Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need it typed with an explanation Question 2 (answer all parts of the question) a. Jasmine Technologies (JT) is looking to acquire Tulip Software

I need it typed with an explanation

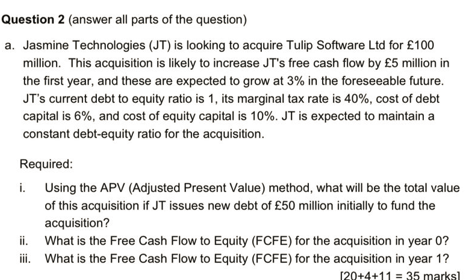

Question 2 (answer all parts of the question) a. Jasmine Technologies (JT) is looking to acquire Tulip Software Ltd for 100 million. This acquisition is likely to increase JT's free cash flow by 5 million in the first year, and these are expected to grow at 3% in the foreseeable future. JT's current debt to equity ratio is 1, its marginal tax rate is 40%, cost of debt capital is 6%, and cost of equity capital is 10%. JT is expected to maintain a constant debt-equity ratio for the acquisition. Required: i. Using the APV (Adjusted Present Value) method, what will be the total value of this acquisition if JT issues new debt of 50 million initially to fund the acquisition? ii. What is the Free Cash Flow to Equity (FCFE) for the acquisition in year 0? What is the Free Cash Flow to Equity (FCFE) for the acquisition in year 1? iii. [20+4+1135 marks] Question 2 (answer all parts of the question) a. Jasmine Technologies (JT) is looking to acquire Tulip Software Ltd for 100 million. This acquisition is likely to increase JT's free cash flow by 5 million in the first year, and these are expected to grow at 3% in the foreseeable future. JT's current debt to equity ratio is 1, its marginal tax rate is 40%, cost of debt capital is 6%, and cost of equity capital is 10%. JT is expected to maintain a constant debt-equity ratio for the acquisition. Required: i. Using the APV (Adjusted Present Value) method, what will be the total value of this acquisition if JT issues new debt of 50 million initially to fund the acquisition? ii. What is the Free Cash Flow to Equity (FCFE) for the acquisition in year 0? What is the Free Cash Flow to Equity (FCFE) for the acquisition in year 1? iii. [20+4+1135 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started