I need the answers to Questions 4 and 5. Or what the 0.1% higher and 0.15% lower mean.

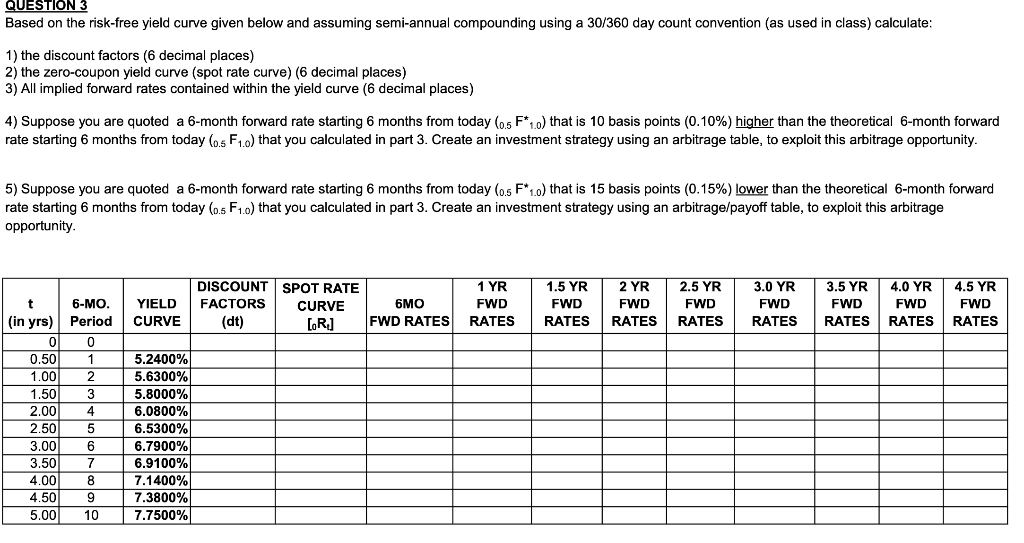

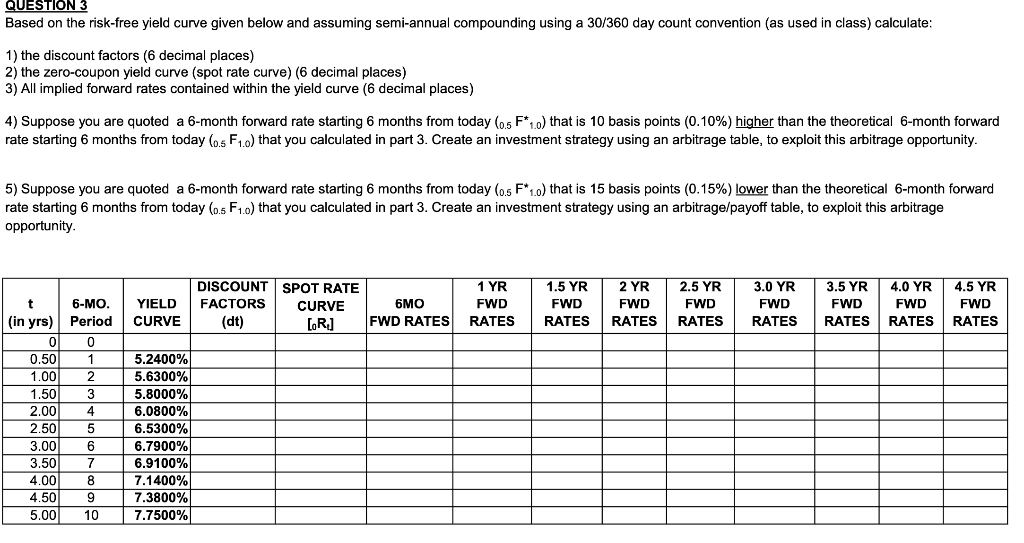

QUESTION 3 Based on the risk-free yield curve given below and assuming semi-annual compounding using a 30/360 day count convention (as used in class) calculate: 1) the discount factors (6 decimal places) 2) the zero-coupon yield curve (spot rate curve) (6 decimal places) 3) All implied forward rates contained within the yield curve (6 decimal places) 4) Suppose you are quoted a 6-month forward rate starting 6 months from today (0.5 F* 1.0) that is 10 basis points (0.10%) higher than the theoretical 6-month forward rate starting 6 months from today (0.5 F1.c) that you calculated in part 3. Create an investment strategy using an arbitrage table, to exploit this arbitrage opportunity. 5) Suppose you are quoted a 6-month forward rate starting 6 months from today (o.5 F*1.0) that is 15 basis points (0.15%) lower than the theoretical 6-month forward rate starting 6 months from today (0.5 F1.0) that you calculated in part 3. Create an investment strategy using an arbitrage/payoff table, to exploit this arbitrage opportunity YIELD CURVE DISCOUNT SPOT RATE FACTORS CURVE 6MO (dt) [R] FWD RATES 1 YR FWD RATES 1.5 YR FWD RATES 2 YR FWD RATES 2.5 YR FWD RATES 3.0 YR FWD RATES 3.5 YR 4.0 YR 4.5 YR FWD FWD FWD RATES RATES RATES t 6-MO. (in yrs) Period 0 0 0.50 1 1.00 2 1.50 3 2.00 4 2.50 5 3.00 6 3.50 7 4.00 8 4.50 9 9 5.00 10 5.2400% 5.6300% 5.8000% 6.0800% 6.5300% 6.7900% 6.9100% 7.1400% 7.3800% 7.7500% QUESTION 3 Based on the risk-free yield curve given below and assuming semi-annual compounding using a 30/360 day count convention (as used in class) calculate: 1) the discount factors (6 decimal places) 2) the zero-coupon yield curve (spot rate curve) (6 decimal places) 3) All implied forward rates contained within the yield curve (6 decimal places) 4) Suppose you are quoted a 6-month forward rate starting 6 months from today (0.5 F* 1.0) that is 10 basis points (0.10%) higher than the theoretical 6-month forward rate starting 6 months from today (0.5 F1.c) that you calculated in part 3. Create an investment strategy using an arbitrage table, to exploit this arbitrage opportunity. 5) Suppose you are quoted a 6-month forward rate starting 6 months from today (o.5 F*1.0) that is 15 basis points (0.15%) lower than the theoretical 6-month forward rate starting 6 months from today (0.5 F1.0) that you calculated in part 3. Create an investment strategy using an arbitrage/payoff table, to exploit this arbitrage opportunity YIELD CURVE DISCOUNT SPOT RATE FACTORS CURVE 6MO (dt) [R] FWD RATES 1 YR FWD RATES 1.5 YR FWD RATES 2 YR FWD RATES 2.5 YR FWD RATES 3.0 YR FWD RATES 3.5 YR 4.0 YR 4.5 YR FWD FWD FWD RATES RATES RATES t 6-MO. (in yrs) Period 0 0 0.50 1 1.00 2 1.50 3 2.00 4 2.50 5 3.00 6 3.50 7 4.00 8 4.50 9 9 5.00 10 5.2400% 5.6300% 5.8000% 6.0800% 6.5300% 6.7900% 6.9100% 7.1400% 7.3800% 7.7500%