Answered step by step

Verified Expert Solution

Question

1 Approved Answer

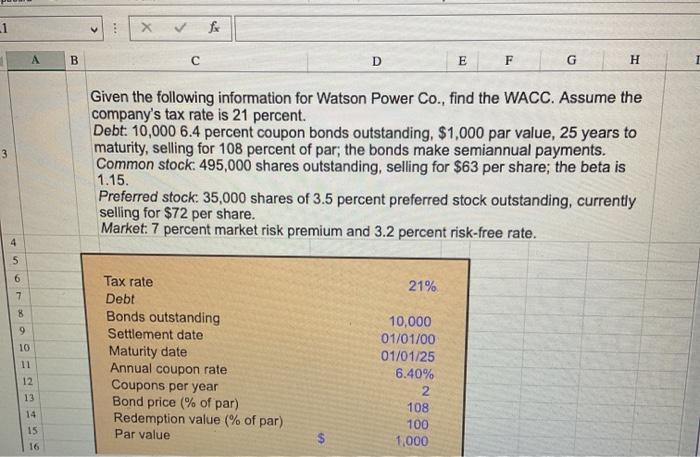

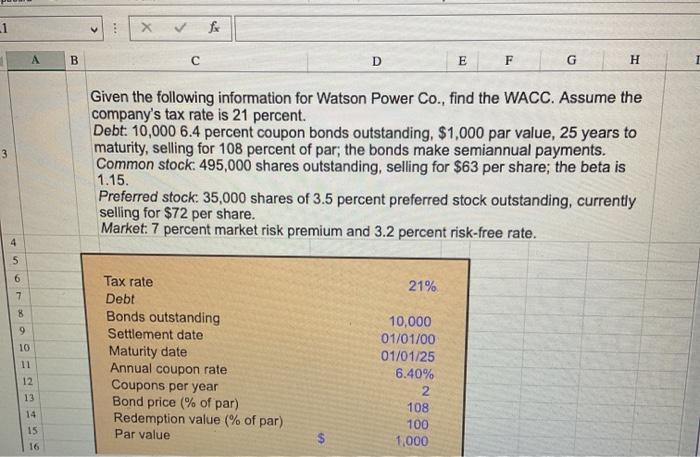

I need the answer as excel formulas. 1 fx B D E F G H 3 Given the following information for Watson Power Co., find

I need the answer as excel formulas.

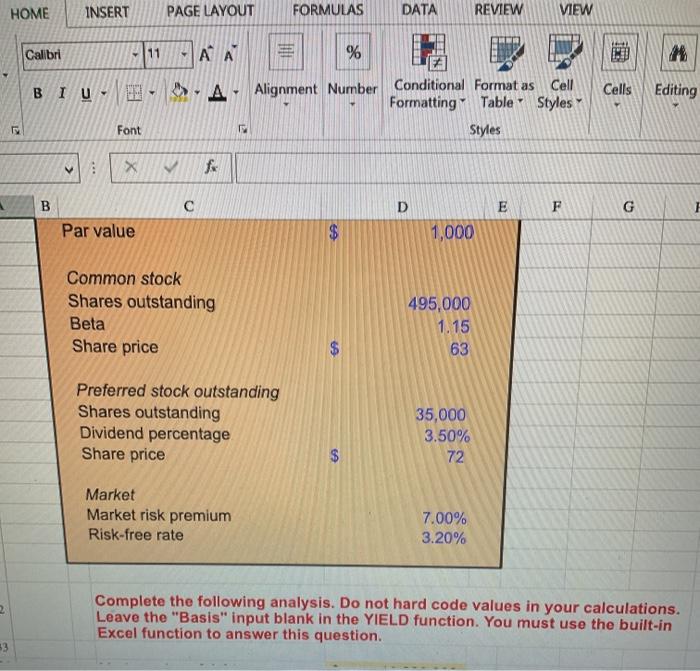

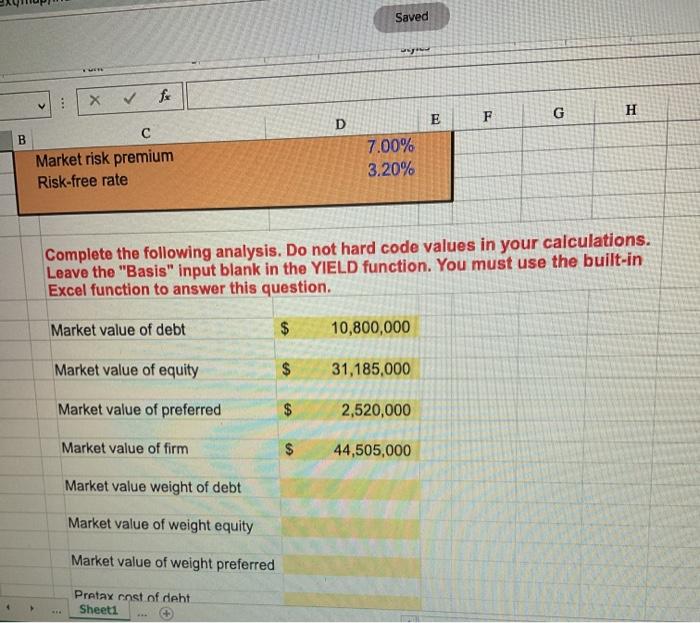

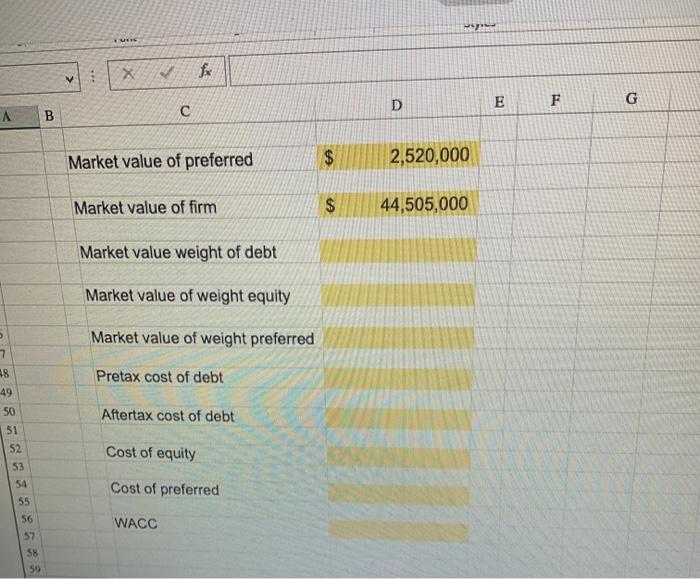

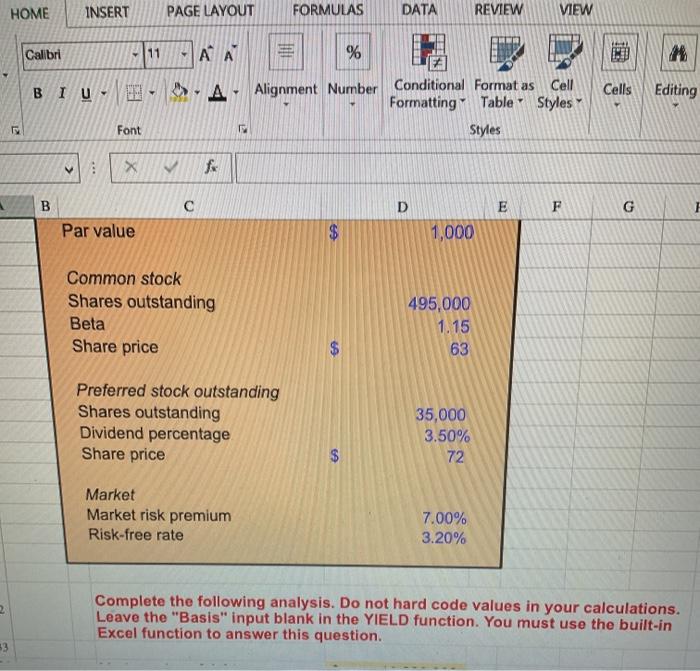

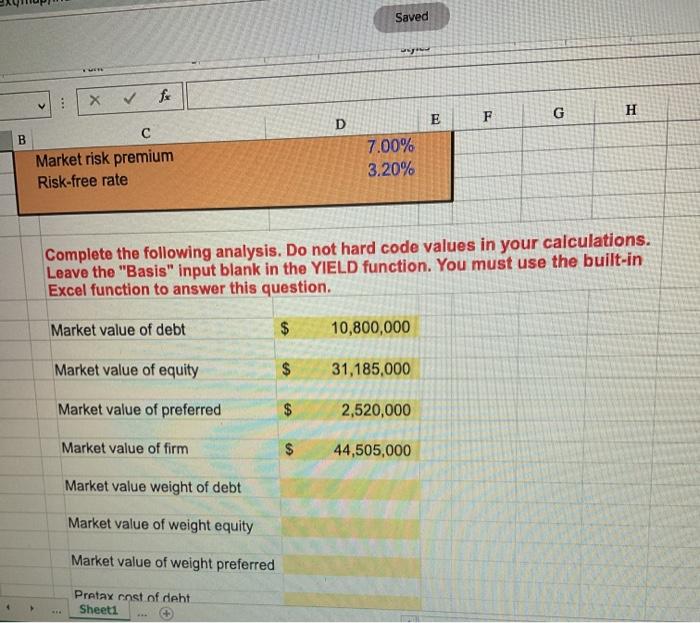

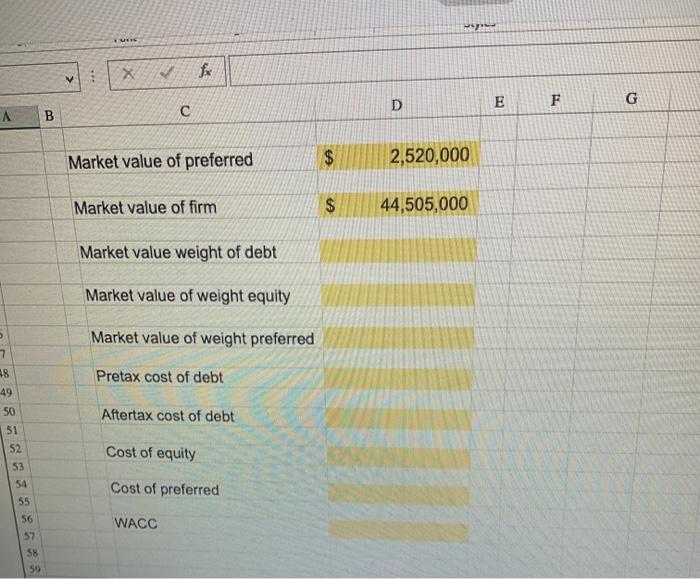

1 fx B D E F G H 3 Given the following information for Watson Power Co., find the WACC. Assume the company's tax rate is 21 percent. Debt: 10,000 6.4 percent coupon bonds outstanding, $1,000 par value, 25 years to maturity, selling for 108 percent of par; the bonds make semiannual payments. Common stock: 495,000 shares outstanding, selling for $63 per share; the beta is 1.15. Preferred stock: 35,000 shares of 3.5 percent preferred stock outstanding, currently selling for $72 per share. Market: 7 percent market risk premium and 3.2 percent risk-free rate. 4 5 6 21% 7 8 9 10 Tax rate Debt Bonds outstanding Settlement date Maturity date Annual coupon rate Coupons per year Bond price % of par) Redemption value (% of par) Par value 12 13 10,000 01/01/00 01/01/25 6.40% 2 108 100 1,000 14 15 16 $ HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Calibri 11 % M BIU. Cells Editing Alignment Number Conditional Format as Cell Formatting Table Styles Styles Font X B D E F th I Par value 1,000 Common stock Shares outstanding Beta Share price 495,000 1.15 63 Preferred stock outstanding Shares outstanding Dividend percentage Share price 35,000 3.50% $ 72 Market Market risk premium Risk-free rate 7.00% 3.20% 2 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the YIELD function. You must use the built-in Excel function to answer this question. 33 Saved . : x & fr H G F D E B Market risk premium Risk-free rate 7.00% 3,20% Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the YIELD function. You must use the built-in Excel function to answer this question. Market value of debt $ 10,800,000 Market value of equity $ 31,185,000 Market value of preferred $ 2,520,000 Market value of firm $ 44,505,000 Market value weight of debt Market value of weight equity Market value of weight preferred Pretax cost of deht Sheet1 ws V E D F G B Market value of preferred $ 2,520,000 Market value of firm $ 44,505,000 Market value weight of debt Market value of weight equity Market value of weight preferred 5 7 18 Pretax cost of debt 49 50 Aftertax cost of debt 51 52 53 Cost of equity Cost of preferred 54 55 56 57 58 59 WACC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started