Answered step by step

Verified Expert Solution

Question

1 Approved Answer

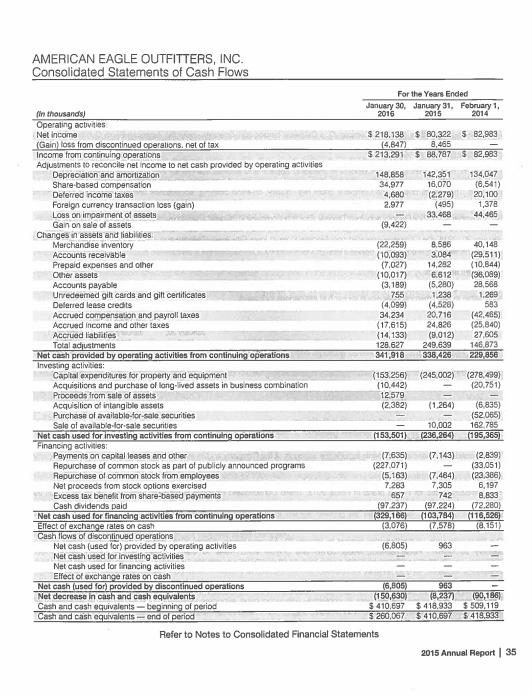

Current Ratio Current Assets/ Current Liabilities AR Ratio Net Credit Sales/Avg AR Inventory Ratio Sales/Average Inventory Working Capital Ratio Current Assents - Current Liabilities Debt

| Current Ratio | Current Assets/ Current Liabilities |

| AR Ratio | Net Credit Sales/Avg AR |

| Inventory Ratio | Sales/Average Inventory |

| Working Capital Ratio | Current Assents - Current Liabilities |

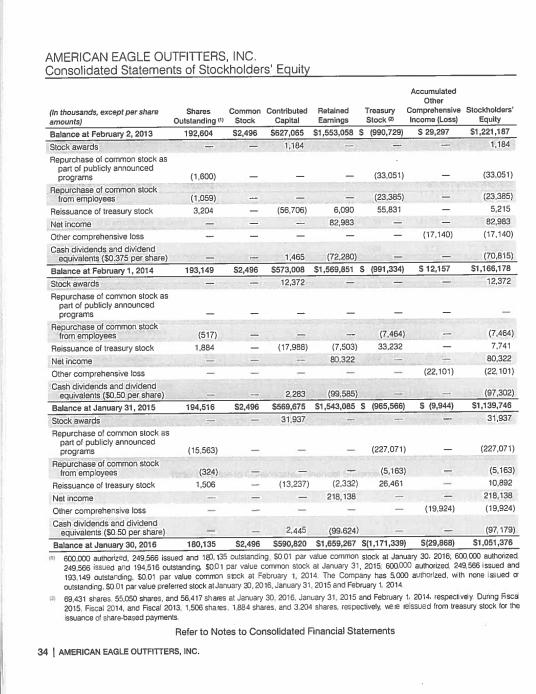

| Debt to Equity | Total Liabilities/Total Stockholders Equity |

| Plant to Long term Liabilities | Net Plant Assets/Long-Term Liabilities |

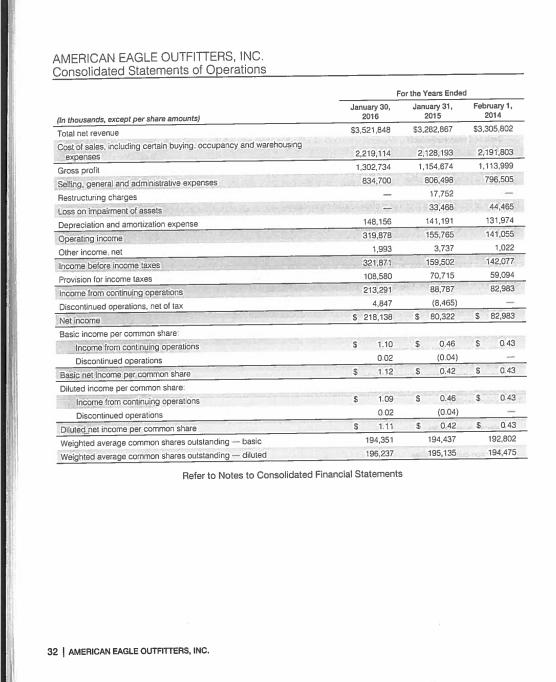

| Net Margin | Net Income/Net Sales |

| RoE | Net Income/Avg Common Shares Outstanding |

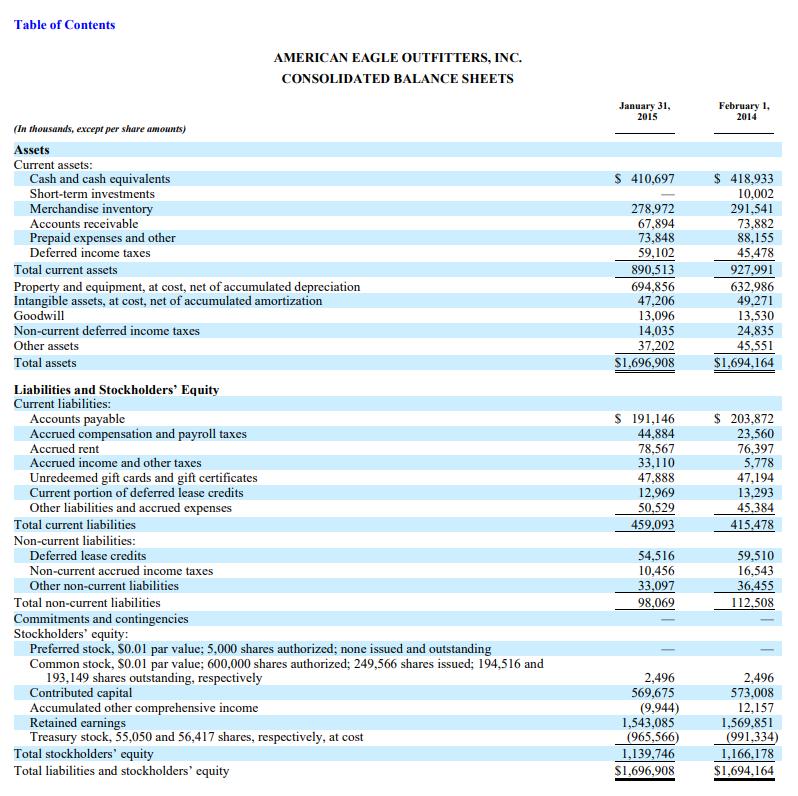

Table of Contents AMERICAN EAGLE OUTFITTERS, INC. CONSOLIDATED BALANCE SHEETS January 31, 2015 February 1, 2014 (In thousands, except per share amounts) Assets Current assets: Cash and cash equivalents S 410,697 $ 418,933 10,002 291,541 73,882 88,155 45,478 Short-term investments | Merchandise inventory 278,972 67,894 73,848 59,102 890,513 Accounts receivable Prepaid expenses and other Deferred income taxes Total current assets 927,991 694,856 47,206 13,096 14,035 632,986 49,271 13,530 24,835 45,551 $1,694,164 Property and equipment, at cost, net of accumulated depreciation Intangible assets, at cost, net of accumulated amortization Goodwill Non-current deferred income taxes Other assets 37,202 S1,696,908 Total assets Liabilities and Stockholders' Equity Current liabilities: S$ 191,146 44,884 $ 203,872 23,560 76,397 5,778 47,194 13,293 45,384 Accounts payable Accrued compensation and payroll taxes Accrued rent 78,567 33,110 47,888 12,969 50,529 459,093 Accrued income and other taxes Unredeemed gift cards and gift certificates Current portion of deferred lease credits Other liabilities and accrued expenses Total current liabilities 415.478 Non-current liabilities: 54,516 10,456 33,097 Deferred lease credits 59,510 16,543 Non-current accrued income taxes Other non-current liabilities 36.455 Total non-current liabilities 98,069 112,508 Commitments and contingencies Stockholders' equity: Preferred stock, S0.01 par value; 5,000 shares authorized; none issued and outstanding Common stock, S0.01 par value; 600,000 shares authorized; 249,566 shares issued; 194,516 and 193,149 shares outstanding, respectively Contributed capital Accumulated other comprehensive income Retained earnings Treasury stock, 55,050 and 56,417 shares, respectively, at cost Total stockholders' equity Total liabilities and stockholders' equity 2,496 569,675 (9,944) 1,543,085 (965,566) 1,139,746 S1,696,908 2,496 573,008 12,157 1,569,851 (991,334) 1,166,178 $1,694,164

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started