the firm holds $2,900,000 in inventories, $2,100,000 in accounts receivable, and $2,400,000 in accounts payable. Approximately how long does it take Red Hamster Manufacturing to convert its raw materials to its finished products and then to sell those goods? (Note: In all calculations, assume that there are 365 days in a year.) 48.66 days 60.83 days 57.79 days 42.58 days On average, it takes from the time a sale is made until the time cash is collected from customers. Red Hamster Manufacturing relies on customer credit when it buys raw materials from its suppliers. On average, it takes after the firm purchases materials before it sends cash to its suppliers. 52.86 days 47.82 days 40.27 days What 50.34 days Red Hamster Manufacturing's cash conversion cycle (CCC)? 33.23 days 35.07 days 36.92 days O 31.38 days The management at Red Hamster Manufacturing wants to continue its internal discussions regarding its cash management. One of the finance team members presents the following case to her cohorts: Which of the following responses to the CFO's statement is most accurate? Case in Discussion O Little Cow Construction Company's management plans to finance its operations with bank loans that will be repaid as soon as cash is available. The company's management expects that it will take 50 days to manufacture and sell its products and 40 days to receive payment from its customers. Little Cow Construction Company's CFO has told the rest of the management team that they should expect the length of the bank loans to be approximately 90 days. The CFO is not taking into account the amount of time the company has to pay its suppliers. Generally, there is a certain length of time between the purchase of materials and labor and the payment of cash for them. The CFO can reduce the estimated length of the bank loan by this amount of time. The CFO's approximation of the length of the bank loans should be accurate, because it will take 90 days for the company to manufacture, sell, and collect cash for its goods. All these things must occur for the company to be able to repay its loans from the bank. Is it possible for a firm to have a negative CCC? Yes