i need the help in this assignment

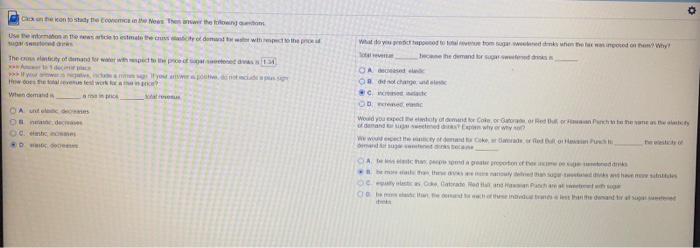

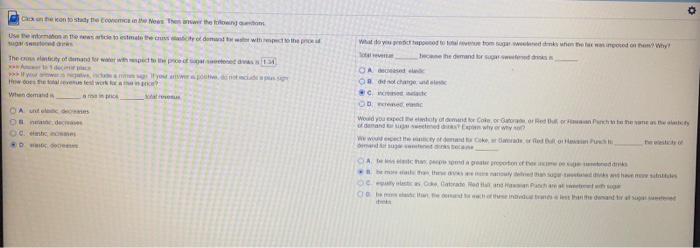

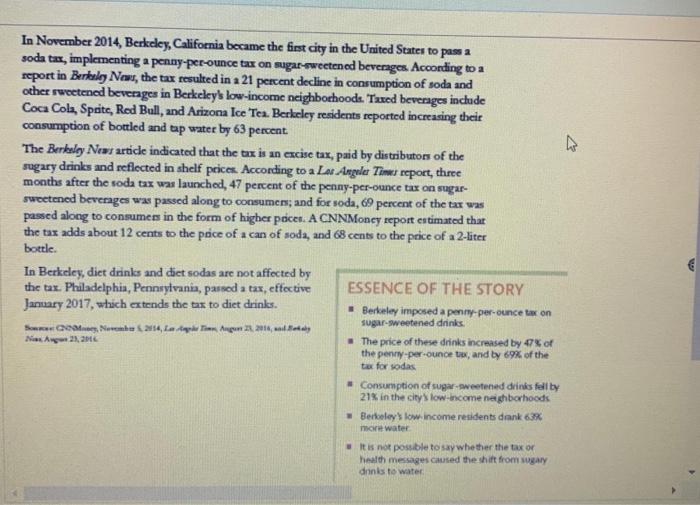

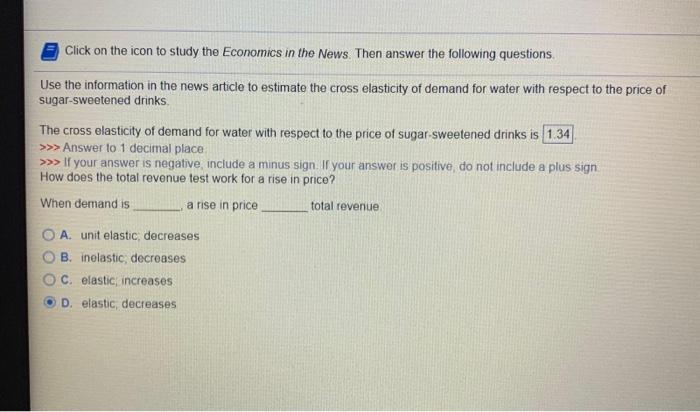

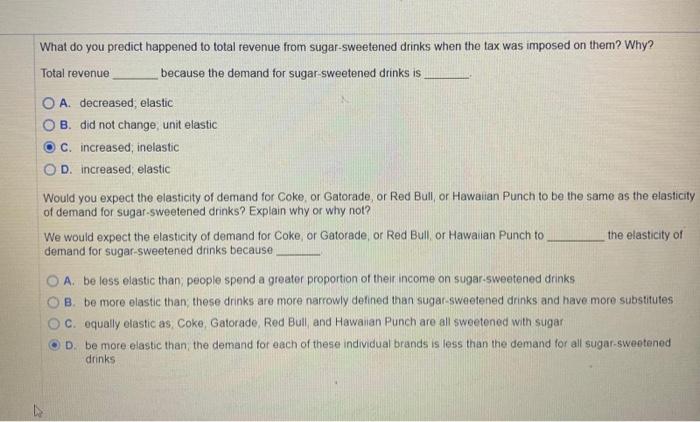

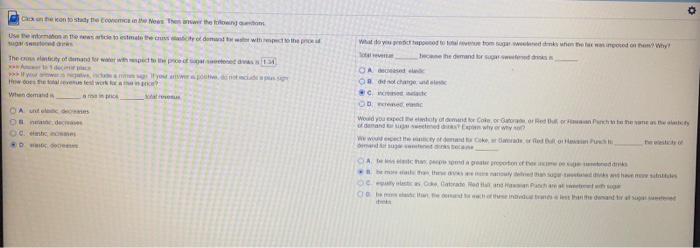

Gehe konto Stay the comes the then Use the thesis methods with the SUS What do your post to weddy when the crew why the demand for some w Och Hoeveer Wom OA Dec O' One Would you to coorden and we were www cewe Dimene Acheron wa In November 2014, Berkeley, California became the first city in the United States to pass a soda tax, implementing a penny-per-ounce tax on sugar-sweetened beverages. According to a report in Berkeley News, the tax resulted in a 21 percent decline in consumption of soda and other sweetened beverages in Berkeley's low-income neighborhoods. Taxed beverages include Coca Cola, Sprite, Red Bull, and Arizona Ice Tea. Berkeley residents reported increasing their consumption of bottled and tap water by 63 percent The Berkeley News artide indicated that the tax is an excise tax, paid by distributors of the sugary drinks and reflected in shelf prices. According to a Los Angeles Times report, three months after the soda tax was launched, 47 percent of the penny-per-ounce tax on sugar- sweetened beverages wat passed along to consumers; and for soda, 69 percent of the tax was passed along to consumers in the form of higher pocen. A CNNMoney report estimated that the tax adds about 12 cents to the price of a can of soda, and 68 cents to the price of a 2-liter bottle. In Berkeley, diet drinks and diet sodas are not affected by the tax. Philadelphia, Pennsylvania, parnod a tax, effective ESSENCE OF THE STORY January 2017, which extends the tax to diet drinks. Berkeley imposed a penny-per-ounce tax on See, Member , 2014, la top Ten Augen 21, 2016, Ny 23, 2016 The price of these drinks increased by 47% of the penny-per-ounce tax, and by 69% of the tax for sodas Consumption of sugar-sweetened drinks fell by 21% in the city's low-income neighborhoods Berkeley's low income residents dank 63% sugar-sweetened drinks more water It is not possible to say whether the tax or health messages caused the shift from sogary drinks to water Click on the icon to study the Economics in the News. Then answer the following questions Use the information in the news article to estimate the cross elasticity of demand for water with respect to the price of sugar-sweetened drinks The cross elasticity of demand for water with respect to the price of sugar-sweetened drinks is 1.34 >>> Answer to 1 decimal place >>> If your answer is negative, include a minus sign. If your answer is positive, do not include a plus sign How does the total revenue test work for a rise in price? When demand is a rise in price total revenue O A. unit elastic, decreases B. inelastic, decreases C. elastic, increases D. elastic decreases What do you predict happened to total revenue from sugar-sweetened drinks when the tax was imposed on them? Why? Total revenue because the demand for sugar-sweetened drinks is O A. decreased, elastic B. did not change, unit elastic C. increased inelastic OD. increased, elastic Would you expect the elasticity of demand for Coke, or Gatorade, or Red Bull or Hawaiian Punch to be the same as the elasticity of demand for sugar-sweetened drinks? Explain why or why not? We would expect the elasticity of demand for Coke or Gatorade, or Red Bull or Hawaiian Punch to the elasticity of demand for sugar-sweetened drinks because A. be less elastic than people spend a greater proportion of their income on sugar-sweetened drinks B. be more elastic than those drinks are more narrowly defined than sugar-sweetened drinks and have more substitutes C. equally elastic as Coke, Gatorade Red Bull and Hawaian Punch are all sweetened with sugar D. be more elastic than the demand for each of these individual brands is less than the demand for all sugar-sweetened drinks