Answered step by step

Verified Expert Solution

Question

1 Approved Answer

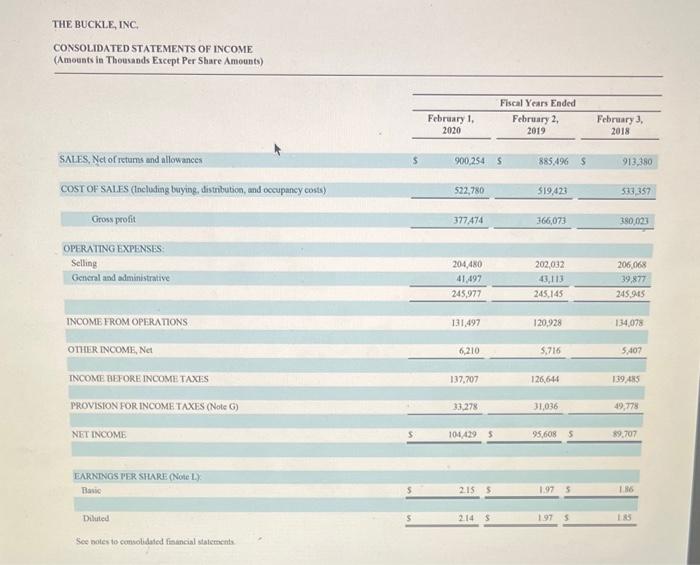

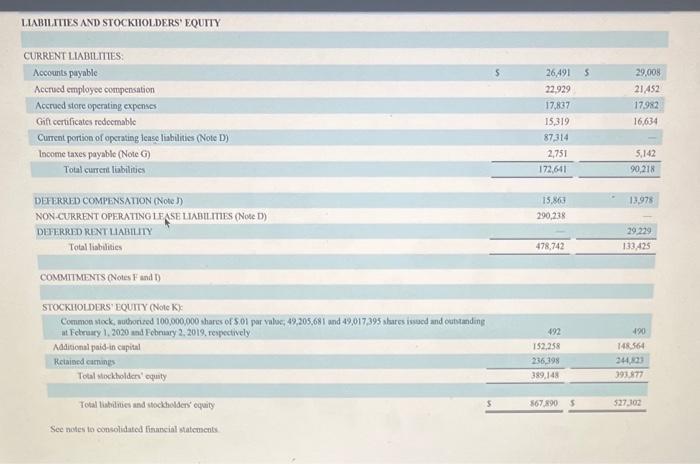

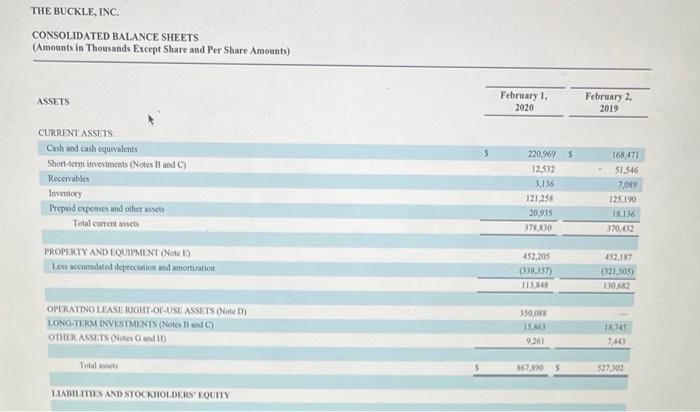

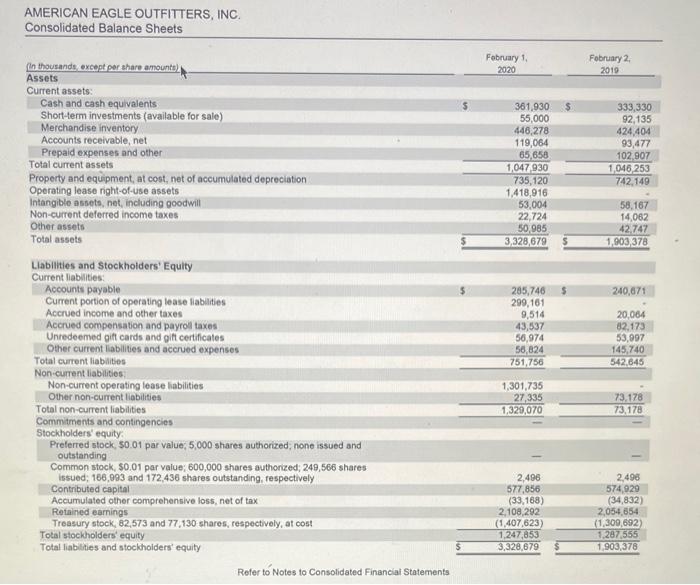

I need the profitability ratio please not the risk ratio. THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF INCOME (Amousts in Thousands Except Per Share Amounts) LHBHLTIES

I need the profitability ratio please not the risk ratio.

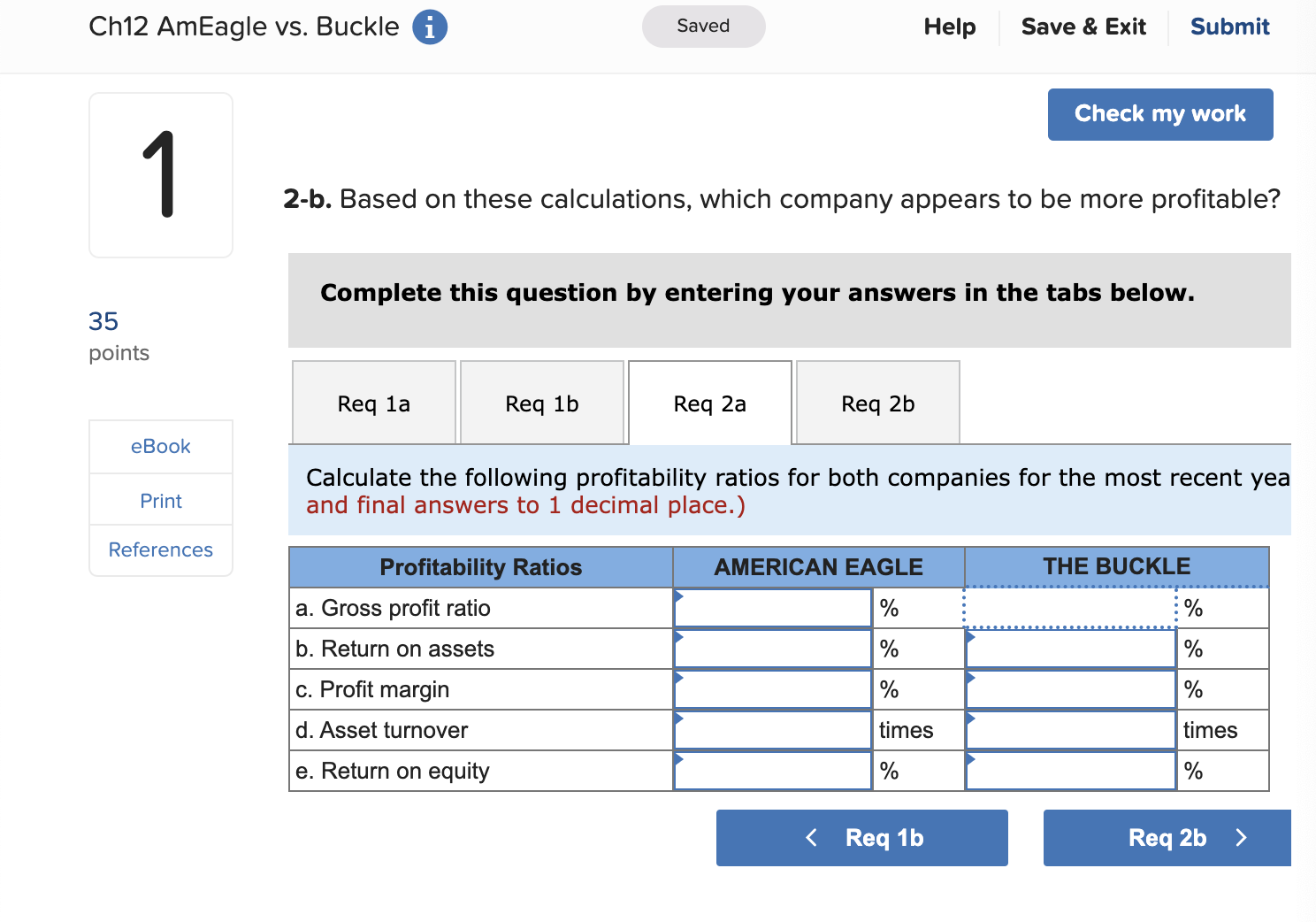

THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF INCOME (Amousts in Thousands Except Per Share Amounts) LHBHLTIES AND STOCKHOLDERS' EQUTTY CURRENT LIABILITES: COMMTMENTS Notes F and D STOCKHOLDERS' EQUTTY (Note K): at Fetruary 1, 2020 and Febrairy 2, 2018, reypectively Adaisconal paid-in capiat Rchaisod eamings Total thockbolderi' cquity Total listilives and sockhelders' equity See notes to ovnsolidated fisarcial statements THE BUCKLE, INC. CONSOLIDATED BALANCE SHEETS (Amounts in Thousands Except Share and Per Share Amounts) ASSETS CURRENT ASSETS HAHLTHE AND STOCKHOLDERs' VOUTY AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets -b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Calculate the following profitability ratios for both companies for the most recent yea and final answers to 1 decimal place.) THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF INCOME (Amousts in Thousands Except Per Share Amounts) LHBHLTIES AND STOCKHOLDERS' EQUTTY CURRENT LIABILITES: COMMTMENTS Notes F and D STOCKHOLDERS' EQUTTY (Note K): at Fetruary 1, 2020 and Febrairy 2, 2018, reypectively Adaisconal paid-in capiat Rchaisod eamings Total thockbolderi' cquity Total listilives and sockhelders' equity See notes to ovnsolidated fisarcial statements THE BUCKLE, INC. CONSOLIDATED BALANCE SHEETS (Amounts in Thousands Except Share and Per Share Amounts) ASSETS CURRENT ASSETS HAHLTHE AND STOCKHOLDERs' VOUTY AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets -b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Calculate the following profitability ratios for both companies for the most recent yea and final answers to 1 decimal place.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started