I need the right answer

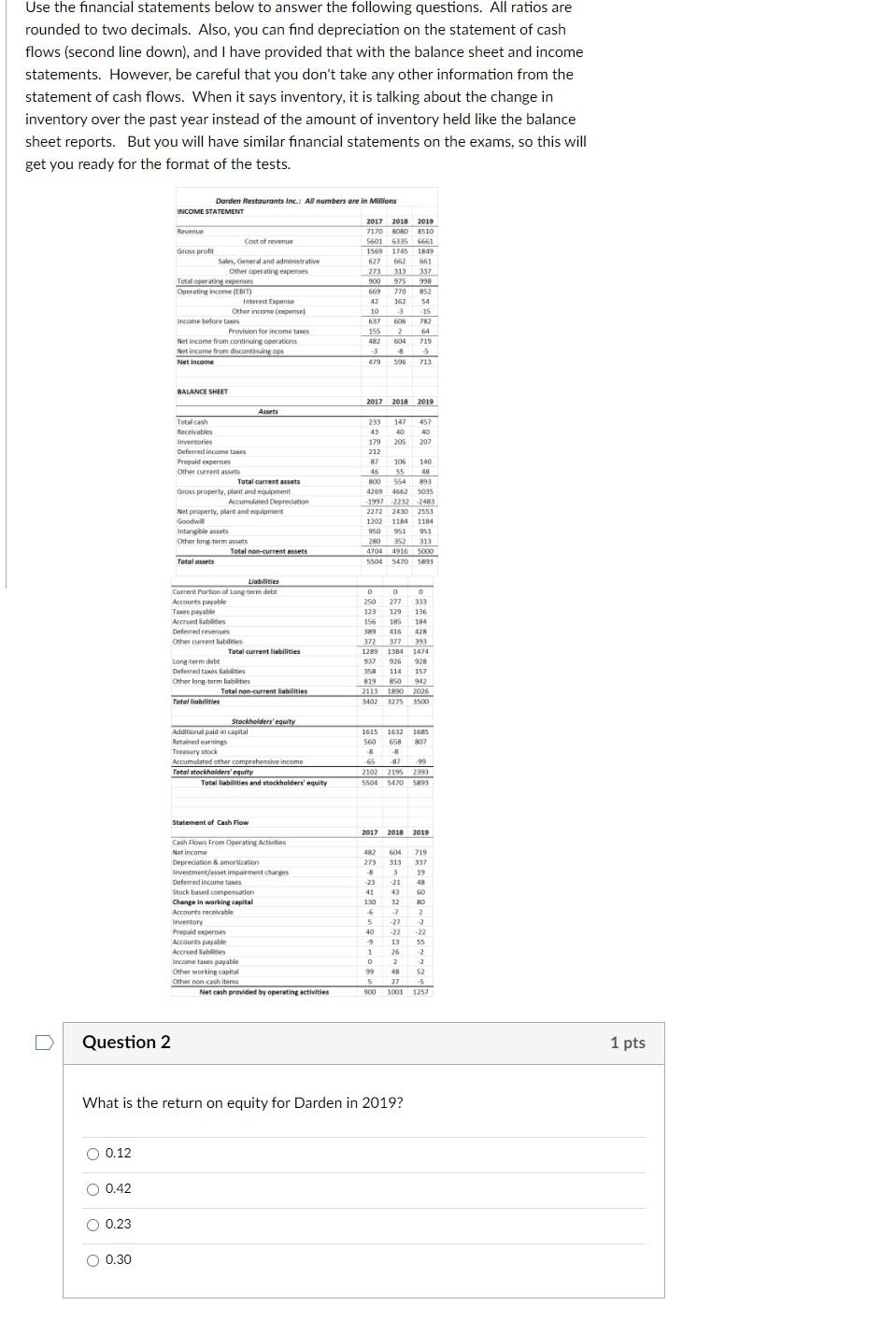

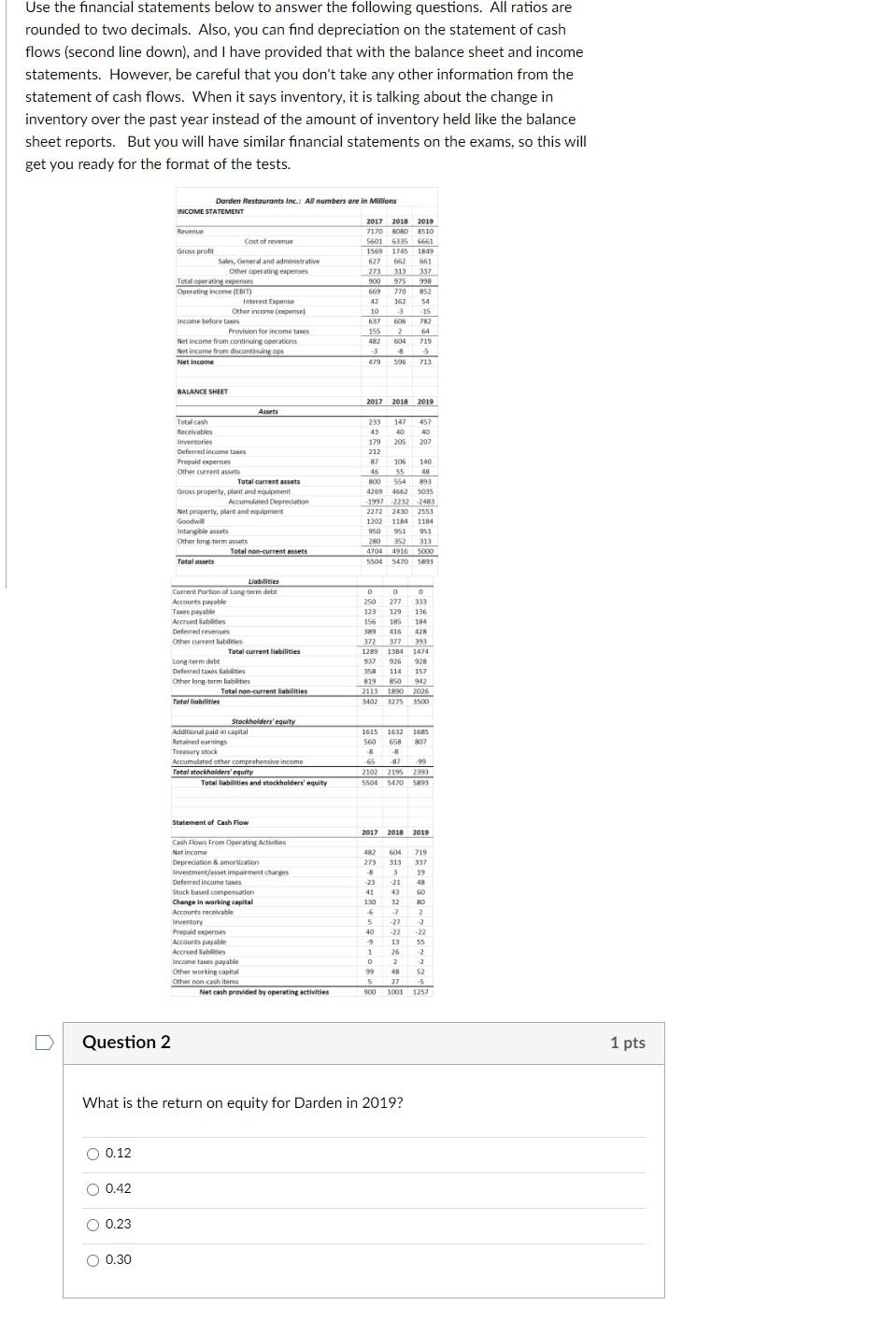

Use the financial statements below to answer the following questions. All ratios are rounded to two decimals. Also, you can find depreciation on the statement of cash flows (second line down), and I have provided that with the balance sheet and income statements. However, be careful that you don't take any other information from the statement of cash flows. When it says inventory, it is talking about the change in inventory over the past year instead of the amount of inventory held like the balance sheet reports. But you will have similar financial statements on the exams, so this will get you ready for the format of the tests. Darden Restaurants Inc.: All numbers are in Millions INCOME STATEMENT 2017 2018 2019 Revenge 7170 BORO 3510 Cost of revenue 5601 6335 661 Gross profit 1569 1745 1849 Sales, General and administrative 627 661 Other operating expenses 273 313 337 Total operating expenses 900 975 998 Operating income (EBIT) 669 770 852 Interest Expense 42 162 54 Other income (perse) 10 3 15 Income before 606 782 Provision for income taxes 155 2 64 Net income from continuing operations 604 719 Net income from discontinuing 8 Net Income 479596 713 BALANCE SHEET 2017 2018 2019 Assets Totalcash Receivables Inventories Deferred income taxes Prepaid expenses Other current assets Total current assets Gross property, plant and equipment Accumulated Depreciation Net property, plant and equipment Goodwill Intangible assets Other lore torm assets Total non-current assets Total assets 233 147 457 43 40 40 179 205 207 212 87 106 140 46 55 48 800 554 893 4269 4662 50:15 - 1997 2232 -2232-2483 2272 2430 2553 1202 1184 1184 950 951 951 352 313 47044916 5000 5504 5470 5893 Libres Current Portion of long-term debit Accounts payable Tas payable Accrued Babies Deferred revenues Other current abilities Total current liabilities Long-term debe Deferred taxes labies Other long term liabilities Total non-current liabilities Total abilities 0 0 0 O 250 277 333 123 124 136 156 185 184 416 428 372 377 393 1259 1354 1474 937 926 928 350 11 157 819 850 942 211318302026 34023275 3500 Stockholders' equity Additional paid in capital Retained earnings Treasury stock Accumulated other comprehensive income Total stockholders'equity Total liabilities and stockholders' equity 1615 1632 1685 560 658 907 8 -65 82 -99 2102 2195 2399 5504 5070 5893 Statement of Cash Flow 2017 2018 2019 Cash Flows From Operating Activities Not income Depreciation & amortization Investment/asset impairment charges Deferred income taxes Stock based compensation Change in working capital Accounts receivable Inventory Prepaid expenses Accounts payable Accruedas Income taxes payable Other working capital Other non cach tar Net cash provided by operating activities 719 273 31 313 337 5 3 19 -21 48 43 60 130 32 0 6 > 2 5. 27 2 40-22-22 -9 9 13 55 1 26 2 0 2 2 99 S2 5 27 -5 900 1001 1257 Question 2 1 pts What is the return on equity for Darden in 2019? 0 0.12 O 0.42 O 0.23 O 0.30