Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need solution today please I need answers for all this question please The data below pertains to the third quarter of Nevan Company which

I need solution today please

I need answers for all this question please

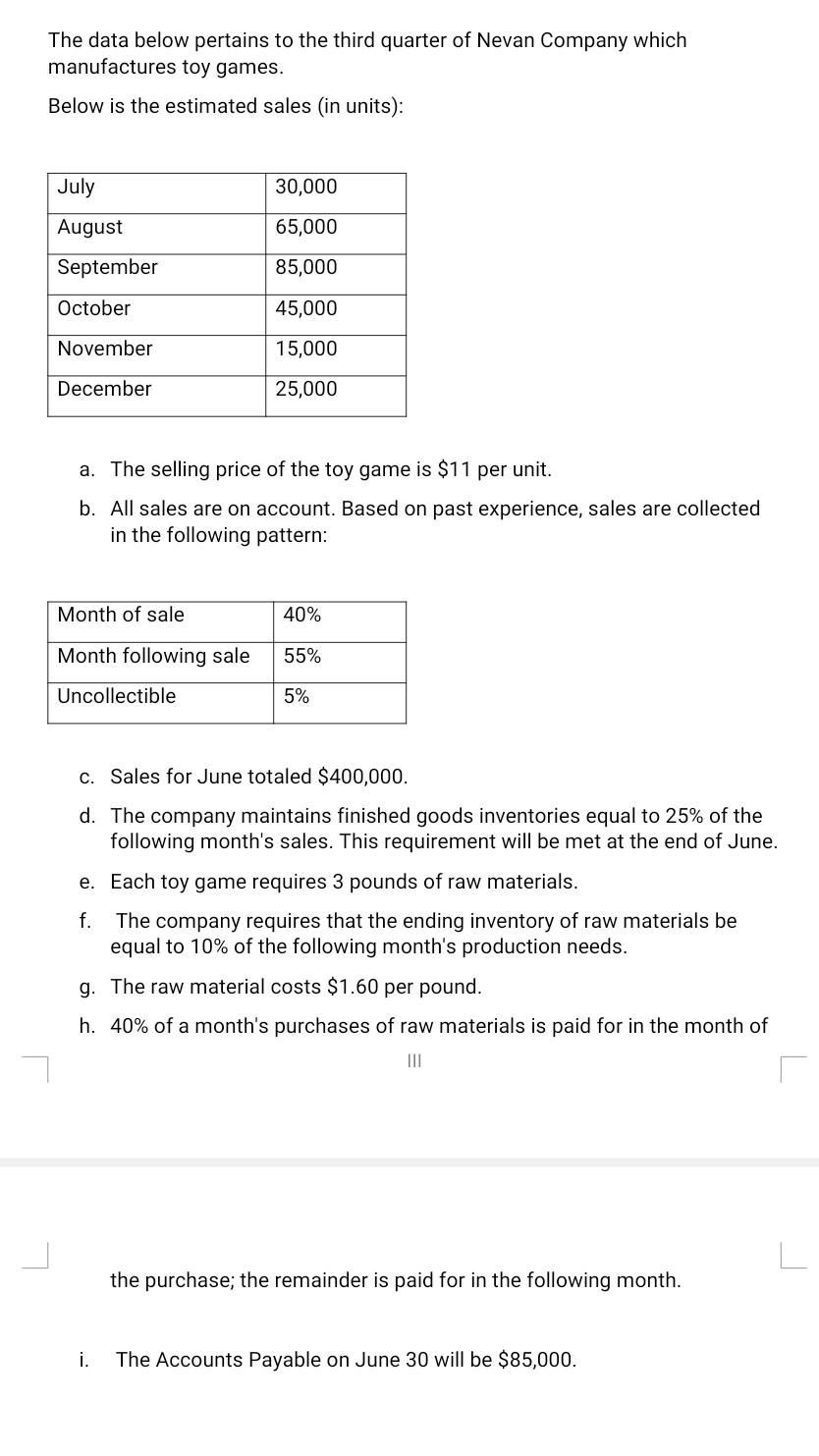

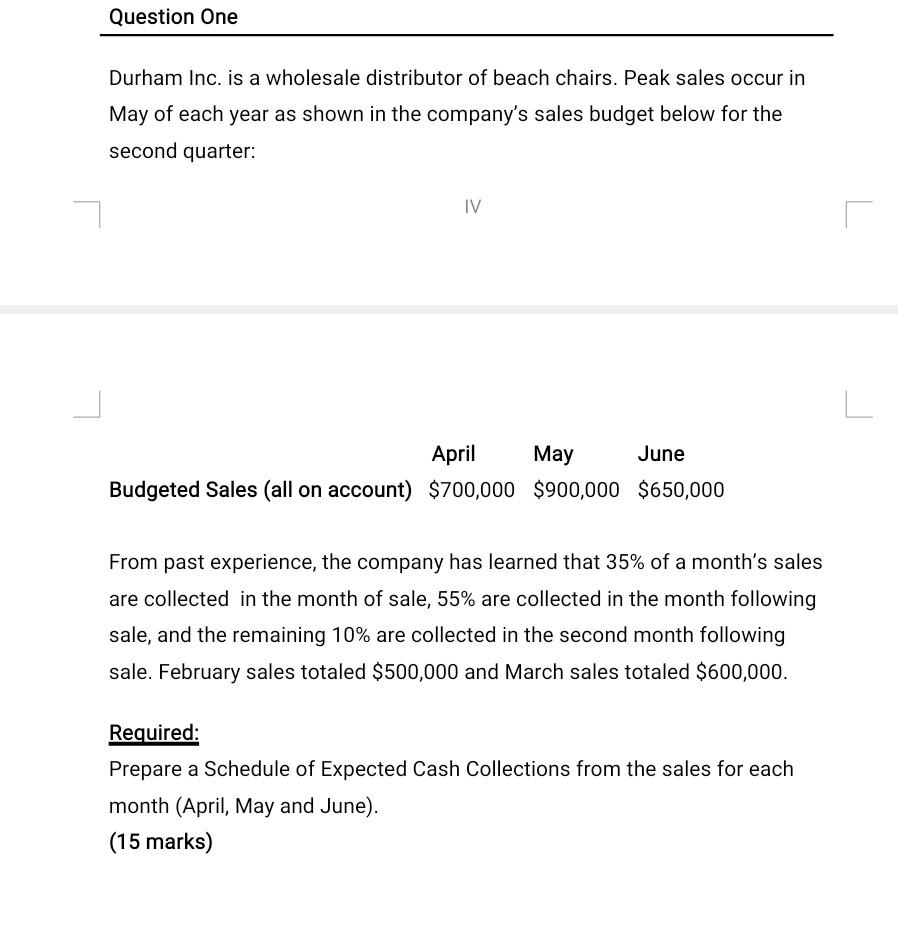

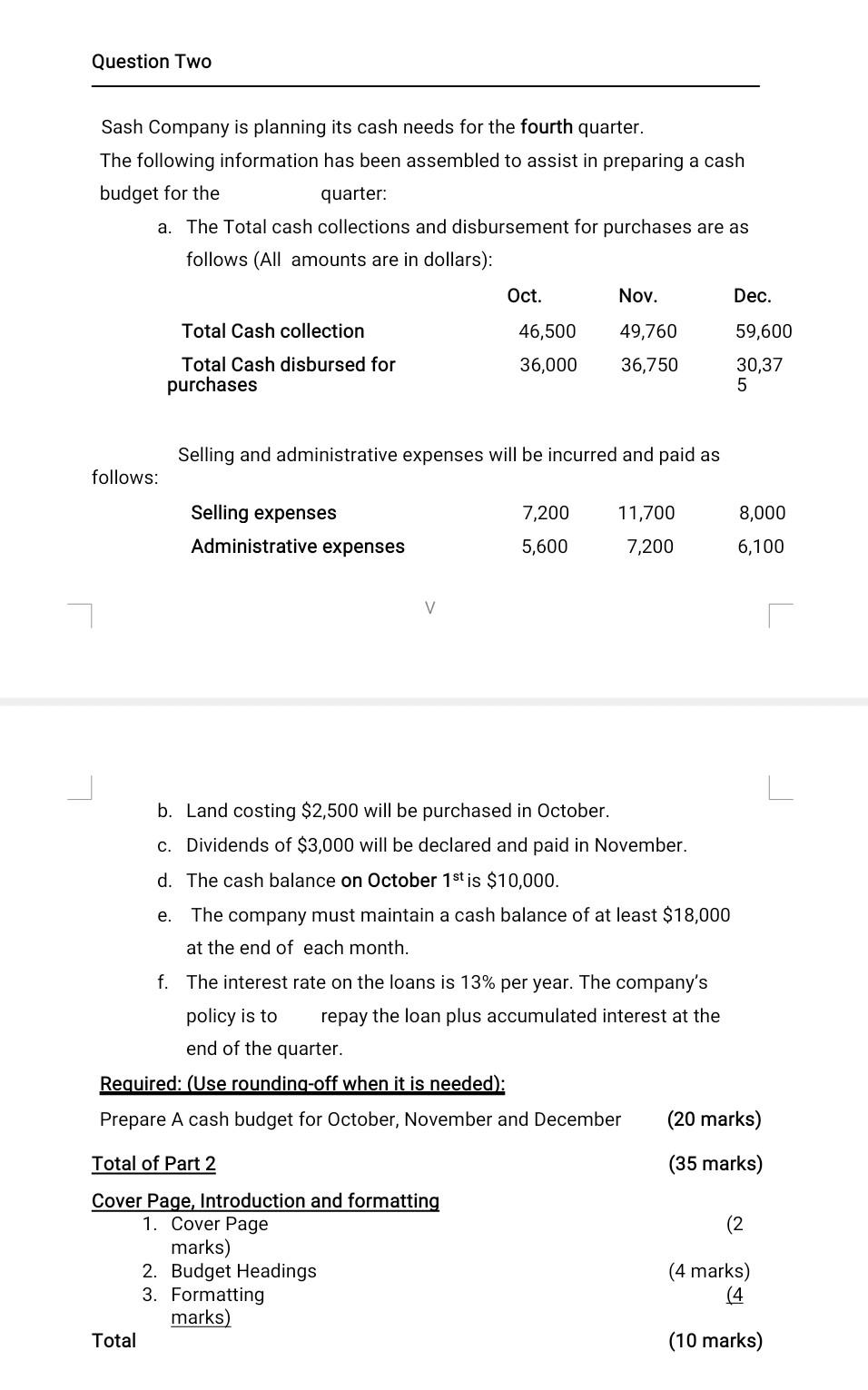

The data below pertains to the third quarter of Nevan Company which manufactures toy games. Below is the estimated sales (in units): a. The selling price of the toy game is $11 per unit. b. All sales are on account. Based on past experience, sales are collected in the following pattern: c. Sales for June totaled $400,000. d. The company maintains finished goods inventories equal to 25% of the following month's sales. This requirement will be met at the end of June. e. Each toy game requires 3 pounds of raw materials. f. The company requires that the ending inventory of raw materials be equal to 10% of the following month's production needs. g. The raw material costs $1.60 per pound. h. 40% of a month's purchases of raw materials is paid for in the month of IIII the purchase; the remainder is paid for in the following month. i. The Accounts Payable on June 30 will be $85,000. Durham Inc. is a wholesale distributor of beach chairs. Peak sales occur in May of each year as shown in the company's sales budget below for the second quarter: From past experience, the company has learned that 35% of a month's sales are collected in the month of sale, 55% are collected in the month following sale, and the remaining 10% are collected in the second month following sale. February sales totaled $500,000 and March sales totaled $600,000. Required: Prepare a Schedule of Expected Cash Collections from the sales for each month (April, May and June). Sash Company is planning its cash needs for the fourth quarter. The following information has been assembled to assist in preparing a cash budget for the quarter: a. The Total cash collections and disbursement for purchases are as follows (All amounts are in dollars): Selling and administrative expenses will be incurred and paid as follows: b. Land costing $2,500 will be purchased in October. c. Dividends of $3,000 will be declared and paid in November. d. The cash balance on October 1st is $10,000. e. The company must maintain a cash balance of at least $18,000 at the end of each month. f. The interest rate on the loans is 13% per year. The company's policy is to repay the loan plus accumulated interest at the end of the quarterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started