I need support to solve problems 2,3&6

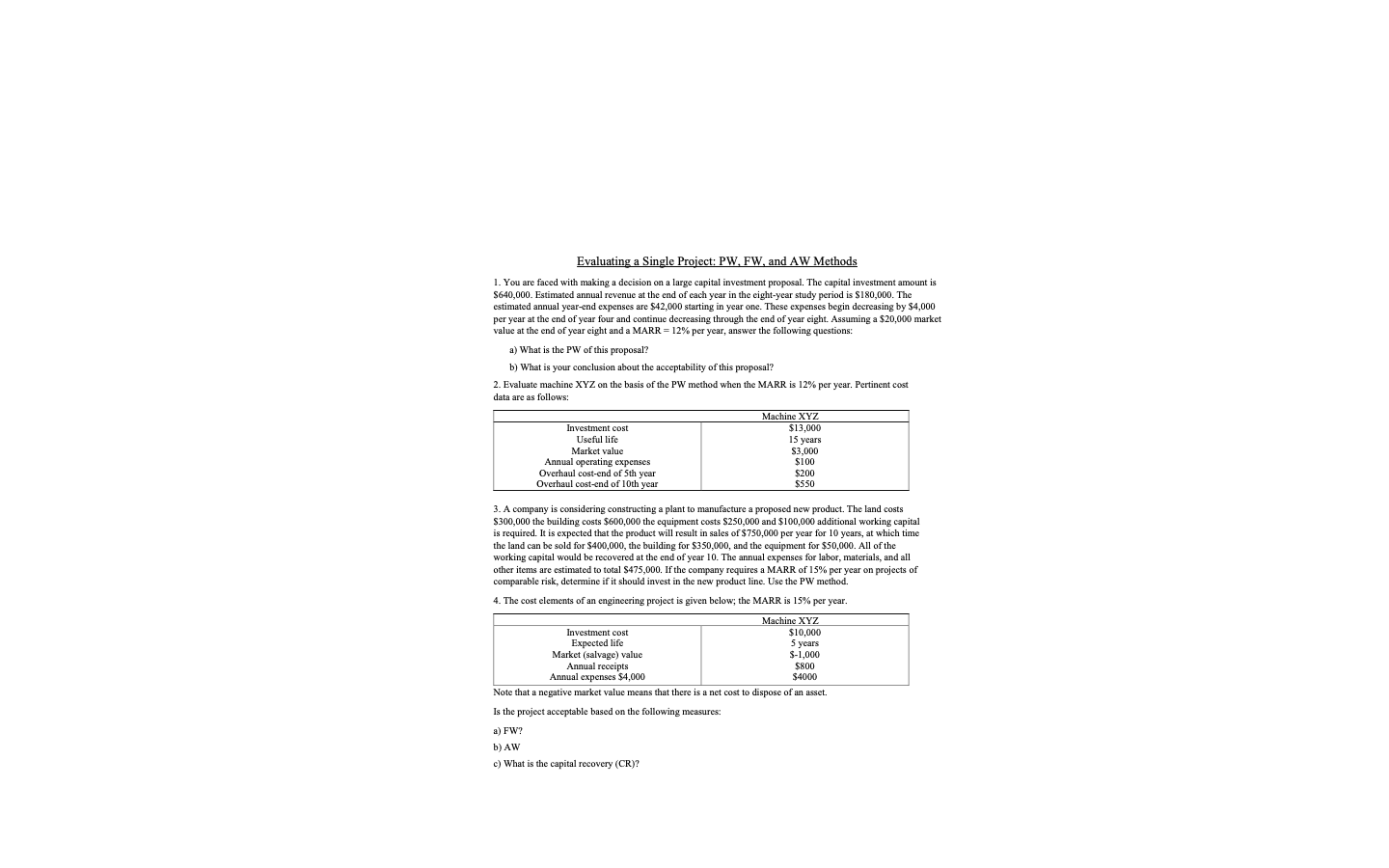

Evaluating a Single Project: PW. FW, and AW Methods 1. You are faced with making a decision on a large capital investment proposal. The capital investment amount is $640,000. Estimated annual revenue at the end of each year in the eight-year study period is $180,000. The estimated annual year-end expenses are $42,000 starting in year one. These expenses begin decreasing by $4,000 per year at the end of year four and continue decreasing through the end of year eight. Assuming a $20,000 market value at the end of year eight and a MARR = 12% per year, answer the following questions: a) What is the PW of this proposal? b) What is your conclusion about the acceptability of this proposal? 2. Evaluate machine XYZ on the basis of the PW method when the MARR is 12% per year. Pertinent cost data are as follows: Machine XYZ nvestment cost $13,000 Useful life IS years Market value $3,000 Annual operating expenses $100 Overhaul cost-end of 5th year $20 Overhaul cost-end of 10th year $550 3. A company is considering constructing a plant to m anufacture a proposed new product. The land costs $300,000 the building costs $600,000 the equipment costs $250,000 and $100,000 additional working capital is required. It is expected that the product will result in sales of $750,000 per year for 10 years, at which time the land can be sold for $400,000, the building for $350,000, and the equipment for $50,000. All of the working capital would be recovered at the end of year 10. The annual expenses for labor, materials, and all other items are estimated to total $475,000. If the company requires a MARR of 15% per year on projects of comparable risk, determine if it should invest in the new product line. Use the PW method. 4. The cost elements of an engineering project is given below; the MARR is 15% per year. nvestment cost Machine XYZ $10,000 Expected life 5 years Market (salvage) value Annual receipts $800 Annual expenses $4,000 $4000 Note that a negative market value means that there is a net cost to dispose of an asset. Is the project acceptable based on the following measures: a) FW? b) AW c) What is the capital recovery (CR)?5. What is the CW, when i = 10% per year, of $1,500 per year, starting in year one and continuing forever, and $10,000 in year five, repeating every four years thereafter, and continuing forever? 6. A city is spending $20 million on a new sewage system. The expected life of the system is 40 years, and it will have no market value at the end of its life. Operating and maintenance expenses for the system are projected to average $0.6 million per year. If the city's MARR is 8% per year, what is the capitalized worth of the system over a 120-year study period? 7. A foundation was endowed with $15,000,000 in July 2010. In July 2014, $5,000,000 was expended for facilities, and the operating expenses are $250,000 at the end of each year forever. The first operating expense is in July 2015, and the first replacement expense in July 2014. If all money earns interest at 5% after the time of endowment, what amount would be available for the capital replacements at the end of every fifth year forever? (Hint: Draw a cash-flow diagram first.)