I need the answer as soon as possible

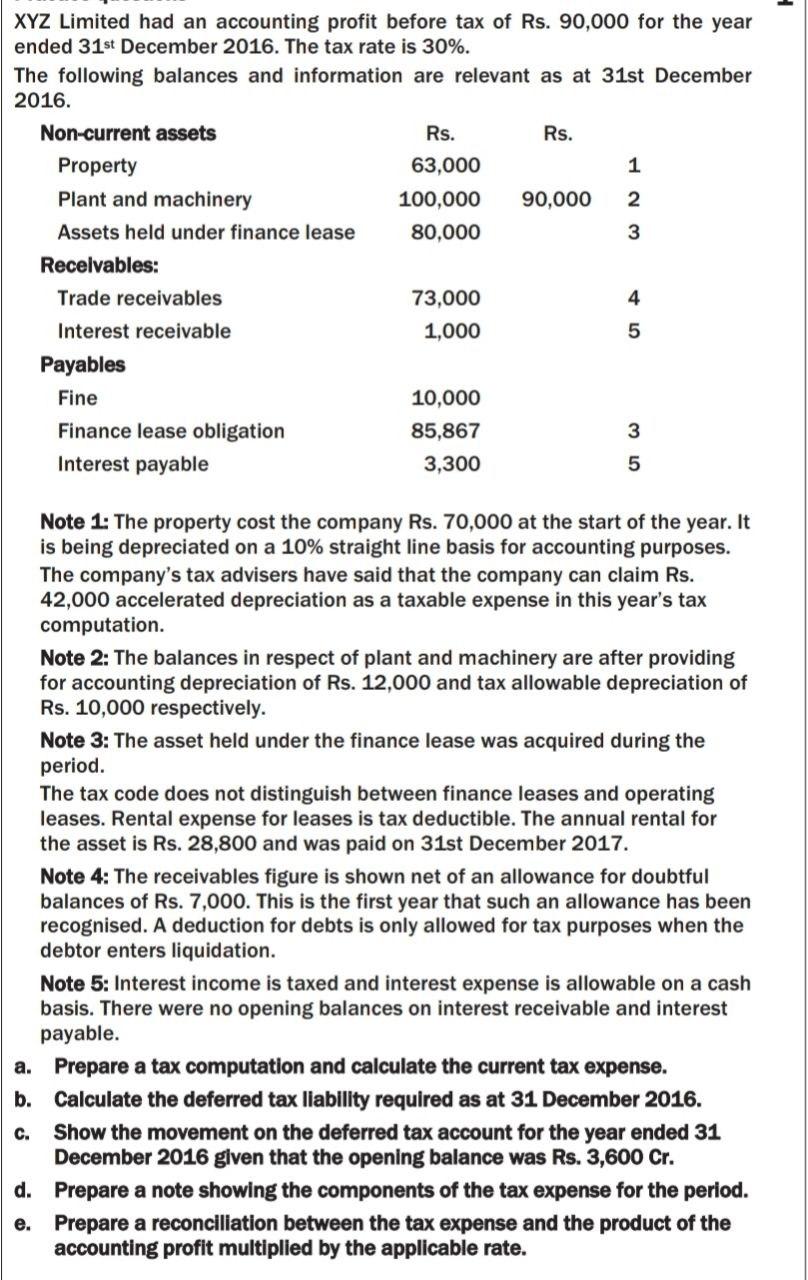

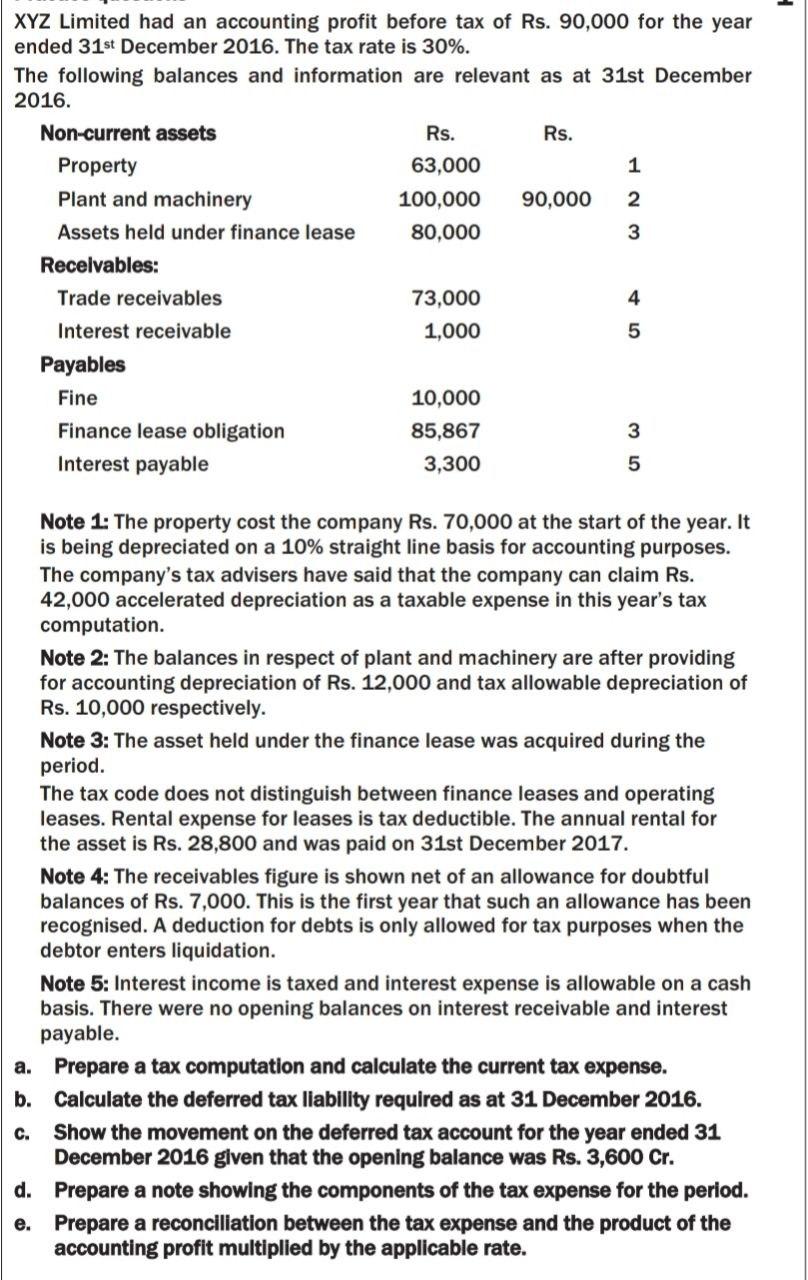

XYZ Limited had an accounting profit before tax of Rs. 90,000 for the year ended 31st December 2016. The tax rate is 30%. The following balances and information are relevant as at 31st December 2016. Non-current assets Rs. Rs. Property 63,000 1 Plant and machinery 100,000 90,000 2 Assets held under finance lease 80,000 3 Receivables: Trade receivables 73,000 4 Interest receivable 1,000 5 Payables Fine 10,000 Finance lease obligation 85,867 3 Interest payable 3,300 5 Note 1: The property cost the company Rs. 70,000 at the start of the year. It is being depreciated on a 10% straight line basis for accounting purposes. The company's tax advisers have said that the company can claim Rs. 42,000 accelerated depreciation as a taxable expense in this year's tax computation. Note 2: The balances in respect of plant and machinery are after providing for accounting depreciation of Rs. 12,000 and tax allowable depreciation of Rs. 10,000 respectively. Note 3: The asset held under the finance lease was acquired during the period. The tax code does not distinguish between finance leases and operating leases. Rental expense for leases is tax deductible. The annual rental for the asset is Rs. 28,800 and was paid on 31st December 2017. Note 4: The receivables figure is shown net of an allowance for doubtful balances of Rs. 7,000. This is the first year that such an allowance has been recognised. A deduction for debts is only allowed for tax purposes when the debtor enters liquidation. Note 5: Interest income is taxed and interest expense is allowable on a cash basis. There were no opening balances on interest receivable and interest payable. a. Prepare a tax computation and calculate the current tax expense. b. Calculate the deferred tax liability required as at 31 December 2016. Show the movement on the deferred tax account for the year ended 31 December 2016 given that the opening balance was Rs. 3,600 Cr. d. Prepare a note showing the components of the tax expense for the period. e. Prepare a reconciliation between the tax expense and the product of the accounting profit multiplied by the applicable rate. C