Answered step by step

Verified Expert Solution

Question

1 Approved Answer

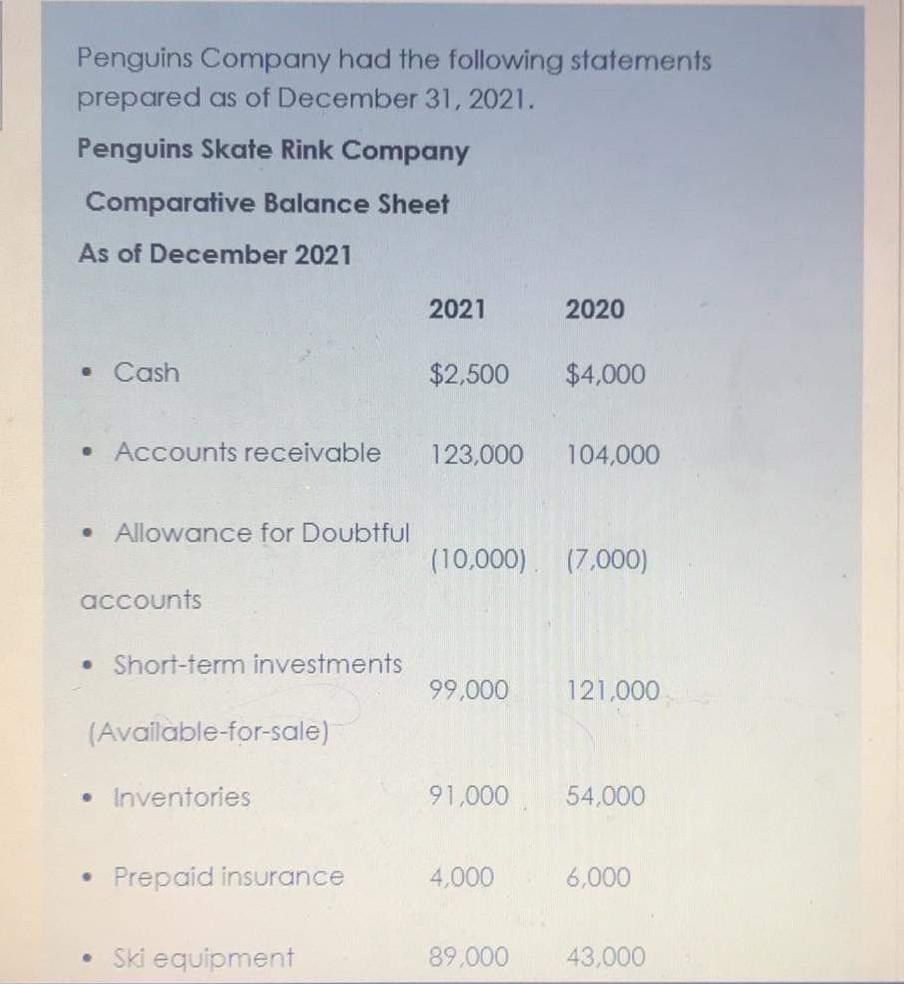

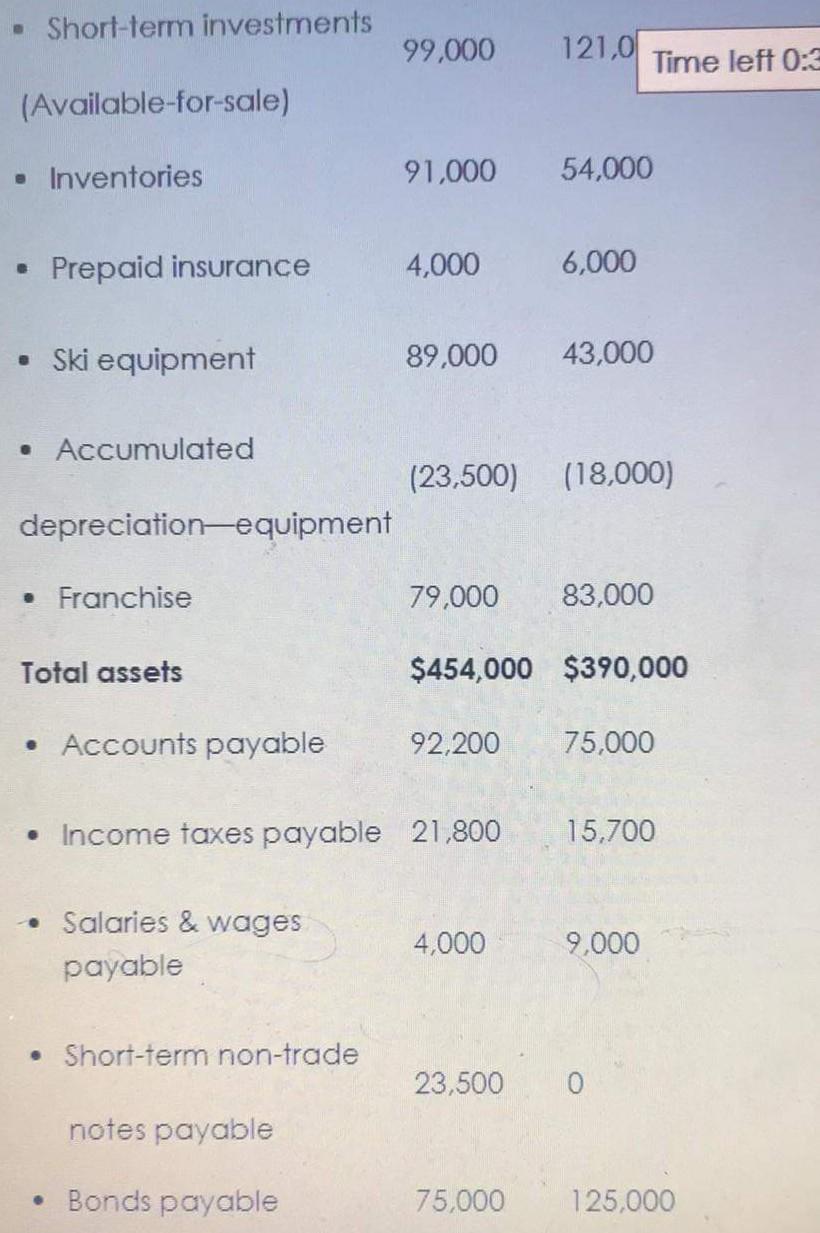

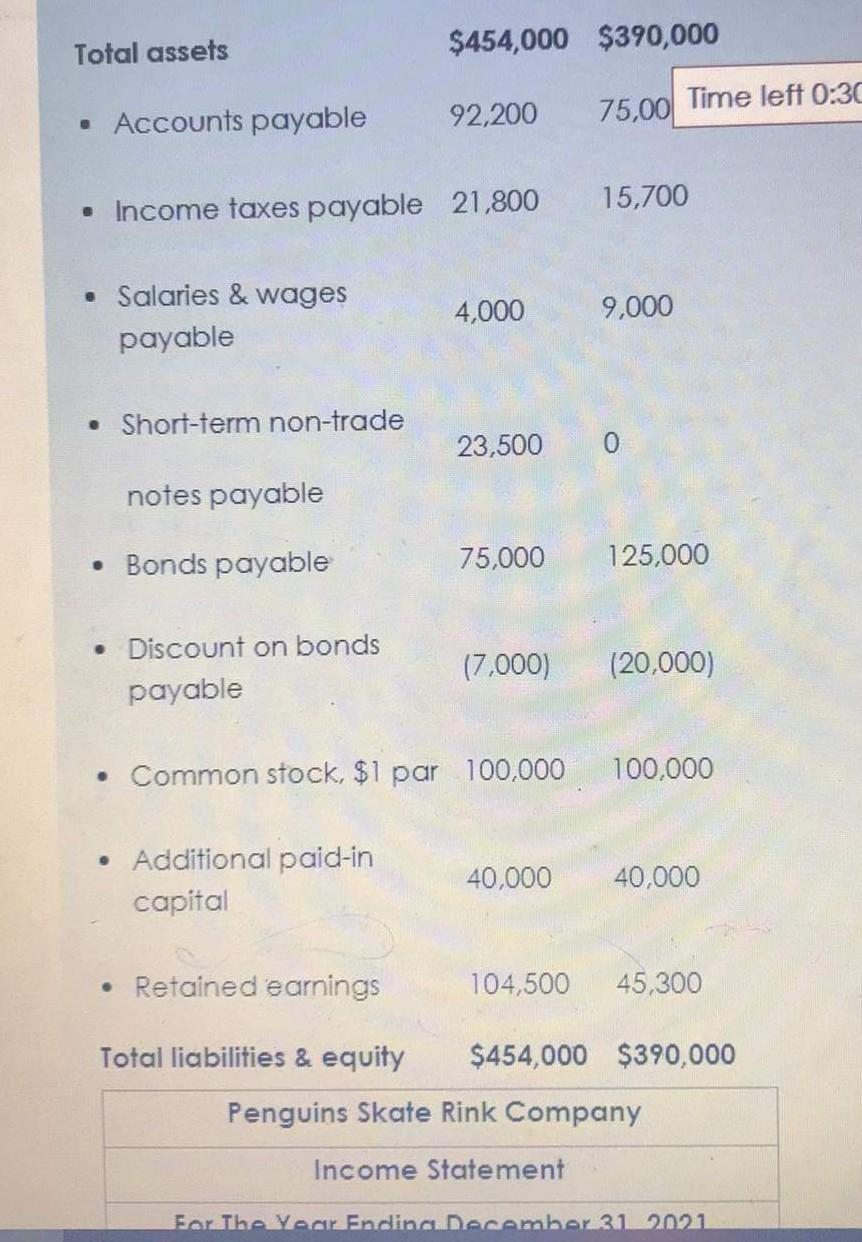

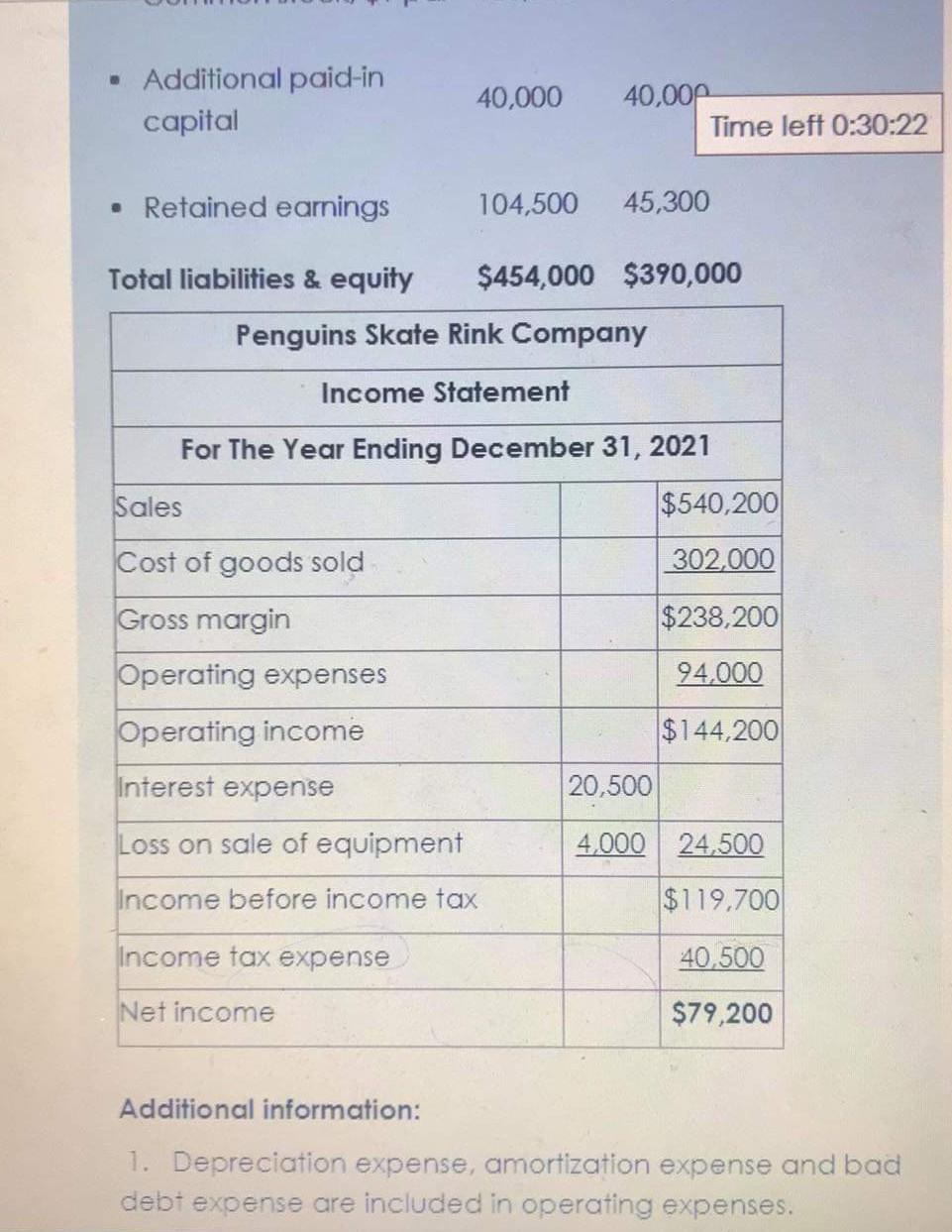

I need investing and financing activity only Penguins Company had the following statements prepared as of December 31, 2021. Penguins Skate Rink Company Comparative Balance

I need investing and financing activity only

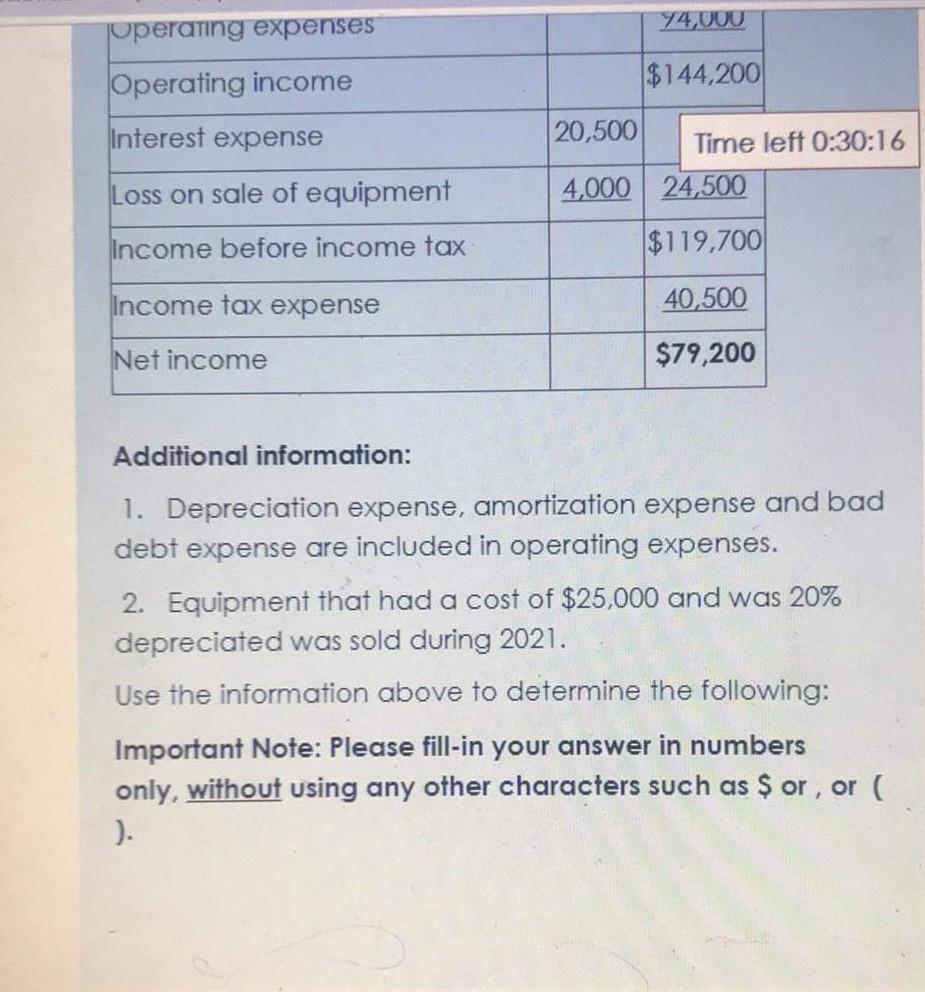

Penguins Company had the following statements prepared as of December 31, 2021. Penguins Skate Rink Company Comparative Balance Sheet As of December 2021 2021 2020 Cash $2,500 $4,000 Accounts receivable 123,000 104,000 . Allowance for Doubtful (10,000). (7,000) accounts Short-term investments 99,000 121,000 (Available-for-sale) Inventories 91,000 54,000 Prepaid insurance 4,000 6,000 Ski equipment 89.000 43,000 Short-term investments 99,000 121,0 Time left 0:3 (Available-for-sale) Inventories 91,000 54,000 Prepaid insurance 4,000 6,000 Ski equipment 89,000 43,000 Accumulated (23,500) (18,000) depreciation-equipment Franchise 79,000 83,000 Total assets $454,000 $390,000 Accounts payable 92,200 75,000 Income taxes payable 21,800 15,700 Salaries & wages 4,000 9,000 payable Short-term non-trade 23,500 0 notes payable Bonds payable 75,000 125,000 Total assets $454,000 $390,000 75,00 Time left 0:30 Accounts payable 92,200 15,700 Income taxes payable 21,800 Salaries & wages 4,000 9,000 payable Short-term non-trade 23,500 0 notes payable Bonds payable 75,000 125,000 Discount on bonds (7,000) (20,000) payable Common stock, $1 par 100,000 100,000 Additional paid-in capital 40,000 40,000 Retained earnings 104,500 45,300 Total liabilities & equity $454,000 $390,000 Penguins Skate Rink Company Income Statement For the Year Endina December 31 2021 - Additional paid-in capital 40,000 40,000 Time left 0:30:22 Retained earnings 104,500 45,300 Total liabilities & equity $454,000 $390,000 Penguins Skate Rink Company Income Statement For The Year Ending December 31, 2021 Sales $540,200 Cost of goods sold 302,000 Gross margin $238,200 Operating expenses 94,000 Operating income $144,200 Interest expense 20,500 Loss on sale of equipment 4,000 24,500 Income before income tax $119,700 Income tax expense 40,500 Net income $79,200 Additional information: 1. Depreciation expense, amortization expense and bad debt expense are included in operating expenses. 74,000 operating expenses Operating income $144,200 Interest expense 20,500 Time left 0:30:16 Loss on sale of equipment 4,000 24,500 Income before income tax $119,700 Income tax expense 40,500 Net income $79,200 Additional information: 1. Depreciation expense, amortization expense and bad debt expense are included in operating expenses. 2. Equipment that had a cost of $25,000 and was 20% depreciated was sold during 2021. Use the information above to determine the following: Important Note: Please fill-in your answer in numbers only, without using any other characters such as $ or, or ( )Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started