I need the solutin filled in table like question table

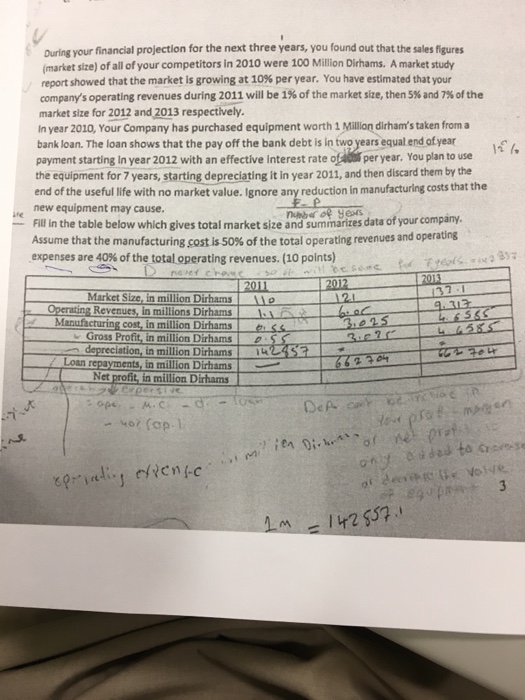

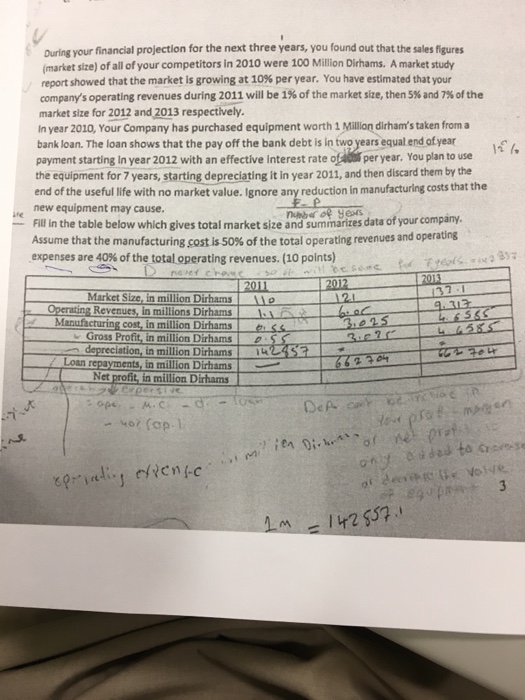

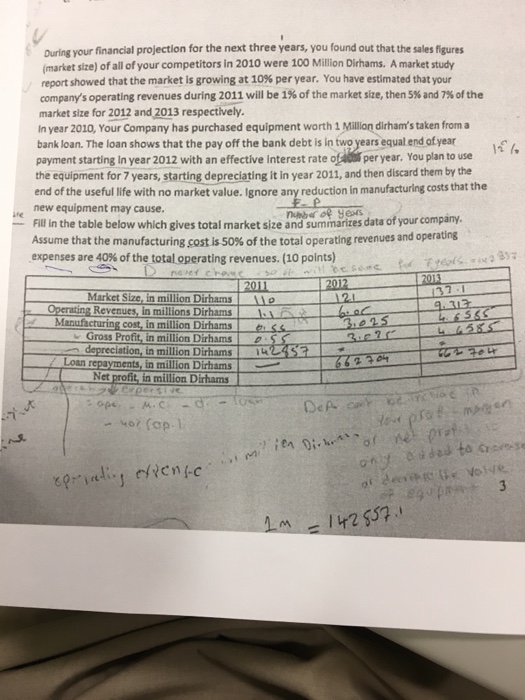

During your financial projection for the next three years, you found out that the sales figures (market size) of all of your competitors in 2010 were 100 Million Dirhams. A market study report showed that the market is growing at 10% per year. You have estimated that your company's operating revenues during 2011 will be 1% of the market size, then 5% and 7% of the market size for 2012 and 2013 respectively. In year 2010, Your company has purchased equipment worth 1 dirham's taken from a bank loan. The loan shows that the pay off the bank debt is ln two years equal end of year payment starting In year 2012 with an effective interest rate of per year, You plan to use the equipment for 7 years, starting depreciating it in year 2011, and then discard them by the end of the useful life with no market value. Ignore any reduction in manufacturing costs that the new equipment may cause. Fill in the table below which gives total market size and Summarizes data of your company. Assume that the manufacturing cost is 50% of the total operating revenues and operating expenses are of the total operating expenses are 40% of the operating revenues During your financial projection for the next three years, you found out that the sales figures (market size) of all of your competitors in 2010 were 100 Million Dirhams. A market study report showed that the market is growing at 10% per year. You have estimated that your company's operating revenues during 2011 will be 1% of the market size, then 5% and 7% of the market size for 2012 and 2013 respectively. In year 2010, Your company has purchased equipment worth 1 dirham's taken from a bank loan. The loan shows that the pay off the bank debt is ln two years equal end of year payment starting In year 2012 with an effective interest rate of per year, You plan to use the equipment for 7 years, starting depreciating it in year 2011, and then discard them by the end of the useful life with no market value. Ignore any reduction in manufacturing costs that the new equipment may cause. Fill in the table below which gives total market size and Summarizes data of your company. Assume that the manufacturing cost is 50% of the total operating revenues and operating expenses are of the total operating expenses are 40% of the operating revenues