I need some help on 22,24,30.38 and 40 please im stuck, please show work!

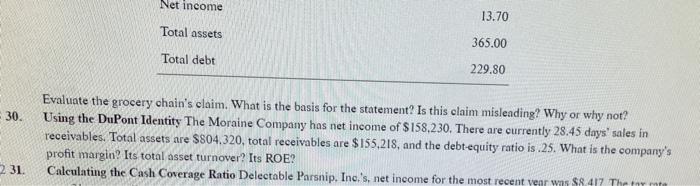

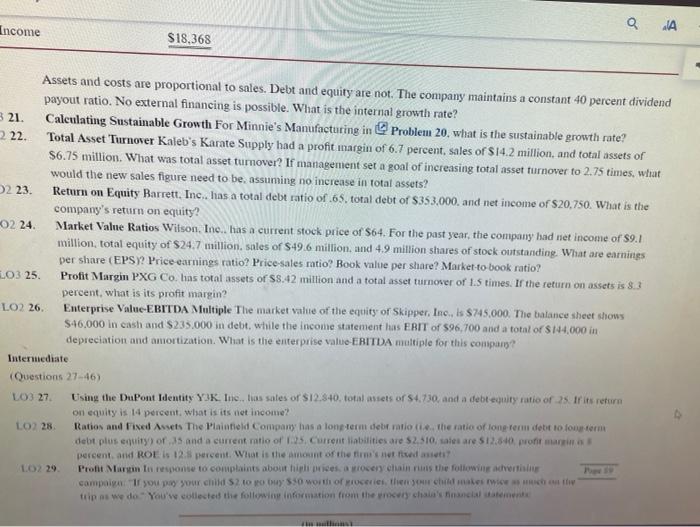

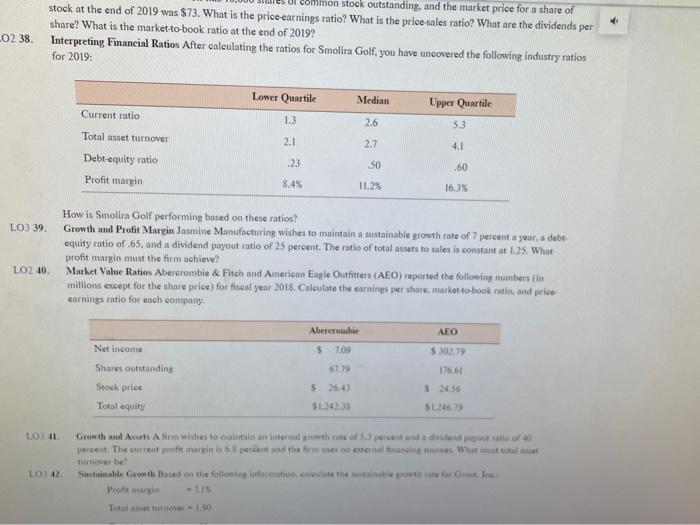

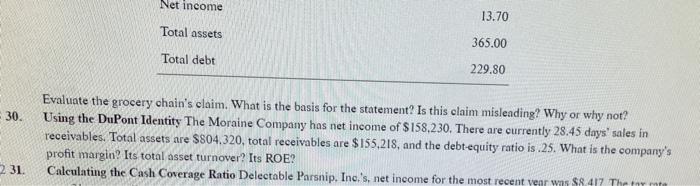

a A Income $18,368 Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 40 percent dividend payout ratio. No external financing is possible. What is the internal growth rate? 3 21. Calculating Sustainable Growth For Minnie's Manufacturing in Problem 20, what is the sustainable growth rate? 2 22. Total Asset Turnover Kaleb's Karate Supply had a profit margin of 6.7 percent, sales of $14.2 million, and total assets of $6.75 million. What was total asset turnover? If management set a goal of increasing total asset turnover to 2.75 times, what would the new sales figure need to be assuming no increase in total assets? 2 23 Return on Equity Barrett. Inc. has a total debt ratio of 65, total debt of $353,000, and net income of $20,750. What is the company's return on equity? 02 24. Market Value Ratios Wilson, Inc. has a current stock price of $64. For the past year, the company had net income of 89.1 million total equity of $24.7 million, sales of $49.6 million, and 4.9 million shares of stock outstanding. What are earnings per share (EPS)? Price earnings ratio? Price sales ratio? Book value per share? Market to book ratio? 203 25 Profit Margin PXG Co. bas total assets of $8.42 million and a total asset turnover of 1.5 times. If the return on assets is 8.3 percent, what is its profit margin? LO2 26. Enterprise Value-EBITDA Multiple The market value of the equity of Skipper, Inc., is $745,000. The balance sheet shows $46,000 in cash and S235.000 in debt, while the income statement has EBIT of 596,700 and a total of 144,000 in depreciation and amortization. What is the enterprise value EBITDA multiple for this company? Intermediate Questions 27-46) LO3 27 Using the DuPont Identity YIK. Imelissates or 12.840. total assets or 1.730, and a debrequity ratio of 25 ir its retorn on equity is 14 percent, what is its net income? LO228 Ratios and Fixed Assets The Painted Company has a long-term debe ratio i. the ratio of long term debt to form debt plus equity or 5 and a current ratio of 1:25. Current liabilities are $2.510 sales are $12.540 pont marin percent and ROE is 12.1 percent. What is the amount of the first editi LO229 Profit Martin la response to complaints about hip prices a wrocery chain is the following advertising campaign. If you pay your child to po buy S10 worth of proceries, the child makes wie schon trip as we do. You'w collected the following information from the my channel ten mon stock outstanding, and the market price for a share of stock at the end of 2019 was $73. What is the priccearnings ratio? What is the price sales ratio? What are the dividends per share? What is the market-to-book ratio at the end of 2019? 20238. Interpreting Financial Ratios After calculating the ratios for Smolira Golf, you have uncovered the following industry ratios for 2019: Lower Quartile Median Current ratio Upper Quartile 5.3 1.3 2.6 Total asset turnover 2.1 2.7 .23 .50 Debt-equity ratio Profit margin .60 8.4% 11.2% 16.3% LO) 39. How is Smolira Golf performing based on these ratios? Growth and Protit Margin Jasmine Manufacturing wishes to maintain a sustainable growth rate of 7 percent a year, a debe equity ratio of 65, and a dividend payout ratio of 25 percent. The ratio of total assets to sales is constant at 1.25. Wat profit margin must the firm achieve Market Value Ratios Abercrombie & Fitch and American Eagle Outfitters (AEO) reported the following numbers in million except for the share price for final year 2018. Caloutate the earnings per share, market to book ratio, and price earnings ratio for each company LO2 10. Abercrombie AEO $ 709 $302.19 67.79 176.61 Net income Shares outstanding Stock price Total equity 5 263 $1,242 33 SLM619 LO) 41 LO2 Growth Aves Afirm wishes to maintain an internal in the of spect and added to of percent. The current profitaris perdent and then we gources. What total turbe Sustainable Growth Based on the following information calculate the table of Groot Profit Totaltungs- 1.90 Net income 13.70 Total assets 365.00 Total debt 229.80 30. Evaluate the grocery chain's claim. What is the basis for the statement? Is this claim misleading? Why or why not? Using the DuPont Identity The Moraine Company has net income of $158,230. There are currently 28.45 days' sales in receivables. Total assets are $804.320, total receivables are $155,218, and the debt-equity ratio is.25. What is the company's profit margin? Its total asset turnover? Its ROE! Calculating the Cash Coverage Ratio Delectable Parsnip, Inc.'s, net income for the most recent vear was $8.417 The forme 231

I need some help on 22,24,30.38 and 40 please im stuck, please show work!

I need some help on 22,24,30.38 and 40 please im stuck, please show work!