I need help with what is blank please and the last image is extra info that I didn't know if you needed

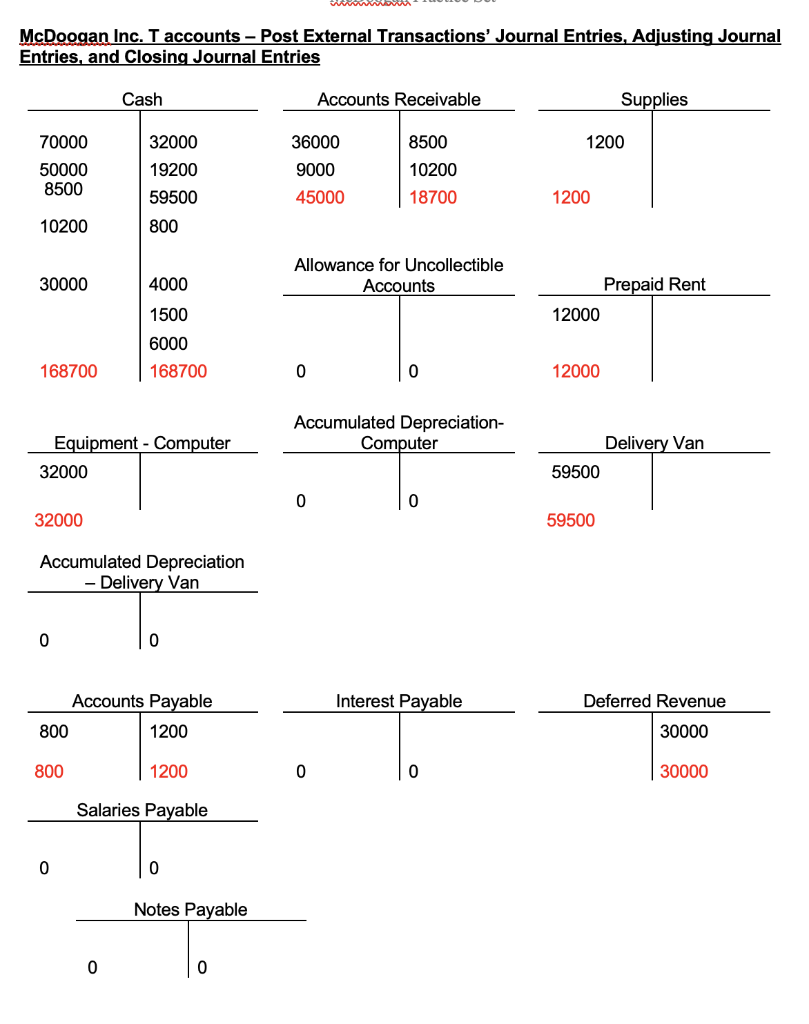

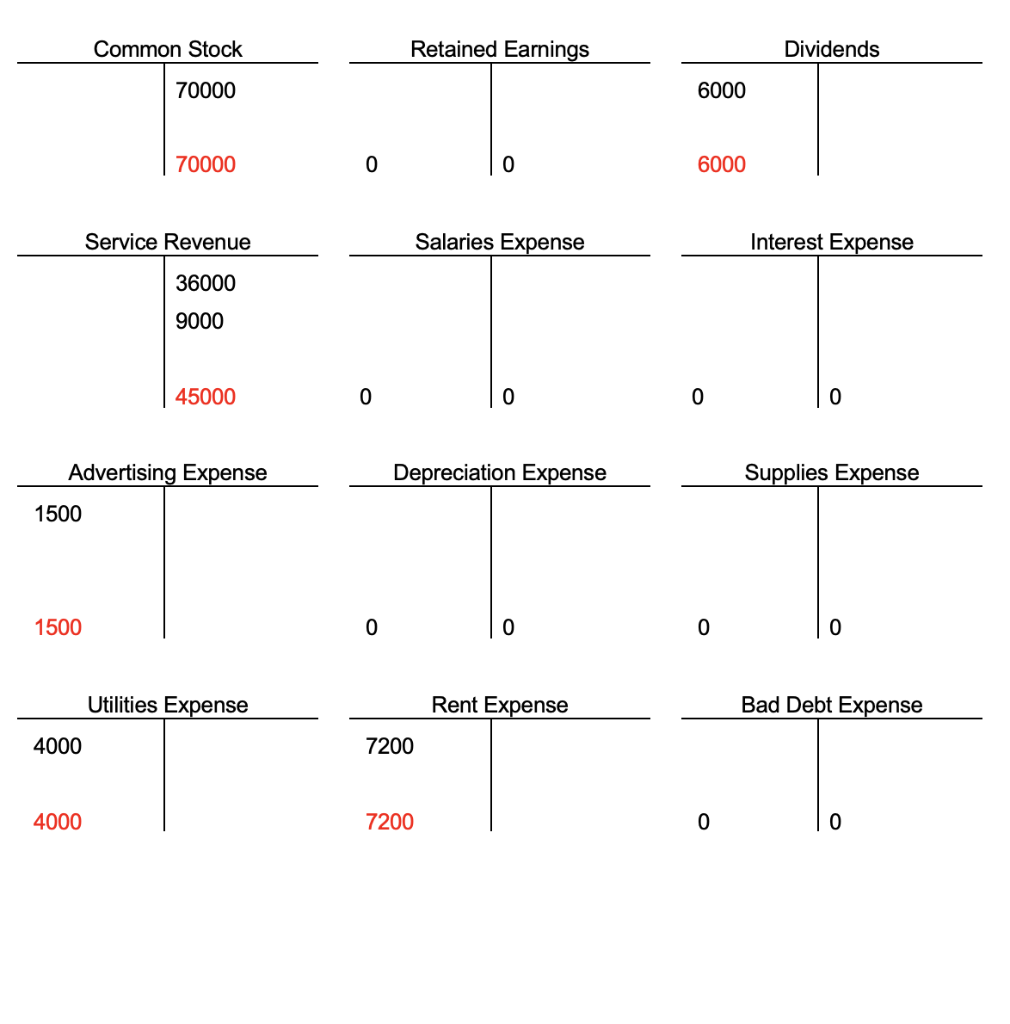

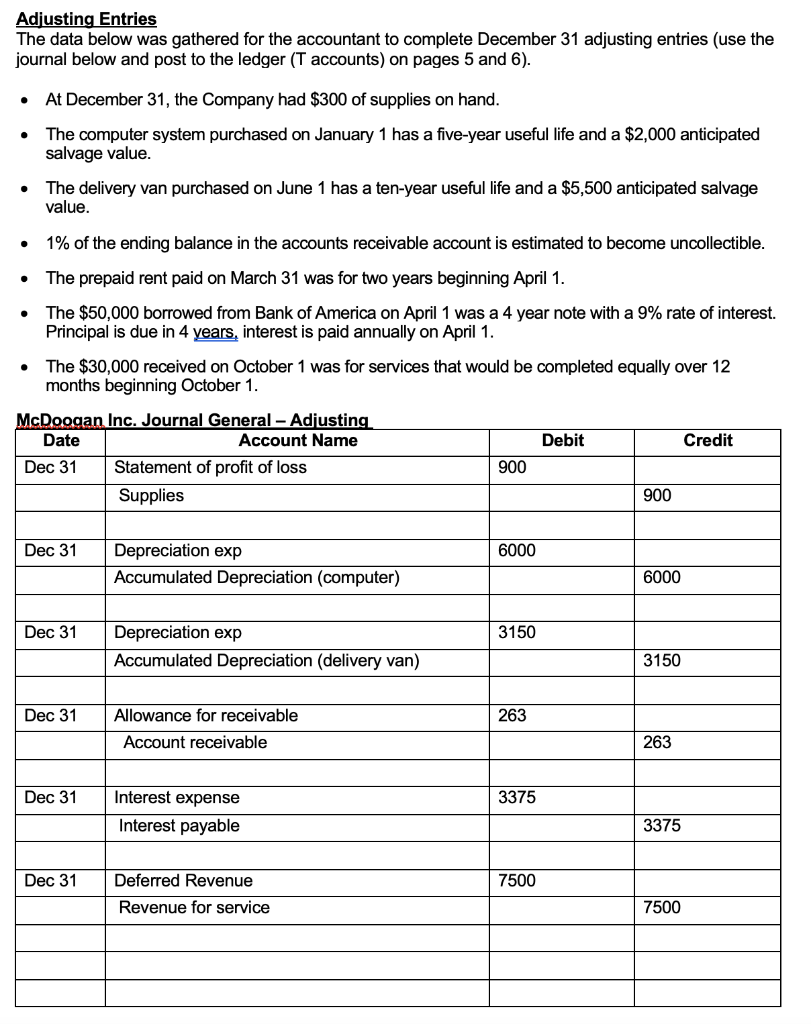

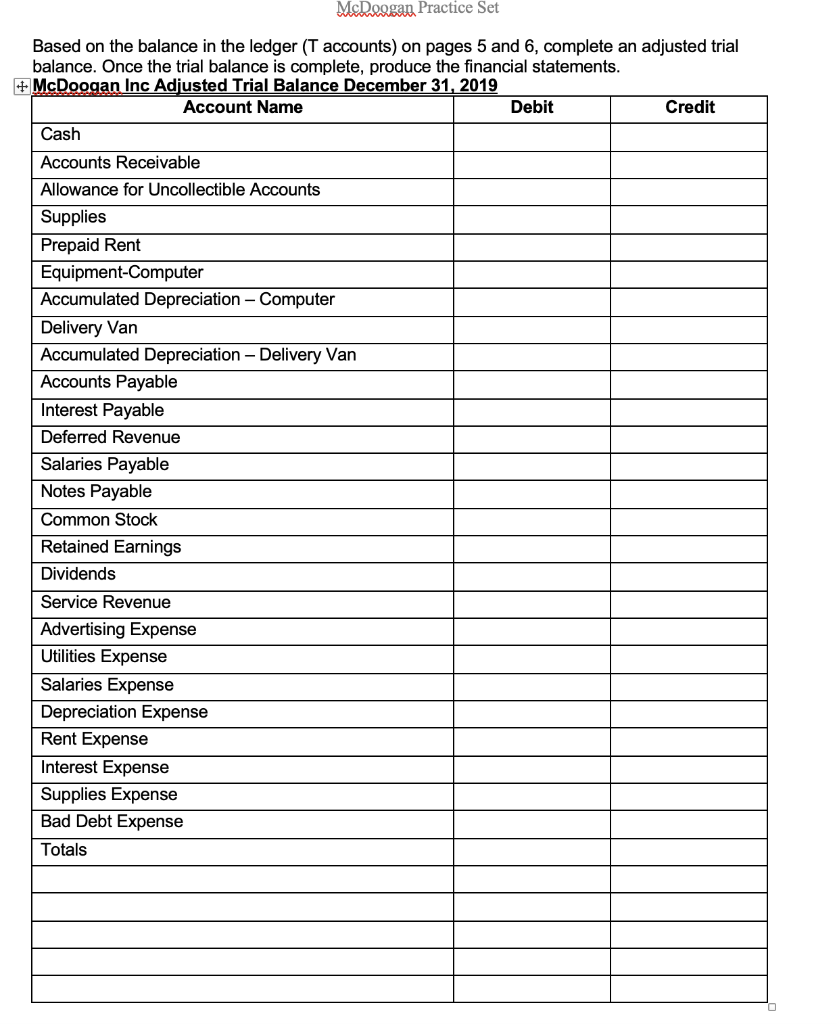

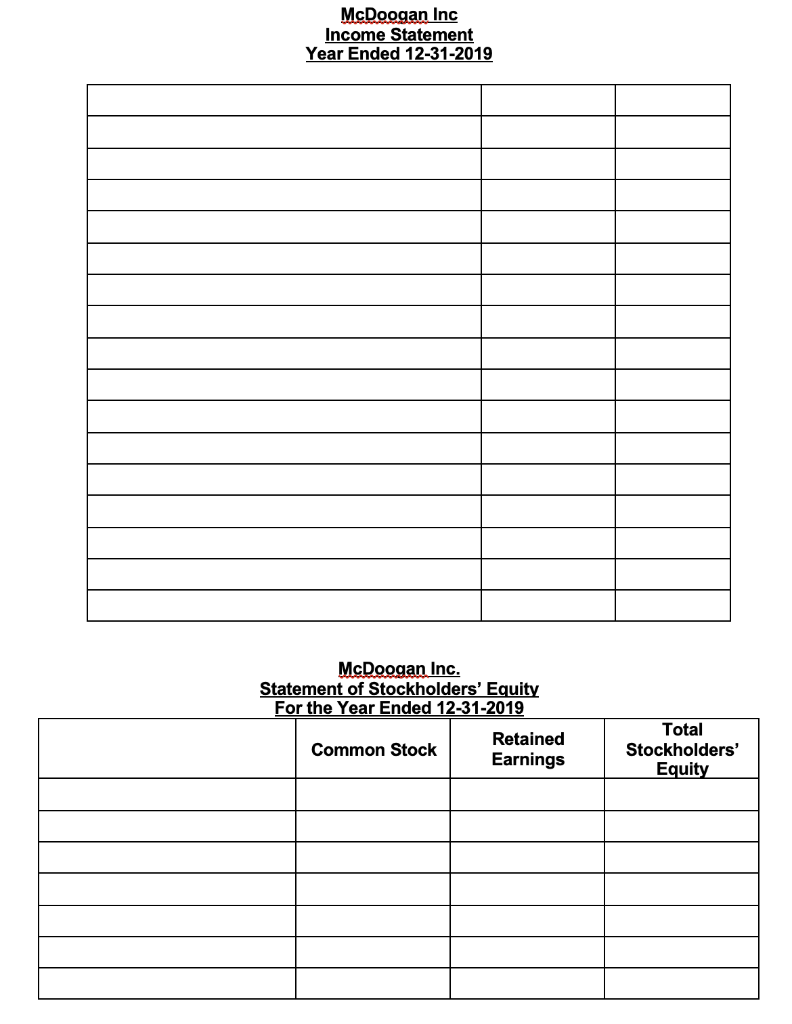

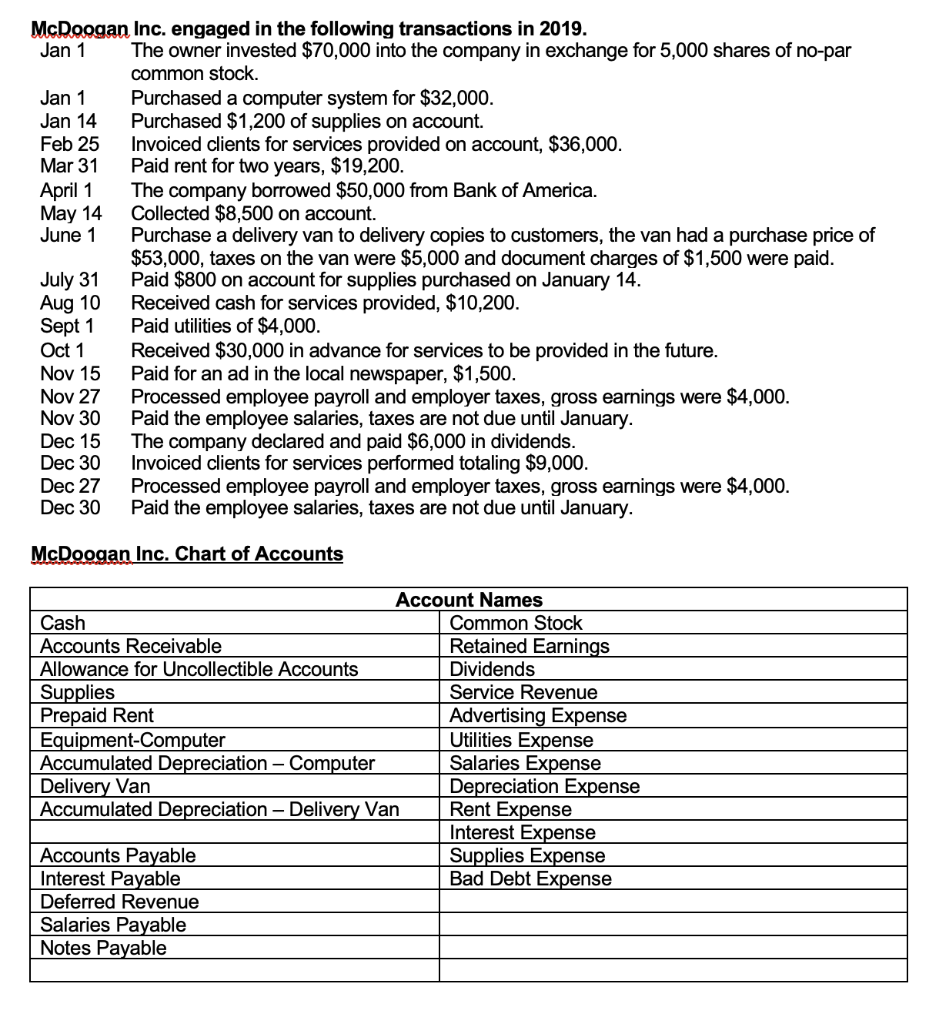

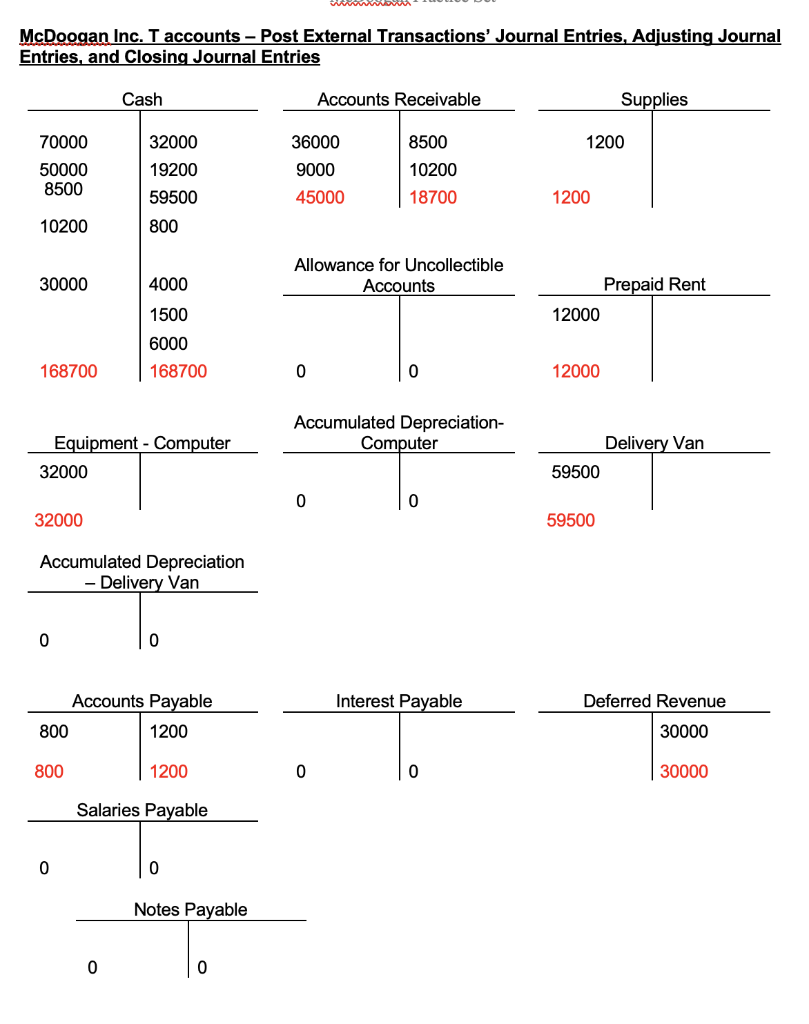

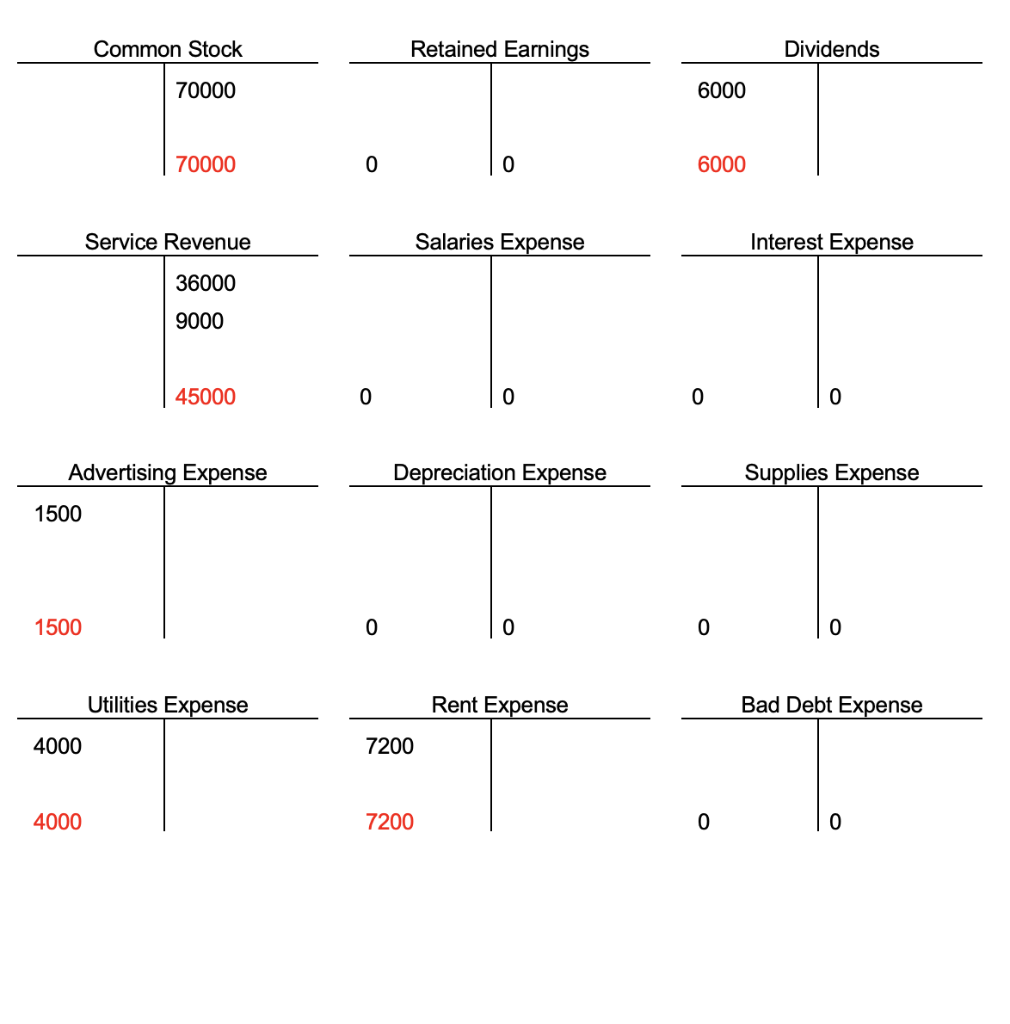

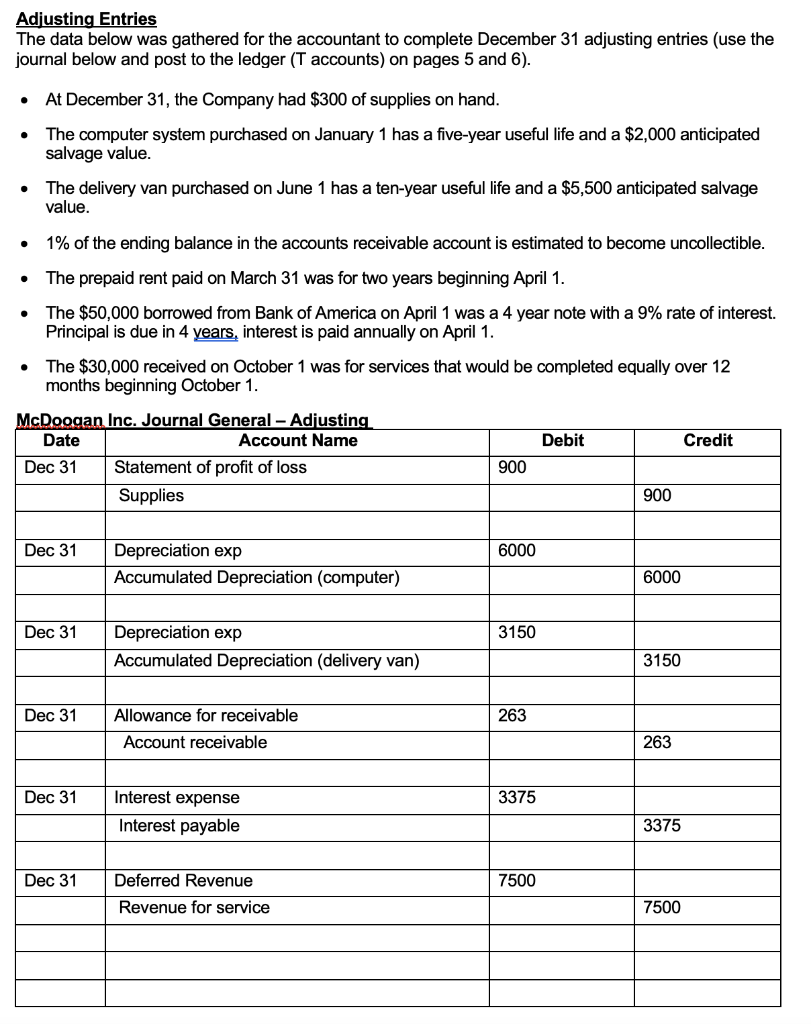

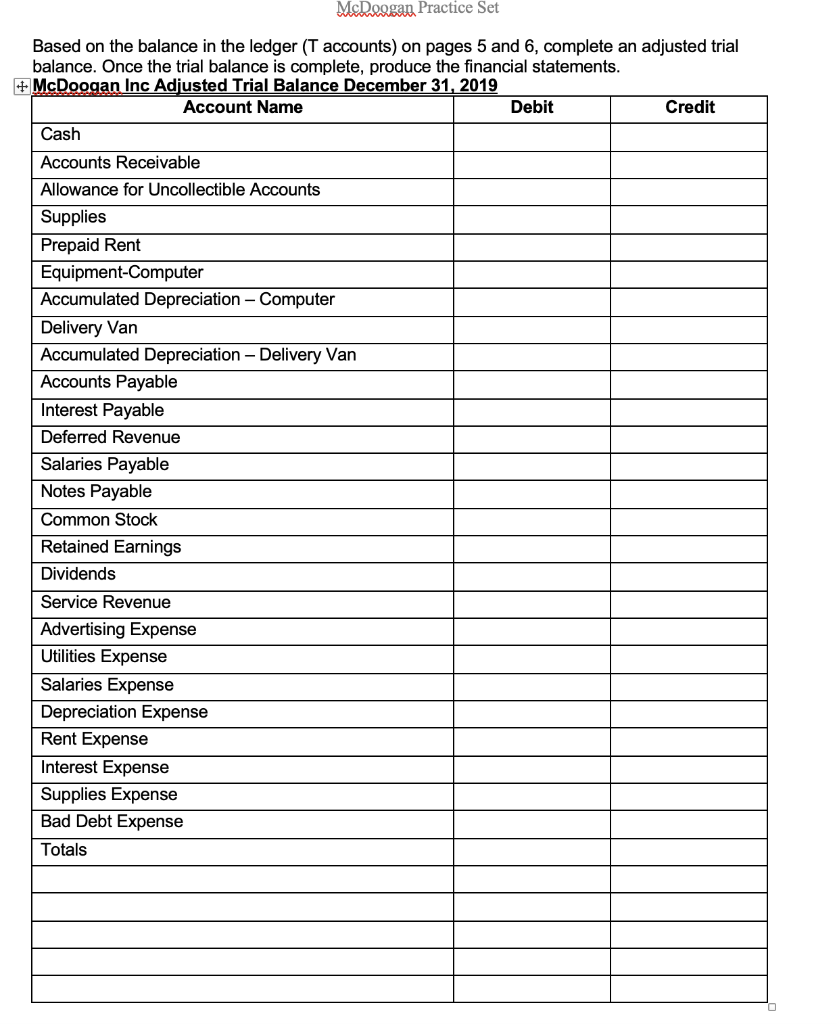

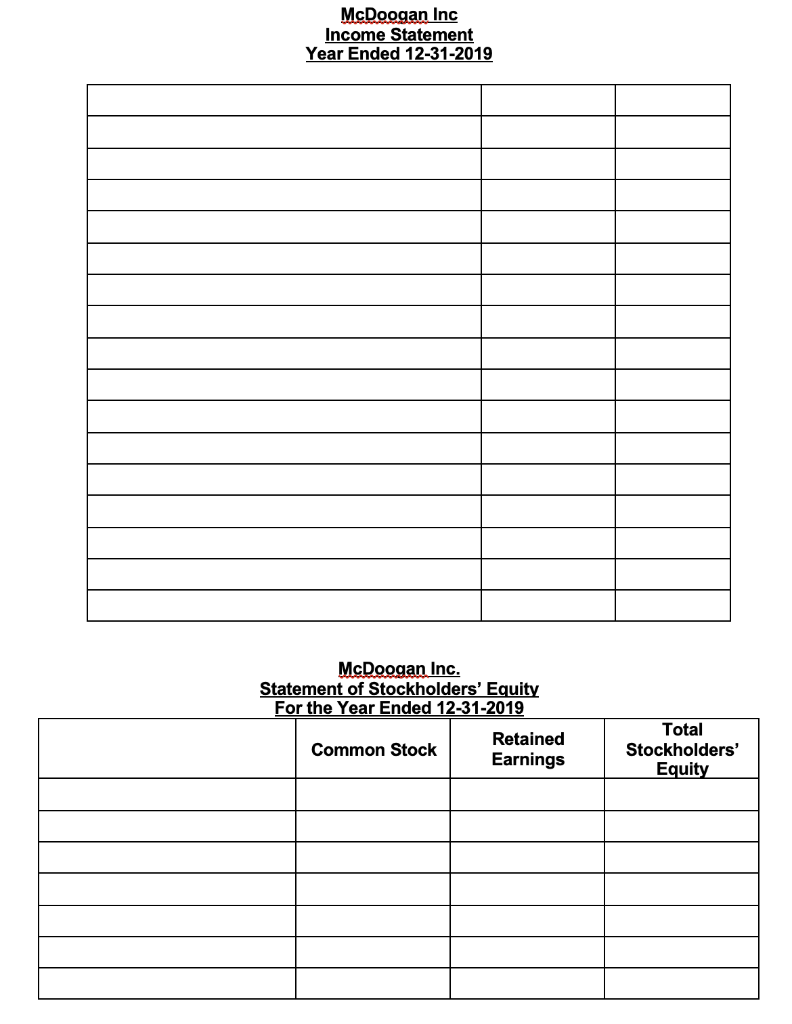

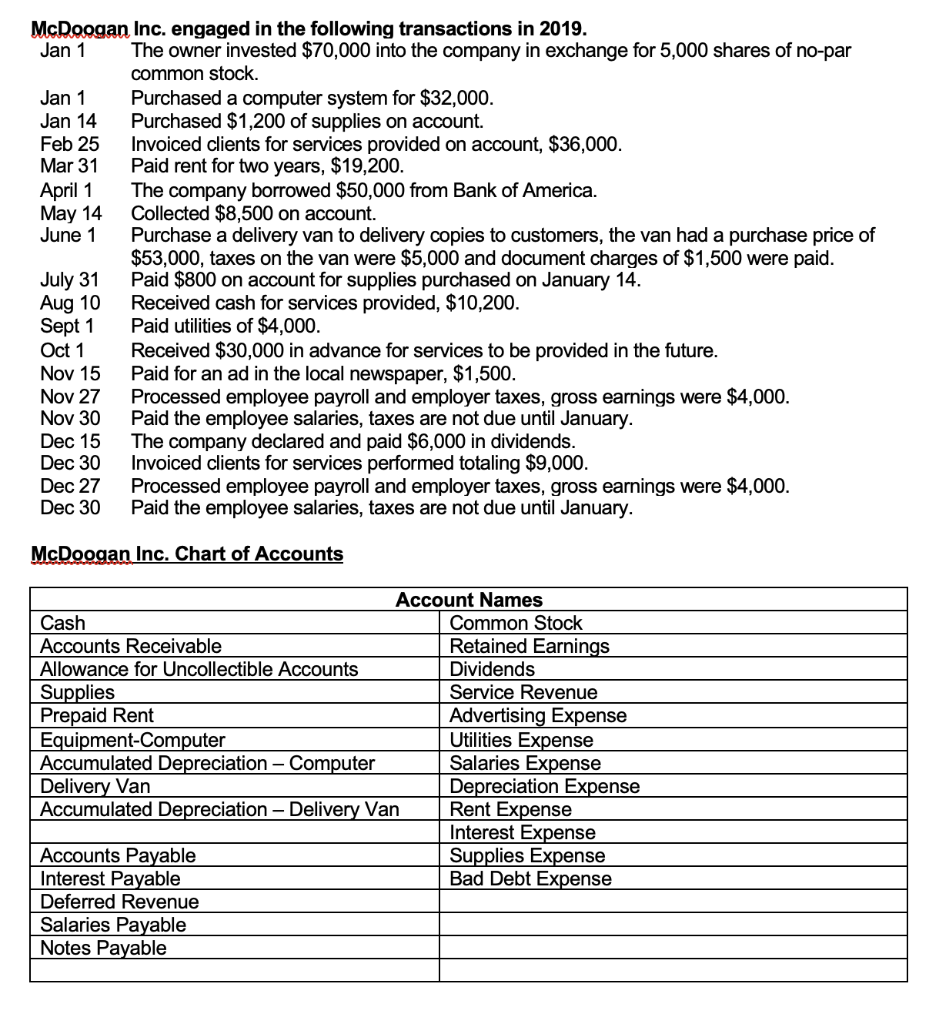

McDoogan Inc. T accounts - Post External Transactions' Journal Entries, Adjusting Journal Entries, and Closing Journal Entries Cash Accounts Receivable Supplies 36000 8500 1200 70000 50000 8500 32000 19200 9000 45000 10200 18700 59500 1200 10200 800 Allowance for Uncollectible Accounts 30000 4000 Prepaid Rent 12000 1500 6000 168700 168700 0 0 12000 Accumulated Depreciation- Computer Equipment - Computer 32000 Delivery Van 59500 0 0 32000 59500 Accumulated Depreciation Delivery Van 0 0 Interest Payable Deferred Revenue Accounts Payable 800 1200 30000 800 1200 0 0 30000 Salaries Payable 0 0 Notes Payable 0 Common Stock Retained Earnings Dividends 70000 6000 70000 0 0 6000 Service Revenue Salaries Expense Interest Expense 36000 9000 45000 Advertising Expense Depreciation Expense Supplies Expense 1500 1500 0 0 Utilities Expense Rent Expense Bad Debt Expense 4000 7200 4000 7200 0 0 Adjusting Entries The data below was gathered for the accountant to complete December 31 adjusting entries (use the journal below and post to the ledger (T accounts) on pages 5 and 6). At December 31, the Company had $300 of supplies on hand. The computer system purchased on January 1 has a five-year useful life and a $2,000 anticipated salvage value. The delivery van purchased on June 1 has a ten-year useful life and a $5,500 anticipated salvage value. . 1% of the ending balance in the accounts receivable account is estimated to become uncollectible. The prepaid rent paid on March 31 was for two years beginning April 1. The $50,000 borrowed from Bank of America on April 1 was a 4 year note with a 9% rate of interest. Principal is due in 4 years, interest is paid annually on April 1. The $30,000 received on October 1 was for services that would be completed equally over 12 months beginning October 1. . Debit Credit McDoogan Inc. Journal General - Adjusting Date Account Name Dec 31 Statement of profit of loss Supplies 900 900 Dec 31 6000 Depreciation exp Accumulated Depreciation (computer) 6000 Dec 31 3150 Depreciation exp Accumulated Depreciation (delivery van) 3150 Dec 31 263 Allowance for receivable Account receivable 263 Dec 31 3375 Interest expense Interest payable 3375 Dec 31 7500 Deferred Revenue Revenue for service 7500 MeReagan Practice Set Based on the balance in the ledger (T accounts) on pages 5 and 6, complete an adjusted trial balance. Once the trial balance is complete, produce the financial statements. #McDoogan Inc Adjusted Trial Balance December 31, 2019 Account Name Debit Credit Cash Accounts Receivable Allowance for Uncollectible Accounts Supplies Prepaid Rent Equipment-Computer Accumulated Depreciation - Computer Delivery Van Accumulated Depreciation - Delivery Van Accounts Payable Interest Payable Deferred Revenue Salaries Payable Notes Payable Common Stock Retained Earnings Dividends Service Revenue Advertising Expense Utilities Expense Salaries Expense Depreciation Expense Rent Expense Interest Expense Supplies Expense Bad Debt Expense Totals McDoogan Inc Income Statement Year Ended 12-31-2019 McDoogan Inc. Statement of Stockholders' Equity For the Year Ended 12-31-2019 Retained Common Stock Earnings Total Stockholders' Equity McDoogan Inc. engaged in the following transactions in 2019. Jan 1 The owner invested $70,000 into the company in exchange for 5,000 shares of no-par common stock. Jan 1 Purchased a computer system for $32,000. Jan 14 Purchased $1,200 of supplies on account. Feb 25 Invoiced clients for services provided on account, $36,000. Mar 31 Paid rent for two years, $19,200. April 1 The company borrowed $50,000 from Bank of America. May 14 Collected $8,500 on account. June 1 Purchase a delivery van to delivery copies to customers, the van had a purchase price of $53,000, taxes on the van were $5,000 and document charges of $1,500 were paid. July 31 Paid $800 on account for supplies purchased on January 14. Aug 10 Received cash for services provided, $10,200. Sept 1 Paid utilities of $4,000. Oct 1 Received $30,000 in advance for services to be provided in the future. Nov 15 Paid for an ad in the local newspaper, $1,500. Nov 27 Processed employee payroll and employer taxes, gross earnings were $4,000. Nov 30 Paid the employee salaries, taxes are not due until January. Dec 15 The company declared and paid $6,000 in dividends. Dec 30 Invoic ents for services performed totaling $9,000. Dec 27 Processed employee payroll and employer taxes, gross earnings were $4,000. Dec 30 Paid the employee salaries, taxes are not due until January. McDoogan Inc. Chart of Accounts Account Names Cash Common Stock Accounts Receivable Retained Earnings Allowance for Uncollectible Accounts Dividends Supplies Service Revenue Prepaid Rent Advertising Expense Equipment-Computer Utilities Expense Accumulated Depreciation - Computer Salaries Expense Delivery Van Depreciation Expense Accumulated Depreciation - Delivery Van Rent Expense Interest Expense Accounts Payable Supplies Expense Interest Payable Bad Debt Expense Deferred Revenue Salaries Payable Notes Payable