i need only part B. ASAP!

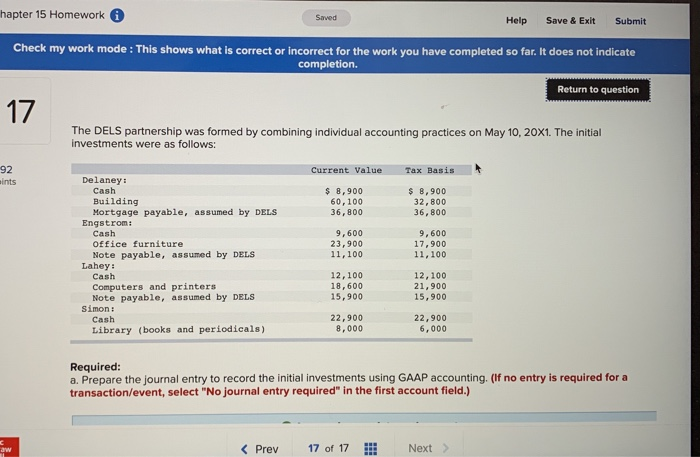

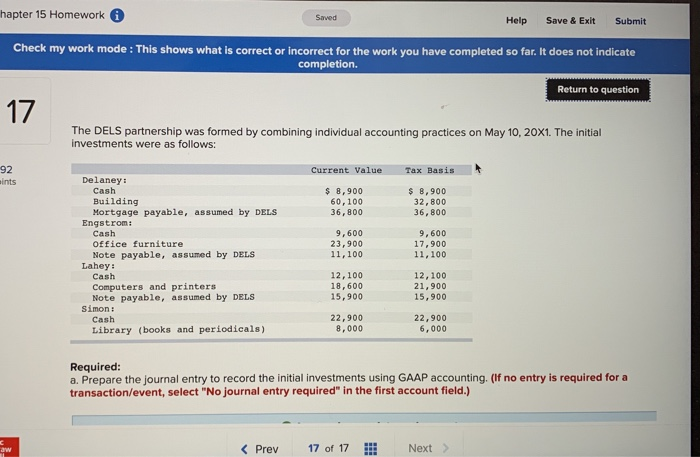

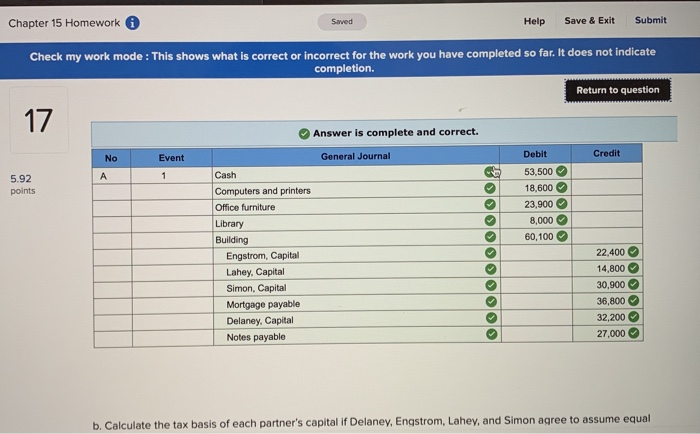

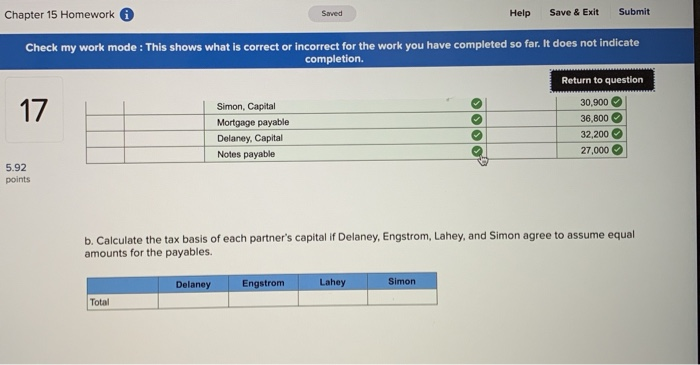

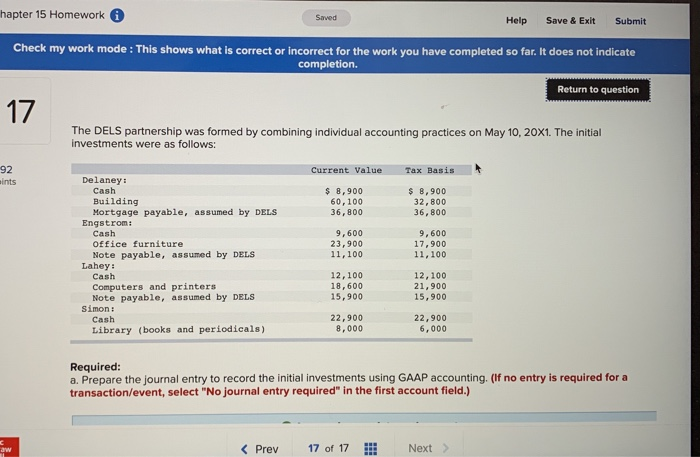

hapter 15 Homework Saved Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 17 The DELS partnership was formed by combining individual accounting practices on May 10, 20X1. The initial investments were as follows: 92 Current Value Tax Basis ints Delaney: Cash $ 8,900 $ 8,900 Building 60,100 32,800 Mortgage payable, assumed by DELS 36,800 36,800 Engstrom: Cash 9,600 9,600 Office furniture 23,900 17,900 Note payable, assumed by DELS 11,100 11,100 Lahey: Cash 12,100 12,100 Computers and printers 18,600 21,900 Note payable, assumed by DELS 15,900 15,900 Simon: Cash 22,900 22,900 Library (books and periodicals) 8,000 6,000 Required: a. Prepare the journal entry to record the initial investments using GAAP accounting. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) aw > Debit 53,500 18,600 23,900 8,000 60,100 Cash Computers and printers Office furniture Library Building Engstrom, Capital Lahey, Capital Simon, Capital Mortgage payable Delaney, Capital Notes payable OOOOOO 22,400 14,800 30,900 36,800 32,200 27,000 > b. Calculate the tax basis of each partner's capital if Delaney, Engstrom, Lahey, and Simon agree to assume equal Chapter 15 Homework Saved Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 17 30,900 Simon, Capital Mortgage payable Delaney, Capital Notes payable GOOOO 36,800 32,200 27,000 5.92 points b. Calculate the tax basis of each partner's capital if Delaney, Engstrom, Lahey, and Simon agree to assume equal amounts for the payables. Delaney Engstrom Lahey Simon Total hapter 15 Homework Saved Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 17 The DELS partnership was formed by combining individual accounting practices on May 10, 20X1. The initial investments were as follows: 92 Current Value Tax Basis ints Delaney: Cash $ 8,900 $ 8,900 Building 60,100 32,800 Mortgage payable, assumed by DELS 36,800 36,800 Engstrom: Cash 9,600 9,600 Office furniture 23,900 17,900 Note payable, assumed by DELS 11,100 11,100 Lahey: Cash 12,100 12,100 Computers and printers 18,600 21,900 Note payable, assumed by DELS 15,900 15,900 Simon: Cash 22,900 22,900 Library (books and periodicals) 8,000 6,000 Required: a. Prepare the journal entry to record the initial investments using GAAP accounting. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) aw > Debit 53,500 18,600 23,900 8,000 60,100 Cash Computers and printers Office furniture Library Building Engstrom, Capital Lahey, Capital Simon, Capital Mortgage payable Delaney, Capital Notes payable OOOOOO 22,400 14,800 30,900 36,800 32,200 27,000 > b. Calculate the tax basis of each partner's capital if Delaney, Engstrom, Lahey, and Simon agree to assume equal Chapter 15 Homework Saved Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 17 30,900 Simon, Capital Mortgage payable Delaney, Capital Notes payable GOOOO 36,800 32,200 27,000 5.92 points b. Calculate the tax basis of each partner's capital if Delaney, Engstrom, Lahey, and Simon agree to assume equal amounts for the payables. Delaney Engstrom Lahey Simon Total