Answered step by step

Verified Expert Solution

Question

1 Approved Answer

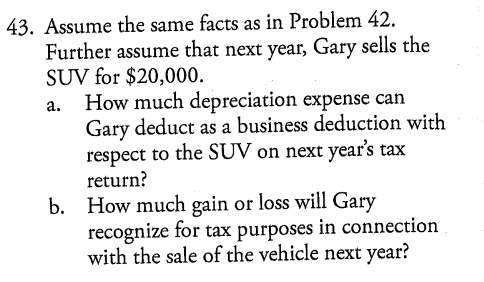

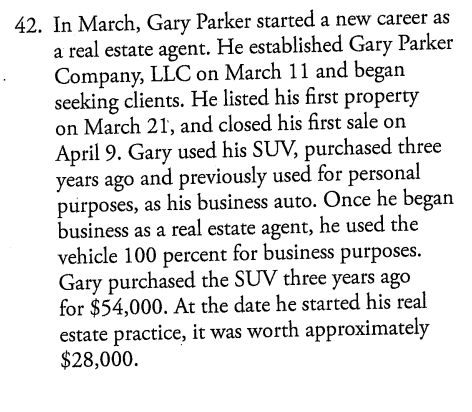

I need question 43 answered but I attached question 42 for the facts. Please answer question 43 (all parts) only! 43. Assume the same facts

I need question 43 answered but I attached question 42 for the facts. Please answer question 43 (all parts) only!

43. Assume the same facts as in Problem 42. Further assume that next year, Gary sells the SUV for $20,000. a. How much depreciation expense can Gary deduct as a business deduction with respect to the SUV on next year's tax return? How much gain or loss will Gary recognize for tax purposes in connection with the sale of the vehicle next year? 42. In March, Gary Parker started a new career as a real estate agent. He established Gary Parker Company, LLC on March 11 and began seeking clients. He listed his first property on March 21, and closed his first sale on April 9. Gary used his SUV, purchased three years ago and previously used for personal purposes, as his business auto. Once he began business as a real estate agent, he used the vehicle 100 percent for business purposes. Gary purchased the SUV three years ago for $54,000. At the date he started his real estate practice, it was worth approximately $28,000. 43. Assume the same facts as in Problem 42. Further assume that next year, Gary sells the SUV for $20,000. a. How much depreciation expense can Gary deduct as a business deduction with respect to the SUV on next year's tax return? How much gain or loss will Gary recognize for tax purposes in connection with the sale of the vehicle next year? 42. In March, Gary Parker started a new career as a real estate agent. He established Gary Parker Company, LLC on March 11 and began seeking clients. He listed his first property on March 21, and closed his first sale on April 9. Gary used his SUV, purchased three years ago and previously used for personal purposes, as his business auto. Once he began business as a real estate agent, he used the vehicle 100 percent for business purposes. Gary purchased the SUV three years ago for $54,000. At the date he started his real estate practice, it was worth approximately $28,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started