Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the answers for all the above 9 questions. Course: Fundamentals of Finance 52 Price today Y (18) Consider two securities that have the

I need the answers for all the above 9 questions.

Course: Fundamentals of Finance

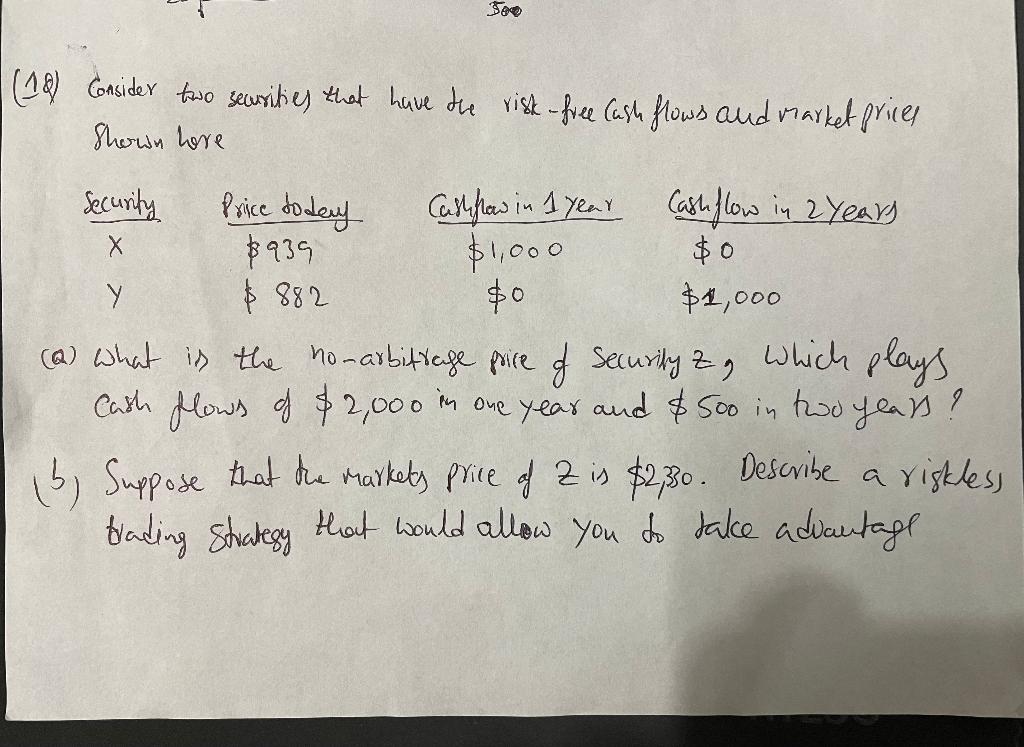

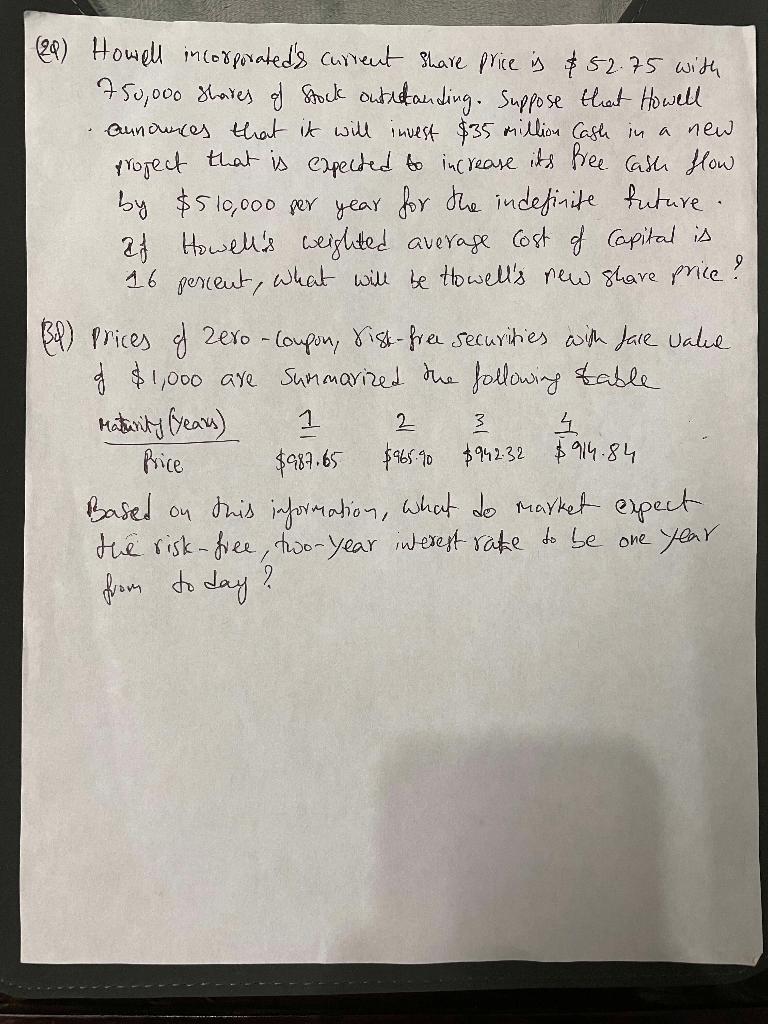

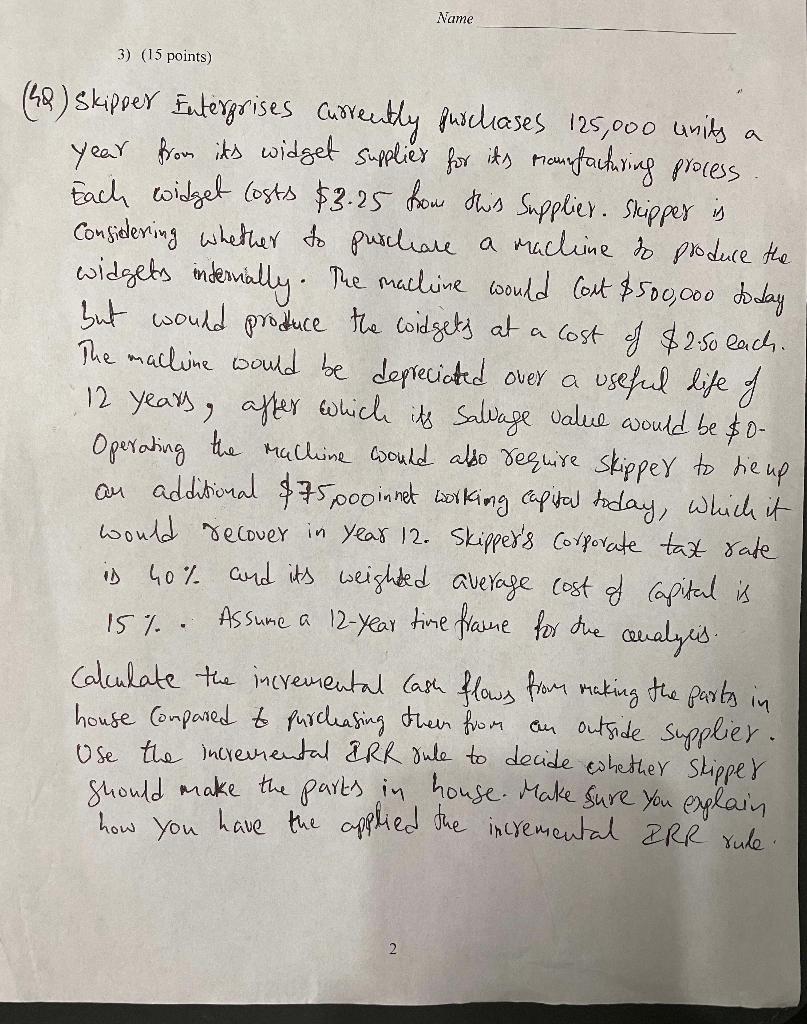

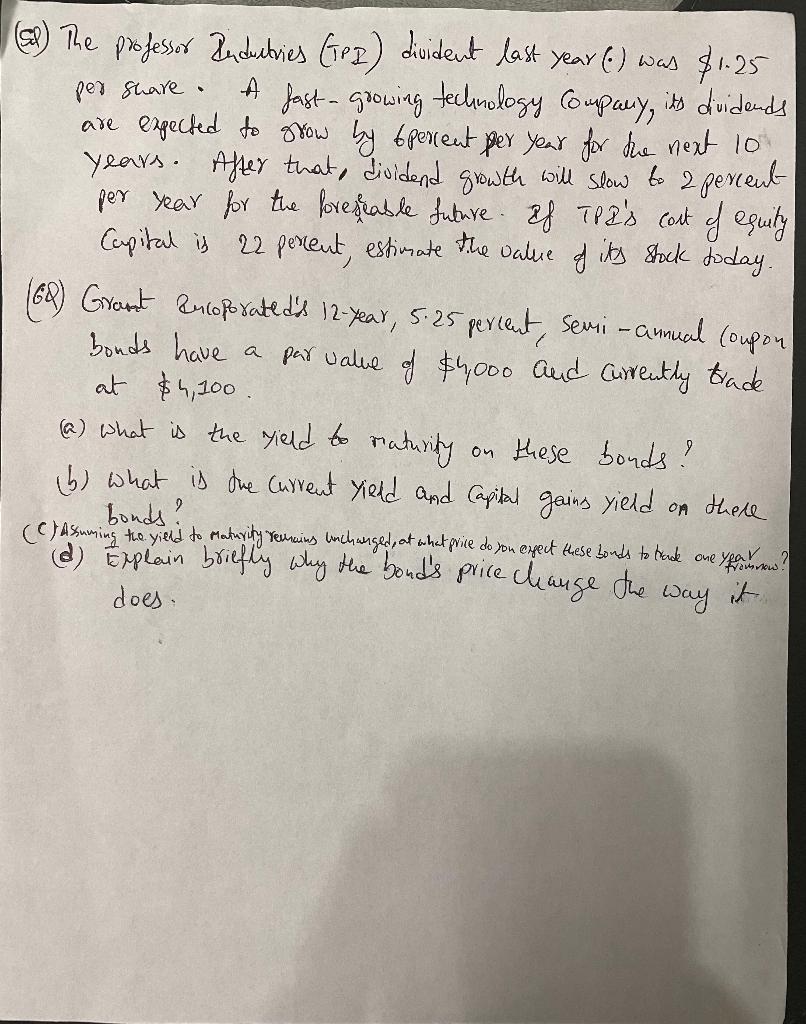

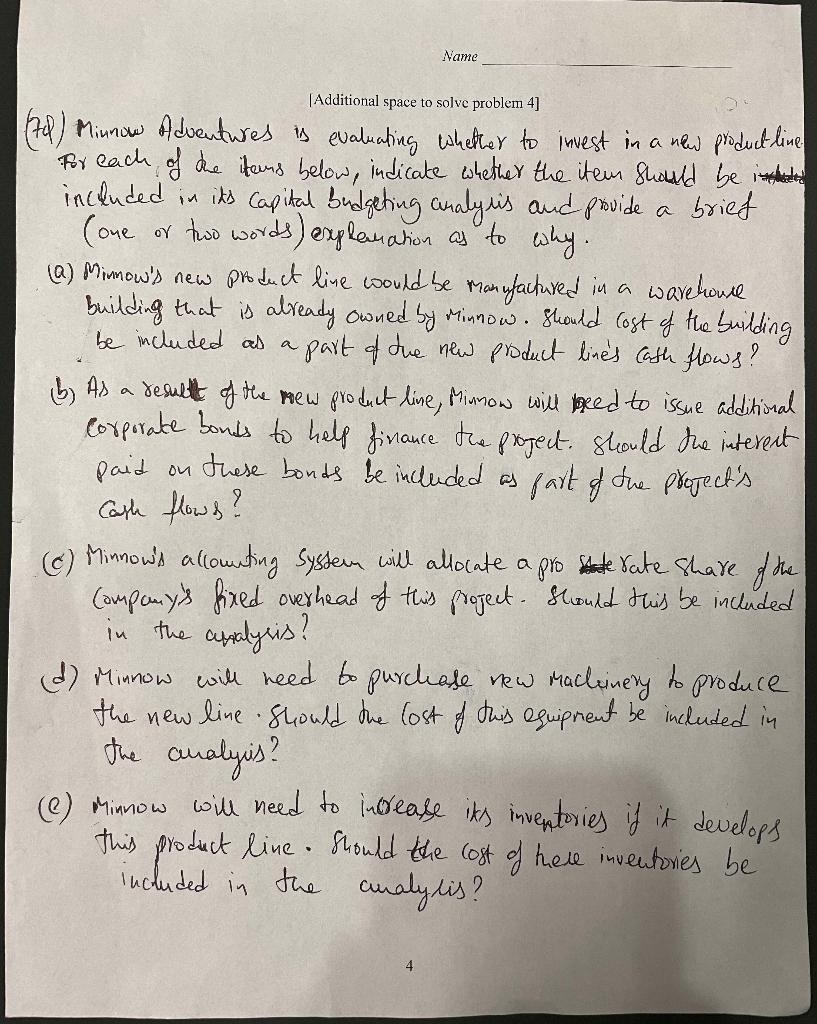

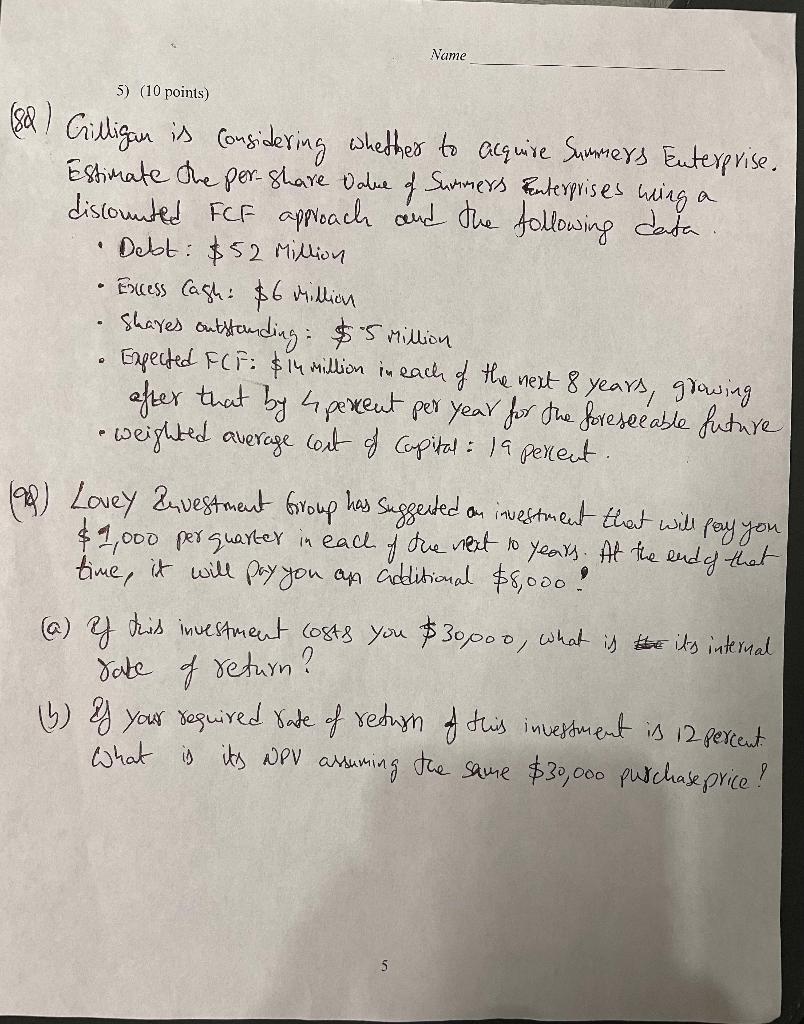

52 Price today Y (18) Consider two securities that have the rist-free Cash flows and market prices Shown wore Security Call flow in 1 year Cash flow in 2 years $935 $1,000 $0 $882 $0 $1,000 (a) What is the no-arbitrage price of security z which plays, 2 cash flows of $2,000 in one year and $500 in the yeas? (3) Suppose that the markets price of Z is $2,30. Describe a riskless trading Strategy that would allow you to take advantage (29) Howell incorporated's current share price is $52.75 with 750,000 shares of Stock outelanding. Suppose that Howell announces that it will invest $35 million Cash in a new project that is expected to increase its free cash flow by $510,000 per year for the indefinite future. If Howell's weighted average cost of capital is 16 percent, what will be towell's new share price? Bl) Prices of Zero - coupon, dist-free securities with face value of $1,000 are summarized the following table Maturity fears) 1 Price $987.65 $965.90 $942.32 $14.84 Based on this information, what do market expect the risk-free, two-year interest rate to be one year from today 2 2 3 Name 3) (15 points) (48) Skipper Euterprises currently furclases 125,000 units a year from its widget Supplies for its raunfacturing process Each widget costs $3.25 hom this supplier. Skippes is Considering whether to purchase a machine to produce the widgets internally. The mallion would cost $500,000 today but would produce the widgets at cost of $2.50 each. The malline would be depreciated over a useful life of 12 years after which its salvage value would be 80- Operating the machine would also require skipper to dieup an additional $75,000 innet working capital today, which it would recover in year 12. Skipper's corporate tax rate is 40% cond its weighted average cost of capital is 15%. Assume a 12-year time frame for the analges. Calculate the incremental cash flows from reaking the parts in house compared to purchasing their from an outside supplier. Use the incremental &RR sule to decide whether Skipper should make the parts in house. Make sure you explain how you have the applied the incremental IRR sule. A (51) The professor Industries (IPB) divident last year () was $1.25 per share. A fast-growing technology Company, its duidends are expected to grow by 6 percent per year for the next 10 years. After that, dividend growth will slow to 2 percent per year for the forefrable future. If TP2's cost of equity Capital is 22 percent, estimate the value of its stock today. (68) Grant ancoporated's 12-year, 5.25 percent, semi-annual coupon bonds have a par value of $4,000 and currently trade at $4,100. (a) What is the yield to raturity on these bonds ? b) what is the current yield and capital gains yield on there (C) Assuming the yield to Maturity rewrains wichwanged, at what price do you expect these bonds to bande (2) Explain briefly why the bonds price change the way it does. 2 bonds ? oue 2 years now! Name [Additional space to solve problem 4] (th) Minnow Adventures is evaluating whether to invest in a new product line for each of the itens below, indicate whether the item should be in included in its capital Budgeting analysis and provide a brief (one or two words) explanation as to why. (a) Minnow's new product live would be manufactured in a warehouse building that is already owned by rinnow. should cost of the building be included as a part of the new product line's cash flows? & As a result of the new product line, Minnow will need to issue additional corporate bonds to help finance the project. should de interest paid on these bonds be included as part of the project's Cash flows ? (6) Minnow's alcounting system will allocate a probate rate share of the company's fixed overhead of this project. Should this be included in the analysis? d) Minnow will need to purchase new machinery to produce the new line Should the cost of this equipment be included in the analyus? (1) Minnow will need to increase its inventories if it develops this product line. Should the cost of here inventories be included in the analylis? 1 4 Name 5) (10 points) ( . sal Gilligan is considering whether to acquire Summers Enterprise. Estimate the per-share Value of Surmers Renterprises wing a discounted FCF approach and the following data Debt: $52 Million Excess cagh: $6 Million shares outstanding : $.5 Million Expected FCF: $14 million in each of the next 8 years, growing after that by 4 percent per year for the foreseeable future weighted average cost of capital: la penent. (98) Lovey & vestment Group has suggested on investment that will pay you $1,000 per quarter in each of the next to years. At the end of that time, it will pay you an additional $8,000 ? (a) y des investment costs you $30poo, what is the its internal date of return? 4) Y your required date of return of this investment is 12 percent What is its NPV assuring the same $30,000 purchase price? 5 52 Price today Y (18) Consider two securities that have the rist-free Cash flows and market prices Shown wore Security Call flow in 1 year Cash flow in 2 years $935 $1,000 $0 $882 $0 $1,000 (a) What is the no-arbitrage price of security z which plays, 2 cash flows of $2,000 in one year and $500 in the yeas? (3) Suppose that the markets price of Z is $2,30. Describe a riskless trading Strategy that would allow you to take advantage (29) Howell incorporated's current share price is $52.75 with 750,000 shares of Stock outelanding. Suppose that Howell announces that it will invest $35 million Cash in a new project that is expected to increase its free cash flow by $510,000 per year for the indefinite future. If Howell's weighted average cost of capital is 16 percent, what will be towell's new share price? Bl) Prices of Zero - coupon, dist-free securities with face value of $1,000 are summarized the following table Maturity fears) 1 Price $987.65 $965.90 $942.32 $14.84 Based on this information, what do market expect the risk-free, two-year interest rate to be one year from today 2 2 3 Name 3) (15 points) (48) Skipper Euterprises currently furclases 125,000 units a year from its widget Supplies for its raunfacturing process Each widget costs $3.25 hom this supplier. Skippes is Considering whether to purchase a machine to produce the widgets internally. The mallion would cost $500,000 today but would produce the widgets at cost of $2.50 each. The malline would be depreciated over a useful life of 12 years after which its salvage value would be 80- Operating the machine would also require skipper to dieup an additional $75,000 innet working capital today, which it would recover in year 12. Skipper's corporate tax rate is 40% cond its weighted average cost of capital is 15%. Assume a 12-year time frame for the analges. Calculate the incremental cash flows from reaking the parts in house compared to purchasing their from an outside supplier. Use the incremental &RR sule to decide whether Skipper should make the parts in house. Make sure you explain how you have the applied the incremental IRR sule. A (51) The professor Industries (IPB) divident last year () was $1.25 per share. A fast-growing technology Company, its duidends are expected to grow by 6 percent per year for the next 10 years. After that, dividend growth will slow to 2 percent per year for the forefrable future. If TP2's cost of equity Capital is 22 percent, estimate the value of its stock today. (68) Grant ancoporated's 12-year, 5.25 percent, semi-annual coupon bonds have a par value of $4,000 and currently trade at $4,100. (a) What is the yield to raturity on these bonds ? b) what is the current yield and capital gains yield on there (C) Assuming the yield to Maturity rewrains wichwanged, at what price do you expect these bonds to bande (2) Explain briefly why the bonds price change the way it does. 2 bonds ? oue 2 years now! Name [Additional space to solve problem 4] (th) Minnow Adventures is evaluating whether to invest in a new product line for each of the itens below, indicate whether the item should be in included in its capital Budgeting analysis and provide a brief (one or two words) explanation as to why. (a) Minnow's new product live would be manufactured in a warehouse building that is already owned by rinnow. should cost of the building be included as a part of the new product line's cash flows? & As a result of the new product line, Minnow will need to issue additional corporate bonds to help finance the project. should de interest paid on these bonds be included as part of the project's Cash flows ? (6) Minnow's alcounting system will allocate a probate rate share of the company's fixed overhead of this project. Should this be included in the analysis? d) Minnow will need to purchase new machinery to produce the new line Should the cost of this equipment be included in the analyus? (1) Minnow will need to increase its inventories if it develops this product line. Should the cost of here inventories be included in the analylis? 1 4 Name 5) (10 points) ( . sal Gilligan is considering whether to acquire Summers Enterprise. Estimate the per-share Value of Surmers Renterprises wing a discounted FCF approach and the following data Debt: $52 Million Excess cagh: $6 Million shares outstanding : $.5 Million Expected FCF: $14 million in each of the next 8 years, growing after that by 4 percent per year for the foreseeable future weighted average cost of capital: la penent. (98) Lovey & vestment Group has suggested on investment that will pay you $1,000 per quarter in each of the next to years. At the end of that time, it will pay you an additional $8,000 ? (a) y des investment costs you $30poo, what is the its internal date of return? 4) Y your required date of return of this investment is 12 percent What is its NPV assuring the same $30,000 purchase price? 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started