Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the solution to solve this problem. Question 9 0.018 +0.20 Not answered Marked out of 2.00 C7 The possible EBITS for the coming

I need the solution to solve this problem.

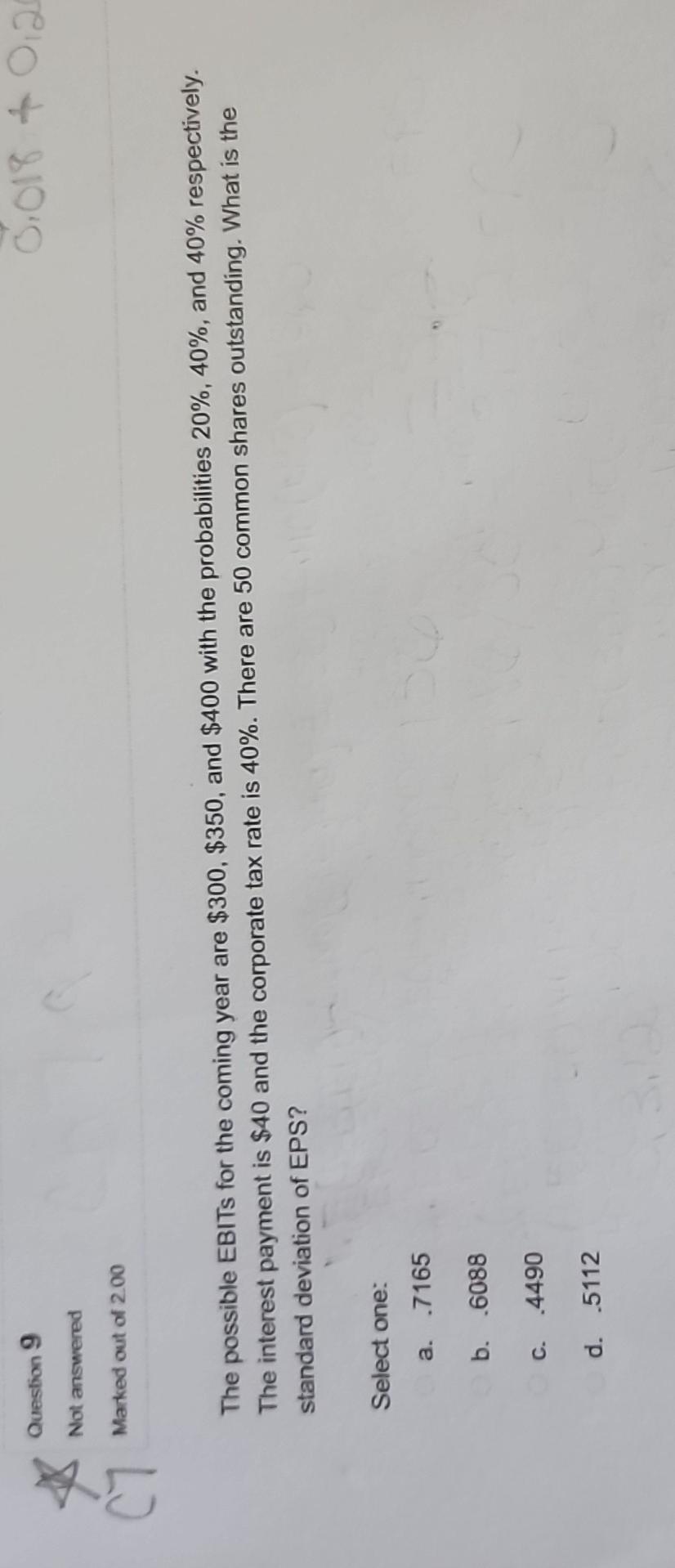

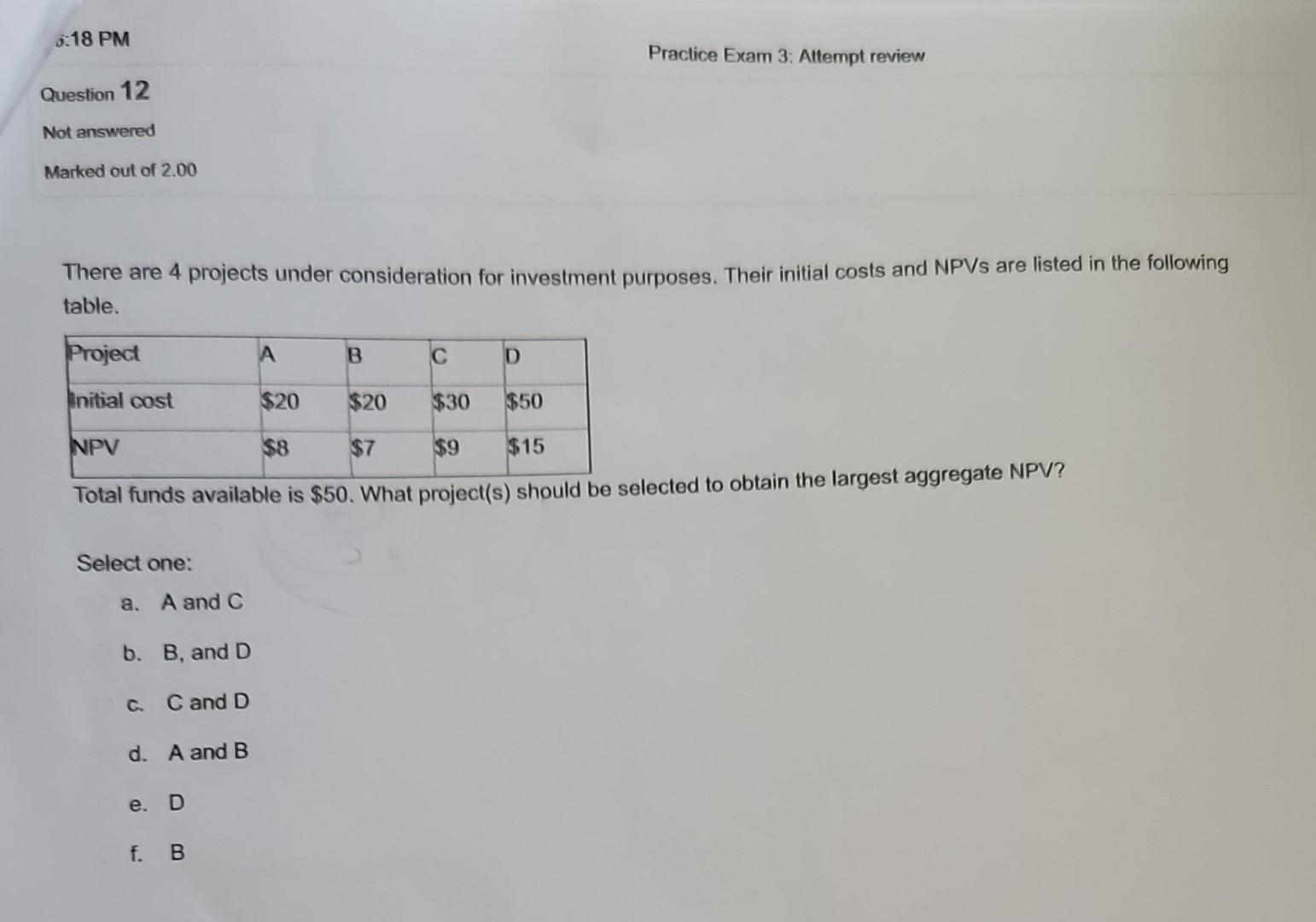

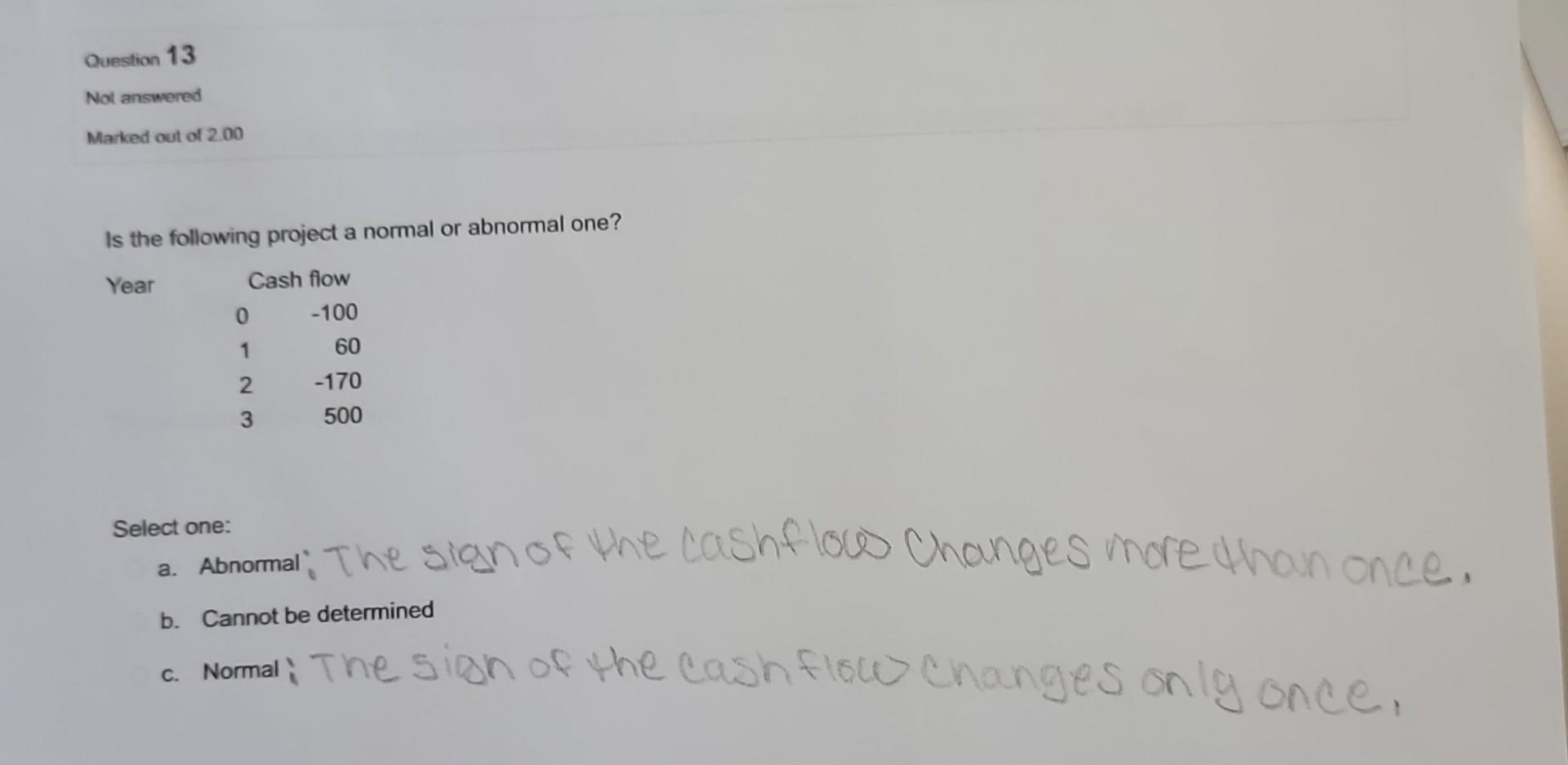

Question 9 0.018 +0.20 Not answered Marked out of 2.00 C7 The possible EBITS for the coming year are $300, $350, and $400 with the probabilities 20%, 40%, and 40% respectively. The interest payment is $40 and the corporate tax rate is 40%. There are 50 common shares outstanding. What is the standard deviation of EPS? Select one: a. .7165 b. .6088 c. .4490 d. 5112 6:18 PM Practice Exam 3: Attempt review Question 12 Not answered Marked out of 2.00 There are 4 projects under consideration for investment purposes. Their initial costs and NPVs are listed in the following table. Project A B C D Initial cost $20 $20 $30 $50 NPV $8 $7 $9 $15 Total funds available is $50. What project(s) should be selected to obtain the largest aggregate NPV? Select one: a. A and C b. B, and D c. C and D d. A and B e. D f. B Question 13 Not answered Marked out of 2.00 Is the following project a normal or abnormal one? Year Cash flow 0 -100 1 60 2 -170 3 500 Select one: at Abnormal. The sign of the cash flow changes more than once. b. Cannot be determined C. Normal; The sign of the cash flow changes only once

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started