Answered step by step

Verified Expert Solution

Question

1 Approved Answer

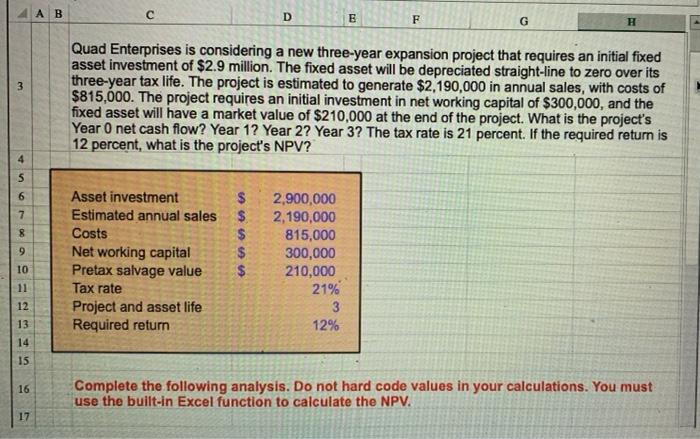

I need the actual excel formula to calculate the answers not just the answers. thanks A B D E F G 3 Quad Enterprises is

I need the actual excel formula to calculate the answers not just the answers. thanks

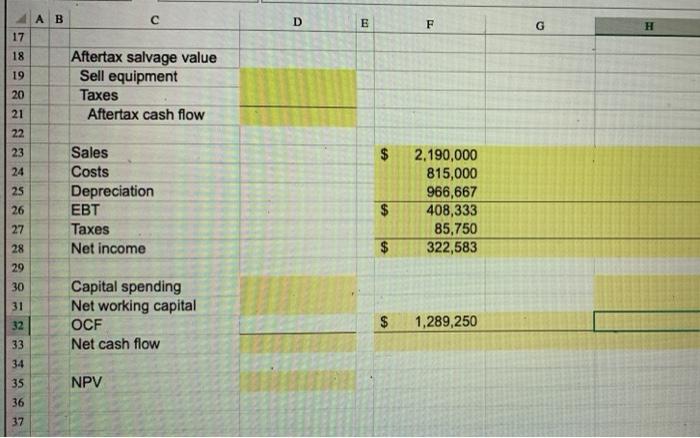

A B D E F G 3 Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life. The project is estimated to generate $2,190,000 in annual sales, with costs of $815,000. The project requires an initial investment in net working capital of $300,000, and the fixed asset will have a market value of $210,000 at the end of the project. What is the project's Year 0 net cash flow? Year 12 Year 2? Year 3? The tax rate is 21 percent. If the required return is 12 percent, what is the project's NPV? 4 5 6 7 8 Asset investment Estimated annual sales Costs Net working capital Pretax salvage value Tax rate Project and asset life Required return $ $ $ $ $ 9 2,900,000 2,190,000 815,000 300,000 210,000 21% 3 12% 10 11 12 13 14 15 16 Complete the following analysis. Do not hard code values in your calculations. You must use the built-in Excel function to calculate the NPV. 17 C D D E F G H 17 18 oc 19 Aftertax salvage value Sell equipment Taxes Aftertax cash flow 20 21 22 23 $ 24 25 Sales Costs Depreciation EBT Taxes Net income 2,190,000 815,000 966,667 408,333 85,750 322,583 26 $ 27 28 $ 29 30 31 32 Capital spending Net working capital OCF Net cash flow $ 1,289,250 33 34 35 NPV 36 37

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started