I need the outline of the problem and the explanation, not the real numbers.

By outline I mean the formulas using x,y,z etc to explain how to solve problem

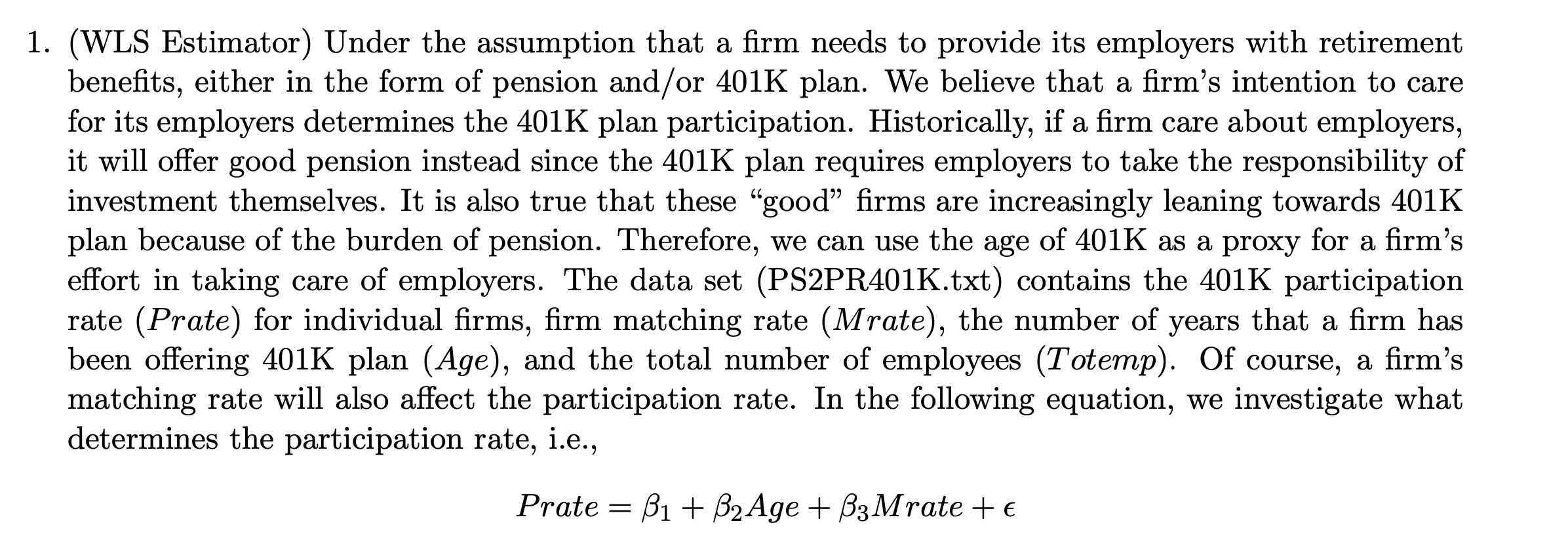

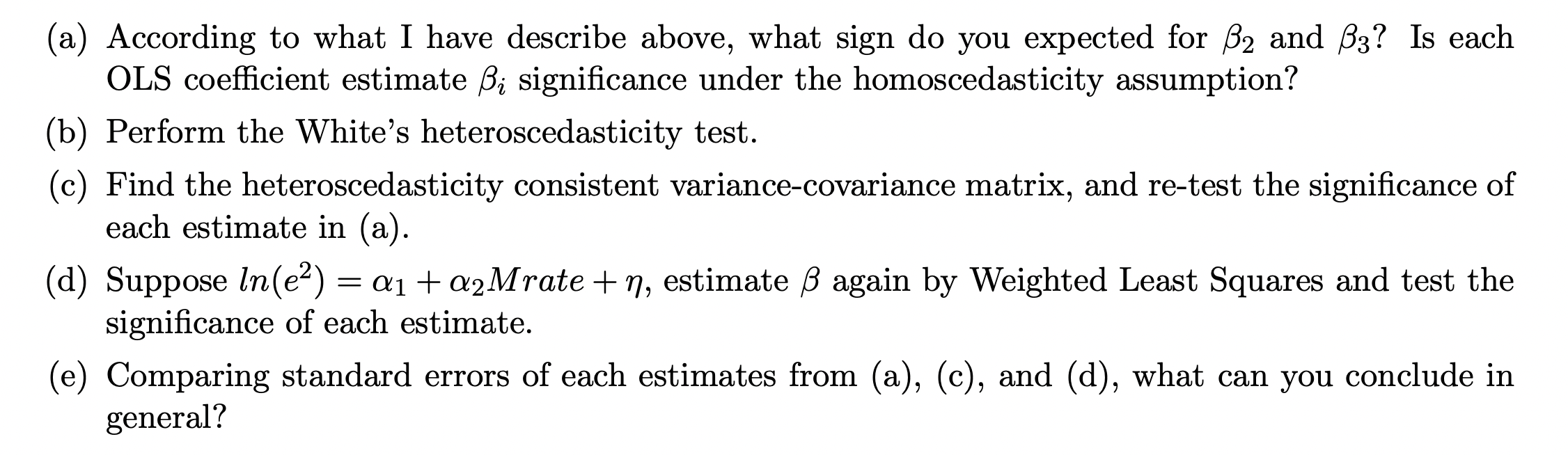

a 1. (WLS Estimator) Under the assumption that a firm needs to provide its employers with retirement benefits, either in the form of pension and/or 401K plan. We believe that a firm's intention to care for its employers determines the 401K plan participation. Historically, if a firm care about employers, it will offer good pension instead since the 401K plan requires employers to take the responsibility of investment themselves. It is also true that these good firms are increasingly leaning towards 401K plan because of the burden of pension. Therefore, we can use the age of 401K as a proxy for a firm's effort in taking care of employers. The data set (PS2PR401K.txt) contains the 401K participation rate (Prate) for individual firms, firm matching rate (Mrate), the number of years that a firm has been offering 401K plan (Age), and the total number of employees (Totemp). Of course, a firm's matching rate will also affect the participation rate. In the following equation, we investigate what determines the participation rate, i.e., Prate = B1 + B2 Age + B3Mrate + = (a) According to what I have describe above, what sign do you expected for B2 and B3? Is each OLS coefficient estimate Bi significance under the homoscedasticity assumption? (b) Perform the Whites heteroscedasticity test. (c) Find the heteroscedasticity consistent variance-covariance matrix, and re-test the significance of each estimate in (a). (d) Suppose In(e) = Q1 + a2Mrate +n, estimate again by Weighted Least Squares and test the significance of each estimate. (e) Comparing standard errors of each estimates from (a), (c), and (d), what can you conclude in general? - 2 a 1. (WLS Estimator) Under the assumption that a firm needs to provide its employers with retirement benefits, either in the form of pension and/or 401K plan. We believe that a firm's intention to care for its employers determines the 401K plan participation. Historically, if a firm care about employers, it will offer good pension instead since the 401K plan requires employers to take the responsibility of investment themselves. It is also true that these good firms are increasingly leaning towards 401K plan because of the burden of pension. Therefore, we can use the age of 401K as a proxy for a firm's effort in taking care of employers. The data set (PS2PR401K.txt) contains the 401K participation rate (Prate) for individual firms, firm matching rate (Mrate), the number of years that a firm has been offering 401K plan (Age), and the total number of employees (Totemp). Of course, a firm's matching rate will also affect the participation rate. In the following equation, we investigate what determines the participation rate, i.e., Prate = B1 + B2 Age + B3Mrate + = (a) According to what I have describe above, what sign do you expected for B2 and B3? Is each OLS coefficient estimate Bi significance under the homoscedasticity assumption? (b) Perform the Whites heteroscedasticity test. (c) Find the heteroscedasticity consistent variance-covariance matrix, and re-test the significance of each estimate in (a). (d) Suppose In(e) = Q1 + a2Mrate +n, estimate again by Weighted Least Squares and test the significance of each estimate. (e) Comparing standard errors of each estimates from (a), (c), and (d), what can you conclude in general? - 2